My Resume

advertisement

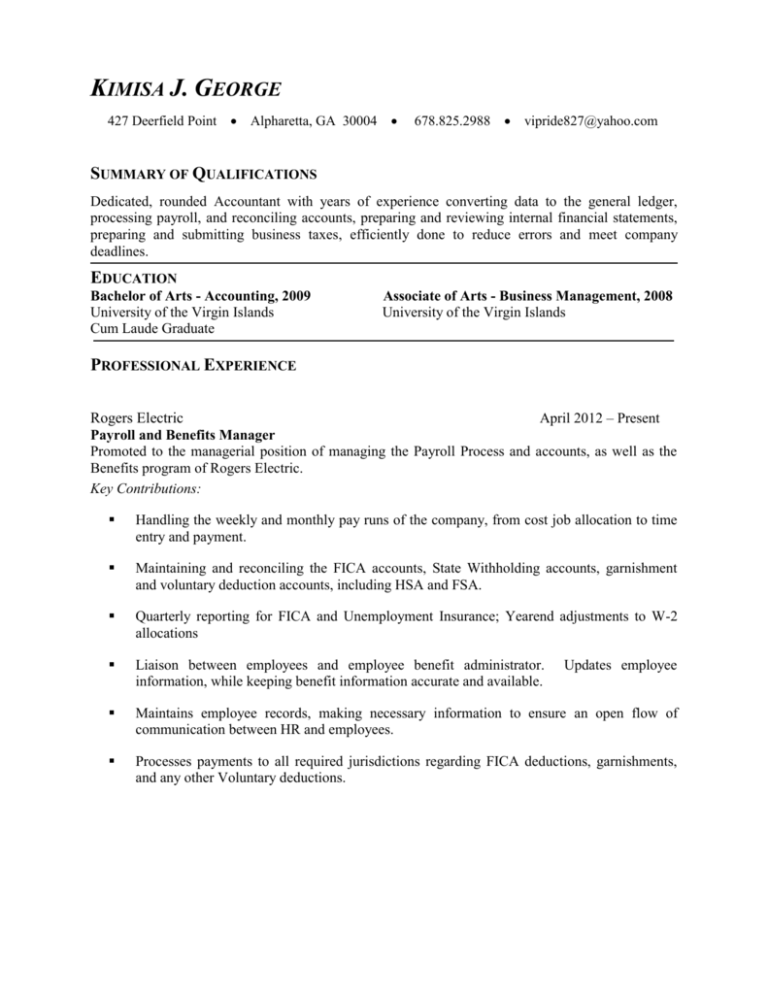

KIMISA J. GEORGE 427 Deerfield Point Alpharetta, GA 30004 678.825.2988 vipride827@yahoo.com SUMMARY OF QUALIFICATIONS Dedicated, rounded Accountant with years of experience converting data to the general ledger, processing payroll, and reconciling accounts, preparing and reviewing internal financial statements, preparing and submitting business taxes, efficiently done to reduce errors and meet company deadlines. EDUCATION Bachelor of Arts - Accounting, 2009 University of the Virgin Islands Cum Laude Graduate Associate of Arts - Business Management, 2008 University of the Virgin Islands PROFESSIONAL EXPERIENCE Rogers Electric April 2012 – Present Payroll and Benefits Manager Promoted to the managerial position of managing the Payroll Process and accounts, as well as the Benefits program of Rogers Electric. Key Contributions: Handling the weekly and monthly pay runs of the company, from cost job allocation to time entry and payment. Maintaining and reconciling the FICA accounts, State Withholding accounts, garnishment and voluntary deduction accounts, including HSA and FSA. Quarterly reporting for FICA and Unemployment Insurance; Yearend adjustments to W-2 allocations Liaison between employees and employee benefit administrator. information, while keeping benefit information accurate and available. Maintains employee records, making necessary information to ensure an open flow of communication between HR and employees. Processes payments to all required jurisdictions regarding FICA deductions, garnishments, and any other Voluntary deductions. Updates employee KIMISA J. GEORGE Page 2 Rogers Electric May 2011 – April 2012 Accountant Processing full-cycle accounting for several managerial companies, as well as processing payroll for the parent corporation. Key Contributions: Bank Reconciliations, Month end close, Expense allocations, and Monthly budget submittals Kept the parent company licensed in all states, counties, and cities as needed; prepared financial statements for the required jurisdictions as requested Prepared end of year documents; e.g. 1099s, Accountant’s copy of financial records Processed multi-state weekly payroll for the parent company; submitted 941 payments, 401k payments, company match, and loan repayments, and HAS/FSA deductions eCompany Store, LLC March, 2010 – April 2011 Staff Accountant Handling the many facets of a Staff Accountant, using the SAP accounting system. Month end procedures include account analysis, credit and cash balance procedures, prepaids and accruals, bank reconciliations and inventory reporting, all to handled within company set timeframes. Key Contributions: Bank, Credit Card, and Inventory Reconciliations, to include Fixed Assets input and tie out to Balance Sheet. Weekly and monthly reporting of Vendor Consignment, as well as reporting of monthly rebates and royalties. Financial analysis of accrual and prepaid accounts, sales entries, including journal entries for complete accuracy of commission and amortization. Prepare company sales files, using advanced excel, such as v-lookups and pivot tables to show multi views of company’s monthly revenue as it relates to each client and resolving any issues so that it ties out to the Profit-Loss Statement Maintenance and reporting responsibility for Sales Tax returns for five states. Monthly tie out of Accounts Payable, Accounts Receivable, GRIR account, and internal financial reporting. Vouching accounts payable invoices, maintaining records of payments vouched. Preparations of accounts receivable invoices, including intercompany transactions, and maintaining receipt of payments. KIMISA J. GEORGE Page 2 Kazi Management VI, LLC – St. Thomas, VI 2008-2009 Staff Accountant Managed financial transactions for a 19 store restaurant market, which included posting to general ledger, producing financial statements, account analysis, handling wire transfers, and recording all transactions, using Sage’s MAS 90/200. Kazi Management is a Fast Food chain corporation across the continental US, as well as the US Virgin Islands, and Hawaii. Key Contributions: Brought the operating and payroll accounts reconciliation up to date, from six months behind, within the first three weeks of employment. Daily cash reconciliation for all nine markets, which encompassed over 300 stores, using the Trintech software system. Prepared and delivered to management, under 5-6 days turnaround timelines, accurate monthly and quarterly financial statements. Prepared and delivered an internal audit book, including variation analysis schedules to the external audit company. Handled month end close for these 19 stores, which included accruals, payments of royalties