The Newsvendor Problem and Info-Gap Decision Theory: Further

advertisement

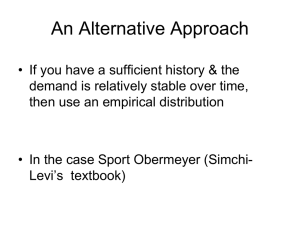

The Newsvendor Problem and Info-Gap Decision Theory: Further Results Michael Sambur*, Yale T. Herer, Yakov Ben-Haim *Contact Author The newsvendor problem is one of the classical operations research models. It can be found in almost any operations management and inventory textbook. It is a single-period, singleproduct inventory problem, with a single procurement before a stochastic demand realization. Several empirical studies have shown that students and professional buyers do not order a quantity similar to that proposed by the classical solution of the newsvendor problem, which has the objective function of maximizing the expected profit. There are many possible explanations. This research was motivated by a desire to explain the deviation from the expected profit maximizing order quantity with one simple decision making criterion. Furthermore, we will explore a new decision paradigm. It is to this end that we studied the newsvendor problem with the info-gap decision methodology. The info-gap theory has been shown, in some cases, to explain the behavior of animals better than other decision making methodologies. Our study compares, both quantitatively and qualitatively, the solutions obtained by the classical, maximum probability of achieving a critical profit level and Info-Gap methodologies. In our analysis of the newsvendor problem with the Info-Gap methodology we do not need to assume any probabilistic demand distribution. In the basic formulation we only use an estimate of the nominal demand and the error of this estimate. We do not assume knowledge of a worst case and do not perform a max-min analysis. Info-Gap decision theory allows us to determine the robustness of the decision to the uncertainty, namely, how much the demand can deviate from the nominal quantity and we can still assure achieving the critical profit. A critical profit is an additional input required for the analysis with info-gap decision theory. We successfully explain the empirical results in some cases, whereas in other cases there is more work to be done. An analysis of the newsvendor problem with info-gap decision theory reveals that some phenomena that are observed in the analysis of other problems with info-gap decision theory are also observed in the analysis of the newsvendor problem. For instance, we will show that lowering the critical profit level leads to an increase in robustness. See Figure 1. The phenomenon of robustness curves that cross one another (again see Figure 1) is very important. The meaning of crossing robustness curves is that for different levels of critical profit we would prefer different order quantities, as being more robust to the uncertainty at that level of critical profit. Figure 1: Robustness plotted as a function of the critical profit for several order quantities We compare the most preferred order quantity from the robust-satisfying methodology with the classical solution and the order quantity that maximizes the probability of obtaining a target profit. In this talk we will emphasize two new info-gap analyses for the newsvendor problem. Hybrid model: In this model we examine the case where the probability distribution of the demand is approximately known, but we are uncertain about how accurately it represents real demand behavior and we do not know by how much it errs. The rationale behind using the Hybrid model is to illustrate the Info-Gap methodology further. That is, we can use the Info-Gap methodology not only in the situations we don't want to assume any demand distribution at all, but also in the situations we do assume that the demand distribution is approximately known. We analyze two demand distributions: normal and exponential. The normal distribution is widely used for modeling demand. We provide an analysis for the case of exponential distribution as well due to the fact that it is quite simple to analyze analytically and provides some useful insights that help in the analysis of the case of the normal distribution. However we are aware of the fact that it is not common to model demand with exponential probability. Multi-item model: We also perform an analysis of the multi-item newsvendor problem. In this model we have several items each with their own revenue and costs. The rationale behind using the Multi-item model is that it is more common for a firm to be interested in a portfolio of items, rather than in a single item. Our analysis demonstrates a way to use the info-gap methodology in such situations. With a traditional total expected profit objective function, the multi-item model is really a multi-single-item model in the sense that the optimal solution to the multi-item problem is simply the vector of info-gap solutions to the single-item problems. Our analysis demonstrates the methodology of choosing the preferred vector of order quantities among several alternative vectors.