Content Map of Unit

advertisement

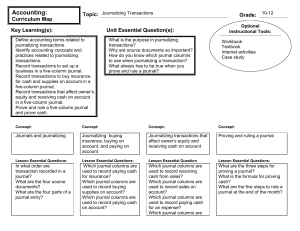

Accounting: Curriculum Map Topic: Journalizing Transactions Key Learning(s): Unit Essential Question(s): The difference types of source documents. Analyze transactions related to buying and selling, on account, owners equity. Proving cash. Correct accounting practices for correcting errors. Identify the different types of source documents And how they are used? Grade: 10-12 Optional Instructional Tools: Textbook/Workbook Case studies Overhead projector How do we journalize transactions related to Buying and selling on account, and owner’s Equity? What procedures are used to prove cash? What are proper practices for correcting errors? Concept: Concept: Concept: Concept: Recording transactions and the multicolumn journal Transactions affecting prepaid insurance and supplies Journalizing transactions that affect owner’s equity and receiving cash on account Proving and ruling a journal Lesson Essential Questions: In what order are transaction recorded in a journal? What are the different types of source documents? What are the four parts of a journal entry? Lesson Essential Questions: How do we journalize transactions that are on account? What is journal entry to record buying supplies and prepaid insurance? Lesson Essential Question Lesson Essential Questions: Which journal columns are used to record receiving cash from sales? Which journal columns are used to record sales on account? Which journal columns are used to record paying cash for an expense? Which journal columns are used to record receiving cash on account? Which journal columns are used to record paying cash to the owner for personal use? What are the three steps for proving a journal? What is the formula for proving cash? What are the five steps to rule a journal at the end of the month? Vocabulary: Journal Journalizing Source document Entry Double-entry accounting Check Invoice Sales invoice Receipt Memorandum Other Information: Vocabulary: Vocabulary: Vocabulary: Proving cash