PFinance_Curriculum_Guide

advertisement

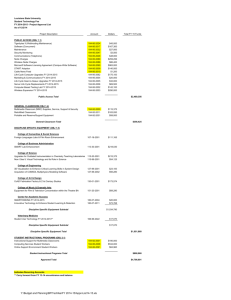

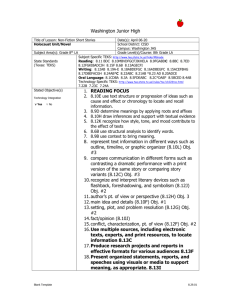

Personal Finance – 11th Grade—Course Content Outline Class 1 Class 2 Class 3 Class 4 TOPIC Pre-test I. Federal Reserve Where does our money come from? What’s the difference between the Federal Reserve and the US Treasury? How is the Fed making monetary policy today? Who is the Fed Chairman today?or There are how many Federal Reserve Banks? CONTENT AND OBJECTIVES RESOURCES AND ASSESSMENT Determine what students know about financial literacy Pre-test Obj.-Students will demonstrate knowledge of financial literacy in a short multiple choice diagnostic assessment. (KWL) What is money? Obj.-Define money History of the Fed www.federalreserveeducation.org Obj.-Read, interpret and summarize in one sentence, the most important concepts in each chronological timeframe in the History of the Fed 101. Obj.-identify and describe the purpose of each element in the structure of the Fed. Obj.-Define monetary policy Obj.-Explain the tools of monetary policy Obj.-Summarize the actions of the Fed today in an article review (relevance) Obj.-Construct the FOMC in class http://www.federalreserveeducation.org/fed101/structure/ Assess-Classwork summaries of the history timeframes completed during class discussion. Assess- History quiz in ‘quizzes’ section http://www.federalreserveeducation.org/fed101/quiz/quizindex.cfm Obj.-Read and comprehend each section on Banking supervision. Obj. Describe 5 financial services offered by the Fed today. Distinguish the markets for these services Obj.-Describe the “5-Cs” needed to obtain a personal loan. Analyze a current news article or online video about the economy and banking supervision. What is the relationship? What is the role of the Fed today? Describe the the “5-Cs” you would need if you applied for a loan. http://www.pbs.org/newshour/extra/teachers/us/ Answer questions while reading online (differentiation)http://www.federalreserveeducation.org/fed101/supervision/ (The Economist and Time Magazine or other current news magazines or newspapers) Differentiation and reinforcement optionshttp://www.moneysbestfriend.com/default.aspx?id=128 http://www.stls.frb.org/publications/pleng/ (In Plain English) Obj. Review for the test using a crossword puzzle Obj.-Demonstrate proficient understanding of the Article Review –Ground Zero Activity- Roleplay- In groups, Students use signs to display each player in the FOMC. After constructing the FOMC, analyze a current article where the FOMC made an important decision about the economy, identifying the role of each group. Crossword puzzle- in-class review activity The Fed video Test- The Fed-(online _ teacher-made) federal reserve and the role played in today’s economy. Class 1 How does one become a millionaire? Who protects our money and for how much? Class 2 What kind of personal information is needed to open a checking account? Class 3 What information appears, or is needed, on a valid check? Class 4 What amount do you save each week or month? II. Banking Intro- Activity: Millionaire “The Millionaire Next Door” or Millionaire game activity Obj.- Recognize the functions of a bank Chapter 9 Textbook – PPT Introduction overview and types of banks Online Activity-Which type institution should I use? Obj.- Describe the safety of financial institutions. (FDIC, NCUA, etc.) Is my money safe? Obj.-Identify laws and restate the impact Article Review and discussion-FDIC of state and federal regulations on the security of Basic Banking Services – PPT – CitiBank banks. Obj.-List and distinguish between different Financial Institution Activity types of accounts. Class activity -In groups, draw a diagram of the route a check takes Obj.-Identify and discuss the different parts of a check recalling correlations to the after it leaves your hands. Online resources and pictures may be used. Federal Reserve system. Check your accuracy at... Obj.-Trace the route of a check after it has http://www.federalreserveeducation.org/fed101/services/checklife/check been written _sim.htm Obj.-Write checks, fill out deposit slips, Checkbook balancing activity- handouts balance a checkbook (Transition to budgeting)- Money Talks- What are video- http://www.moneytalks.ucr.edu/english/video/video_home.html you saving? Class 1 What do you know about money? Class 2 What was the most recent lie you told about money? Class 3 How much do you spend in a week? Class 4 How might spending of teens differ in other countries Budgeting Intro- What do you know about money? http://www.moneyfactory.gov/ (additional Obj.