Microsoft Word version

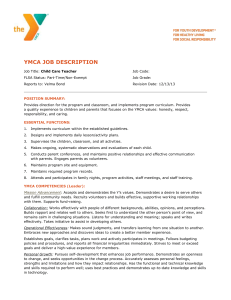

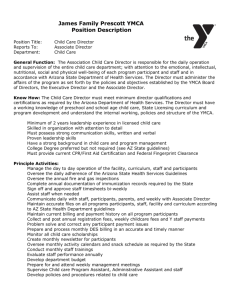

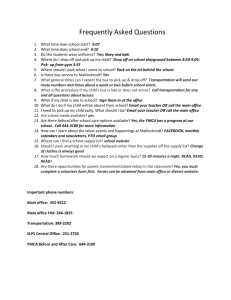

advertisement

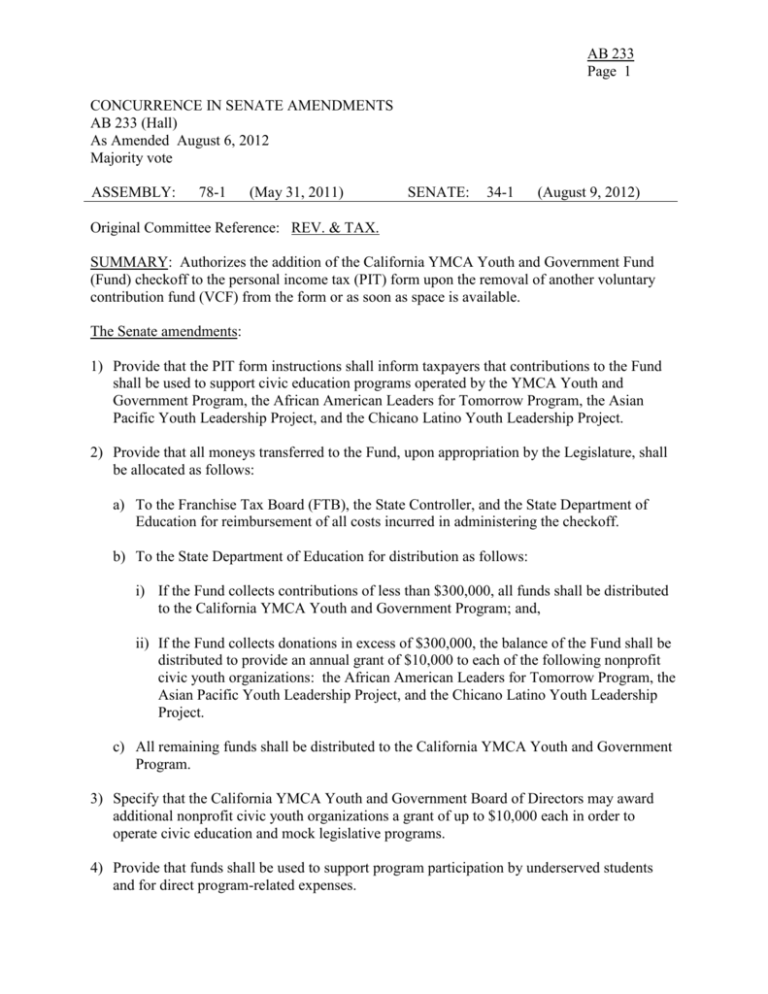

AB 233 Page 1 CONCURRENCE IN SENATE AMENDMENTS AB 233 (Hall) As Amended August 6, 2012 Majority vote ASSEMBLY: 78-1 (May 31, 2011) SENATE: 34-1 (August 9, 2012) Original Committee Reference: REV. & TAX. SUMMARY: Authorizes the addition of the California YMCA Youth and Government Fund (Fund) checkoff to the personal income tax (PIT) form upon the removal of another voluntary contribution fund (VCF) from the form or as soon as space is available. The Senate amendments: 1) Provide that the PIT form instructions shall inform taxpayers that contributions to the Fund shall be used to support civic education programs operated by the YMCA Youth and Government Program, the African American Leaders for Tomorrow Program, the Asian Pacific Youth Leadership Project, and the Chicano Latino Youth Leadership Project. 2) Provide that all moneys transferred to the Fund, upon appropriation by the Legislature, shall be allocated as follows: a) To the Franchise Tax Board (FTB), the State Controller, and the State Department of Education for reimbursement of all costs incurred in administering the checkoff. b) To the State Department of Education for distribution as follows: i) If the Fund collects contributions of less than $300,000, all funds shall be distributed to the California YMCA Youth and Government Program; and, ii) If the Fund collects donations in excess of $300,000, the balance of the Fund shall be distributed to provide an annual grant of $10,000 to each of the following nonprofit civic youth organizations: the African American Leaders for Tomorrow Program, the Asian Pacific Youth Leadership Project, and the Chicano Latino Youth Leadership Project. c) All remaining funds shall be distributed to the California YMCA Youth and Government Program. 3) Specify that the California YMCA Youth and Government Board of Directors may award additional nonprofit civic youth organizations a grant of up to $10,000 each in order to operate civic education and mock legislative programs. 4) Provide that funds shall be used to support program participation by underserved students and for direct program-related expenses. AB 233 Page 2 EXISTING LAW: 1) Allows taxpayers to designate on their PIT returns a contribution to any of 18 VCFs. 2) Provides a specific sunset date for each VCF, except for the California Seniors Special Fund. 3) Provides that each VCF must meet a minimum annual contribution amount to remain in effect, except for the California Seniors Special Fund, the California Firefighters' Memorial Fund, and the California Peace Officer Memorial Foundation Fund. AS PASSED BY THE ASSEMBLY, this bill: 1) Established the Fund in the State Treasury. 2) Provided that all moneys transferred to the Fund, upon appropriation by the Legislature, shall be allocated as follows: a) To the FTB and the State Controller for reimbursement of all costs incurred in administering the checkoff; and, b) To the State Department of Education for distribution to the California YMCA Youth and Government Program, for its ongoing activities on behalf of youth. 