Innocent - International University, Sofia

advertisement

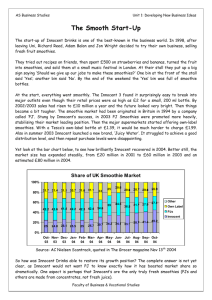

Week 10: Innocent Smoothies Case study: Launching “innocent” into the growing Fruit Smoothie market. Since launching their business in 1999 “innocent” has not only witnessed the rise of its own business, but also the rise of the smoothie market and the rise of competitors. Whilst being the market leader, the recent purchase of the number two smoothie brand, PJ Smoothies, by the multinational Pepsi Co firm means that “innocent” can expect fierce competition as it attempts to be the dominant smoothie brand in Europe. This case study tells the story of how “innocent” developed a business idea into a product and launched it into the UK market with very limited funds. At that time the smoothie market was in its infancy, although “innocent” was not the first into the market and could not benefit from any early entrant advantages. Nonetheless, the launch of the product coincided with the rapid growth of the market, especially in the form of own-label smoothies from Sainsbury, Tesco and M&S. The Fruit Smoothies market Fruit Smoothies are a fruit based beverage (usually 100% crushed fruit and very little else). According to the advertisements they are nutritious and versatile, and are an excellent way of grabbing a quick meal. Smoothies have been popular in health-conscious California for many decades. They are generally low in fat and calories and make an excellent drink and or snack especially at lunch-time. Innocent is now the brand leader in the UK smoothie market, which research groups estimate to be worth between £60m to £70m annually. Pete & Johnny's - the first UK smoothie company - has annual sales of £13m while private label brands make up around one-third of the market. Innocent's timing has been lucky or astute. As concern grows over rising levels of obesity in Europe, consumers are paying more attention to what they eat and drink and multinational food and beverage companies are trying to tap into changing consumer tastes by selling healthier products. The following companies are currently operating in the UK Fruit Smoothie market: Cadbury Schweppes Drinks Express Innocent GlaxoSmithKline Halewood International S Daniels plc (New Covent Garden Food Company) Orchard House Foods Pete & Johnny (P&J) Princes Soft Drinks Sunjuice The Juice Company Tiger Bay Beverages Co. Tropicana United Kingdom Ltd Unilever Bestfoods Californians had been consuming Fruit Smoothies for a number of years before the drink was exported to the UK. It is Harry Cragoe founder of P&J Smoothies who is generally regarded as the first entrant into the UK in 1994. Harry had been living in California and had enjoyed Fruit Smoothies for lunch; when he returned to the UK he realised this drink was not available. But, importing a fresh product and transporting it 8000 miles across the world proved to be extremely difficult. Indeed the first few years of operating were full of problems. Initially the smoothies were simply imported in large containers. They were frozen and there were problems of them not defrosting or still being frozen when they were put on the shelves. Not surprisingly the product was twice as expensive as other drinks at the time. Many experienced traders were doubtful such a product could succeed in such a highly competitive market. Eventually, however, Cragoe was able to establish production in Newark, Nottinghamshire, which has solved many of the initial logistical problems. The success of the PJ Smoothie business is remarkable and unusual in that very little money has been spent on marketing and market research. This is even more remarkable for a fast moving consumer good. Cragoe is a critic of traditional market research arguing that: “I’ve never spent a penny on market research because you end up looking at it too religiously. The growth we have experienced is purely from word of mouth. People have tasted the products and told their friends. We also tried to get away from bad labelling deciding instead to use just pictures of apples and oranges. We have always tried to be fun, relevant and interesting with our packaging.” Cragoe insists that tasting the product is the best way to experience whether it is good or bad and this has led to even more growth. He believes that 99% of people like the taste and pass on the message. Innocent and developing a new product concept Hot on the heels of P&J Smoothies was Innocent Smoothies. In 2005 Innocent drinks was the fastest growing food and drinks company in the UK. Innocent Drinks was launched in 1999, and the company has grown into the No.1 smoothie brand in the UK with 60 staff and a £35 million turnover. It has gone from making three recipes of smoothie to 17 different drinks. Through constant innovation and refusal to compromise, innocent continues to make an unrivalled range of totally natural fruit drinks that taste good and have health benefits. But the road to success was far from simple. Figure 1: Innocent brand and logo The beverage market is fiercely competitive dominated by global players such as Coca-Cola and Pepsi. The range of beverages available is also vast from bottled water to carbonated drinks in all flavours. The Fruit Smoothie product being launched was perishable, with a very short shelf life, and with a price tag at almost £2 a bottle it was four times that of other beverages on the shelf. Achieving success was not going to be easy. The beginnings of the business idea stretch back many years and is the result of a friendship started at university. Richard Reed, Adam Balon and Jon Wright left university and went into the obligatory milk-round professions - one into advertising, two into management consultancy. Four years later, they were still talking about their business ideas, although they still had no product. One idea they all liked and enjoyed was Fruit Smoothies. They all enjoyed a fruit smoothie for lunch and all had enjoyed making them at home with fresh soft fruit and an electric blender. At the time there were very few smoothies on the shelf. In 1998, during their spare time from work and sometimes during their time at work the three friends began planning their business idea of fruit smoothies. Sometimes they would covertly arrange to meet suppliers at the offices of their employers. Eventually, in June of that year they admitted to their respective bosses what they had been up to and were granted two months off. During this time they continued trying out recipes on friends and developing their business plan. At the end of that time they spent £500 on fruit, turned it into smoothies and tested their drinks on visitors to the Jazz on the Green festival in London. Their much-recounted scenario goes like this: "We put up a big sign saying, 'Do you think we should give up our jobs to make these smoothies?’ and put out a bin saying 'YES' and a bin saying 'NO' and asked people to put the empty bottle in the right bin (see Figure 2). At the end of the weekend the 'YES' bin was full so we went in the next day and resigned." But the launch of the business took much longer than they had realised; firstly, there was the problem of funds? