Summary Statistics and Empirical Results

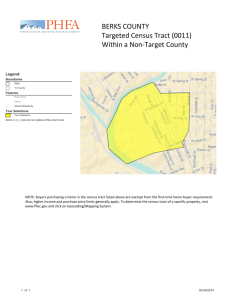

advertisement