ESOPs - ICSI

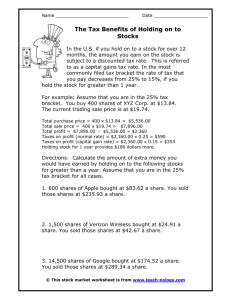

advertisement

ESOPs By: Meenakshi Gupta, LCS Table of Contents 1. An Introduction To ESOP's 2. Kinds of Stock option plans 3. Legal Framework 4. The Recipients 5. Procedure to be followed for offering ESOPs 6. Pricing & Lock-in 7. Costs & Accounting 8. Tax Implications 9. Advantages 10. Caveats 11. Apprehensions Reference Section Bibiliography Statutes The Companies ACT, 1956 (as amended till date) SEBI Regulations CBDT Guidelines AN INTRODUCTION TO ESOP'S ESOPs were the brainchild of a visionary economist named Louis Kelso, who said that for capitalism to survive, there needed to be more capitalists. Employee Stock Option Plans (ESOPs) & Employee Stock Purchase Schemes (ESPSs) are employee benefit plans, which makes the employee of the company owners of stock in that company. Stock options are the instruments that are offered to employees, allowing them to buy a certain number of shares in the company at a specific price. This price could either be lower than the current market-price of scrip-in which case their gains are immediate-or the same, whereupon future jumps in the share-price will show up as profits for them. There has to be a gap between the announcement of the ESOP and its coming into 1 effect. You also have the freedom to specify how many shares an employee gets, which employees get them, and when the ownership is actually transferred. ESOPs & ESPSs are unique employee benefit plans and are fast replacing cash incentives as a method to reward and retain employees. The spirit of ESOP is that it would give the employees a share in the wealth of the company and infuse a sense of ownership & thence loyalty. This helps retaining talented and skilled employees, especially in today’s scenario when the employee turnover and churn is high. It also improve the productivity and performance of the Employees. Grant of ESOPs is a two-way mechanism. Employees receive stock from the promoter, as a kind of an incentive. And the incentive is on account of their good work and loyalty towards the company. Presently ESOPs is in vogue with knowledge driven industries like software, where the major input going into the success of a company are the “intellectual inputs'' provided by the skilled labour, and there exists shortage of such skilled labour and high turnover. KINDS OF STOCK OPTION PLANS STOCK OPTION PLANS There are basically following types of stock option plans: 1. The first, called the Incentive Stock Option (ISO), is issued to key employees of a firm, like the CEO. To take an example, a company might hire a new CEO and offer him the option of buying 100,000 shares three years later at a price of Rs 150. The market price today is only Rs 100. In an ISO, the exercise price (Rs 150) must be equal to or greater than the current market price. In effect, the CEO is being told that if he improves the performance of the firm to the extent that the market price after three years rises above Rs 150, he stands to gain immensely. For instance, if the price reaches Rs 200 he stands to gain Rs 50 lakh at one shot. 2. The second kind of stock option is issued under what is called an Employee Stock Purchase (ESP) plan. This must be issued to all employees, though temporary workers and those who have been with the company for less than two years can be kept out. In an ESP plan, a stock option can be issued at a price that is at least 85% of the current market price or more. Thus, if the current market price is Rs 100, the company can offer to give its employees the option of buying shares three years later at a price of Rs 85 3. There can also be a shadow or phantom option. A.k.a. Stock Appreciation Rights (SARs) In such a scheme, the entire transaction is notional, and every employee simply gets an amount equivalent to the appreciation in the stocks granted to her under the ESOP-without any shares actually changing hands. A practice that has already been in 2 use among transnationals like PepsiCo, Procter & Gamble (P&G), Motorola, and Texas Instruments-since Indian citizens aren't allowed to buy or sell shares in foreign companies-offering SARs is now permitted under SEBI's ESOP guidelines. And it works just as effectively as the real thing. Under this, an employee is given an SAR and is paid the amount by which the stock appreciates at the time the SAR is exercised. Example: an employee is granted an SAR today when the price is Rs 50. If the SAR is exercised after five years when the price is Rs 140, each SAR is worth Rs 90. In P&G's case the prices applicable are those in the US. In practice there are following kinds of ESOP schemes prevalent in India. First variety of ESOPs is the scheme under which the employee is directly allotted shares by the Company either at market price or at a concessional price. Source of purchase may be own funds of the employee or loan(s) from the Company / Banks / Financial Institutions. Second Variety is when the employee has the 'option' to acquire the shares, debentures or warrants of the Company at a price that may be the market price or lower than that. After that there is a waiting period or Vesting Period when the employee has to wait to exercise his option. After this is the 'Exercise-Period' during which the employee can exercise the option to seek allotment of shares; and warrants, securities etc. are converted into shares at a pre agreed price. In a variation of the scheme, bonus is accumulated or not given. In another bonus shares are given to employees as soon as they are issued There may also be a 'Lock-in Period' during which the employee can not