December 2013

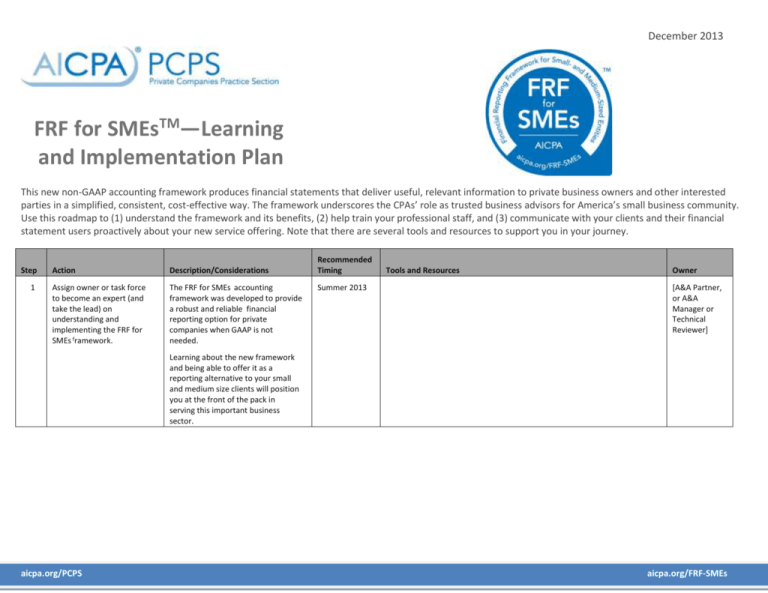

FRF for SMEsTM—Learning

and Implementation Plan

This new non-GAAP accounting framework produces financial statements that deliver useful, relevant information to private business owners and other interested

parties in a simplified, consistent, cost-effective way. The framework underscores the CPAs’ role as trusted business advisors for America’s small business community.

Use this roadmap to (1) understand the framework and its benefits, (2) help train your professional staff, and (3) communicate with your clients and their financial

statement users proactively about your new service offering. Note that there are several tools and resources to support you in your journey.

Step

1

Action

Description/Considerations

Assign owner or task force

to become an expert (and

take the lead) on

understanding and

implementing the FRF for

SMEs framework.

The FRF for SMEs accounting

framework was developed to provide

a robust and reliable financial

reporting option for private

companies when GAAP is not

needed.

Recommended

Timing

Summer 2013

Tools and Resources

Owner

[A&A Partner,

or A&A

Manager or

Technical

Reviewer]

Learning about the new framework

and being able to offer it as a

reporting alternative to your small

and medium size clients will position

you at the front of the pack in

serving this important business

sector.

aicpa.org/PCPS

aicpa.org/FRF-SMEs

Step

2

Action

Description/Considerations

Familiarize yourself with FRF

for SMEs

Start by dowloading a free copy of

the Framework.

Then check out the Introduction to

FRF for SMEs to help you understand

Why the framework was

developed

What types of entities

might be interested in

using the new framework

The basic concepts of the

framework

Additionally, webcasts, publications,

CPE courses and conference sessions

are available to augment your

understanding of the new

framework.

aicpa.org/PCPS

Recommended

Timing

Summer 2013

Tools and Resources

Owner

AICPA Resources

Financial Reporting Framework for Small- and Medium-Sized

Entities

[Assigned

owner or task

force]

AICPA FRF for SMEs Firm Toolkit

An Introduction to the Financial Reporting Framework for Smalland Medium-Sized Entities

Video explaining the framework and its important features

Publications

Framework and Implementation Resources

FRF for SMEs Alert

aicpa.org/FRF-SMEs

Step

3

Action

Take a deeper look at the

framework to gain an

understanding of this nonGAAP accounting

methodolgy.

Description/Considerations

The framework is concise and selfcontained without excess narrative

and prescriptive rules. The entire

framework is approximately 200

pages. Generally, if a CPA knows the

accrual basis of accounting and

aspects of tax accounting, he or she

should find the framework

uncomplicated.

