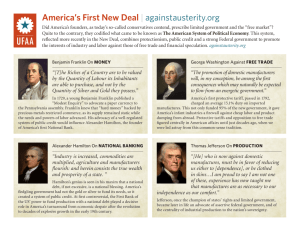

hamilton's vision of america

advertisement

HAMILTON'S VISION OF AMERICA The tariff and tonnage duties, linked as they were to other issues, marked but the beginning of the effort to get the country on a sound fiscal basis. In finance, with all its broad implications for policy in general, it was thirty-four-year-old Alexander Hamilton who seized the initiative. The first secretary of the treasury was a protégé of the president, a younger man who had been Washington's aide during four years of the Revolution. Born out of wedlock on a Caribbean island and deserted by a ne'er-do-well father, Hamilton was left an orphan at thirteen by the death of his mother. With the help of friends and relatives, he found his way at seventeen to New York, attended King's College (later Columbia University), entered the revolutionary agitations as speaker and pamphleteer, and joined the army, where he came to the attention of the commander. George Washington was an essential to me," Hamilton wrote later, after the president's death. He studied law, passed the bar examination, established a legal practice in New York, and became a self-made aristocrat, serving as collector of revenues and member of the Confederation Congress. An early convert to nationalism, he had a major role in promoting the Constitutional Convention. Hamilton had been a hero of the siege of Yorktown, and he remained forever after a frustrated military genius, hungry for greater glory on the field of battle. Shrewd, energetic, and determined, Hamilton was also quick to take offense and reluctant to forgive, impatient with critics and intolerant of error. When Jefferson once told him that he considered Francis Bacon, Isaac Newton, and John Locke the three greatest men who ever lived. Hamilton quickly countered: "The greatest man that ever lived was Julius Caesar," Hamilton indeed had Caesar's limitless ambition. As he recognized at age fourteen. "To confess my weakness, my ambition is prevalent." In a series of classic reports submitted to Congress in the two years from January 1790 to December 1791, Hamilton outlined his program for government finances and the economic development of the United States. The reports were soon adopted, with some alterations in detail but little in substance. The last of the series, the Report on Manufactures, outlined a program of protective tariffs and other governmental supports of business. This .eventually would become government policy, despite much brave talk of free enterprise and free trade. Hamilton submitted the first and most important of his reports to the House of Representatives in January 1790 at the invitation of that body. This First Report on the Public Credit, as it has since been called, made two key recommendations: first, funding of the federal debt at face value, which meant that those citizens holding government bonds could exchange them for new interest-bearing bonds; and second, the federal government's assumption of state debts from the Revolution to the amount of $21 million. The funding scheme was controversial because many farmers and soldiers in immediate need of money had sold their securities for a fraction of their value to speculators who were eager to buy them up after reading Hamilton's First Report. These common folk argued that they should be reimbursed for their losses; otherwise, the speculators would gain a windfall from the new government's funding of bonds at face value. Hamilton sternly resisted such pleas. The speculators, he argued, had "paid what the commodity was worth in the market, and took the risks." Therefore, they should reap the benefits. In fact, Hamilton insisted, the government should do all it could to win over the financial community because it represented the bedrock of a successful nation. The report provided the material for lengthy debates before its substance was adopted in August. Then in short order came three more reports: a Second Report on Public Credit, which included a proposal for an excise tax on distilled spirits to aid in raising revenue to cover the nation's debts (Hamilton meant this tax also to establish the precedent of an excise tax, and to rebuke elements that had been least friendly to his program). Another report recommended a national bank, a revival of the Robert Morris idea that had led to the Bank of North America. The secretary proposed a national mint-which was established in 1792. Finally, in December 1791, as the culmination of his basic reports, the Report on Manufactures proposed an extensive program of government aid and encouragement to the development of manufacturing enterprises. Each of Hamilton's reports excited vigorous discussion and disagreement. His program was substantially the one Robert Morris had urged upon the Confederation a decade before, and which Hamilton had ~ ESTABLISHING THE PUBLIC CREDIT strongly endorsed at the time. "A national debt," he had written Morris in 1781, "if it is not excessive, will be to us a national