sell these shares. Third Variety may be 'Stock Appreciation Rights'. A specified number of shares are notionally allotted to him at a certain price. At the end of a specified period, the price of the shares is noted and if the price has increased then the difference is paid to him by the Company. Another Variety may be 'staggered options' available to the employee over a period of time. As per SEBI Guidelines: "employee stock option scheme (ESOS)" means a scheme under which a company grants option to employees. "employee stock purchase scheme (ESPS)" means a scheme under which the company offers shares to employees as part of a public issue or otherwise. According to CBDT Guidelines on ESOPs, an Employees' Stock Option Plan or Scheme shall include:- 3 i. "Employee Stock Purchase Plan or Employee Stock Option Scheme" whereby the employee allows the employer to withhold a certain portion of his monthly salary, the accumulated amount of which is utilized to acquire shares at a discounted value or otherwise at a future date. ii. "Employee Stock Ownership Plan" whereby an employee of the company is given option to acquire shares of the company at a pre-determined price after a certain period, directly or indirectly through a trust. iii. "Employee Stock Purchase Scheme" under which the company offers shares to an employee, as part of a public issue or otherwise at a predetermined price. iv. "Employees Stock Option Scheme" under which a company grants option to its employees to buy a specified number of shares at a specified price during a specified period. v. "Stock Appreciation Rights or Plans" under which the employees are awarded stock equivalents at a certain pre-determined value, and after a certain minimum stipulated period, the employees are allowed to encash such rights STOCK OPTION RIGHTS A stock option is a right but not an obligation that is given by the Company to its employees to buy shares of the Company. The right of the employees is by way of an entitlement to exercise his/her option and buy shares in the Company. The said price at which the employee buys the option could be and is usually lower than the prevailing price of the share in the market. An option is first granted to an employee and after a specific period when exercised vests with the employee. This period is referred to as the vesting period. An option is said to vest in the employee when he/she is given the right to apply for shares as against an option granted in pursuance of an ESOP. E.g.: ‘X’ is granted an option on 01-01-2002, if the vesting period is 1 year, it would vest with ‘X’ on 01-01-2003, on vesting the option could be exercised and ‘X’ may buy shares against the Option at the pre-determined price. A company may also have a lock-in period for the shares following the exercise of the option by the employee. This would mean that the shares allotted to the employee pursuant to an ESOP cannot be transferred for a fixed number of years. This could be viewed as a long term incentive which seeks to encourage loyalty. The terms of options differ from Company to Company and therefore the lock-in periods, the vesting period etc. vary. From the employee’s point of view, it must be noted that the ESOP is not something that is free or some benefit that is immediate. They must be clear that not only will they have to forgo income if they choose not to participate in the scheme 4 and exercise their option, but in a case where they do exercise the option, the benefit that would accrue to them will not be immediate. The lock in and vesting period specified by the company is a way in which the company can tie the employee down. Eg: If the company has granted an employee option to buy 100 shares, they might structure the scheme in such a way that only 20 shares will vest after a period of 2 years. So if the employee has to get the entire 100 shares, the period would be 10 years. It must be remember that when a company structures a scheme that it has to keep in mind the actual worth of its shares as if the share price is low then an ESOP scheme with a long vesting period would not be attractive. In the case of Companies that are listed on a recognised stock exchange in India , the Securities and Exchange Board of India (SEBI) has issued certain guidelines that are to be adhered to. These guidelines are with a view to regulate stock option schemes. The SEBI guidelines prescribe the various resolutions and approvals that are required and also certain accounting policies to be followed by the Company and also provide for administration of the ESOP in a specific manner as laid out therein. However, schemes by unlisted Companies could also be in consonance with these guidelines, this would be beneficial in the case of a Company which may go public and be listed in a stock exchange. Recently the Central Board of Direct Taxes has issued guidelines that are to be followed in respect of ESOP’s. These are applicable to Unlisted Companies as well as Listed Companies. LEGAL FRAMEWORK PROVISIONS UNDER COMPANY LAW Issue Of Sweat Equity Shares (Sec.79 A) Notwithstanding anything contained in the Section 79, a company may issue sweat equity shares of a class of shares already issued if the following conditions are fulfilled: 1. The issue of sweat equity shares is authorised by a special resolution passed by the company in the general meeting. 2. The resolution specifies the current market price, the number of shares, consideration, if any, and the class or classes of the employees or directors to whom such equity shares are to be issued. 