-Restate SMART financial planning PPT- How to plan your finances materials) Formative assessment- Write the SMART goals; List the three R’s of NEFE Materials1 Obj. Students will engage in an online a successful financial plan. NEFE Materials 2 ‘reality check’ to determine a hypothetical cost of http://www.jumpstart.org/realitycheck/pgv_money_rc_main.html Chapter 8-text living based on their choices. http://www.moneysbestfriend.com/ Obj.-Monitor personal spending habits Assess personal spending, set budget limits and maintain a budget for through use of a Log for two-weeks - budget two weeks. Engage in a group simulation in building a budget based on Junior Achievement activity Obj.-(Diversity) Compare wants and needs PPT-Building a budget between China and US teens based on current research Obj.-Analyze wants and needs in the context of boycotts 2 MakingDecisions aboutMoney CREDIT Types of credit Loans Installment Regular Revolving Sources – bankcards, stores, gasoline, credit union, finance companies, savings and loans, pawnshops Creditworthiness Credit ratings and reports Application Credit counseling Consumer rights Legal issues in money management Careers in Banking and Finance Obj.-Compare the costs of renting in a geographic area. Obj.-Analyze a lease agreement (optional) Obj.-Based on the list at this website, list ten ways you personally, will save money (transition to saving) Obj.-Compare and contrast roadmaps to Saving and Investing Class 1 How much money have you saved in t he past year? Class 2 Who regulates banks? Class 3 How can we save when the country is in a financial crisis? Class 4 What kinds of jobs are in the financial industry today? Saving, Investing Why save? and Stocks http://fefe.arizona.e Obj.-Research and analyze the reasons for du/takeCharge.php the current financial crisis. (need to register) Obj.-Analyze the ‘Anatomy of a Crisis’ by identifying major causes China - Where will they fit in the world economy? I Don't Want Much, I Just Want More: Allocation, Competition and Productivity To Buy or not to buy Class activity- Based on the budget created, pair with a partner, share budgets. Pair with another pair and select the budget that best demonstrates SMART goals and is realistic. Introduction: DVD – Buried by Debt: the Dangers of Borrowing Vocabulary and concept management Textbook Ch-16-Credit Management How do you determine your creditworthiness? www.experian.com www.freecreditreport.com Create a chronological graphic organizer demonstrating a five-year plan for building credit Examine a credit application document Discuss most recently enacted laws pertaining to consumer credit PPT-Lease and rental agreements Call three landlords in your area and use a newspaper; list and compare three apartment rental options. Hand in Complete a lease agreement analysis http://www.pueblo.gsa.gov/cic_text/money/66ways/index.html Money saving exercise http://www.sec.gov/investor/pubs/roadmap.htm PPT – Saving goals Roadmap to saving and investing Video Clip “Understanding the Financial Crisis: Origin and Impact”, JA Worldwide.handout http://www.washingtonpost.com/wp- Obj.-Explain bank regulation Obj.-Apply concepts of APY, CD,compound interest, discretionary income, interest, liquidity, money market. Obj.-Calculate how money grows through compound interest Obj.- Explain why people invest money Obj.-Describe the relationship between risk and return in investment strategies. Obj.- Predict an investment’s rate of return using the Rule of 72 (page. 260-text). Explain why this principle works. Obj.-Summarize the process for filing a complaint against a financial institution STOCKS Obj.-Distinguish common and preferred stocks (pge.281-text) Obj.- Classify stock investments Obj.-Read and discuss a stock table(page 293-text) Obj.- Determine how a stock is priced, ROI in one year (pge-284), and evaluate dollar-cost averaging. Obj.-Participate in buying stocks in a simulation Class 1 Class 2 Class 3 Class 4 Insurance Obj.-Read and interpret a stock table Obj.-Discuss the origins and history of the stock market (Ch1) Obj.-Examine agencies and laws regulating securities and the NYSE (Ch 3) Obj.-Identify trends in the economy and behaviors that drive stock prices Ch4) List and describe avenues for buying stocks(Ch5) What are some risks you take each day? What kinds of jobs are available in the insurance field? Who regulates the insurance industry? Does everyone need life insurance? dyn/content/graphic/2008/09/16/GR2008091600631.html BankRegulation Chapter 10 page 254 Solve Problems [overhead] --compound interest exercise-Student skills guide --calculate interest given these scenarios Activity 10.4 and 10.5-Calculate compound interest PPT-Ch 11 Investing fundamentals Visit this website to practice the Rule of 72 .In a paragraph, explain why this principle works. PPT-Rule of 72 http://www.mymoney.gov/scams.shtml Access stock market materials at http://www.nyse.com/about/education/1098034584990.html Diagnostic assessment Choose stocks and maintain a portfolio in a spreadsheet, updated each class for 3 weeks. Analyze the results of tracking the stocks and draw a conclusion based on the results and the research. Write a onepage summary based on PSSA guidelines. Alternative- Stock Market Game at www.smgww.org Stock Table NYSE-online book NYSE activities Stocks/investment assessment PPT- Introduction to ‘Risk Management’ Chapter 1-Insurance Basics and terminology Ch 1 Insurance Basics (small book) Obj.