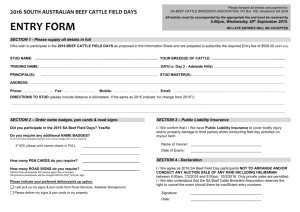

Jan - National Cattlemen's Beef Association

advertisement

2000 Beef Exports Increase 7.7% in Volume; 10.6% in Value by Chuck Lambert March/April 2001 Summary US beef and beef variety meat exports during 2000 increased 7.7 percent in volume, and 10.6 percent in value compared to exports during 1999. NCBA is aggressively working to gain access to the European Community, to maintain access to the market in Mexico, for China's accession to the WTO and to have export data released in a more timely manner. Background US beef exports (including variety meats) during 2000 reached a record 1.244 million metric tones valued at more than $3.6 billion. By comparison, exports during all of 1999 totaled 1.155 million metric tons valued at $3.26 billion. Traditional primary export markets Japan, Mexico, Canada and the Republic of South Korea accounted more than 81.6 percent of export tonnage and 91.1 percent of the export value. Exports to Mexico and Korea continued to grow after rebounding sharply during 1999. Russian trade data has been revised to account for 1999 food-aid shipments. Now that the Senate has approved Permanent Normal Trading Relations (PNTR) China is projected to become an increasingly important export market once they join the WTO -- projected by mid-2001. U.S. Beef Exports to Primary Markets: 1999 vs. 2000 Volume (Thousand Metric Tons) Value (Million Dollars) Beef Japan Mexico S. Korea Canada Egypt Russian Fed. HK/China Tiawan EU 1999 358.92 158.05 106.27 85.00 6.67 31.03 13.52 10.69 6.30 2000 368.01 178.75 143.46 87.48 2.18 12.07 16.29 11.96 4.98 % Change 2.53 13.09 35.00 2.91 -67.29 -61.11 20.52 11.84 -20.94 1999 1,364.55 454.05 330.95 273.26 21.74 70.56 44.61 43.79 28.52 2000 1,466.54 530.77 506.20 299.25 5.55 21.66 59.80 52.98 20.47 % Change 7.47 16.90 52.95 9.51 -74.47 -69.30 34.07 21.00 -28.22 803.96 852.03 5.98 2,724.01 3,049.18 11.94 1999 150.24 49.91 7.37 11.08 37.89 20.74 9.92 3.14 16.76 2000 158.25 49.81 18.53 11.02 17.46 31.41 19.46 8.81 23.51 % Change 5.33 -0.19 151.45 -0.52 -53.93 51.50 96.20 180.99 40.32 1999 353.15 58.51 12.47 58.51 21.80 16.34 16.27 6.57 6.21 2000 318.59 65.40 30.73 65.40 11.29 24.59 31.73 11.15 9.15 % Change -9.78 11.77 146.50 11.77 -48.19 50.49 95.04 69.65 47.30 351.33 392.19 11.63 535.52 555.44 3.72 . All U.S. Variety Meats Japan Mexico S. Korea Canada Russian Fed. Egypt HK/China Tiawan EU All U.S. Beef Plus Variety Meats Japan Mexico S. Korea Canada Egypt Russia Fed. HK/China Tiawan EU 1999 509.16 207.96 113.64 96.08 27.41 68.92 23.44 13.83 23.05 2000 526.26 228.56 161.98 98.50 33.60 29.52 35.76 20.77 28.49 % Change 3.36 9.91 42.55 2.52 22.57 -57.16 52.55 50.19 23.58 1999 1,717.69 512.56 343.42 331.77 38.08 92.36 60.88 50.36 34.74 2000 1,785.13 596.17 536.93 364.64 30.14 32.95 91.54 64.13 29.63 % Change 3.93 16.31 56.35 9.91 -20.85 -64.32 50.37 27.35 -14.71 All U.S. 1155.30 1,244.22 7.70 3,259.53 3,604.61 10.59 Note: % Change is change from 1999 in percent, i.e., beef volume exported to Canada in 2000 increased 2.9 percent; beef volume exported to Mexico increased 13.1 percent, etc. Russian data has been adjusted to account for 1999 food aid shipments. Key Points Beef exports are a key component of total beef demand. NCBA is aggressively working to gain access to emerging markets and to have export data released in a more timely manner. Is a Moratorium on Imports the Answer? By: Chuck Lambert & Gary Weber March/April 2001 Summary Certain sectors of the US beef industry and some members of Congress have proposed a moratorium on the imports of beef and cattle (others have broadened the request to all meats and livestock) in the interest of protecting US herd health from introduction of BSE and FMD. The industry is very aware of the need to protect herd health and has supported science-based controls on meat and animal trade to assure that herd health is not put at risk. Less focus has been placed on the greater risk of human traffic from FMD countries and assuring that the Animal and Plant Health Inspection Service (APHIS) has adequate funding and other critical resources for monitoring and