3. Not less than one year has passed since the day on which the company was entitled to commence the business. 4. The sweat equity share of a company, whose shares are listed on a recognised stock exchange, are to be issued according the guidelines issued by SEBI. The 5 companies who are not listed can issue sweat equity by following the above mentioned guidelines. THE REGULATIONS Primary among the new rules is the stipulation of a 1-year lock-in period between the granting of the options-which must be non-transferable-and their conversion into shares, only after which will voting- and dividend-rights come into play. Approves Ravi Ramu, 40, Partner, KPMG Peat Marwick India: ''SEBI has taken the right approach by playing the role of a facilitator instead of policing companies. The onus of adhering to the rules is now on the company.''7 Covering both stock option and stock purchase schemes, the regulations now allow you to issue ESOPs to all the employees of your company-or its subsidiaries-provided the recipient doesn't already own more than 10 per cent of the equity. Sure, not everyone is happy about the implication, which is that promoters may be shut out of the benefits of ESOPs. In infotech companies, this is doubly critical since many senior managers are the entrepreneurs who started those companies. At Infosys, for instance, this will leave 6 directors ineligible for stock options. Complains V.S. Prabhakar Gupta, 44, Vice-President (Internal Audit), Satyam Computers: ''This will be a major disincentive for the promoters of new infotech companies.'' ''But then,'' argues Anita Ramachandran, 43, CEO, Cerebrus Consultants: ''there's no other way to prevent unscrupulous promoters from using the device to short-change investors and shareholders.'' Don't be surprised, though, if amendments in future offer some leeway for promoters and owners to be offered ESOPs too. Of course, you must get your shareholders' permission-after providing them the details about the number of shares, the pricing, the identity of the beneficiaries, and how they were chosen-and, crucially, set up a compensation committee, comprising your directors, to manage the process. The company must also disclose those details in its annual report, spelling out the names of the recipients and the post-options diluted EPS. Says T.V. Mohandas Pai, 40, Senior Vice-President (Finance), Infosys: ''I have no complaints. The guidelines provide all the freedom we need. It's upto companies to decide how well they can use it. SEBI GUIDELINES Any company whose securities are listed on any stock exchange may offer equity to its employees under the Employee Stock Option Scheme subject to the conditions specified below: 6 1. Promoters and the part- time directors will not be entitled to receive the securities under the ESOPs even if the promoter(s) is/are employee(s) of the company. Provided a director who is an employee and not a promoter may be entitled to receive the securities under the scheme. 2. The issue of shares/convertible instruments under an ESOP shall not exceed 5% of the paid-up capital of the company in any one year. 3. Clause 4 of the guidelines on preferential issues providing for pricing shall be also applicable to the ESOPs. 4. Shareholders' permission must be taken after providing them with complete details 5. A company introducing ESOPs shall submit a certificate to the concerned stock exchange at the time of the listing of the securities issued through the scheme certifying as to whether the securities has been issued as per the scheme to the permanent employees. 6. The companies would be free to devise the ESOPs for the issue of shares/warrants or debt instruments/bonds with warrants including the terms of payment. 7. Companies are free to determine the exercise-price of the stock options they offer 8. If the exercise-price is at a discount to the market price, the discount will be treated as a cost 9. A minimum lock-in period of 1 year from the date of grant will be applicable IMPLICATIONS - Recipients can be cherry-picked. But promoter-employees cannot get stock options - Shareholders can block resolution to issue stock options by voting against the move - Option-holders will be forced to stay with the company for at least 1 year to benefit - Companies can offer their options at a discount, at the market-price, or at a premium - The larger the discount and the gain to the recipient, the greater the impact on net profits THE RECIPIENTS 7 SELECTION CRITERION OF EMPLOYEES Selection criteria for the selection of employees to be covered under ESOPS vary from organization to organization. According to Rajesh Ghai, 28, a Consultant at Noble & Hewitt: ''Many factors are important: whether it's a stock option or a stock-purchase scheme, what the length of the vesting-period is, and whether it is grade or performancelinked.'' Despite the seeming simplicity of such schemes, they can be tailored to meet different organizational and human resource management needs. Generally the following points are taken into consideration: 1. Performance- You can use ESOPS as a mean for rewarding excellence by linking performance with the allotment of stock options. In this way your star performers becomes your shareholders also. ICICI, for instance, took into account performance against pre-set targets, the management level, the leadership quality, and the technical knowledge of every individual before picking the 100-and-odd out of the 1,200 people that the company employs. So high are the eligibility-bars that inability to meet these conditions at any point will rule a beneficiary out of the ESOP. For many companies, ESOPs are, actually, an obvious carrot for employees to do better in future. At one level, since the market is the ultimate arbiter of performance, the price it puts on the company's scrip will help determine the value of every employee's stockholding. But whether the offer is an identical number of shares to each or it varies according to their past and potential contribution? That's where picking the right parameter of performance comes in. Judging from the precedents set by US corporations, the primary choice is between absolute and relative indicators: improvement in sales, profits, or share-prices, either in absolute terms or relative to those of rivals. In addition, specific targets could be set for different individuals. 