blessing; it will be a powerful cement of our union. It will also create a necessity for keeping up taxation to a degree which without being oppressive, will be a spur to industry." Payment of the national debt, in short, would be not only a point of national honor and sound finance, ensuring the country's credit for the future; it would also be an occasion to assert a national taxing power and thus instill respect for the authority of the national government. Not least, the plan would win the new government the support of wealthy, influential creditors. It was on this point, however, that Madison, who had been Hamilton's close ally in the movement for a stronger government, broke with him for the second time (their first break had been over tonnage duties), and as in the first case the difference here had ominous overtones of sectionalism. Madison did not question that the debt should be paid; he was troubled, however, that speculators and "stock-jobbers" would become the chief beneficiaries. That the far greater portion of the debt was held north of the MasonDixon line further troubled him. Madison, whom Hamilton had expected to take the lead for his program in the House, therefore advanced an alternative plan to give a larger share to the first owners than to the later speculators. "Let it be a liberal one in favor of the present holders," Madison conceded. "Let them have the highest price which has prevailed in the market; and let the residue belong to the original sufferers." Madison's opposition touched off a vigorous debate, but Hamilton carried his point by a margin of three to one when the house brought it to a vote. Madison’s opposition to the assumption of state debts got more support, however, and set up a division more clearly along sectional lines. The southern states, with the exception of South Carolina, had whittled clown their debts. New England, with the largest unpaid debts, stood to be the greatest beneficiary of the assumption plan. Rather than see Virginia victimized, Madison held out an alternative. Why not, he suggested, have the government assume state debts as they stood in 1783 at the conclusion of the peace? Debates on this point deadlocked the whole question of debt funding and assumption through much of 1790. The stalemate finally ended when Hamilton accosted Thomas Jefferson on the steps of the president's home and suggested a compromise. The next evening, at a dinner arranged by Jefferson, Hamilton and Madison reached an understanding. In return for northern votes in favor of locating the permanent capital on the Potomac, Madison pleddged to seek enough southern votes to pass the assumption, with the further arrangement that those states with smaller debts would get in SECTIONAL DIFFERENCES EMERGE effect outright grants from the federal government to equalize the difference. With these arrangements, enough votes were secured to carry Hamilton's funding and assumption schemes. The capital would be moved to Philadelphia for ten years, after which time it would be settled at a Federal City on the Potomac, the site to be chosen by the president. In August 1790 Congress finally passed the legislation for Hamilton's plan. By this vast program of funding and assumption, ~ Hamilton had called up from nowhere, as if by magic, a great sum of capital. As he put it in his original report, a national debt "answers most of the purposes of money." Transfers of government bonds, once the debt was properly funded, would be "equivalent to payments in specie." This feature of the program was especially important in a country that had, from the first settlements, suffered a shortage of hard money. Having established the public credit, Hamilton moved on to a related measure essential to his vision of national greatness. He called for a national bank, which by issuance of bank notes (paper money) might provide a uniform currency. Government bonds held by the bank would back up the value of its new bank notes, needed as a medium of exchange because of the chronic shortage of specie. The national bank, chartered by Congress, would remain under governmental surveillance, but private investors would supply fourfifths of the $10 million capital and name twenty of the twenty-five directors; the government would pro~ A NATIONAL BANK The first Bank of the United States in Philadelphia. Proposed by Hamilton, the bank opened in 1 i91. vide the other fifth of the capital and name five directors. Government bonds would be received in payment for three-fourths of the stock in the bank, and the other fourth would be payable in gold and silver. The bank, Hamilton explained, would serve many purposes. Its notes would become a stable currency, uniform in value because redeemable in gold and silver upon demand. Moreover, the bank would provide a source of capital for loans to fund the development of business and commerce. Bonds, which might otherwise be stowed away in safes, would instead become the basis for a productive capital by backing up bank notes available