surveillance at airports, seaports and other points of entry to control these situations. Background Who are the primary suppliers and what controls do they have in place? Three countries, Australia, Canada and New Zealand, account for 87.4 percent of US beef import tonnage. Australia and New Zealand are rated as less likely to have BSE than the US or Canada because TSEs are not present in those countries. Canada, the US, Mexico and other Western Hemisphere countries are rated as very unlikely to have a case of BSE. None of these countries have FMD and all have restrictions on imports of meat and animals and on the feeding of animal-based proteins comparable to, or stricter than, the US. Two countries, Canada and Mexico, account for 100 percent of US live cattle imports. These countries are free from BSE and FMD and both have restrictions on imports of meat and animals and on the feeding of animal-based proteins comparable to, or stricter than, the US. NCBA leadership meets on an on-going basis with leadership of the cattle industry in Mexico and with government officials in Mexico to emphasize that it is absolutely critical import and feed-ban regulations are implemented and strictly enforced. The latest meeting was March 7-9, 2001 between NCBA leadership and SAGAR (Mexico Department of Agriculture) officials in Mexico City. FMD has been eradicated from North America, including all Central American countries and a 50-mile wide animal-free zone (the Darien Gap) is maintained at the southern tip of Panama to ensure FMD is not transmitted from South American countries. No cases of BSE have been identified in the Western Hemisphere and all beef-exporting countries have implemented restrictions on imports of meat and animals and the feeding of animal-based proteins comparable to or stricter than the US. What about the other 12.6 percent of meat imports? Argentina and Uruguay supply 5.6 percent of US beef imports and are currently rated FMD-free. Argentina recently began vaccinating livestock in the northern region to strengthen a barrier on the border with Brazil. USDA most recently evaluated and reconfirmed FMD conditions in Argentina during March 2001. Even though these countries are rated FMD-free all fresh, chilled or frozen beef exported from Argentina and Uruguay to North or Central America must continue to be certified as meeting the following specifications to further assure that no FMD virus could be introduced: Has not been in contact with meat from a region with greater disease risk; Originates from premises where neither FMD nor rinderpest have been present during the life of any ruminants or swine slaughtered for export; Originates from premises on which ruminants or swine have not been vaccinated with modified or attenuated live viruses for FMD during the lifetime of any animals slaughtered for export; Must be from animals not vaccinated for other specific diseases; Must be from carcasses that have been allowed to mature at 40 to 50 degrees Farenheit for a minimum of 36 hours after slaughter and have dropped to at least a pH of 5.8 or below in the loin muscle at the end of maturation. Must be free of all bone, blood clots and lymphoid tissue. APHIS has been conducting unannounced site inspections in Argentinean packing plants to verify that these steps are in place Brazil accounts for 4.25 percent of US beef imports. Because Brazil has not achieved FMD-free status without vaccination, beef imported from Brazil must be cooked, canned or preserved. A NAFTA -- US, Canada and Mexico -- evaluation team completed evaluation of the BSE status in Brazil during February 2001 and determined that there is not a BSE risk in Brazil. This leaves 2.75 percent of beef imports (or less than 3-tenths of one percent of the total US beef supply) to be addressed. This beef is primarily imported from Central American countries, mostly Nicaragua and Costa Rica that are free of BSE and FMD and have restrictions on imports of meat and animals and on the feeding of animal-based proteins comparable to the US. USDA also conducts surveillance and monitoring activities throughout Central America