2. Length of Service- You can reward loyalty of your employees by taking seniority as the criterion for ESOPs. The length of service is important in the knowledge-based industries where the turnover rate is quite high. 3. Size of the Company- A large size company has to be very selective while granting ESOPs whereas a small company can have the luxury of being able to grant ESOPs to all of its employees. At the Bangalore-based Aditi Technologies, for instance, all 300 employees are stock-option holders, with ESOPs being an intrinsic part of the compensation-package. In fact, the straightforward stock-purchase scheme could be the ideal solution since it creates instantaneous ownership. The focus is on rewarding a track record, not on incentivising future performance. 4. Criticality of Employees- You also have to take into account the criticality and the market value of both the position and the individual when picking whom to reward with ESOPs. Smart strategists classify their people in 2 ways: those who, both as individuals 8 and by virtue of the roles they play, are critical to your company's competitive advantage. And those who are substitutable head-and-body players. The differentiation is needed because it is best to use ESOPs only for the first category. At Satyam Computers, for instance, only 3 grades of employees are eligible-project leaders, project managers, and managers above the level of Junior Project Officer-with the eligibility being based on the period of service, the level of responsibility, performance-assessments, and the salarylevel. Thus, only about 600 employees out of 3,500 have been short-listed. ELIGIBILITY TO PARTICIPATE IN ESOS AND/OR ESPS As per Securities and Exchange Board of India (Employee Stock Option Scheme and Employee Stock Purchase Scheme) Guidelines, 1999 1 An employee shall be eligible to participate in ESOS of the company. 2 An employee who is a promoter or belongs to the promoter group shall not be eligible to participate in the ESOS. 3 A director who either by himself or through his relative or through any body corporate, directly or indirectly holds more than 10% of the outstanding equity shares of the company shall not be eligible to participate in the ESOS. "employee" means a) a permanent employee of the company working in India or out of India; or b) a director of the company, whether a whole time director or not; or c) an employee as defined in sub-clauses (a) or (b) of a subsidiary, in India or out of India, or of a holding company of the company. "promoter" means; (a) the person or persons who are in over-all control of the company; (b) the person or persons who are instrumental in the formation of the company or programme pursuant to which the shares were offered to the public; (c) the persons or persons named in the offer document as promoter(s). Provided that a director or officer of the company, if they are acting as such only in their professional capacity will not be deemed to be a promoter. [Explanation: Where a promoter of a company is a body corporate, the promoters of that body corporate shall also be deemed to be promoters of the company.] "promoter group" means 9 (a) an immediate relative of the promoter (i.e. spouse of that person, or any parent, brother, sister or child of the person or of the spouse); (b) persons whose shareholding is aggregated for the purpose of disclosing in the offer document "shareholding of the promoter group". PROCEDURE TO BE FOLLOWED FOR OFFERING ESOPs All Company(s), whether private, public, listed or not-listed can issue Sweat Equity Shares. But the procedure prescribed as per Sec-79A of the Companies Act has to be followed. In case of listed companies, SEBI (Employees Stock Option Scheme & Employee Stock Purchase scheme) Guidelines, 1999 has to be complied with: - Compensation Committee, which shall be a committee of Board of Directors & consisting of majority of independent directors, has to be constituted for administration & superintendence of the ESOS. The committee shall formulate detailed terms & conditions, and policies & systems for the ESOS. - Shareholder Approval by passing special resolution has to be obtained to offer ESOS &/ or ESPS. - Disclosure in Director’s Report has to be made about the details of the ESOS &/ or ESPS. - Certificate from Auditors shall be obtained and placed before the shareholders in general meeting that ESOP scheme has been implemented in accordance with legal provisions and special resolution approving such ESOP scheme. - Shares issued pursuant to ESOP &/ or ESPS in accordance with the SEBI Guidelines shall be eligible to be listed in any recognised stock exchanges. - SEBI Guidelines on Preferential Allotment to employees shall remain applicable PRICING & LOCK-IN PRICING As per SEBI Guidelines, the companies have freedom to determine the exercise price of options under ESOS/ price of shares under ESPS, subject to the condition that the company conform to the accounting policies as prescribed in the SEBI Guidelines. The price should be determined, keeping in view the objectives and rationale for the ESOPs and/or ESPSs. If offered as rewards: Offer ESOPs at a discount, so that their gains are immediate. 