You can use the Introduction to FRF

for SMEs for a brief overview of each

chapter in the framework and a look

at sample reports.

The Comparison of FRF for SMEs to

Other Bases of Accounting highlights

some of the significant differences

from GAAP, Income Tax and IFRSSMEs. The Ilustrative Financial

Statements and the Illustrations of

the Application of Certain Principles

and Criteria will also help you further

your knowledge of the framework.

Recommended

Timing

Summer 2013

Tools and Resources

Owner

AICPA Resources

Financial Reporting Framework for Small- and Medium-Sized

Entities

[Assigned

owner or task

force]

AICPA FRF for SMEs Firm Toolkit

An Introduction to the Financial Reporting Framework for Smalland Medium-Sized Entities

Comparison of FRF for SMEs to Other Bases of Accounting

Illustrative Financial Statements

Illustrations of the Application of Certain Principles and Criteria

Decision Tool for Adopting an Accounting Framework

Publications

Framework and Implementation Resources

FRF for SMEs Alert

Other

Group study course ((product no. FRFS) – contact your AICPA

Learning sales representative or call 1-888-777-7077.

Self study course

Check frequently for new learning resources

The Framework and Implementation

Resources publication offers insight in

one convenient bundle. You’ll find

sample audit, compilation

and review reports

illustrations of principles

and critieria on topics such

as the initial application of

the FRF for SMEs framework

a presentation and

disclosure checklist

illustrative financial

statements

aicpa.org/PCPS

aicpa.org/FRF-SMEs

Step

4

Action

Description/Considerations

Apply what you have

learned about the FRF for

SMEs to your firm’s audit

and attest methodology and

guidance.

Incorporate FRF for SMEs sample

reports, presentation and disclosure

considerations into your firm

guidance and methodology.

Recommended

Timing

Tools and Resources

Owner

Summer 2013

through Fall

2013

AICPA Resources

Financial Reporting Framework for Small- and Medium-Sized

Entities

[Assigned

owner or task

force]

AICPA FRF for SMEs Firm Toolkit

FRF for SMEs Presentation and Disclosure Checklists

An Introduction to the Financial Reporting Framework for Smalland Medium-Sized Entities (includes sample reports on financial

statements)

Decision Tool for Adopting an Accounting Framework

Publications

Framework and Implementation Resources

FRF for SMEs Alert

5

Facilitate training for your

professional staff and

partner group.

To begin implementing the FRF for

SMEs as a service offering, inform,

educate and train your staff.

Introduce your staff members to the

framework with the Staff Article

included in the toolkit.

Use the Staff Training PowerPoint

template along with the Introduction

to FRF for SMEs and Comparison of

FRF for SMEs to Other Bases of

Accounting to facilitate an in-house

training session on the framework.

Look for other educational resources

including group study and self study

courses coming soon.

aicpa.org/PCPS

Summer 2013

through Fall

2013

AICPA FRF for SMEs Firm Toolkit

Staff Article – coming soon

An Introduction to the Financial Reporting Framework for Smalland Medium-Sized Entities

Comparison of FRF for SMEs to Other Bases of Accounting

Staff Training PowerPoint - powered by PCPS

Decision Tool for Adopting an Accounting Framework

Other

[Assigned

owner or task

force]

Group study course ((product no. FRFS) – contact your AICPA

Learning sales representative or call 1-888-777-7077.

Self study course

Check frequently for new learning resources

aicpa.org/FRF-SMEs

Step

6

Action

Description/Considerations

Inform your clients about

the new framework and the

benefits it may have for their

financial reporting

engagements.

Utilize the components of the FRF for

SMEs toolkit designed specifically for

use with clients or potential clients.

Consider posting these documents on

your website and using them in client

presentations to position your

practice as a leader in providing this

service tailored to America’s small

businesses.

