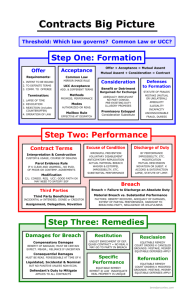

contracts outline - Ihatelawschool.com

advertisement