10 If they are incentives for future performance: The option price must be at the current market price (the average of the weekly high and low during the six months preceding the date of approval of the scheme by shareholders), with the incentives being available only if the recipients can take the company to greater heights on the bourses. Observes Ragini Subramanian, 39, a Principal at the consulting firm, William M. Mercer: ‘‘one of the important objectives of ESOPs is to incentivise your people to work harder for a better future.'' If the aim is to ensure immediate gains for employees, offer shares directly instead of structuring a stock option plan. LOCK-IN REQUIREMENTS In case of ESOS: - There shall be a minimum period of one year between the grant of options and vesting of option. - The company shall have the freedom to specify the lock-in period for the shares issued pursuant to exercise of option. - The employee shall not have right to receive any dividend or to vote or in any manner enjoy the benefits of a shareholder in respect of option granted to him, till shares are issued on exercise of option. In case of ESPS: - Shares issued under an ESPS shall be locked in for a minimum period of one year from the date of allotment. - If the ESPS is part of a public issue and the shares are issued to employees at the same price as in the public issue, the shares issued to employee pursuant to ESPS shall not be subject to any lock-in. COSTS & ACCOUNTING COSTS Companies may sell shares to their employees under ESOP in any of following three ways: Sell from treasury stocks Sell after issuance of new shares : This carries a two-fold cost: 1. in form of lower earnings, because of a higher equity-base. 2. the cost involved in offering the shares at a discount. 11 As KPMG's Ramu points out: ''A discounted issue implies an opportunity-loss since the same shares could have been issued at the market-price or even higher.'' Buyback shares and sell. This option will mean dipping into your reserves to bankroll the repurchase. In some cases Corporate may resort to borrowing for buyback and get into a debt trap that is not beneficial. All these options either bear opportunity cost or borrowing cost. Any method will dilute control for the owners. ACCOUNTING SEBI Guidelines lays down the accounting policies for ESOS & ESPS. Further some Companies, Indian Accounting Standards (IAS) for accounting also follow US GAAP. Accounting for ESOPs SEBI guidelines The SEBI guidelines specify how the cost will show up books of accounts. In case of Employee Stock Option Plans, the difference between the price at which your employees can exercise their options and the market-price-on the date on which the option is granted-must be taken as an expenditure on your Profit & Loss Account although there is no actual cash-outflow. But this can be spread out over the entire period during which the scheme is in play instead of taking the blow in 1 year. A guideline issued by the SEBI for stock options requires companies to show expenses in either of the following ways. · Show in the form of option discount [difference between market price of the share at the date of grant of the option under ESOS over the exercise price of the option (including up-front payment, if any)] · Or, the fair value of the option measured by the Black and Scholes model. But, This model understates the value of the option as it gives the liberty of choosing the variables to the corporate. If variables like standard deviation of the scrip and interest rate are changed, the value of option will also change. Variations in option value using Black and Scholes model There are five variables that could change the option value. These are 1. Fall in the share price at the time of announcement of ESOP. 2. Increase of the exercise price. 3. Use of lower interest rate. 4. Use of lower standard deviation. 12 5. Use of shorter vesting period. The accounting value as measured above should be accounted as employee compensation (aggregate of accounting value of the options so granted under ESOS during the accounting period) and has to be amortised on a straight-line basis over the vesting period. Market experts raise questions about this form of accounting, as it does not use the time value of money in measuring the cost of the stock option. This borrowed framework has the same lapses as the US GAAP. US GAAP The FASB (Financial Accounting Standard Board) has given two choices for accounting of ESOP 1. To take the cost of stock options to the financial statements directly. 