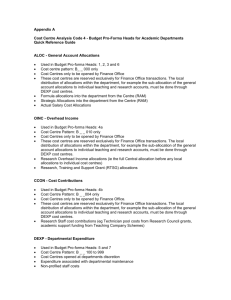

budget pro-forma - general definitions of cost

advertisement

BUDGET PRO-FORMA - GENERAL DEFINITIONS OF COST CENTRE USAGE WITHIN HEADS 1. Introduction The purpose of this paper is to provide a general definition of how cost centres should be used within each area which feeds, via the use of analysis codes (see appendix A for crossreferencing of budget heads to analysis codes), reporting against the Departmental Budget Pro-forma. It draws heavily on discussions which took place last year within the Finance Client Group, and the resulting paper dated 11th May 2000, which proposed the lengthening of the Prophecy cost centre code from 6 to 7 characters, and the division of the existing >B= ledger into a series of sub ledgers. The alternative of using analysis codes against the existing cost centre codes should facilitate similar reporting objectives, but with the advantage of avoiding the upheaval of a wholesale change in the coding structure. However, the downside is an increase in ongoing effort to review and maintain the consistent use of analysis codes. 2. Heads 1 to 7 - Departmental Maintenance 2.1 Heads 1 to 7 comprise those cost centre codes that we would traditionally recognise as the ledger for recording allocations and expenditure associated with Departmental Maintenance. All balances held within these headings will be under the control of the Head of Resource Centre. Although financial managerial responsibility for local allocations maybe devolved to members of staff within the Resource Centre, any unspent local allocations at the end of one financial year will not carry forward to the next. Any local allocations to Personal Accounts where the member of staff has discretion to carry over unspent balances from one financial year to the next should be accounted for under Head 8. 2.2 Sources of Aincome@ under these Heads will include: Formula allocations from the RAM Strategic allocations from the RAM RTSG allocations Research overhead allocations (ie the full Central allocation before any local allocations to individual members of staff), research staff cost contributions (eg technician pool costs from Research Council grants, academic support funding from Teaching Company grants etc.). Internal recharges of central stores, facilities or services to other ledgers (eg. Research). Other special factors. 2.3 These Heads should not receive any third party income arising by way of cash receipts or the issue of sales invoices, except where such receipts strictly relate to the reimbursement of costs (eg. photocopying charges or field trip expenses paid on behalf of students). Therefore, no income relating to the external provision of services should be credited to these Heads. 2.4 These Heads will generally record all expenditure associated with: Profiled staff costs Non-profiled staff costs Local teaching allocations, whether by level, course or module, provided that there is no carry forward of unspent balances from one year to the next Page 1 of 3 Local research allocations, including for example bench fees and Local departmental Research Committee allocations, where there is no carry forward of unspent balances from one year to the next Departmental facilities for teaching and research Departmental services and administrative support costs Departmental stores 2.5 It would be expected that all balances on individual cost centres under these Heads would be closed-off at the end of the financial year to a single Resource Centre reserve fund. 3. Head 8 - Personal Accounts 3.1 Head 8 comprises those cost centres which are controlled by individual members of staff (ie Personal Accounts), and where unspent balances maybe transferred from one financial year to the next. Any such accounts where there is no carry forward from one financial year to the next should be classified under Head 7 (see section 2 above). Individuals may hold one or more such accounts. 3.2 The accounts may receive local allocations of funding or miscellaneous 3 rd party income (ie that which arises by way of cash receipt or issue of official University invoice) provided that no supply of a service is involved. Supplies of services should be recorded through the University=s Other Services Rendered >J= Ledger. This is administered by the Finance Office following the same principles as the Research >R= Ledger. Supplies of services for this purpose would encompass, for example, consultancy, testing and short course/training activity. 3.3 All balances held against cost centres under Head 8 are ultimately under the control of the Head of Resource Centre, and taken together with the balances under Heads 1 to 7 will form the total Discretionary Funds of the Resource Centre. 4. Head 9 - Miscellaneous 4.1 Cost centres under Head 9 are controlled at the Departmental level and will be used where there is a need to capture 3rd party income (ie that which arises by way of cash receipt or issue of official University invoice) provided that no supply of a service is involved. The use of cost centres under this Head are therefore expected to be limited. Local allocations to these cost centres would not normally be expected. The directly related expenditure of such activity will be recorded here, and any Asurplus@ which crystallises will be transferred to Head 5. Unspent balances may therefore transfer from one year to the next, and there may not necessarily be any Asurplus@ to transfer at completion. On the other hand, cost centres under this Head should not be in deficit at the year end. 4.2 Supplies of services should be recorded through the University=s Other Services Rendered >J= Ledger. This is administered by the Finance Office following the same principles as the Research >R= Ledger. Supplies of services for this purpose would encompass, for example, consultancy, testing and short course/training activity. 5. Head 10 - Non-discretionary Allocations 5.1 Head 10 will be used for cost centres where there is a need to monitoring expenditure associated with awards of funding by the University=s Central Research Committee or any other similar Central allocations that may be made from time to time. Each award by the Research Committee will be accounted for through a Page 2 of 3 segregated cost centre, which will record both the allocation and related expenditure. Unspent balances maybe transferred from one financial year to the next. However, any sum not required for the original purpose of the award will revert to the Committee. The Committee may also reserve the right for any unspent balance to revert if the award is not fully expended by a given date. 5.2 Codes under this Head will only be opened by the Finance Office. 6. Head 11 - Specific Funding Council Grants 6.1 Head 11 will be used to account for all specific non-recurrent or capital grants from HEFCW which require separate monitoring and recording. Examples include Academic Infrastructure, project funding for Teaching Quality Excellence, Research Infrastructure, JISC etc. Each award will be accounted for through a segregated cost centre, which will record both the allocation and related expenditure. Unspent balances maybe transferred from one financial year to the next. However, any sum not required for the original purpose of the award will revert to the University centrally or HEFCW as appropriate. HEFCW may also reserve the right for any unspent balance to revert if the award is not fully expended by a given date. 6.2 Codes under this Head will only be opened by the Finance Office. 7. Coding of Local Allocations and Journal Entries 7.1 It is essential that a disciplined approach to coding is adopted with respect to local allocation entries. Resource Centres will be required to use only two specific category codes for this purpose. The first (category 033) will be used for allocations within the Resource Centre (ie Intra-department allocations) and the second (category 044) will be used for allocations between two different Resource Centres (ie Interdepartment transfers). The same category must be used on both sides of the journal. 7.2 The Finance Office will run monthly reconciliation reports to verify the consistent use of coding. 7.3 It is important to distinguish between a local allocation on the one hand and the transfer/reallocation/recharge of a specific cost on the other. The transfer/reallocation/recharge of a specific cost from one cost centre to another must be made using a specific expense category code (ie in the range 401 to 999). The same category must be used on both sides of the journal unless it is correcting a mis-posting. 7.4 The failure to use category codes correctly will prohibit the ability to produce accurate reports of expenditure both for both internal and external purposes. To facilitate improvement in this area it is proposed that the Finance Office will review and release all journals raised by Academic Resource Centres. SGH, 25 February 2001 Page 3 of 3