-Describe ways to deal with, and reduce Ch 25 – textbook risk. Obj.-Explain the variety of insurance policies that cover risk Obj.-Discuss the purpose of each type insurance Obj.-Explain factors to consider when buying insurance (in particular-auto insurance) Obj. Evaluate PENNA laws and insurance http://www.ins.state.pa.us/ins/cwp/view.asp?a=1339&Q=544190&PM= rules. 1&insNav=| Obj.-Demonstrate and share in-depth Professional Powerpoint presentations including handouts for the knowledge about a single type of insurance class. (group presentation and assessment) Obj.-Describe some insurance pitfalls and Take the insurance quiz online how to avoid them. Obj.-Examine the options for consumers in http://www.ins.state.pa.us/ins/cwp/view.asp?a=1337&Q=543749&PM= the event of problems 1&insNav=| Class 1 How many different scams can you name? Class 2 Which government agency is responsible for protecting consumers? Class 3 What is a Ponzi scheme? Class 4 What would you do if you suspected someone else was using your credit card? Consumer Fraud http://www.consume Obj.-Identify and describe 6 common PPT-Frauds and Scams rreports.org/cro/inde consumer frauds or scams CNN Video x.htm?bhfv=5&bhqs Obj.-Describe the agency responsible for http://www.ftc.gov/ftc/about.shtm =1 consumer protection http://www.consumer.gov Obj.-Explain a Ponzi scheme http://www.ftc.gov/bcp/consumer.shtm Obj.-In groups of three or four research, write Article Review-“Con of the Century” The Economist, Dec 20th, 2008 a scenario, summarize information and produce a 60-second commercial about one consumer fraud. Commercial Presentations- follow Rubric on completed production Warn consumers about this fraud/scam and steps they can take to avoid it. Card fraud -reading and comprehension assignment Obj.- list steps to take if you suspect you are a victim of fraud. Class 1 How much is the federal debt today and what is your share of that debt? (175,000) Class 2 Who has to file an income tax return? Class3 What are the alternatives to paying taxes? Class 4 What happens when people don’t pay taxes? GovernmentIntroduction video http://www.iousathemovie.com/ (30-minutes) Economics-taxes Obj.-Discuss the responsibility of each *Describe each type of debt shown in the movie. Hand in citizen in the federal debt *What IS your share of the federal debt? Obj.-Distinguish Budget deficits and Public debt Chapter 12Government and the US Economy- JA Economics (handout) Obj. Discussion- who should file an income tax return. Obj.-Analyze and discuss paychecks and deductions Obj.-Explain the purpose of the current government stimulus package. (government intervention in the economy) Obj.-Describe how state, local, national government spends and raises money Obj.-Describe how proportional, regressive, progressive taxes differ Obj.-Identify the main federal taxes and who pays them Obj.-Compute your withholding taxes for W-4 Form Post-test and/or Final Exam reinforcements NCEE CD-Macroeconomics/Budget Deficits and Public Debt- video http://www.irs.gov/individuals/article/0,,id=96623,00.html http://finance.yahoo.com/taxes http://fefe.arizona.edu/curriculum.php?categoryID=17#39 http://ecedweb.unomaha.edu/K-12/ve.cfm Research and explain- government stimulus package Find out Selinsgrove’s budget for 2009 Reading and comprehension guide questions Complete a tax form http://www.irs.gov/ http://www.irs.gov/individuals/article/0,,id=96196,00.html Summative (end of course) Assessment Multimedia Book review presentation (PPT) Example Research projects/Reports Resources: JA Economics by Junior Achievement Inc. 2000 www.ja.org Managing Your Personal Finances 5th Ed. by Joan S. Ryan, Thomson Publishing, 2006. Banking Systems, Thompson Publishing Fundamentals of Insurance, Thompson Publishing The Economist magazine Time magazine Trillion Dollar Meltdown by Charles Morris The Age of Turbulence by Alan Greenspan Freakonomics by Steven D. Levitt and Stephen J. Dubner Suze Orman’s 2009 Action Plan http://www.jumpstart.org/search.cfm http://www.handsonbanking.org/ http://ve.ncee.net/features/display_standards.php?ss2=PA http://www.aafcs.org/resources/framework.html www.Practicalmoneyskills.com NCEE VirtualEconomics CD http://www.irs.gov/individuals/article/0,,id=96623,00.html http://finance.yahoo.com/taxes http://fefe.arizona.edu/curriculum.php?categoryID=17#39 http://www.ftc.gov/ftc/about.shtm http://www.consumer.gov