3) Provided for the Fund provisions' automatic repeal on either January 1 of the fifth taxable year following the Fund's first appearance on the PIT return or on January 1 of an earlier year, if FTB estimates that the annual contribution amount will be less than $250,000, or an adjusted amount for subsequent years. FISCAL EFFECT: According to the Senate Appropriations Committee, pursuant to Senate Rule 28.8, negligible state costs. COMMENTS: The author has provided the following statement in support of this bill: The California YMCA Youth & Government Program (YMCA Y&GP) is a statewide youth educational program annually involving more than 2200 high school students in a yearlong "hands on" civic experience. Since its inception 63 years ago, the program has successfully used a variety of activities to encourage high school youth [to] become involved, responsible and respected citizens. As part of the YMCA Y&GP, regional student delegations discuss public policy issues facing the state as well as ways to implement their solutions through the legislative and judicial processes. Teen delegates draft legislation, prepare issue briefs, select governmental positions to role-play, attend statewide training and election conferences and run for various offices and leadership positions. The program concludes with a Model Legislature each February at the State Capitol. AB 233 Page 3 Unfortunately, in recent years, costs to operate this program and participant demand for financial assistance has greatly increased making it difficult to maintain and expand this important program for California youth. AB 233 would allow state taxpayers to voluntarily contribute to the California YMCA Youth & Government Fund through a tax check-off donation on their state tax return. Donations would be used to help finance the YMCA Youth & Government Program and its ongoing activities on behalf of youth. Assembly Revenue and Taxation Committee Staff Comments: 1) The California Senior Legislature: This bill is roughly modeled after the successful California Senior Legislature, which is supported by the California Fund for Senior Citizens checkoff on the PIT return. The California Senior Legislature notes that, since 1981, it has labored to identify, develop, and support legislative proposals that protect and enhance the quality of life of California's seniors. 2) So many causes, so little space: There are countless worthy causes that would benefit from the inclusion of a new VCF on the state's income tax returns. At the same time, space on the returns is limited. Thus, it could be argued that the current system for adding VCFs to the form is subjective and essentially rewards organizations that can convince the Legislature to include their fund on the form. 3) A tale of two checkoff bills: This bill is similar to AB 2017 (Hall) of 2009, which would have added an identically-named fund to the PIT form to support the ongoing activities of the California YMCA Youth and Government Program. The California Coalition for Youth opposed the introduced version of AB 2017, and instead supported SB 516 (DeSaulnier) of 2009, which had been introduced the year prior. As heard in the Assembly Revenue and Taxation Committee, SB 516 (DeSaulnier) would have established a California Youth Legislature, funded by a new VCF, to examine and discuss issues affecting California's youth and formally advise the Legislature and Governor on specific policy matters. After extensive negotiations, the authors of AB 2017 (Hall) and SB 516 (DeSaulnier) reached a compromise, whereby SB 516 was amended to delete the separate checkoff fund, and AB 2017 was amended to divide the bulk of fund moneys evenly between the existing YMCA program and the newly established California Youth Legislature. Both bills then passed the Legislature, and both were then vetoed by the Governor. In his veto message for AB 2017, the Governor noted: "This bill is contingent on the enactment of Senate Bill 516, which I cannot support. I would ask that the authors of these bills reconcile their efforts to support greater youth involvement in public policy without creating additional organizations when there are numerous organizations and entities already dedicated to working with youth from all backgrounds." Analysis Prepared by: M. David Ruff / REV. & TAX. / (916) 319-2098 FN: 0004590