Include the Newsletter/Website

article template in your client-facing

communications to introduce the

new framework and some of its

benefits.

Personalize the Cover Letter and send

it to the clients for whom the

framework may be an appropriate

reporting option.

Recommended

Timing

Summer 2013

Tools and Resources

Owner

AICPA FRF for SMEs Toolkit

Newsletter/Website article

Cover Letter to clients

o For small firms

o For medium firms

o For large firms

Introduction to FRF for SMEs for Private Company

Owners/Managers

PowerPoint Presentation

Flyer to mail or hand out

Logo for firm website or promotional materials/stationery

Video

Backgrounder

Social Media blurbs

The Introduction to FRF for SMEs for

Private Company Owners/Managers

is specifically tailored for you to

present to your clients, along with the

client-facing PowerPoint

presentation.

Post the FRF for SME logo for firms on

your website to promote your service

offering. A short video is also available

to post on your site.

Placing copies of the Backgrounder in

your lobby is a good way spark

conversations with clients.

Power up your online presence with

social media blurbs to inform your

client base and others of the service

you’re providing.

aicpa.org/PCPS

aicpa.org/FRF-SMEs

Step

Action

Description/Considerations

7

Once you’ve determined

which clients may be

interested in using the FRF

for SMEs, more in-depth

conversations can be held to

answer their questions and

discuss transition timelines.

8

Communicate with bankers,

surety companies and others

in your community.

Clients may have questions about

what will be different and what the

transition to the new framework will

require. You can review the

Illustrative Financial Statements and

Frequently Asked Questions and

Comparison of FRF for SMEsto Other

Bases of Accounting with them to

address their questions.

Bankers, surety companies and other

financial statement users that receive

financial statements prepared based

on the FRF for SMEs will find relevant

information they need to understand

the company and its finances. By

introducing the FRF for SMEs to these

stakeholders, you can explain why the

framework was developed and

identify the benefits for them.

Recommended

Timing

Fall – Winter

2013

Fall 2013ongoing

Tools and Resources

AICPA PCPS FRF for SMEs Toolkit

Illustrative Financial Statements

Frequently Asked Questions for Private Companies

Comparison of FRF for SMEs to Other Bases of Accounting

Decision Tool for Adopting an Accounting Framework

Owner

AICPA FRF for SMEs Toolkit for Financial Statement Users

Backgrounder

PowerPoint Presentation

Frequently Asked Questions for Financial Statement Users

Introduction to FRF for SMEs for Financial Statement Users

Comparison of FRF for SMEs to Other Bases of Accounting

[Assigned

owner or task

force ]

[Assigned

owner or task

force]

Consider using the PowerPoint

Presentation, Backgrounder and

Frequently Asked Questions to

intoduce the FRF for SMEs to

banks/credit untions

surety companies

civic or small business

organizations

You’ll position yourself as an

authority in providing this service

benefiting the small business

community.

The Introduction to FRF for SMEs for

Financial Statement Users is tailored

to this audience and can be a useful

tool in gaining acceptance for the

framework. The Comparison of FRF

for SMEs to Other Bases of

Accounting and Illustrative Financial

Statements can foster more in-depth

conversations.

DISCLAIMER: This publication has not been approved, disapproved or otherwise acted upon by any senior technical committees of, and does not represent an official position of, the American Institute of Certified Public Accountants. It is

distributed with the understanding that the contributing authors and editors, and the publisher, are not rendering legal, accounting, or other professional services in this publication. If legal advice or other expert assistance is required, the

services of a competent professional should be sought.

Copyright © 2013 by American Institute of Certified Public Accountants, Inc. New York, NY 10036-8775. All rights reserved. For information about the procedure for requesting

permission to make copies of any part of this work, please email copyright@aicpa.org with your request. Otherwise, requests should be written and mailed to the Permissions Department, AICPA, 220 Leigh Farm Road, Durham, NC 27707-8110.

aicpa.org/PCPS

aicpa.org/FRF-SMEs