Chapter 5

Cost Behavior: Analysis and Use

Solutions to Questions

5-1

a. Variable cost: A variable cost remains constant on a per unit basis, but changes in total in direct relation to changes in volume.

b. Fixed cost: A fixed cost remains constant in

total, but if expressed on a per unit basis,

varies inversely with changes in volume.

c. Mixed cost: A mixed cost contains both variable and fixed cost elements.

5-2

a. Unit fixed costs decrease as volume increases.

b. Unit variable costs remain constant as volume increases.

c. Total fixed costs remain constant as volume

increases.

d. Total variable costs increase as volume increases.

5-3

a. Cost behavior: Cost behavior is the way in

which costs change in response to changes

in some underlying activity, such as sales

volume, production volume, or orders processed.

b. Relevant range: The relevant range is the

range of activity within which assumptions

relative to variable and fixed cost behavior

are valid.

5-4

An activity base is a measure of whatever causes the incurrence of a variable cost.

Examples of activity bases include units produced, units sold, letters typed, beds in a hospital, meals served in a cafe, service calls made,

etc.

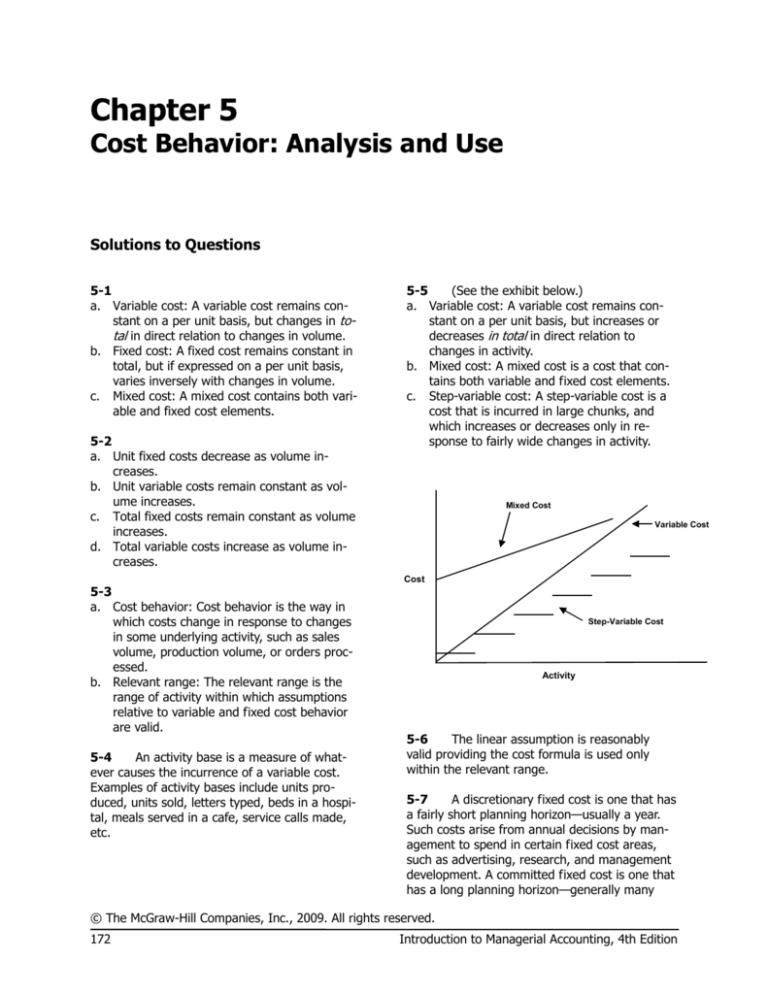

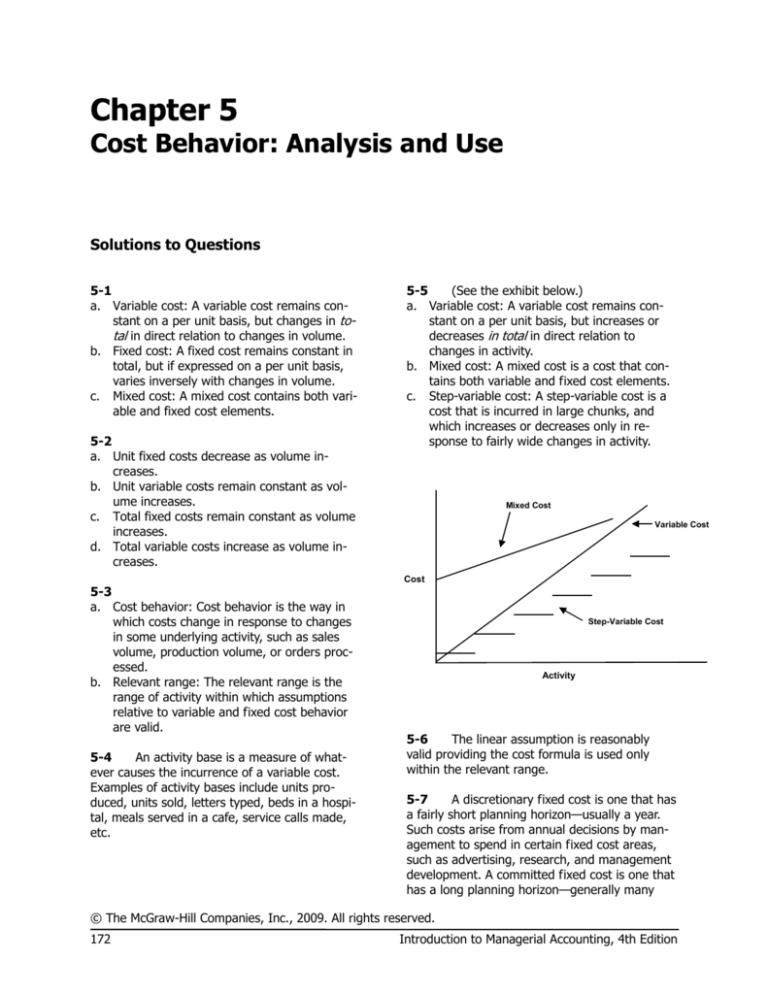

5-5

(See the exhibit below.)

a. Variable cost: A variable cost remains constant on a per unit basis, but increases or

decreases in total in direct relation to

changes in activity.

b. Mixed cost: A mixed cost is a cost that contains both variable and fixed cost elements.

c. Step-variable cost: A step-variable cost is a

cost that is incurred in large chunks, and

which increases or decreases only in response to fairly wide changes in activity.

Mixed Cost

Variable Cost

Cost

Step-Variable Cost

Activity

5-6

The linear assumption is reasonably

valid providing the cost formula is used only

within the relevant range.

5-7

A discretionary fixed cost is one that has

a fairly short planning horizon—usually a year.

Such costs arise from annual decisions by management to spend in certain fixed cost areas,

such as advertising, research, and management

development. A committed fixed cost is one that

has a long planning horizon—generally many

© The McGraw-Hill Companies, Inc., 2009. All rights reserved.