for foreign animal diseases and pests. Doesn't vaccination in northern Argentina and continued shipment from southern regions that do not vaccinate (regionalization) put the US at risk? NCBA supports trade rules based on science and there is no science-based risk associated with this trade practice, especially since processing requirements (bottom of prior page) are also in place. Regionalization also has other implications. If, for example without regionalization, if an isolated case of FMD occurred in a swine-herd in an eastern US state, US beef exports from the Texas to Nebraska corridor and from Iowa and Colorado or the Northwest would be stopped. With regionalization they could continue. NCBA supports regionalization and the use of risk reduction measures based on science to ensure that trade will not expose the US to FMD and other foreign animal diseases. OK, if beef and cattle imports aren't the primary risk factors where should we focus? It is imperative that USDA continues to protect the health of the U.S. beef herd. USDA must assure that all conditions are met and that the necessary controls are in place so U.S. herd health is not put at risk. In today's mobile society the risk of tourists, pets and visitors from foreign counties that have recently been on farms is greater than risks posed by imports of beef and cattle. Assuring that inspection and customs clearance procedures are strictly enforced is vital. The APHIS budget for Veterinary Services (VS) that conducts inspections at airports and seaports has been cut over time. The same is true for research budgets related to foreign animal diseases. It is critical that USDA budgets and resources for animal disease monitoring, surveillance and research are increased and NCBA supports efforts to that end. The US does not import beef from Europe due to concerns about BSE and has not for some time, so FMD exposure from European beef imports is not a factor. However, the US is a major importer of pork from Denmark and the Netherlands. NCBA is closely monitoring the spread of FMD in the UK and into Ireland. To date, no cases of FMD have been reported on Continental Europe. If cases are reported, especially if they are in Denmark, the Netherlands or other pork-exporting countries, we are prepared to work with USDA/APHIS to assure that US herd health is not put at risk. Key Points NCBA's primary concern is that all conditions are met and that the necessary controls are in place so U.S. herd health is not put at risk. The US does not import any cattle or beef from countries that do not meet our animal health and safety regulations. NCBA has been in close contact with members of congress and with APHIS as these issues have evolved and has worked with industry leadership and government officials in other countries to assure that animal health and feed regulations are in place and enforced. It is critical that USDA budgets and resources for animal disease monitoring, surveillance and research are increased and NCBA supports efforts to that end. Percent of 2000 US Beef Import Volume Uruguay Other Argentina 1.98% 2.35% New 3.60% Zealand 20.99% Canada 33.03% Mexico 0.10% Australia 33.69% Brazil 4.25% 2000 Beef Imports Increase 5.6% in Volume; 12.3% in Value by Chuck Lambert March/April 2001 Summary US beef and variety meat imports increased 5.6 percent in tonnage and more than 12.3 percent in value during 2000 compared to 1999. Major suppliers continue to be Canada, Australia and New Zealand, with those three countries accounting for approximately 87 percent of the beef tonnage and value imported by the US. Australia has a 378,214 metric ton tariff-rate quota and New Zealand has a tariff-rate quota of 213,402 metric tons. Uruguay and Argentina were declared free of foot-and-mouth disease (FMD) in 1987 and became eligible to export fresh, chilled and frozen beef to the United States under USDA guidelines at that time. US, Canadian and other North American imports of fresh, chilled and frozen beef from Argentina were suspended August 10, 2000 due to positive serology readings on two cattle reportedly smuggled into Argentina from