for loan at low rates of interest, the "natural effect" of which would be "to increase trade and industry." What is more, the existence of the bank would serve certain housekeeping needs of the government: a safe place to keep its funds, a source of "pecuniary aids" in sudden emergencies, and the ready transfer of funds to and from branch offices through bookkeeping entries rather than shipment of metals. Once again Madison rose to lead the opposition, arguing that he could find no basis in the Constitution for such a bank. He himself had proposed in the Constitutional Convention a grant of power to charter corporations, but no specific provisions had been adopted. That was enough to raise in President Washington's mind serious doubts as to the constitutionality of the measure, which Congress passed fairly quickly over Madison's objections. Before signing the bill into law, therefore, the president sought the advice of his cabinet and found there an equal division of opinion. The result was the first great and fundamental debate on constitutional interpretation. Should there be a strict or a broad construction of the document? Were the powers of Congress only those explicitly stated or were others implied? The argument turned chiefly on Article I, Section 8, which authorized Congress to "make all laws which shall be necessary and proper for carrying into execution the foregoing Powers." Such language left room for disagreement and led to a confrontation between Jefferson, with whom Attorney-General Edmund Randolph agreed, and Hamilton, who had the support of Secretary of War Henry Knox. Jefferson pointed to the Tenth Amendment, which reserved to the states and the people powers not delegated to Congress. "To take a single step beyond the boundaries thus specially drawn around the powers of Congress, is to take possession of a boundless field of power, no longer susceptible of any definition." A bank might be a convenient aid to Congress in collecting taxes and regulating the currency, but it was not, as Article I, Section 8, specified, necessary. Hamilton had not expected the constitutionality of the bank to become a divisive issue. His original report had neglected the point, but he was prepared to meet his opponents on their own ground. In a long report to the president, Hamilton insisted that the power to charter corporations was included in the sovereignty of any government, whether or not expressly stated. The word "necessary," he explained, often meant no more than "needful, requisite, incidental, useful, or conducive to." And in a classic summary, he expressed his criterion on constitutionality: "This criterion is the end, to which the measure relates as a mean. If the end be' clearly comprehended within any of the specified powers, collecting taxes and regulating the currency, and if the measure have an obvious relation to that end, and is not forbidden by any particular provision of the Constitution, it may safely be deemed to come within the compass of the national authority." The president, influenced by the fact that the matter came within the jurisdiction of the secretary of the treasury, accepted Hamilton's argument and signed the bill. In doing so, he had indeed, in Jefferson's words, opened up "a boundless field of power," which in coming years would lead to a further broadening of implied powers with the approval of the Supreme Court. Under John Marshall the Court would eventually adopt Hamilton's words almost verbatim. On July 4, 1791, the bank's stock was put up for sale and in what seemed to Jefferson a "delirium of speculation" sold out within a few hours, with hundreds of buyers turned away. It cost the government itself nothing until later, for its subscription of $2 million was immediately returned by the bank in a loan of the same amount, with ten years for repayment. * ENCOURAGING MANUFACTURES Hamilton's imagination and his ambitions for the new country were as yet unexhausted. In the last of his great reports, the Report on Manufactures, he set in place the capstone of his design: the active encouragement of manufacturing to provide productive uses for the new capital created by his funding, assumption, and banking schemes. Hamilton believed that several advantages would flow from the development of manufactures: the diversification of labor in a country given over too much to farming; greater use of machinery; paid work for those not ordinarily employed outside the home, such as women and children; the promotion of immigration; a greater scope for the diversity of talents in business; more ample and various opportunities for entreprenurial activity; and a better domestic market for agricultural products. To secure his ends Hamilton proposed to use the means to which other countries had resorted, and which he summarized: protective tariffs on foreign goods, or in Hamilton's words, "protecting duties," which in some cases might be put so high as to deter imports altogether; restraints on the export of raw materials; bounties