172

Introduction to Managerial Accounting, 4th Edition

years. Such costs relate to a company’s investment in facilities, equipment, and basic

organization. Once such costs have been incurred, a company becomes “locked in” to the

decision for many years.

5-8

a. Committed

b. Discretionary

c. Discretionary

d. Committed

e. Committed

f. Discretionary

5-9

Yes. As the anticipated level of activity

changes, the level of fixed costs needed to support operations may also change. Fixed costs

may often be adjusted in broad steps, rather

than being absolutely fixed at one level for all

ranges of activity.

5-10 The major disadvantage of the high-low

method is that it uses only two points in determining a cost formula and these two points are

likely to be less than typical since they represent

extremes of activity.

5-11 The quick-and-dirty method, the highlow method, and the least-squares regression

method can be used to analyze mixed costs. The

least-squares regression method is generally

considered to be most accurate, since it derives

the fixed and variable elements of a mixed cost

by means of statistical analysis. The quick-anddirty method is relatively crude and subjective.

The high-low method utilizes only two data

points, making it the least accurate of the three

methods.

5-12 A mixed cost can be expressed in the

form Y = a + bX, where the a term represents

the fixed cost element and the b term represents the variable cost element per unit of activity.

5-13 The fixed cost element is represented by

the point where the line intersects the vertical

axis on the graph. The variable cost per unit is

represented by the slope of the line.

5-14 The term “least-squares regression”

means that the sum of the squares of the deviations from the plotted points on a graph to the

regression line is smaller than could be obtained

from any other line that could be fitted to the

data.

5-15 The contribution approach to the income

statement organizes costs by behavior, first deducting variable expenses to obtain the contribution margin, and then deducting fixed expenses

to obtain net operating income. The traditional

approach organizes costs by function, such as

production, selling, and administration. Within a

functional area, fixed and variable costs are intermingled.

5-16 The contribution margin is total sales

revenue less total variable expenses.

5-17 The basic difference between absorption

and variable costing is due to the accounting for

fixed manufacturing overhead. Under absorption

costing, fixed manufacturing overhead is accounted for as a product cost and hence is an

asset until products are sold. Under variable

costing, fixed manufacturing overhead is accounted for as a period cost and is charged in

full against the current period’s income.

5-18 Selling and administrative expenses are

accounted for as period costs under both variable costing and absorption costing.

5-19 Under absorption costing, fixed manufacturing overhead costs are included in product

costs, along with direct materials, direct labor,

and variable manufacturing overhead. If some of

the units are not sold by the end of the period,

then they are carried into the next period as inventory. The fixed manufacturing overhead cost

attached to the units in ending inventory follow

the units into the next period as part of their

inventory cost. When the units carried over as

inventory are finally sold, the fixed manufacturing overhead cost that has been carried over

with the units is included as part of that period’s

cost of goods sold.

5-20 If production exceeds sales, absorption

costing will usually show higher net operating

income than variable costing. When production

exceeds sales, inventories increase and under

absorption costing part of the fixed manufacturing overhead cost of the current period is deferred in inventory to the next period. In contrast, under variable costing all of the fixed

manufacturing overhead cost of the current period is charged immediately against income as a

period cost.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

173

5-21 If fixed manufacturing overhead cost is

released from inventory, then inventory levels

must have decreased and therefore production

must have been less than sales.

5-22 Under absorption costing it is possible to

increase net operating income simply by increasing the level of production without any increase

in sales. If production exceeds sales, units are

added to inventory. These units carry a portion

of the current period’s fixed manufacturing overhead costs into the inventory account, thereby

reducing the current period’s reported expenses

and causing net operating income to increase.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

174

Introduction to Managerial Accounting, 4th Edition

Brief Exercise 5-1 (20 minutes)

1.

Fixed cost ..................................

Variable cost ..............................

Total cost ..................................

Cost per cup of coffee served * ..

Cups of Coffee Served

in a Week

1,800

1,900

2,000

$1,100

468

$1,568

$0.871

$1,100

494

$1,594

$0.839

$1,100

520

$1,620

$0.810

* Total cost ÷ cups of coffee served in a week

2. The average cost of a cup of coffee declines as the number of cups of

coffee served increases because the fixed cost is spread over more cups

of coffee.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

175

Brief Exercise 5-2 (45 minutes)

1. The completed scattergraph is presented below:

16,000

14,000

12,000

Total Cost

10,000

8,000

6,000

4,000

2,000

0

0

2,000

4,000

6,000

8,000

10,000

Units Processed

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

176

Introduction to Managerial Accounting, 4th Edition

Brief Exercise 5-2 (continued)

2. (Students’ answers will vary considerably due to the inherent

imprecision and subjectivity of the quick-and-dirty scattergraph method

of estimating variable and fixed costs.)

The approximate monthly fixed cost is $6,000—the point where the

straight line intersects the cost axis.

The variable cost per unit processed can be estimated as follows using

the 8,000-unit level of activity, which falls on the straight line:

Total cost at the 8,000-unit level of activity ...........

Less fixed costs ...................................................

Variable costs at the 8,000-unit level of activity .....

$14,000

6,000

$ 8,000

$8,000 ÷ 8,000 units = $1 per unit.

Observe from the scattergraph that if the company used the high-low

method to determine the slope of the line, the line would be too steep.

This would result in underestimating the fixed cost and overestimating

the variable cost per unit.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

177

Brief Exercise 5-3 (30 minutes)

1.

Month

High activity level (August) ..

Low activity level (October) .

Change ...............................

OccupancyDays

3,608

186

3,422

Electrical

Costs

$8,111

1,712

$6,399

Variable cost = Change in cost ÷ Change in activity

= $6,399 ÷ 3,422 occupancy-days

= $1.87 per occupancy-day

Total cost (August) .....................................................

Variable cost element

($1.87 per occupancy-day × 3,608 occupancy-days) .

Fixed cost element .....................................................

$8,111

6,747

$1,364

2. Electrical costs may reflect seasonal factors other than just the variation

in occupancy days. For example, common areas such as the reception

area must be lighted for longer periods during the winter. This results in

seasonal effects on the fixed electrical costs.

Additionally, fixed costs are affected by the number of days in a

month. In other words, costs like the costs of lighting common areas

are variable with respect to the number of days in the month, but are

fixed with respect to how many rooms are occupied during the month.

Other, less systematic, factors may also affect electrical costs such as

the frugality of individual guests. Some guests turn off lights when they

leave a room. Others do not.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

178

Introduction to Managerial Accounting, 4th Edition

Brief Exercise 5-4 (30 minutes)

1.

The Haaki Shop, Inc.

Income Statement—Surfboard Department

For the Quarter Ended May 31

Sales ................................................................

Variable expenses:

Cost of goods sold

($150 per surfboard × 2,000 surfboards*).....

Selling expenses

($50 per surfboard × 2,000 surfboards) ........

Administrative expenses (25% × $160,000) .....

Contribution margin...........................................

Fixed expenses:

Selling expenses .............................................

Administrative expenses ..................................