Paraguay. Uruguay voluntarily suspended exports August 26, 2000 among concerns that FMD had affected herds there. During the last half of December USDA re-certified both countries as eligible to ship fresh, chilled and frozen beef to the US. Quotas of 20,000 metric tons generally limit the exports of fresh and frozen beef to the US from Argentina and Uruguay, however cooked and processed beef may be shipped without quota restrictions. Because Brazil has not achieved FMD-free status, beef imported from Brazil must be cooked, canned or preserved. Brazil's initiative to attain FMD-free status suffered a setback with an FMD outbreak in November and will be delayed indefinitely. During 1999 Argentina and Uruguay filled their tariff rate quotas. Beef Imports from Primary Suppliers: 1999 vs. 2000 Volume (Thousand Metric Tons) Value (Million Dollars) 1999 2000 % Change Canada 345.07 335.40 -2.80 Australia 288.74 342.08 18.47 New Zealand 186.93 213.13 14.02 Brazil 50.38 43.11 -14.42 Argentina 44.84 36.57 -18.45 Uruguay 21.50 20.15 -6.24 Mexico 4.79 5.20 8.63 Other 21.40 23.90 11.65 Total US Beef Imports 963.65 1019.55 5.80 Variety Meats 35.17 34.79 -1.07 Total US Imports: Beef + Variety Meats 998.82 1054.34 5.56 1999 937.64 505.97 335.77 122.13 125.56 46.38 16.53 45.88 2000 % Change 982.26 4.76 670.11 32.44 430.11 28.10 91.95 -24.71 108.82 -13.33 46.20 -0.37 19.01 15.02 52.84 15.16 2,135.85 79.30 2,401.30 87.14 12.43 9.89 2,215.15 2,488.43 12.34 Percent of 2000 US Beef Import Value Other ArgentinaUruguay 2.20% 1.92% New 4.53% Zealand 17.91% Canada 40.91% Mexico 0.79% Australia 27.91% Brazil 3.83% Key Points Higher US beef prices and stronger demand have resulted in larger US beef imports. NCBA will continue to monitor and report cattle and beef trade to the industry and assure that trade flows are legal under existing trade agreements and laws. NCBA will work to assure that all requirements are met and that verification methods are in place before access to the US beef market is granted to Argentina, Uruguay, Brazil or other beef exporting countries. Producer Share Highest in Five and a Half Years as Fed Cattle Prices Rally by Chuck Lambert March/April 2001 Summary The packer’s and retailer's share of beef’s retail value continued to decrease as fed cattle prices increased in December and January. The retailer's share decreased to 37.2 percent during December 2000 after reaching a near-record 45.6 percent in September. During December and January the packer’s share of beef’s retail value remained below the trend line at 8.8 percent. The record high packer share was in August 1998 at 12.4 percent. The total marketing share during December and January was 54 and 53.5 percent respectively. Producers received the highest percent of beef’s retail value since September and October 1996 as fed cattle prices increased because of smaller supplies of market-ready cattle due to weather impacts on cattle performance. Background USDA data show that the retailer's share of beef’s retail value has generally increased from the 35 to 38 percent range common during the first half of 1993. Retail margins declined to those levels during December 2000 and January 2001 in spite of continued modest inflation in costs for labor, utilities and other variable and fixed costs. The retail spread was a record 46.1 percent during December 1998, and was reported at 37.2 percent during December 2000 and 37.8 percent during January 2001. During 1997 the packer spread averaged 7.3 percent -- compared to 7.9 percent during 1995 and 1996. An increased packer's share of beef’s retail value to the 8 to 10 percent range is consistent with the trend to further fabrication, case-ready pre-packaged beef and increased value-added close-trimmed boxed beef. USDA includes by-product values in packer spreads and in the total “retail” value of products. The packer spread is calculated as the sum of by-product values plus the value of boxed beef minus the cost of fed cattle. Part of the increase in packers’ share of retail value prior to 1997 was due to an increase in by-product values to more than $100/ head during most of 1996 and 