The Stock Market

advertisement

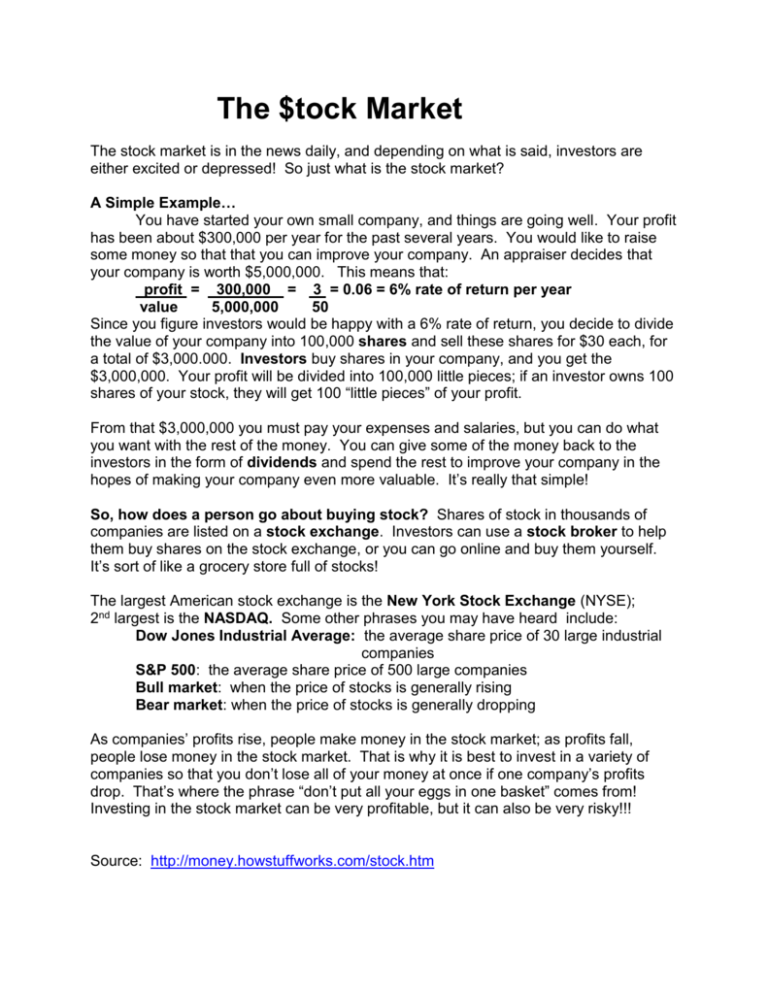

The $tock Market The stock market is in the news daily, and depending on what is said, investors are either excited or depressed! So just what is the stock market? A Simple Example… You have started your own small company, and things are going well. Your profit has been about $300,000 per year for the past several years. You would like to raise some money so that that you can improve your company. An appraiser decides that your company is worth $5,000,000. This means that: profit = 300,000 = 3 = 0.06 = 6% rate of return per year value 5,000,000 50 Since you figure investors would be happy with a 6% rate of return, you decide to divide the value of your company into 100,000 shares and sell these shares for $30 each, for a total of $3,000.000. Investors buy shares in your company, and you get the $3,000,000. Your profit will be divided into 100,000 little pieces; if an investor owns 100 shares of your stock, they will get 100 “little pieces” of your profit. From that $3,000,000 you must pay your expenses and salaries, but you can do what you want with the rest of the money. You can give some of the money back to the investors in the form of dividends and spend the rest to improve your company in the hopes of making your company even more valuable. It’s really that simple! So, how does a person go about buying stock? Shares of stock in thousands of companies are listed on a stock exchange. Investors can use a stock broker to help them buy shares on the stock exchange, or you can go online and buy them yourself. It’s sort of like a grocery store full of stocks! The largest American stock exchange is the New York Stock Exchange (NYSE); 2nd largest is the NASDAQ. Some other phrases you may have heard include: Dow Jones Industrial Average: the average share price of 30 large industrial companies S&P 500: the average share price of 500 large companies Bull market: when the price of stocks is generally rising Bear market: when the price of stocks is generally dropping As companies’ profits rise, people make money in the stock market; as profits fall, people lose money in the stock market. That is why it is best to invest in a variety of companies so that you don’t lose all of your money at once if one company’s profits drop. That’s where the phrase “don’t put all your eggs in one basket” comes from! Investing in the stock market can be very profitable, but it can also be very risky!!! Source: http://money.howstuffworks.com/stock.htm 1. Explain this sentence: “I own 200 shares of stock in the Coca-Cola company.” 2. Name two ways you can you go about buying shares of stock in a company? 3. What is the difference between a bull market and a bear market. Three investors had money in the stock market on March 1, 2001. Use the chart of Twelve Large Companies to answer the following questions. Show what you put into your calculator! 4. On March 1, 2001, all three investors owned a portfolio of 100 shares in each of the twelve companies on the list. What was the value of each investor’s portfolio on that date? 5. Larry Lazyboy could not be bothered keeping up with what was going on in the stock market, so he just left his 100 shares of stock where they were – 100 shares in each of the ten companies on the list. a. What was the value of his portfolio on March 1, 2011? b. Compared to March 1, 2001, did Larry show a profit or a loss? How much? 6. Barry Businessman follows the stock market closely. He understood that many stocks were losing value and the economy was in trouble. He knew that Apple was making lots of money due to sales of iPods and iPhones, and the health care industry was still hiring. He decided to sell some stocks and purchase others to respond to the economy. On March 1, 2011, he owned 400 shares each of AAPL and UNH, and 200 shares each of MCD and HD. a. How much was his portfolio worth on March 1, 2011? b. Compared to March 1, 2001, did Barry show a profit or a loss? How much? 7. Perry Panicker could not stand to see the value of his stocks drop. When he kept hearing on the news that the “tech stocks” were losing money, he sold all of his MSFT and AAPL. However, he didn’t read the business section of the paper, so he really had no idea what was going on in the rest of the stock market. He figured “everyone loves McDonald’s” so he put more money in MCD. He figured everyone was trying to save money, so he put extra money in BIG, HD and WMT. He also figured no one would stop getting sick, so he bought some UNH. On March 1, 2011, he owned 250 shares each of MCD, BIG, HD, WMT and 200 shares of UNH. a. How much was his portfolio worth on March 1, 2011? b. Compared to March 1, 2011, did Perry show a profit or a loss? How much? Twelve Large Companies Company Name Stock Type of Business Symbol Amazon AMZN Apple Bank of America Big Lots AAPL BAC Boeing BA CocaCola KO Home Depot HD McDonald’s MCD Microsoft MSFT Nike NKE BIG UnitedHealth UNH Group Walmart WMT On-Line retailer of books, music, etc. Computers, iPods, iPhones, etc The largest consumer bank in the United States Nation’s largest close-out merchandise retailer Maker of many types of military and commercial airplanes Sells 40% of all soft drinks in the US and 50% world-wide Largest home-improvement retailer in the U.S. Almost 20,000 fast-food outlets world-wide Largest software company in the world Controls nearly 40% of the U.S. athletic shoe market The biggest health insurance Company in the US One of the largest discount department stores in the U.S. Source: bigcharts.marketwatch.com/historical Avg Share Price 3/1/01 $10.44 Avg Share Price 3/1/11 177.24 $18.75 $49.34 $348.16 $14.20 $12.00 $40.71 $59.65 $72.30 $52.70 $64.31 $41.50 $37.08 $29.21 $74.44 $59.36 $26.55 $38.20 $87.98 $58.99 $42.52 $48.34 $51.75