Net operating income ........................................

$800,000

$300,000

100,000

40,000

150,000

120,000

440,000

360,000

270,000

$ 90,000

*$800,000 sales ÷ $400 per surfboard = 2,000 surfboards.

2. Since 2,000 surfboards were sold and the contribution margin totaled

$360,000 for the quarter, the contribution of each surfboard toward

covering fixed costs and toward earning of profits was $180 ($360,000

÷ 2,000 surfboards = $180 per surfboard). Another way to compute the

$180 is:

Selling price per surfboard.................

Variable expenses:

Cost per surfboard .........................

Selling expenses ............................

Administrative expenses

($40,000 ÷ 2,000 surfboards) ......

Contribution margin per surfboard .....

$400

$150

50

20

220

$180

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

179

Brief Exercise 5-5 (45 minutes)

1. a. The unit product cost under absorption costing would be:

Direct materials ................................................................

Direct labor ......................................................................

Variable manufacturing overhead ......................................

Total variable costs ...........................................................

Fixed manufacturing overhead ($160,000 ÷ 20,000 units) ..

Unit product cost ..............................................................

$18

7

2

27

8

$35

b. The absorption costing income statement:

Sales (16,000 units × $50 per unit) .......................... $800,000

Cost of goods sold (16,000 units × $35 per unit) ...... 560,000

Gross margin........................................................... 240,000

Selling and administrative expenses

[(16,000 units × $5 per unit) + $110,000] .......... 190,000

Net operating income .............................................. $ 50,000

2. a. The unit product cost under variable costing would be:

Direct materials ...................................

Direct labor .........................................

Variable manufacturing overhead .........

Unit product cost .................................

$18

7

2

$27

b. The variable costing income statement:

Sales (16,000 units × $50 per unit) ..............

$800,000

Less variable expenses:

Variable cost of goods sold

(16,000 units × $27 per unit) ................. $432,000

Variable selling expense

(16,000 units × $5 per unit) ...................

80,000 512,000

Contribution margin .....................................

288,000

Less fixed expenses:

Fixed manufacturing overhead ................... 160,000

Fixed selling and administrative expense .... 110,000 270,000

Net operating income ..................................

$ 18,000

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

180

Introduction to Managerial Accounting, 4th Edition

Brief Exercise 5-6 (30 minutes)

1.

Beginning inventories

(units) ..............................

Ending inventories (units) ....

Change in inventories

(units) ..............................

Variable costing net

operating income ..............

Add: Fixed manufacturing

overhead cost deferred in

inventory under

absorption costing (10

units × $450 per unit; 40

units × $450 per unit) .......

Deduct: Fixed

manufacturing overhead

cost released from

inventory under

absorption costing (30

units × $450 per unit) .......

Absorption costing net

operating income ..............

Year 1

Year 2

Year 3

180

150

150

160

160

200

(30)

10

40

$292,400

$269,200

$251,800

4,500

18,000

$273,700

$269,800

13,500

$278,900

2. Since absorption costing net operating income was greater than variable

costing net operating income in Year 4, inventories must have increased

during the year and hence fixed manufacturing overhead was deferred

in inventories. The amount of the deferral is just the difference between

the two net operating incomes or $27,000 = $267,200 – $240,200.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

181

Exercise 5-7 (30 minutes)

1.

High activity level ................

Low activity level .................

Change ...............................

Miles

Driven

Total

Annual

Cost*

120,000 $13,920

80,000 10,880

40,000 $ 3,040

* 120,000 miles × $0.116 per mile = $13,920

80,000 miles × $0.136 per mile = $10,880

Variable cost per mile:

Change in cost

$3,040

=

=$0.076 per mile

Change in activity 40,000 miles

Fixed cost per year:

Total cost at 120,000 miles ..................

Less variable cost element:

120,000 miles × $0.076 per mile .......

Fixed cost per year ..............................

$13,920

9,120

$ 4,800

2. Y = $4,800 + $0.076X

3. Fixed cost ...............................................................

Variable cost: 100,000 miles × $0.076 per mile ........

Total annual cost .....................................................

$ 4,800

7,600

$12,400

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

182

Introduction to Managerial Accounting, 4th Edition

Exercise 5-8 (60 minutes)

1.

High activity level ............

Low activity level .............

Change ..........................

Units Shipped

8

2

6

Shipping Expense

$3,600

1,500

$2,100

Variable cost element:

Change in cost

$2,100

=

=$350 per unit

Change in activity 6 units

Fixed cost element:

Shipping expense at the high activity level ...................

Less variable cost element ($350 per unit × 8 units) ....

Total fixed cost...........................................................

$3,600

2,800

$ 800

The cost formula is $800 per month plus $350 per unit shipped or

Y = $800 + $350X,

where X is the number of units shipped.

2. a. See the scattergraph on the following page.

b. (Note: Students’ answers will vary due to the imprecision and

subjective nature of this method of estimating variable and fixed

costs.)

Total cost at 5 units shipped per month [a point

falling on the line in (a)]......................................

Less fixed cost element (intersection of the Y axis) .

Variable cost element ............................................

$2,600

1,100

$1,500

$1,500 ÷ 5 units = $300 per unit.

The cost formula is $1,100 per month plus $300 per unit shipped or

Y = $1,100 + 300X,

where X is the number of units shipped.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

183

Exercise 5-8 (continued)

2. a. The scattergraph appears below:

4,000

3,500

Total Shipping Expense

3,000

2,500

2,000

1,500

1,000

500

0

0

1

2

3

4

5

6

7

8

9

10

Units Shipped

3. The cost of shipping units is likely to depend on the weight and volume

of the units shipped and the distance traveled as well as on the number

of units shipped. In addition, higher cost shipping might be necessary to

meet a deadline.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

184

Introduction to Managerial Accounting, 4th Edition

Exercise 5-9 (30 minutes)

1. Sales (40,000 units × $33.75 per unit) ..........

Less variable expenses:

Variable cost of goods sold

(40,000 units × $16 per unit*) ................

Variable selling and administrative expenses

(40,000 units × $3 per unit) ....................

Contribution margin......................................

Less fixed expenses:

Fixed manufacturing overhead....................

Fixed selling and administrative expenses ...

Net operating income ...................................

* Direct materials ..............................

Direct labor ....................................

Variable manufacturing overhead ....

Total variable manufacturing cost ....

$1,350,000

$640,000

120,000

250,000

300,000

760,000

590,000

550,000

$ 40,000

$10

4

2

$16

2. The difference in net operating income can be explained by the $50,000

in fixed manufacturing overhead deferred in inventory under the

absorption costing method:

Variable costing net operating income ...........................

Add: Fixed manufacturing overhead cost deferred in

inventory under absorption costing: 10,000 units × $5

per unit in fixed manufacturing overhead cost .............

Absorption costing net operating income .......................

$40,000

50,000

$90,000

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

185

Exercise 5-10 (30 minutes)

1.

High activity level (February) ........

Low activity level (June) ...............

Change ........................................