1997. The financial crisis in Asia reduced export demand for variety meats and lowered hide values. May 1999 by-product values declined to a new five-year low price level of $7.68/cwt. and have continued recovery to the $9.50/cwt. range. Byproduct values were $9.46/cwt. during January 2001 -- the fifth month they have been above $9.00 since August 1998. Total packer gross margins (combination of boxed beef and by-products) during April 1998 at $65.85/head were the lowest since February 1995, but rebounded to a new record $170.34/head during June 2000. Packer gross margin was $127.65/head during January 2001. Key Points As packers continue to add value – for example, through closer trimming, more boneless cuts, branded products, improved packaging, and ultimately, branded case-ready products -- the packer's share of the total retail value of beef will increase. As value is added by further processing, the value of the raw product (cattle, in the case of beef production) declines as a percent of the total value of the end product. However, this does not mean that the amount that producers receive declines, in fact, it is likely to increase because the end product will be worth more because of the added value. Hide and other by-product values contribute to the packers’ share of total value. Packers have added value to by-products through blue chrome tanning of hides and developing international markets for beef variety meats. The Asian and Russian crises resulted in lower prices for hides and variety meats but those products have continued price recovery since 1999. These spreads do not account for costs and therefore say nothing about the net profitability of any sector. The National Cattlemen’s Beef Association will continue to actively work to eliminate flaws and improve accuracy and timeliness of USDA data and monitor spreads to assure that normal seasonal patterns are in place. Jan '93 May '93 Sept '93 Jan '94 May '94 Sept '94 Jan '95 May '95 Sept '95 Jan '96 May '96 Sept '96 Jan '97 May '97 Sept '97 Jan '98 May '98 Sept '98 Jan '99 May '99 Sept '99 Jan '00 May '00 Sept '00 Jan '01 10 8 6 Percent 12 4 2 40 30 $100 $80 $40 Month/Year By-product Value ($/head) Live to Cutout Spread ($/head) Jan '93 May '93 Sept '93 Jan '94 May '94 Sept '94 Jan '95 May '95 Sept '95 Jan '96 May '96 Sept '96 Jan '97 May '97 Sept '97 Jan '98 May '98 Sept '98 Jan '99 May '99 Sept '99 Jan '00 May '00 Sept '00 Jan '01 45 Percent Jan '93 May '93 Sept '93 Jan '94 May '94 Sept '94 Jan '95 May '95 Sept '95 Jan '96 May '96 Sept '96 Jan '97 May '97 Sept '97 Jan '98 May '98 Sept '98 Jan '99 May '99 Sept '99 Jan '00 May '00 Sept '00 Jan '01 Percent Packers Share of Beef's Retail Value 60 Total Marketing Spread for Beef 65.0 55 60.0 50 55.0 Month/Year Monthly Packer Spreads, 1993-'01 $160 $140 Jan '93 May '93 Sept '93 Jan '94 May '94 Sept '94 Jan '95 May '95 Sept '95 Jan '96 May '96 Sept '96 Jan '97 May '97 Sept '97 Jan '98 May '98 Sept '98 Jan '99 May '99 Sept '99 Jan '00 May '00 Sept '00 Jan '01 $120 $/Cwt. Jan '93 May '93 Sept '93 Jan '94 May '94 Sept '94 Jan '95 May '95 Sept '95 Jan '96 May '96 Sept '96 Jan '97 May '97 Sept '97 Jan '98 May '98 Sept '98 Jan '99 May '99 Sept '99 Jan '00 May '00 Sept '00 Jan '01 Percent 0 Jan '93 May '93 Sept '93 Jan '94 May '94 Sept '94 Jan '95 May '95 Sept '95 Jan '96 May '96 Sept '96 Jan '97 May '97 Sept '97 Jan '98 May '98 Sept '98 Jan '99 May '99 Sept '99 Jan '00 May '00 Sept '00 Jan '01 $/Head 14 48.0 46.0 44.0 42.0 40.0 38.0 36.0 34.0 32.0 30.0 Retailers Share of Beef's Retail Value Month/Year Month/Year Total Producer Share for Beef 50.0 45.0 35 40.0 35.0 30.0 Month/Year $180 12 Monthly Avg. Beef By-Product Values 11 10 $60 9 8 7 Month/Year Calf & Feeder Cattle Prices Set Historical Records: All Classes Higher by Chuck Lambert January/February 2001 Summary Prices for steer calves and feeder cattle averaged an all-time record $109.12/cwt. and $91.91/cwt. respectively during 2000 while fed cattle prices averaged $69.65/cwt. -- the highest annual price in seven years but less than the plus-$70/cwt. annual averages posted during 1988 through 1993. Monthly prices for steer