Weekly Economic Update - 4th Generation Financial

advertisement

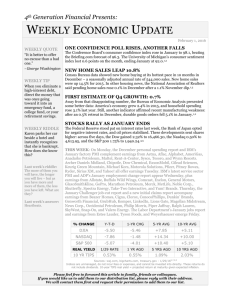

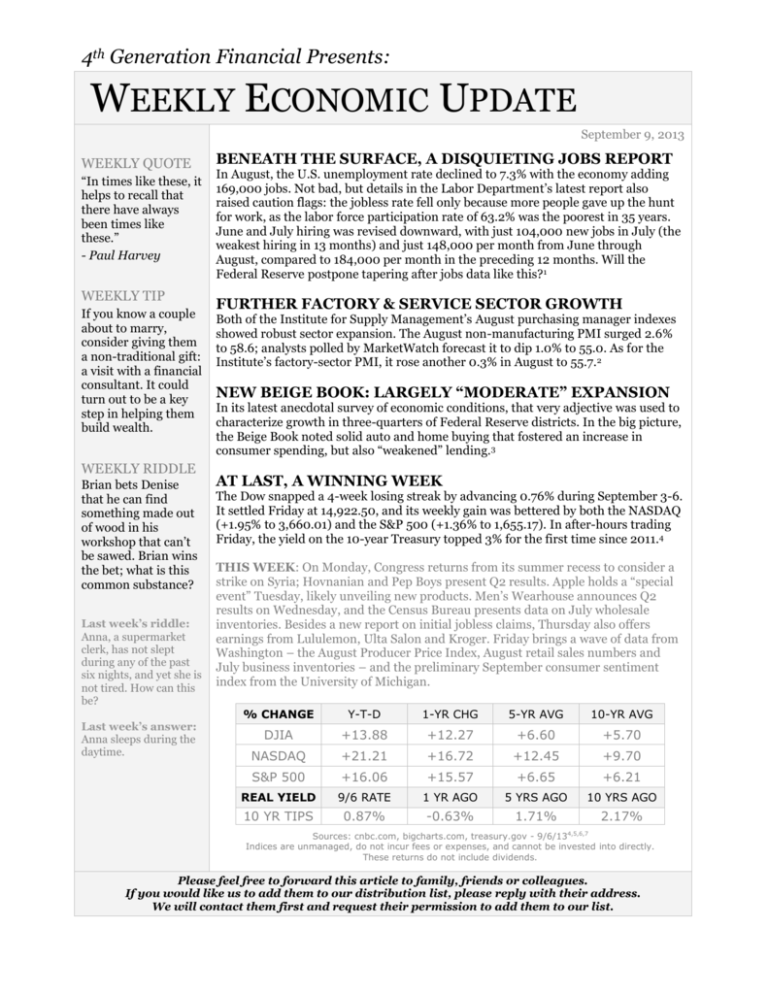

4th Generation Financial Presents: WEEKLY ECONOMIC UPDATE September 9, 2013 WEEKLY QUOTE “In times like these, it helps to recall that there have always been times like these.” - Paul Harvey WEEKLY TIP If you know a couple about to marry, consider giving them a non-traditional gift: a visit with a financial consultant. It could turn out to be a key step in helping them build wealth. WEEKLY RIDDLE Brian bets Denise that he can find something made out of wood in his workshop that can’t be sawed. Brian wins the bet; what is this common substance? Last week’s riddle: Anna, a supermarket clerk, has not slept during any of the past six nights, and yet she is not tired. How can this be? Last week’s answer: Anna sleeps during the daytime. BENEATH THE SURFACE, A DISQUIETING JOBS REPORT In August, the U.S. unemployment rate declined to 7.3% with the economy adding 169,000 jobs. Not bad, but details in the Labor Department’s latest report also raised caution flags: the jobless rate fell only because more people gave up the hunt for work, as the labor force participation rate of 63.2% was the poorest in 35 years. June and July hiring was revised downward, with just 104,000 new jobs in July (the weakest hiring in 13 months) and just 148,000 per month from June through August, compared to 184,000 per month in the preceding 12 months. Will the Federal Reserve postpone tapering after jobs data like this?1 FURTHER FACTORY & SERVICE SECTOR GROWTH Both of the Institute for Supply Management’s August purchasing manager indexes showed robust sector expansion. The August non-manufacturing PMI surged 2.6% to 58.6; analysts polled by MarketWatch forecast it to dip 1.0% to 55.0. As for the Institute’s factory-sector PMI, it rose another 0.3% in August to 55.7.2 NEW BEIGE BOOK: LARGELY “MODERATE” EXPANSION In its latest anecdotal survey of economic conditions, that very adjective was used to characterize growth in three-quarters of Federal Reserve districts. In the big picture, the Beige Book noted solid auto and home buying that fostered an increase in consumer spending, but also “weakened” lending.3 AT LAST, A WINNING WEEK The Dow snapped a 4-week losing streak by advancing 0.76% during September 3-6. It settled Friday at 14,922.50, and its weekly gain was bettered by both the NASDAQ (+1.95% to 3,660.01) and the S&P 500 (+1.36% to 1,655.17). In after-hours trading Friday, the yield on the 10-year Treasury topped 3% for the first time since 2011.4 THIS WEEK: On Monday, Congress returns from its summer recess to consider a strike on Syria; Hovnanian and Pep Boys present Q2 results. Apple holds a “special event” Tuesday, likely unveiling new products. Men’s Wearhouse announces Q2 results on Wednesday, and the Census Bureau presents data on July wholesale inventories. Besides a