X-rays Taken

7,000

3,000

4,000

X-ray Costs

$29,000

17,000

$12,000

Variable cost per X-ray:

Change in cost

$12,000

=

=$3.00 per X-ray

Change in activity 4,000 X-rays

Fixed cost per month:

X-ray cost at the high activity level .......................

Less variable cost element:

7,000 X-rays × $3.00 per X-ray ..........................

Total fixed cost....................................................

$29,000

21,000

$ 8,000

The cost formula is $8,000 per month plus $3.00 per X-ray taken or, in

terms of the equation for a straight line:

Y = $8,000 + $3.00X

where X is the number of X-rays taken.

2. Expected X-ray costs when 4,600 X-rays are taken:

Variable cost: 4,600 X-rays × $3.00 per X-ray ...........

Fixed cost ...............................................................

Total cost ................................................................

$13,800

8,000

$21,800

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

186

Introduction to Managerial Accounting, 4th Edition

Exercise 5-11 (45 minutes)

Cost of X-Rays

1. The scattergraph appears below.

32,000

30,000

28,000

26,000

24,000

22,000

20,000

18,000

16,000

14,000

12,000

10,000

8,000

6,000

4,000

2,000

0

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

Number of X-Rays Taken

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

187

Exercise 5-11 (continued)

2. (Note: Students’ answers will vary considerably due to the inherent lack

of precision and subjectivity of the quick-and-dirty method.)

Total costs at 5,000 X-rays per month [a point falling

on the line in (1)] .................................................

Less fixed cost element (intersection of the Y axis) ...

Variable cost element ..............................................

$23,000

6,500

$16,500

$16,500 ÷ 5,000 X-rays = $3.30 per X-ray.

The cost formula is therefore $6,500 per month plus $3.30 per X-ray

taken. Written in equation form, the cost formula is:

Y = $6,500 + $3.30X,

where X is the number of X-rays taken.

3. The high-low method would not provide an accurate cost formula in this

situation, since a line drawn through the high and low points would

have a slope that is too flat. Consequently, the high-low method would

overestimate the fixed cost and underestimate the variable cost per

unit.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

188

Introduction to Managerial Accounting, 4th Edition

Exercise 5-12 (20 minutes)

(Note: All currency values are in thousands of rupees.)

1. Under absorption costing, all manufacturing costs (variable and fixed)

are included in product costs.

Direct materials ..................................

Direct labor ........................................

Variable manufacturing overhead ........

Fixed manufacturing overhead

(R600,000 ÷ 10,000 units) ...............

Unit product cost ................................

R120

140

50

60

R370

2. Under variable costing, only the variable manufacturing costs are

included in product costs.

Direct materials ..................................

Direct labor ........................................

Variable manufacturing overhead ........

Unit product cost ................................

R120

140

50

R310

Note that selling and administrative expenses are not treated as product

costs under either absorption or variable costing; that is, they are not

included in the costs that are inventoried. These expenses are always

treated as period costs and are charged against the current period’s

revenue.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

189

Exercise 5-13 (45 minutes)

(Note: All currency values are in rupees.)

1. 2,000 units × R60 per unit fixed manufacturing overhead = R120,000

2. The variable costing income statement appears below:

Sales .................................................

Less variable expenses:

Variable cost of goods sold

(8,000 units × R310 per unit) ........

Variable selling and administrative

expenses

(8,000 units × R20 per unit) ..........

Contribution margin ............................

Less fixed expenses:

Fixed manufacturing overhead ..........

Fixed selling and administrative

expenses ......................................

Net operating income .........................

R4,000,000

R2,480,000

160,000

2,640,000

1,360,000

600,000

400,000

1,000,000

R 360,000

The difference in net operating income between variable and absorption

costing can be explained by the deferral of fixed manufacturing

overhead cost in inventory that has taken place under the absorption

costing approach. Note from part (1) that R120,000 of fixed

manufacturing overhead cost has been deferred in inventory to the next

period. Thus, net operating income under the absorption costing

approach is R120,000 higher than it is under variable costing.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

190

Introduction to Managerial Accounting, 4th Edition

Exercise 5-14 (30 minutes)

1. The company’s variable cost per unit would be:

$150,000

=$2.50 per unit.

60,000 units

Taking into account the difference in behavior between variable and

fixed costs, the completed schedule would be:

Units produced and sold

Total costs:

Variable costs ..........

Fixed costs ..............

Total costs ...............

Cost per unit:

Variable cost ............

Fixed cost ................

Total cost per unit ....

*Given.

60,000

80,000

100,000

$150,000 *

360,000 *

$510,000 *

$200,000

360,000

$560,000

$250,000

360,000

$610,000

$2.50

6.00

$8.50

$2.50

4.50

$7.00

$2.50

3.60

$6.10

2. The company’s income statement in the contribution format would be:

Sales (90,000 units × $7.50 per unit) ............................

Variable expenses (90,000 units × $2.50 per unit) .........

Contribution margin .....................................................

Fixed expenses ............................................................

Net operating income ...................................................

$675,000

225,000

450,000

360,000

$ 90,000

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

191

Problem 5-15A (60 minutes)

1.

The Fun Store, Inc.

Income Statement

For the Month of October

Sales (450 units × $40 per unit) .........................

Cost of goods sold

(450 units × $9 per unit) .................................

Gross margin .....................................................

Selling and administrative expenses:

Selling expenses:

Advertising ...................................................

Sales salaries and commissions

[$800 + (5% ×$18,000)]............................

Delivery of toys (450 units × $6 per unit) .......

Utilities .........................................................

Depreciation of sales facilities ........................

Total selling expenses ......................................

Administrative expenses:

Executive salaries ..........................................

Insurance .....................................................

Clerical [$500 + (450 units × $5 per unit)] .....

Depreciation of office equipment ...................

Total administrative expenses ...........................

Total selling and administrative expenses.............

Net operating income .........................................

$18,000

4,050

13,950

$1,000

1,700

2,700

700

900

7,000

3,500

500

2,750

600

7,350

14,350

$ (400)

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

192

Introduction to Managerial Accounting, 4th Edition

Problem 5-15A (continued)

2.

The Fun Store, Inc.

Income Statement

For the Month of October

Sales (450 units × $40 per unit) ........................

Variable expenses:

Cost of goods sold (450 units × $9 per unit) ....

Sales commissions (5% × $18,000) .................

Delivery of toys (450 units × $6 per unit) ........

Clerical (450 units × $5 per unit) .....................

Total variable expenses......................................

Contribution margin...........................................

Fixed expenses:

Advertising .....................................................

Sales salaries..................................................

Utilities ..........................................................

Depreciation of sales facilities ..........................

Executive salaries ...........................................

Insurance .......................................................

Clerical ...........................................................

Depreciation of office equipment .....................

Total fixed expenses ..........................................

Net operating income ........................................