2. To make pro forma disclosures of cost by way of notes to accounts. Almost all companies chose the second option, as it did not reduce the profit figures. FASB’s accounting regulations for stock based compensation also have some loopholes. Instance : INFOSYS uses both US GAAP and Indian Accounting Standards (IAS) for accounting the ESOP. As per US GAAP, Infosys uses the intrinsic value-based method for Stock issued to employees, to account for employee stock-based compensation plan. The company has therefore adopted the proforma disclosure provisions of US GAAP. As per Indian accounting procedures, INFOSYS has valued its ESOP in the form of option discount and accounted the expenses. Accounting for ESPS With respect to Stock Purchase Scheme, SEBI guidelines requires companies to show expenses as price discount (excess of the market price of the shares at the date of issue over the price at which they are issued under the ESPS) The accounting value as measured above should be accounted as employee compensation (aggregate of accounting value of the shares so issued under ESPS during the accounting period) Instance: Suppose a company issues 500 shares on 1/4/2002 under an ESPS at Rs 40 when the market price is Rs 160. The accounting value of the shares being : 500 x (160-40) = 500 x 120 = 60,000 The accounting entry would be as follows : 1/4/2002 Cash 20,000 13 Employee Compensation Expense 60,000 Paid Up Equity Capital 5,000 Share Premium Account 75,000 (Issue of 500 shares under ESPS at a price of Rs 40 each when market price is Rs 160) Caution ESOP may be attractive in a booming market but it is not the same story in a falling market both to the individuals and to the companies offering ESOPs. Companies need to know what cost they are paying for the human capital before deciding on ESOPs. TAX IMPLICATION Taxation is a contentious issue in stock option plans. Till A.Y. 2000-01, the difference between the market value and the cost of acquisition of such shares, debentures or warrants was taxable as perquisites. However, For A.Y.2001-02 and subsequent year(s), the Law stands modified and such benefit(s) are not to be taxed as perquisites. Mere grant of stock options or even exercise of such stock options whereby shares are in fact allotted does not attract tax as perquisite(s). They are to be taxed only once when sold, as capital gains. Before the above amendment, the difference between the market price & exercise price is to be treated as perquisite.The Central Board of Direct Taxes, with a view to clarifying various aspects pertaining to the taxability of such offerings issued on July 24, 1995 a circular No 710, the salient points of which are: Shares issued by the employer company to its employees at a price lower than the market value would be treated as a perquisite within the meaning of clause (iii) of sub-section (2) of section 17 of the Income tax Act, 1961.6 Where shares held by the government have been transferred to the employee, there will be no perquisite because the employer- employee relationship does not exist between government and the employee. Where the employer offers shares to its employees at the same price as has been offered to the public/other shareholders, there will be no perquisite. Where the employer has offered the shares to its employees at a price lower than that offered to public or other shareholders, the difference between the two prices will be treated as a perquisite. Where the employer has offered shares only to its employees, the perquisite value will be the difference between the market price of the shares on the date of 14 acceptance of the offer by the employee and the price at which shares are offered. The above treatment of ESOPs suffer with various anomalies. Let us examine the following. Shares offered under ESOP have a minimum lock-in period during which employees are prohibited from selling shares. This naturally would lead to a diminished market value because of the restriction imposed. Is it fair and equitable to tax the employees if shares cannot be sold in the market? Under ESOP, it is common to issue warrants that give a 'right' to employees to subscribe to the shares of the company after a stipulated period of time. No tax should be levied on the granting of such 'right'. The perquisite value for the difference between the market price and offer price is not treated as a cost of acquisition. When such shares are sold, for computing long-term capital gains, the actual price of acquisition (adjusted for indexation) will be deductible from the sale price. An employee ends up in paying tax on the deemed perquisite value whilst acquiring but when it comes to computing capital gain such deemed acquisition price is ignored! (The Expert Group in its report on rationalisation and simplification of Income tax law has suggested adding of the perquisite value to the acquisition cost of shares.) Why is there a discrimination made between the private sector and public sector employees on the grounds that there is no employer/employee relationship? When an employee subscribes to shares under an ESOP, he has to pay for these shares. Taxing an employee on the perquisite value for a gain he has not yet realised (and may or may not realise in the future) is unjust. For the provisions of clause (iii) of sub-section (2) of section 17 of the Income tax Act, 1961 to apply, one has to consider whether there has been a benefit or amenity provided free of cost or at a concessional rate. The value of the benefit or amenity has to be considered logically from the cost incurred by the employer. In the case of a company offering shares to its employees there is no 'cost' involved. The company has not procured shares in the market at a 'cost' and then transferred shares to its employees. All employees are offered shares at the same rate. Therefore, there can be no case of benefit being offered at a concessional rate. If the concession is (incorrectly, in my view) with reference to the market rate, the benefit will arise only on sale. In such a case the provisions of capital gains tax will apply. Given the nature of the stock markets, can anyone predict with certainty that the shares under an ESOP will always benefit the employees? In view of the complications involved, such deeming perquisite value should be done away with completely as the revenue lost by the government will be more than compensated by the increased productivity of the employees. 