and premiums to encourage certain industries; tariff exemptions for the raw materials needed for American manufacturing, or "drawbacks" (rebates) to man- moved between these regions than across the Atlantic, thus strengthening the Union: "every thing tending to establish substantial and permanent order in the affairs of a Country. to increase the total mass of industry and opulence, is ultimately beneficial to every part of it." Largely owing to the skillful Hamilton, the Treasury Department, which employed half or more of the civil servants at the time, largely as customs agents, was established on a basis of integrity and efficiency. The department began to retire the Revolutionary War debt, and a "Continental" became worth something after all (if only at a ratio of 100 to 1 in payments to the government), the credit of the government was secure, government securities sold at par, and foreign capital began to flow in once again. Prosperity, so elusive in the 1780s, began to flourish once again, although President Washington cautioned against attributing "to the Government what is due only to the goodness of Providence." Yet suspicions lingered that Hamilton's program was designed to promote his personal interest. There is, however, no evidence that Hamilton benefited personally in any way from his program, although Assistant Treasury Secretary William Duer, unbeknownst to Hamilton, did leak word of the funding and assumption message to favored friends in time for them to reap a speculative harvest from the rise in values. Duer himself later became involved in deals that landed him in prison. Hamilton was inclined toward a truly nationalist outlook, and he focused his energies on the rising power of commercial capitalism. In fact, he would have favored a much stronger central government, including a federal veto on state action; even a constitutional monarchy if that had been practicable. Hamilton believed that throughout history a minority of the strong dominated the weak. There was always a ruling group, perhaps military or aristocratic, and Hamilton had the foresight to see now the rising power of commercial capitalism. He was in many ways a classic Whig who, like Britain's ruling oligarchy of the eighteenth century, favored government by the rich and well-born. The mass of the people, he once said, "are turbulent and changing; they seldom judge or determine right." And once, under the influence of strong drink, he went further: "Your people, sir, is a great beast!" Aligning the government closely to the social elite, Hamilton believed, promoted good government and guarded the public order against the potential turbulence that always haunted him. Hamilton's achievement, however, was to tie more closely to the government those who were already on its side-and to overlook, or even antagonize, those who had their doubts. Hamilton never understood or appreciated the people of the small villages and farms, the people of the frontier. They were foreign to his world, despite his own humble HAMILTON'S ACHIEVEMENT Hamilton's Report on Manufactures proposed tariffs on foreign products to encourage American manufacturing and innovation, as represented by this mechanized grain elevator patented by a Delaware resident in 1795. ufacturers where duties had been levied for revenue or other purposes; encouragements to inventions and discoveries; regulations for the inspection of commodities; and finally, the encouragement of internal improvements in transportation, including the development of roads, canals, and navigable streams. Some of Hamilton's tariff proposals were enacted in 1792. Otherwise the program was filed away-but not forgotten. It became an arsenal of arguments for the advocates of manufactures in years to come, in Europe as well as in America. A summary can hardly do justice to a complex state paper that anticipated and sought to demolish all counterarguments, among them the ominous question that kept arising with Hamilton's schemes, "ideas of a contrariety of interests between the northern and southern regions of the Union," which he found "in the Main as unfounded as they are mischievous." If, as seemed likely, the northern and middle states should become the chief scenes of manufacturing, they would create robust markets for agricultural products, some of which the southern states were peculiarly qualified to produce. North and South would both benefit, he argued, as more commerce beginnings in the Caribbean islands. Along with the Planters of the South, common folk would be at best only indirect beneficiaries of his programs. Below the Potomac the Hamiltonian vision excited little enthusiasm except in South Carolina, which had a large state debt to be assumed and a concentration of mercantile interests at Charleston. There were, in short, a vast number of people who were drawn into opposition to Hamilton's new engines of power. In part they were southern, in part backcountry, and in part a politically motivated faction opposing Hamilton in New York.