Total

$18,000

4,050

900

2,700

2,250

9,900

8,100

Per Unit

$40

9

2

6

5

22

$18

1,000

800

700

900

3,500

500

500

600

8,500

$ (400)

3. Total fixed costs remain constant, but per unit fixed costs change with

the activity level. For example, as the activity level increases, a per unit

fixed cost will decrease. Showing fixed costs on a per unit basis make

them appear to be variable costs. That is, management might be misled

into thinking that the per unit fixed costs would be the same regardless

of how many toys were sold during the month. For this reason, fixed

costs should be shown only in totals on a contribution format income

statement.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

193

Problem 5-16A (30 minutes)

1. a. Change in cost:

Monthly operating costs at 85% occupancy:

340 beds × 85% = 289 beds;

289 beds × 30 days × $40 per bed-day ...................

Monthly operating costs at 70% occupancy (given) .....

Change in cost ...........................................................

$346,800

339,150

$ 7,650

Change in activity:

85% occupancy (340 beds × 85% × 30 days) ..........

70% occupancy (340 beds × 70% × 30 days) ..........

Change in activity ....................................................

8,670

7,140

1,530

Variable cost =

=

Change in cost

Change in activity

$7,650

=$5.00 per bed-day

1,530 bed-days

b. Monthly operating costs at 85% occupancy (above) .....

Less variable costs

289 beds × 30 days × $5.00 per bed-day .................

Fixed operating costs per month .................................

2. 340 beds × 80% = 272 beds occupied.

Fixed costs......................................................................

Variable costs: 272 beds × 30 days × $5.00 per bed-day ..

Total expected costs ........................................................

$346,800

43,350

$303,450

$303,450

40,800

$344,250

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

194

Introduction to Managerial Accounting, 4th Edition

Problem 5-17A (60 minutes)

1. High-low method:

High activity level ......

Low activity level .......

Change .....................

Variable cost =

Number

of Scans

100

10

90

Utilities

Cost

$7,490

4,880

$2,610

Change in cost

$2,610

=

=$29.00 per scan

Change in activity 90 scans

Fixed cost:

Total cost at high activity level ........

Less variable element:

100 scans × $29.00 per scan .......

Fixed cost element .........................

$7,490

2,900

$4,590

Therefore, the cost formula is: Y = $4,590 + $29.00X.

2. Scattergraph method (see the scattergraph on the following page):

(Note: Students’ answers will vary according to their placement of the

regression line.)

The straight line intersects the cost axis at about $4,500. The variable

cost can be estimated as follows:

Total cost at 50 scans (a point that falls on the

regression line) ......................................................

Less the fixed cost element.......................................

Variable cost element at 50 scans (total) ...................

$6,000

4,500

$1,500

$1,500 ÷ 50 scans = $30.00 per scan.

Therefore, the cost formula is: Y = $4,500 + $30.00X.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

195

Problem 5-17A (continued)

The completed scattergraph:

$8,000

$7,000

Total Utilities Cost

$6,000

$5,000

$4,000

$3,000

$2,000

$1,000

$0

0

20

40

60

80

100

120

Number of Scans

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

196

Introduction to Managerial Accounting, 4th Edition

Problem 5-18A (45 minutes)

1. The unit product cost under the variable costing method is computed as

follows:

Direct materials ....................................

Direct labor ..........................................

Variable manufacturing overhead ..........

Unit product cost ..................................

$ 8

10

2

$20

With this figure, the variable costing income statements can be

prepared:

Sales .........................................................

Less variable expenses:

Variable cost of goods sold (20,000 units

x $20 per unit; 30,000 units x $20 per

unit) .....................................................

Variable selling and administrative (20,000

units x $3 per unit; 30,000 units x $3

per unit) ...............................................

Total variable expenses ...............................

Contribution margin ....................................

Less fixed expenses:

Fixed manufacturing overhead ..................

Fixed selling and administrative expenses .

Total fixed expenses ...................................

Net operating income (loss) ........................

Year 1

Year 2

$1,000,000

$1,500,000

400,000

600,000

60,000

460,000

540,000

90,000

690,000

810,000

350,000

250,000

600,000

$ (60,000) $

350,000

250,000

600,000

210,000

2. The reconciliation of absorption and variable costing follows:

Year 1

Year 2

Variable costing net operating income (loss) . $ (60,000) $ 210,000

Add: Fixed manufacturing overhead cost

deferred in inventory under absorption

costing (5,000 units × $14 per unit) ..........

70,000

Deduct: Fixed manufacturing overhead cost

released from inventory under absorption

costing (5,000 units × $14 per unit) ..........

(70,000)

Absorption costing net operating income ...... $ 10,000 $ 140,000

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

197

Problem 5-19A (45 minutes)

1.

a. 10

b. 4

c. 6

d. 1

e. 9

f. 2

g. 11

h. 3

i. 7

2. Without a knowledge of underlying cost behavior patterns, it would be

difficult if not impossible for a manager to properly analyze the firm’s

cost structure. The reason is that not all costs behave in the same way.

One cost might move in one direction as a result of a particular action,

and another cost might move in an opposite direction. Unless the

behavior pattern of each cost is clearly understood, the impact of a

firm’s activities on its costs will not be known until after the activity has

occurred.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

198

Introduction to Managerial Accounting, 4th Edition

Problem 5-20A (60 minutes)

1. Cost of goods sold...................

Advertising..............................

Shipping .................................

Salaries and commissions ........

Insurance ...............................

Depreciation ...........................

Variable

Fixed

Mixed

Mixed

Fixed

Fixed

2. Analysis of the mixed costs:

High activity level ...........

Low activity level ............

Change ..........................

Units

7,400

6,500

900

Shipping

Expense

P75,600

67,500

P 8,100

Salaries and

Commissions

P34,400

30,800

P 3,600

Variable cost element:

Variable cost =

Shipping:

Change in cost

Change in activity

P8,100

=P9.00 per unit.

900 units

Salaries and commissions:

P3,600

=P4.00 per unit.

900 units

Fixed cost element:

Cost at high level of activity ........

Less variable cost element:

7,400 units × P9.00 per unit .....

7,400 units × P4.00 per unit .....

Fixed cost element......................

Shipping

Expense

P75,600

66,600

P 9,000

Salaries and

Commissions

P34,400

29,600

P 4,800

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

199

Problem 5-20A (continued)

The cost formulas are:

Shipping:

P9,000 per month plus P9.00 per unit

or

Y = P9,000 + P9.00X.

Salaries and commissions:

P4,800 per month plus P4.00 per unit

or

Y = P4,800+ P4.00X.

3.

Compania Maritima S.A.

Income Statement

For the Month Ended June 30

Sales (7,000 units × P40 per unit) .......................

Variable expenses:

Cost of goods sold (7,000 units × P12 per unit) .

Shipping (7,000 units × P9 per unit) .................

Salaries and commissions

(7,000 units × P4 per unit) ............................

Contribution margin............................................

Fixed expenses:

Advertising ......................................................

Shipping..........................................................

Salaries and commissions .................................

Insurance ........................................................

Depreciation ....................................................

Net operating income .........................................