new report on initial jobless claims, Thursday also offers earnings from Lululemon, Ulta Salon and Kroger. Friday brings a wave of data from Washington – the August Producer Price Index, August retail sales numbers and July business inventories – and the preliminary September consumer sentiment index from the University of Michigan. % CHANGE Y-T-D 1-YR CHG 5-YR AVG 10-YR AVG DJIA +13.88 +12.27 +6.60 +5.70 NASDAQ +21.21 +16.72 +12.45 +9.70 S&P 500 +16.06 +15.57 +6.65 +6.21 REAL YIELD 9/6 RATE 1 YR AGO 5 YRS AGO 10 YRS AGO 10 YR TIPS 0.87% -0.63% 1.71% 2.17% 4,5,6,7 Sources: cnbc.com, bigcharts.com, treasury.gov - 9/6/13 Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. Please feel free to forward this article to family, friends or colleagues. If you would like us to add them to our distribution list, please reply with their address. We will contact them first and request their permission to add them to our list. Registered representative, securities offered through Cambridge Investment Research, Inc., broker-dealer, member FINRA/SIPC. Investment advisor representative, Cambridge Investment Research Advisors, Inc., a registered investment advisor. Cambridge and 4th Generation Financial are not affiliated. 4th Generation Financial | 1115 N. Kentucky Avenue | Winter Park, FL 32789 This material was prepared by MarketingLibrary.Net Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. Marketing Library.Net Inc. is not affiliated with any broker or brokerage firm that may be providing this information to you. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is not possible to invest directly in an index. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world's largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. Citations. 1 - latimes.com/business/money/la-fi-mo-jobs-federal-reserve-stimulus-unemployment-economy-20130906,0,5880212.story [9/6/13] 2 - marketwatch.com/economy-politics/calendars/economic [9/6/13] 3 - forbes.com/sites/steveschaefer/2013/09/04/feds-beige-book-housing-autos-pace-growth-but-lending-weakens/ [9/4/13] 4 - tinyurl.com/lp244bl [9/6/13] 5 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F6%2F12&x=0&y=0 [9/6/13] 5 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F6%2F12&x=0&y=0 [9/6/13] 5 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F6%2F12&x=0&y=0 [9/6/13] 5 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F5%2F08&x=0&y=0 [9/6/13] 5 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F5%2F08&x=0&y=0 [9/6/13] 5 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F5%2F08&x=0&y=0 [9/6/13] 5 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F5%2F03&x=0&y=0 [9/6/13] 5 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F5%2F03&x=0&y=0 [9/6/13] 5 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F5%2F03&x=0&y=0 [9/6/13] 6 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [9/6/13] 7 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [9/6/13]