15 Moreover, when an employee sells such shares, he will anyway pay a higher capital gains tax because of his lower purchase price. The Sebi guidelines of March 1, 1996 state that clause 4 of its guidelines on preferential issues dated August 4, 1994 shall be applicable to the ESOP. Clause 4 of the August 4, 1994 guidelines provides that the issue of shares on a preferential basis can be made at a price, which is not less than the following: The average of the weekly high and low of the closing prices of the related shares quoted on the stock exchange during the six months preceding the relevant date. The average of the weekly high and low of the closing prices of the related shares quoted on the stock exchange during the two weeks preceding the relevant date. Here again the employees have become the unintended casualties of guidelines that were correctly aimed at discouraging the undesirable practice of allotment to the promoters at prices unrelated to the prevailing market prices. In order to maintain the effectiveness of ESOP and the benefit derived by companies, it is essential to change this method of pricing. The pricing of shares offered through ESOP to employees should be left to the discretion of the company with a proviso that such shares shall not be offered at a price lower than the book value. There can be suitable checks/guidelines provided to prevent misuse of such schemes. Now with the amendment in the Tax treatment w.e.f AY 2001-02, the above discrepancies have been taken care of. Further for the purpose of computation of capital gains w.r.t. transfer of securities which were allotted under an ESOP plan and have already been treated as perquisites at the time of the exercise of the option by the employees, its fair market value at the time of exercise of option shall be the cost of the share for working out the capital gain. This amendment is w.e.f. 1.4.01 and, applies in relation to the A.Y. 2001-2002 and subsequent years. w.e.f. 1.4.2001 i.e. for A.Y. 2001-02 and subsequent year(s), Income Tax Act has been suitably amended and transfer of securities issued under ESOPs are considered for the purposes of computation of capital gains. Even when such share(s), debenture(s) or warrant(s) (received as ESOPs/Sweat Equity) are transferred under a gift or an irrevocable trust, the transaction will be a taxable transfer. The transfer consideration will be the market value of such assets minus the cost paid by the employee, if any. ADVANTAGES 16 ESOPs provide advantages like aligning the interest of the managers with those of the owners. It is a non-cash compensation tool to compete for the best human resources. The main advantage is the accounting advantage that gives an opportunity to corporate to pay without a reduction in book profits. One can observe the following advantages of ESOPs: - Sense of Ownership and Belongingness amongst the Employees. - Lower Attrition Rates - Boosted Morale of Employees - Greater Effort on the Part of Employees - More Equitable Distribution of Profits. As we don’t have much of empirical data related to ESOPs in the Indian context, we can observe the performance of ESOPs in the U.S. Employee stock ownership plans have gained popularity in the United States. There are more than 10,000 employee ownership enterprises in the United States; of those, about 1,500 are plans in which employees hold 50percent or more of the stock. In general, the average is about 30 percent. Studies by the General Accounting Office have shown that such plans are most successful when employee owners participate in management decisions. In a 1987 study by the National Center for Employee Ownership, it was found that participative ESOP firms grew 8% to 11% faster with their plans than they would have without them. Several subsequent studies have confirmed this relationship. Of course, there are risks for workers, since not all employee ownership plans succeed. About 0.8% of all ESOPs have gone bankrupt, for instance, harming workers' retirement savings. CAVEATS Again, we can analyse the U.S. experience and study existing and probable pitfalls. Following can be a few of problems faced by the organizations adopting ESOPs: - There can be a feeling of dejection and disappointment amongst the employees who fail to get ESOPs. - Only profit-making companies can use this tool in a big way. - It can dilute the equity of the company. - In a multi-business companies, ESOPs might end up rewarding even employees in businesses which haven't performed as well as the rest. - ESOPs are complicated and expensive. Even if the company is Successful, management gets frustrated and confused in maintaining the ESOPs. 17 - ESOPs don't just go away when management wants them to. After the Principal owners sell out to the ESOP, the remaining employees and Management must live with it. Terminating an ESOP can be prohibitively expensive - Companies, which have ESOPs, are harder to sell to outsiders. Since company an ESOP holder holds shares. - Stock options can also be inherently unfair. A company's stock price can go up not because its performance has improved but because the market as a whole is moving up. So employees can exercise their options at a profit although their company has not benefited from their work. APPREHENSIONS There is a lot of enthusiasm regarding the ESOPS but there are a lot of apprehensions also. Few of these have been listed below: Incorrect Projection of the Financial Position- Legendary investor Warren Buffet is downgrading companies that