P280,000

P84,000

63,000

28,000

5,000

9,000

4,800

4,000

2,500

175,000

105,000

25,300

P 79,700

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

200

Introduction to Managerial Accounting, 4th Edition

Problem 5-21A (60 minutes)

1. a. The unit product cost under absorption costing:

Direct materials ..............................................................

Direct labor ....................................................................

Variable manufacturing overhead ....................................

Fixed manufacturing overhead ($640,000 ÷ 40,000 units)

Unit product cost ............................................................

$15

7

2

16

$40

b. The absorption costing income statement is:

Sales (35,000 units × $60 per unit) ..................... $2,100,000

Cost of goods sold (35,000 units × $40 per unit)

1,400,000

Gross margin .....................................................

700,000

Selling and administrative expenses

[(35,000 units x $2 per unit) + $560,000].........

630,000

Net operating income ......................................... $ 70,000

2. a. The unit product cost under variable costing is:

Direct materials ................................................ $15

Direct labor ......................................................

7

Variable manufacturing overhead ......................

2

Unit product cost .............................................. $24

b. The variable costing income statement is:

Sales (35,000 units × $60 per unit) ................

$2,100,000

Less variable expenses:

Variable cost of goods sold

(35,000 units × $24 per unit) ................... $840,000

Variable selling expense

(35,000 units × $2 per unit) .....................

70,000

910,000

Contribution margin .......................................

1,190,000

Less fixed expenses:

Fixed manufacturing overhead ..................... 640,000

Fixed selling and administrative expense ...... 560,000 1,200,000

Net operating loss .........................................

$ (10,000)

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

201

Problem 5-21A (continued)

3. The difference in the ending inventory relates to a difference in the

handling of fixed manufacturing overhead costs. Under variable costing,

these costs have been expensed in full as period costs. Under

absorption costing, these costs have been added to units of product at

the rate of $16 per unit ($640,000 ÷ 40,000 units produced = $16 per

unit). Thus, under absorption costing a portion of the $640,000 fixed

manufacturing overhead cost of the month has been added to the

inventory account rather than expensed on the income statement:

Added to the ending inventory

(5,000 units × $16 per unit) ......................................... $ 80,000

Expensed as part of cost of goods sold

(35,000 units × $16 per unit) ....................................... 560,000

Total fixed manufacturing overhead cost for the month .... $640,000

Since $80,000 of fixed manufacturing overhead cost has been deferred

in inventory under absorption costing, the net operating income

reported under that costing method is $80,000 higher than the net

operating income under variable costing, as shown in parts (1) and (2)

above.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

202

Introduction to Managerial Accounting, 4th Edition

Problem 5-22A (75 minutes)

1.

Direct materials cost @ $4.00 per unit .

Direct labor cost @ $8.00 per unit .......

Manufacturing overhead cost* ............

Total manufacturing costs ...................

Add: Work in process, beginning .........

Deduct: Work in process, ending .........

Cost of goods manufactured ...............

January—Low

12,000 Units

$ 48,000

96,000

107,000

251,000

5,000

256,000

6,000

$250,000

April—High

15,000 Units

$ 60,000

120,000

113,000

293,000

16,000

309,000

9,000

$300,000

*Computed by working upwards through the statements.

2.

Units

Produced

Cost

Observed

April—High activity level ..............

15,000

$113,000

January—Low activity level ..........

12,000

107,000

Change ..........................................................................

3,000

$ 6,000

Variable cost =

Change in cost

$6,000

=

= $2.00 per unit

Change in activity 3,000 units

Total cost at the high activity level .................

Less variable cost element

(15,000 units × $2.00 per unit) ..................

Fixed cost element .......................................

$113,000

30,000

$ 83,000

Therefore, the cost formula is: $83,000 per month, plus $2.00 per unit

produced or

Y = $83,000 + $2.00X,

where X represents the number of units.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

203

Problem 5-22A (continued)

3. The cost of goods manufactured if 13,500 units are produced:

Direct materials cost

(13,500 units × $4.00 per unit) ..........................

$ 54,000

Direct labor cost (13,500 units × $8.00 per unit) ...

108,000

Manufacturing overhead cost:

Fixed portion ..................................................... $83,000

Variable portion (13,500 units × $2.00 per unit) ..

27,000 110,000

Total manufacturing cost ......................................

272,000

Add: Work in process, beginning ...........................

0

272,000

Deduct: Work in process, ending ...........................

0

Cost of goods manufactured .................................

$272,000

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

204

Introduction to Managerial Accounting, 4th Edition

Problem 5-23A (60 minutes)

1. Maintenance cost at the 20,000 machine-hour level of activity can be

isolated as follows:

Level of Activity

5,000 MHs 20,000 MHs

Total factory overhead cost ........

Deduct:

Utilities cost @ $2.40 per MH*.

Supervisory salaries ................

Maintenance cost ......................

$80,000

$138,500

12,000

13,000

$55,000

48,000

13,000

$ 77,500

*$12,000 ÷ 5,000 MHs = $2.40 per MH

2. High-low analysis of maintenance cost:

High activity level ....................

Low activity level .....................

Change ...................................

Machine- Maintenance

Hours

Cost

20,000

5,000

15,000

$77,500

55,000

$22,500

Variable cost:

Change in cost

$22,500

=

=$1.50 per MH.

Change in activity 15,000 MHs

Total fixed cost:

Total maintenance cost at the high activity level ...............

$77,500

Less variable cost element

(20,000 MHs × $1.50 per MH) ......................................

30,000

Fixed cost element .........................................................

$47,500

Therefore, the cost formula for maintenance is: $47,500 per month plus

$1.50 per machine-hour or

Y = $47,500 + $1.50X,

where X represents machine-hours.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

205

Problem 5-23A (continued)

3.

Maintenance cost ..............

Utilities cost ......................

Supervisory salaries cost ....

Totals ...............................

Variable

Cost per

MachineHour

$1.50

2.40

$3.90

Fixed

Cost

$47,500

13,000

$60,500

Thus, the cost formula would be: Y = $60,500 + $3.90X.

4. Total overhead cost at an activity level of 17,000 machine-hours:

Fixed cost .....................................................

Variable cost: 17,000 MHs × $3.90 per MH .....

Total overhead cost .......................................

$ 60,500

66,300

$126,800

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

206

Introduction to Managerial Accounting, 4th Edition

Problem 5-24A (60 minutes)

1. Maintenance cost at the 5,000 direct labor-hour level of activity can be

isolated as follows:

Total factory overhead cost .................

Deduct:

Indirect materials @ ¥2,000 per

DLH* ............................................

Rent ................................................

Maintenance cost ...............................

Level of Activity

4,000 DLHs

5,000 DLHs

¥15,250,000

¥17,625,000

8,000,000

5,000,000

¥ 2,250,000

10,000,000

5,000,000

¥ 2,625,000

* ¥8,000,000 ÷ 4,000 DLHs = ¥2,000 per DLH

2. High-low analysis of maintenance cost:

High activity level ............

Low activity level .............

Change ...........................