calves have ranged above $100/cwt. since November 1999. Prices for 650 lb. feeder steers ranged from $89.50 to $94.50/cwt. during 2000 while fed cattle prices averaged a monthly high $73.22/cwt. during April before declining seasonally to the mid-$60s/cwt. during August and September. Fed cattle prices averaged $76.32/cwt during December 2000, the highest monthly price average since June 1993. Higher fed cattle prices are primarily due to increased demand and strengthening boxed beef prices, weather-compounded tightening supplies of market-ready cattle and increasing beef exports. The recovering Asian market has resulted in improved by-product values and general improvement in export markets. Higher fed cattle prices and relatively low feed grain prices resulted in record prices paid for feeder cattle and calves. Background An inverse relationship normally exists between the price that feedlots pay for corn and the price that feedlots pay for calves and feeder cattle. The 1995 corn crop totaled approximately 7.37 billion bushels versus crops of more than 10 billion bushels in 1993 and 1994. As a direct result the prices for feeder cattle and steer calves -- which had traded at a premium to fed cattle prior to October 1995 -- sold for less than fed cattle prices during 1996. The August 2000 corn price of $1.53/bu. established the lowest since September 1987 before increasing to $1.91/bu. in December. Prices for steer calves and feeder cattle have increased faster than prices for fed cattle as corn prices remain relatively low. Increased fed cattle prices since March 1999, low corn prices and tightening supplies have resulted in continued increases in prices for calves and feeder cattle. During December 2000 calf prices were 8.4 percent higher than in January 1993 while the price for corn was approximately 5.5 percent less than the January 1993 corn price. Prices for all classes of cattle are greatly improved from the cyclical lows established during 1996, and prices for calves and feeder cattle set records during 2000. During March and April 1996, the monthly average price for steer calves averaged less than $60/cwt. and feeder cattle prices averaged less than $54/cwt. These prices were a major decline from prices for steer calves that ranged from $96.50/cwt. in 1988 to $105.70/cwt. during 1991 and $103.15/cwt. during 1993. Fed cattle prices averaged $78.32/cwt. during 1992 with a monthly high average of $82.32/cwt. during March 1993. During 1996 the fed cattle price averaged $65/cwt. with a monthly low average of $59.60 during April and May 1996. Prices for feeder cattle and calves remain at record levels primarily due to higher fed cattle prices, lower feed grain prices and declining feeder cattle supplies. Key Points The National Cattlemen’s Beef Association will continue to evaluate factors impacting prices and price discovery. Continued efforts to market relatively large beef supplies -- including retail price featuring and other initiatives to reduce the total cost of producing, processing and marketing beef -- and growth in exports will be critical to maintaining a viable beef industry and increasing market share. Monitoring and reporting feed grain crop conditions will help producers anticipate impacts on prices for feeder cattle and calves. Jan '93 May '93 Sept '93 Jan '94 May '94 Sept '94 Jan '95 May '95 Sept '95 Jan '96 May '96 Sept '96 Jan '97 May '97 Sept '97 Jan '98 May '98 Sept '98 Jan '99 May-99 Sept '99 Jan '00 May '00 Sept '00 $/Cwt. Fed Cattle Jan '93 May '93 Sept '93 Jan '94 May '94 Sept '94 Jan '95 May '95 Sept '95 Jan '96 May '96 Sept '96 Jan '97 May '97 Sept '97 Jan '98 May-98 Sept '98 Jan '99 May-99 Sept '99 Jan '00 May '00 Sept '00 Index: Jan '93 = Base Corn Index Feeder Cattle Fed Cattle 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 $/Cwt. 120.00 Annual Average Cattle Prices: 1980-2000 110.00 100.00 90.00 80.00 70.00 60.00 50.00 40.00 Year Str. Calves Monthly Cattle Prices 115.00 105.00 95.00 85.00 75.00 65.00 55.00 45.00 Year Feeder Steers 2.5 2.25 2 1.75 1.5 1.25 1 0.75 0.5 0.25 0 Index of Corn and Calf Prices Year/Month Calf Index Str. Calves