and advertising for multiple franchisee stores, as well as single franchisee stores, splitting of revenue to address sales tax, management fee and allocation of multiple market managerial employees. Monthly, quarterly, and yearly account reconciliation on accounts payable, accounts receivable, management fee payable, intercompany transactions (due to/from), and balance sheet accounts, entered data into excel spreadsheets and financial system. Computed payroll deductions (garnishments, 401k, insurance, John Hancock), compiled data, reconciled errors, and allocated managerial (overhead) payroll costs across several markets which created due to /due from intercompany transactions, end of year payroll reconciliation and tie out to payroll taxes. KIMISA J. GEORGE Page 3 The deJongh, Group – St. Thomas, VI 2007-2008 Accountant/Executive Assistant Managed financial transactions of this architectural firm, using the QuickBooks system. Reconciled business accounts, which consisted of operating and payroll accounts. Processed payments, and generated invoices and statements for clients. Compiled, computed, and entered payroll data into the company’s financial system. Maintained office environment by filing, creating a liaison relationship with vendors, setting appointments through Outlook, making travel arrangements for co-workers, upholding a high level of customer service professionalism. The deJongh Group, PC is a husband/wife owned Architectural firm that uses the percentage of completion billing technique, while also charging for any contractors hired by them on a client’s behalf. Key Contributions: Installed QuickBooks software onto company system maintained company files on software. Created a chart of accounts for this 40 plus year business. Created invoices for customers, using percentage of completion billing, time and use billing, and standard billing facets. Made accounts payable management a weekly occurrence where I processed the payments, cut checks, and submitted to owner for review and sign, then mailed all payments. Updated vendor file to reflect up to date information and accuracy. Prepared and submitted payroll taxes, unemployment insurance, reconciled payroll account monthly and yearly, reconciled payroll errors, computed payroll deductions for garnishments, charity donations, health insurance, entered data in financial system. Educated business owner on needed accounting procedures and policies regarding the financials of the business. Maintained current records of clients, vendors, business and tax licenses, contracts, supplies, operable office equipment, and architectural minded reading material within the office environment. KIMISA J. GEORGE Page 4 Spenceley Office Equipment, Inc. – St. Thomas, VI 2004-2007 Accountant/Office Manager Performed accounts receivable and payable functions, balancing cash and posting sales invoices. Worked daily in a collections capacity, on accounts 3 to 4 years old and accurately entered transactions into QuickBooks accounting system. Prepared and submitted payroll taxes, business insurance renewals, and monthly, quarterly, and yearly business taxes. Spenceley Office Equipment, Inc. is a family owned office equipment merchandiser, selling copiers, fax machines, time clocks, typewriters, printers, and money counting machines. Key Contributions: Initial job title as an office clerk, with promotion to Accountant/Office Manager within one year. Made substantial progress on several key accounts receivable accounts that were over three to four years old. Brought over five accounts, including government accounts well outside of their fiscal period, up to date, while maintaining the business relationship between the entities. Contacts for accounts receivable was done by phone, mail, and personal contact. Processed manual receipts for the St. Thomas and St. Croix location, entering all manual receipts into the system for month close, and processed monthly statements for both locations. Process all payroll taxes, gross receipts taxes, quarterly and yearend tax reports, end of year W-2 preparation, child support deductions, garnishment deductions, unemployment insurance, excise taxes, and shipper’s insurance for the business. Maintained merchandise supplies in store to ensure inventory levels for customers. Month end inventory count and comparison with system inventory levels to ensure validity. Calculated and wrote contracts for new clients and renewals, within company deadlines. Processed payroll for the St. Thomas and St. Croix location, while maintaining and securing all employee files for both locations. Software Skills SAP MAS 90/200 MS Office Suite Peachtree Oracle Quickbooks Advanced Excel (macros, pivot tables, v-lookups) Essbase