Direct LaborHours

5,000

4,000

1,000

Maintenance

Cost

¥2,625,000

2,250,000

¥ 375,000

Variable cost element:

Change in cost

¥375,000

=

= ¥375 per DLH

Change in activity 1,000 DLHs

Fixed cost element:

Total cost at the high activity level .....................

Less variable cost element

(5,000 DLHs × ¥375 per DLH) ........................

Fixed cost element ...........................................

¥2,625,000

1,875,000

¥ 750,000

Therefore, the cost formula for maintenance is: ¥750,000 per year plus

¥375 per direct labor-hour or

Y = ¥750,000 + ¥375X

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

207

Problem 5-24A (continued)

3. Total factory overhead cost at 4,800 direct labor-hours would be:

Indirect materials

(4,800 DLHs × ¥2,000 per DLH) ............

¥ 9,600,000

Rent .......................................................

5,000,000

Maintenance:

Variable cost element

(4,800 DLHs × ¥375 per DLH) ............ ¥1,800,000

Fixed cost element ...............................

750,000

2,550,000

Total factory overhead cost ......................

¥17,150,000

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

208

Introduction to Managerial Accounting, 4th Edition

Teamwork in Action

The costs necessary to manufacture chocolate chip cookies might include,

but would not be limited to, the following:

Product Components and Costs

Ingredients (such as flour,

chocolate chips, sugar, salt, etc.) .

Packages .......................................

Corrugated shipping boxes .............

Assembly line workers (mixers,

bakers, packagers, etc.) ..............

Depreciation on building ................

Depreciation on machinery .............

Insurance ......................................

Factory supplies .............................

Lubricants .....................................

Property taxes on building ..............

Supervisors ...................................

Telephone .....................................

Utilities (electricity, water, etc.) ......

(1)

(2)

Type of

Product Cost

Type of

Cost Behavior

Direct materials Variable

Direct materials Variable

Direct materials Variable

Direct labor

Overhead

Overhead

Overhead

Overhead

Overhead

Overhead

Overhead

Overhead

Overhead

Variable (1)

Fixed

Fixed (2)

Fixed

Mixed

Variable

Fixed

Fixed (if salaried)

Mixed

Mixed

Assumed; however, see related discussion of whether direct labor is

a variable or fixed cost in the text.

The depreciation may be wholly or partially variable if the machinery

wears out through use.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

209

Communicating in Practice (45 minutes)

Note to the instructor: The issues raised in this assignment will challenge

your students to think about the application of the concepts covered in this

chapter.

Date:

To:

From:

Subject:

Current Date

Jasmine Lee

Student’s Name

Cost Estimate

You must consider cost behavior when estimating future costs, such as the

cost of catering a cocktail party. A variable cost is a cost whose total dollar

amount varies in direct proportion to changes in the activity level (in your

case, the number of guests). A fixed cost is a cost whose total dollar

amount remains constant within a relevant range of activity. A mixed cost

is one that contains both variable and fixed cost elements.

Food and beverage and labor are examples of variable costs. These costs

increase in total as the number of guests increases. On the other hand,

overhead cost is an example of a mixed cost. It has both variable and fixed

cost elements. The costs of hiring and writing paychecks for temporary

workers is an example of a variable cost, while the annual office rent and

administrative salaries are examples of fixed costs.

Before you make a decision about what to bid on this event, you should

remove the amount of fixed overhead from your total estimated cost per

guest to arrive at your total estimated variable cost per guest. To do this,

you need to break your overhead cost down into its variable and fixed

components. There are a variety of methods that you can use to break

down this mixed cost.

Finally, you noted that you are not willing to lose money on the fundraising cocktail party. Because this cocktail party will not require you to

incur any additional fixed expenses, your bid just needs to cover your

variable costs in order for the party to be profitable. As such, any bid

amount that exceeds your total variable cost per guest will generate a

profit. This will be less than the $31.32 total cost since that amount

includes fixed costs.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

210

Introduction to Managerial Accounting, 4th Edition

Analytical Thinking Case (60 minutes)

1. The completed scattergraph for the number of units produced as the

activity base is presented below:

5,000

4,500

Janitorial Labor Cost

4,000

3,500

3,000

2,500

2,000

1,500

1,000

500

0

0

20

40

60

80

100

120

140

Units Produced

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

211

Analytical Thinking Case (continued)

2. The completed scattergraph for the number of workdays as the activity

base is presented below:

5,000

4,500

Janitorial Labor Cost

4,000

3,500

3,000

2,500

2,000

1,500

1,000

500

0

0

2

4

6

8

10

12

14

16

18

20

22

24

Number of Janitorial Workdays

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

212

Introduction to Managerial Accounting, 4th Edition

Analytical Thinking Case (continued)

3. The number of workdays should be used as the activity base rather

than the number of units produced. There are several reasons for this.

First, the scattergraphs reveal that there is a much stronger relationship

(i.e., higher correlation) between janitorial costs and number of

workdays than between janitorial costs and number of units produced.

Second, from the description of the janitorial costs, one would expect

that variations in those costs have little to do with the number of units

produced. Two janitors each work an eight-hour shift—apparently

irrespective of the number of units produced or how busy the company

is. Variations in the janitorial labor costs apparently occur because of

the number of workdays in the month and the number of days the

janitors call in sick. Third, for planning purposes, the company is likely

to be able to predict the number of working days in the month with

much greater accuracy than the number of units that will be produced.

Note that the scattergraph in part (1) seems to suggest that the

janitorial labor costs are variable with respect to the number of units

produced. This is false. Janitorial labor costs do vary, but the number of

units produced isn’t the cause of the variation. However, since the

number of units produced tends to go up and down with the number of

workdays and since the janitorial labor costs are driven by the number

of workdays, it appears on the scattergraph that the number of units

drives the janitorial labor costs to some extent. Analysts must be careful

not to fall into this trap of using the wrong measure of activity as the

activity base just because it appears there is some relationship between

cost and the measure of activity. Careful thought and analysis should go

into the selection of the activity base.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

213

Research and Application

1. Blue Nile succeeds first and foremost because of its operational

excellence customer value proposition. Page 3 of the 10-K says “we

have developed an efficient online cost structure … that eliminates

traditional layers of diamond wholesalers and brokers, which allows us

to generally purchase most of our product offerings at lower prices by

avoiding markups imposed by those intermediaries. Our supply solution

generally enables us to purchase only those diamonds that our

customers have ordered. As a result, we are able to minimize the costs

associated with carrying diamond inventory.” On page 4 of the 10-K,

Blue Nile’s growth strategy hinges largely on increasing what it calls

supply chain efficiencies and operational efficiencies. Blue Nile also

emphasizes jewelry customization and customer service, but these

attributes do not differentiate Blue Nile from its competitors.

2. Blue Nile faces numerous business risks as described in pages 8-19 of

the 10-K. Students may mention other risks beyond those specifically

mentioned in the 10-K. Here are four risks faced by Blue Nile with

suggested control activities:

Risk: Customer may not purchase an expensive item such as a

diamond over the Internet because of concerns about product quality

(given that customers cannot see the product in person prior to

purchasing it.)