choose to reward their employees this way. The world's most celebrated stock picker is put off by American conventions that allow companies to post earnings unaffected by the cost of stock options. In its annual report for 1997-98, Infosys Technologies, which initiated stock options in 1994-95, mentions in the notes that it accounts for stock options using the intrinsic value method. Accordingly, no compensation cost has been recognized for stock options issued to employees in 1997. The compensation cost related to the company's 70,000 vested employee stock options at December 31, 1997, and based on the fair value of the options at the grant date, was determined not to be material to the company's results of operations or financial position. Now that there has been a significant change in the price of Infosys shares, the company can no longer call this cost immaterial. ESOPs as Exit Policy- ESOPs can be the exit strategy of the 21st century. ESOPs have been around for years, but they have been rediscovered by the financial-services industry. ESOPs are being pushed as a magic wand for selling a business. If the owner cannot find someone to buy the business, no problem. Simply make one: an ESOPs. Every business owner has "the dream": to sell his business for big money and live the good life in retirement. There are certainly plenty of buyers out there for that business. The problem, however, is that most of those buyers don't have any money. Everyone wants to own a business, but no one has the cash to do it. Quite frequently, the prospective buyer is an employee of the company. In these circumstances, the ESOPs are frequently introduced as the way to get it done. The ESOPs can work the magic. 18 ESOPs IN INDIA What is driving the companies to offer stock options? The basic premise is that such stock options, being another form of monetary reward, would stem employee turnover. But are stock options the right option? For one, it presumes that employee turnover is only due to lack of adequate monetary reward. And even if that be the case, would stock options help stem employee turnover? For, companies appear willing to pay any sum to attract a good employee from a competing organization. For another, offering stock options may inculcate a conservative tendency among employees. And that may impact the long-term growth of companies. For instance, consider a case where the company has to decide on a risky project which may generate large profits in three years' time. If the stock option plan were designed such that employees can sell shares after a year or two, the company may be forced into deciding against the project. For embarking on a risky project may dampen the stock price and, in turn, the monetary benefit that employees can derive from the stock option. In other words, employees may become conservative to protect the value of their stock options. Of course, an argument may arise here that, in India, most companies are family-owned. The project decisions are, therefore, taken by the management, which holds large chunk of shares for lifetime. Hence, a question of having short-term tendencies may not arise, as the argument goes. True, but trends suggest that most such stock options, till date, have been offered by companies which are professionally-managed. Hence, the above argument about familyrun organisations may not hold water in all cases. The fad for stock options becomes intriguing if the tax treatment is considered. Tax laws in our country are indifferent between an employee buying shares under stock options and receiving higher salary instead. For, an amendment to the Finance Act, 1999 has sought to tax the difference between the market price and the cost of stock acquisition under stock options as perquisite at the hands of the employee. So, what then is the hullabaloo about? Perhaps, companies could do well to adopt employee stock options (ESOPs) on the lines of schemes in force in the US. There, ESOPs are retirement-plans like the pension plans. Under an ESOP, the company creates a trust to which it contributes its stock on a yearly basis. In some cases, the company contributes cash to the trust, which uses the proceeds to buy the company's stock, either existing or new. Each employee has an account with the 19 trust. When the employee leaves the organisation on retirement or otherwise, the company buys the shares at the prevailing market price. The basis difference in this case is that employees cannot take managerial decision so as to impact the stock price. This is so because ESOPs are encashable only when the employee leaves the organisation, unlike stock option plans where stocks can be encashed after a fixed lock-in period. If anything, ESOPs actually help in moderating agency costs. That is, the cost incurred by the principals (the shareholders) due to the failure of the employees (the agents) to act in the best interest of the former. By offering ESOPs, the shareholders link a proportion of the employees' compensation to the stock price. To ensure a better stock valuation, employees take decision which help improve profits. Small wonder than that ESOPs are popular in the US. But, both ESOPs and stock options are just another form of monetary reward to the employees. The larger issue is whether such schemes would succeed in our country. Only time will be the best judge of that. REFERENCE SECTION BIBILIOGRAPHY - The Companies Act, 1956 - SEBI (Employee Stock Option Scheme And Employee Stock Purchase Scheme) Guidelines, 1999 - CBDT Guidelines on ESOPs - www.projectshub.com - Business World - Economic Times - Business Line 20