Bill Id - Around The Capitol

advertisement

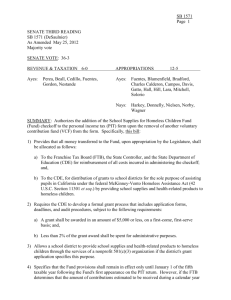

SB 1571 Page 1 SENATE THIRD READING SB 1571 (DeSaulnier) As Amended August 24, 2012 Majority vote SENATE VOTE: 36-3 REVENUE & TAXATION 6-0 APPROPRIATIONS Ayes: Ayes: Fuentes, Blumenfield, Bradford, Charles Calderon, Campos, Davis, Gatto, Hall, Hill, Lara, Mitchell, Solorio Nays: Harkey, Donnelly, Nielsen, Norby, Wagner Perea, Beall, Cedillo, Fuentes, Gordon, Nestande 12-5 SUMMARY: Authorizes the addition of the School Supplies for Homeless Children Fund (Fund) checkoff to the personal income tax (PIT) form upon the removal of another voluntary contribution fund (VCF) from the form. Specifically, this bill: 1) Provides that all money transferred to the Fund, upon appropriation by the Legislature, shall be allocated as follows: a) To the Franchise Tax Board (FTB), the State Controller, and the State Department of Education (CDE) for reimbursement of all costs incurred in administering the checkoff; and, b) To the CDE, for the sole purpose of assisting pupils in California under the federal McKinney-Vento Homeless Assistance Act (42 U.S.C. Section 11301 et seq.) by providing school supplies and health-related products to homeless children, through a competitive grant program developed and awarded by the Superintendent of Public Instruction (Superintendent). 2) Requires the Superintendent to develop a competitive grant program that includes application forms and deadlines. 3) Specifies that the Fund provisions shall remain in effect only until January 1 of the fifth taxable year following the Fund's first appearance on the PIT return. However, if the FTB determines that the amount of contributions estimated to be received during a calendar year will not meet a minimum contribution threshold, the provisions shall be inoperative with respect to taxable years beginning on or after January 1 of that calendar year. EXISTING LAW: 1) Allows taxpayers to designate on their PIT returns a contribution to any of 18 VCFs. 2) Provides a specific sunset date for each VCF, except for the California Seniors Special Fund. SB 1571 Page 2 3) Provides that each VCF must meet a minimum annual contribution amount to remain in effect, except for the California Seniors Special Fund, the California Firefighters' Memorial Fund, and the California Peace Officer Memorial Foundation Fund. FISCAL EFFECT: The FTB estimates annual revenue losses of roughly $20,000 resulting from itemized deductions. COMMENTS: The author has provided the following statement in support of this bill: California has the nation's largest population of homeless children. As of 2010, there were upwards of 300,000 homeless students attending California elementary, middle and high schools. Among many other problems, homeless students often lack basic school supplies like backpacks, binders, and pencils or pens, as well as dental supplies essential to good oral health. Consequently, homeless children are at a critical disadvantage in school. These students consistently test well below average in math and English, and only one-fourth graduate from high school. While not solving all of the problems that come with homelessness, SB 1571 will help to level the material playing field by giving compassionate taxpayers the opportunity to cover the costs of basic school supplies and health services for homeless children. Assembly Revenue and Taxation Committee staff comments: What would this bill do?: This bill would authorize the addition of a new VCF to the PIT return. The CDE would use Fund moneys to assist California students under the federal McKinneyVento Homeless Assistance Act. Specifically, Fund moneys would be used to provide school supplies and "health-related products" to homeless children. So many causes, so little space: There are countless worthy causes that would benefit from the inclusion of a new VCF on the state's income tax returns. At the same time, space on the return is limited. Thus, it could be argued that the current system for adding VCFs to the form is subjective and essentially rewards causes that can convince the Legislature to include their fund on the form. Related legislation: Assembly Revenue and Taxation Committee staff notes the following related bills from the 2011-12 legislative session: 1) AB 564 (Smyth), Chapter 549, Statutes of 2011, reauthorized the addition of the Municipal Shelter Spay-Neuter Fund checkoff to the PIT return upon the removal of another VCF from the form. 2) AB 764 (Swanson), Chapter 465, Statutes of 2011, authorized the addition of the Child Victims of Human Trafficking Fund checkoff to the PIT return upon the removal of another VCF from the form. 3) AB 971 (Monning), Chapter 209, Statutes of 2011, reauthorized the addition of the California Sea Otter Fund checkoff to the PIT form beginning with the 2011 return. 4) SB 164 (Simitian), Chapter 699, Statutes of 2011, extended, from January 1, 2013, to January 1, 2018, the sunset date for two VCFs currently on the PIT return. Specifically, SB 164 SB 1571 Page 3 extended the VCF provisions for both the State Children's Trust Fund and the Rare and Endangered Species Preservation Program. 5) SB 583 (Vargas), Chapter 711, Statutes of 2011, reauthorized the addition of the ALS/Lou Gehrig's Disease Research Fund checkoff to the PIT return upon the removal of another VCF from the form. Analysis Prepared by: M. David Ruff / REV. & TAX. / (916) 319-2098 FN: 0005605