Control activities: Sell only independently certified diamonds and

market this fact heavily. Also, design a web site that enables

customers to easily learn more about the specific products that they

are interested in purchasing.

Risk: Customers may avoid Internet purchases because of fears that

security breaches will enable criminals to have access to their

confidential information.

Control activities: Invest in state-of-the-art encryption technology

and other safeguards.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

214

Introduction to Managerial Accounting, 4th Edition

Research and Application (continued)

Risk: Because Blue Nile sells luxury products that are often

purchased on a discretionary basis, sales may decline significantly in

an economic downturn as people have access to less disposable

income.

Control activities: Expand product offerings and expand the number

of geographic markets served.

Risk: The financial reporting process may fail to function properly

(e.g., it may not comply with the Sarbanes-Oxley Act of 2002) as the

business grows.

Control activities: Implement additional financial accounting systems

and internal control over those systems.

Blue Nile faces various risks that are not easily reduced through control

activities. Three such examples include:

If Blue Nile is required by law to charge sales tax on purchases it will

reduce Blue Nile’s price advantage over bricks-and-mortar retailers

(see page 17 of the 10-K).

Restrictions on the supply of diamonds would harm Blue Nile’s

financial results (see page 9 of the 10-K).

Other Internet retailers, such as Amazon.com, could offer the same

efficiencies and low price as Blue Nile, while leveraging their stronger

brand recognition to attract Blue Nile’s customers (see page 10 of

the 10-K).

3. Blue Nile is a merchandiser. The first sentence of the overview on page

3 of the 10-K says “Blue Nile Inc. is a leading online retailer of high

quality diamonds and fine jewelry.” While Blue Niles does some

assembly work to support its “Build Your Own” feature, the company

essentially buys jewelry directly from suppliers and resells it to

customers. In fact, Blue Nile never takes possession of some of the

diamonds it sells. Page 4 of the 10-K says “our diamond supplier

relationships allow us to display suppliers’ diamond inventories on the

Blue Nile web site for sale to consumers without holding the diamonds

in our inventory until the products are ordered by customers.” This

sentence suggests that items are shipped directly from the supplier to

the consumer.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

215

Research and Application (continued)

4. There is no need to calculate any numbers to ascertain that cost of

sales is almost entirely a variable cost. Page 25 of the 10-K says “our

cost of sales consists of the cost of diamonds and jewelry products sold

to customers, inbound and outbound shipping costs, insurance on

shipments and the costs incurred to set diamonds into ring, earring and

pendant settings, including labor and related facilities costs.” The

overwhelming majority of these costs are variable costs. Assuming the

workers that set diamonds into ring, earring, and pendant settings are

not paid on a piece rate, the labor cost would be step-variable in

nature. The facilities costs are likely to be committed fixed in nature;

however, the overwhelming majority of the cost of sales is variable.

Similarly, there is no need to calculate any numbers to ascertain that

selling, general and administrative expense is a mixed cost. Page 25 of

the 10-K says “our selling, general and administrative expenses consist

primarily of payroll and related benefit costs for our employees,

marketing costs, credit card fees and costs associated with being a

publicly traded company. These expenses also include certain facilities,

fulfillment, customer service, technology and depreciation expenses, as

well as professional fees and other general corporate expenses.” At the

bottom of page 25, the 10-K says “the increase in selling, general and

administrative expenses in 2004 was due primarily to…higher credit

card processing fees based on increased volume.” This indicates that

credit card processing fees is a variable cost. At the top of page 26 of

the 10-K it says “the decrease in selling, general and administrative

expenses as a percentage of sales in 2004 resulted primarily from our

ability to leverage our fixed cost base.” This explicitly recognizes that

selling, general and administrative expense includes a large portion of

fixed costs.

Examples of the various costs include:

Variable costs: cost of sales, credit card processing fees

Step-variable costs: diamond setting labor, fulfillment labor

Discretionary fixed costs: marketing costs, employee training costs

Committed fixed costs: general corporate expenses, facilities costs

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

216

Introduction to Managerial Accounting, 4th Edition

Research and Application (continued

5. The data needed to complete the table as shown below is found on page 49 of the 10-K:

Net sales ..................

Cost of sales .............

Gross profit ...............

Selling, general and

administrative

expense .................

Operating income ......

Quarter

1

$35,784

27,572

8,212

5,308

$ 2,904

High Quarter (‘04 Q4) ......

Low Quarter (’04 Q3) .......

Change ............................

2004

Quarter Quarter

2

3

$35,022

27,095

7,927

$33,888

26,519

7,369

5,111

$ 2,816

5,033

$ 2,336

Quarter

4

$64,548

50,404

14,144

7,343

$ 6,801

2005

Quarter

1

Quarter 2

$44,116

34,429

9,687

$43,826

33,836

9,990

6,123

$ 3,564

6,184

$ 3,806

Selling, General,

and

Net sales Administrative

$64,548

$33,888

$30,660

$7,343

$5,033

$2,310

Variable cost = $2,310/$30,660 = 0.075342 per dollar of revenue

Fixed cost estimate (using the low level of activity):

$5,033 − ($33,888 × 0.075342) = $2,480 (rounded up)

The linear equation is: Y = $2,480 + 0.075342X, where X is revenue.

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

217

Research and Application (continued)

6. The contribution format income statement using the high-low method

for the third quarter of 2005 would be as follows:

2005

Third Quarter

Net sales .........................................

$45,500

Cost of sales .................................... $35,128

Variable selling, general and

administrative ...............................

3,428 38,556

Contribution margin .........................

6,944

Fixed selling, general and

administrative ...............................

2,480

Operating income ............................

$ 4,464

The contribution format income statement using least-squares

regression for the third quarter of 2005 would be as follows:

2005

Third Quarter

Net sales .........................................

$45,500

Cost of sales .................................... $35,128

Variable selling, general and

administrative ...............................

3,422 38,550

Contribution margin .........................

6,950

Fixed selling, general and

administrative ...............................

2,627

Operating income ............................

$ 4,323

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

218

Introduction to Managerial Accounting, 4th Edition

Research and Application (continued)

7. Blue Nile’s cost structure is heavily weighted towards variable costs.

Less than 10% of Blue Nile’s costs are fixed. Blue Nile’s cost of sales as

a percentage of sales is higher than bricks-and-mortar retailers. Page 22

of the 10-K says “As an online retailer, we do not incur most of the

operating costs associated with physical retail stores, including the costs

of maintaining significant inventory and related overhead. As a result,

while our gross profit margins are lower than those typically maintained

by traditional diamond and fine jewelry retailers, we are able to realize

relatively higher operating income as a percentage of net sales. In

2004, we had a 22.2% gross profit margin, as compared to gross profit

margins of up to 50% by some traditional retailers. We believe our

lower gross profit margins result from lower retail prices that we offer

to our customers.”

© The McGraw-Hill Companies, Inc., 2008. All rights reserved.

Solutions Manual, Chapter 5

219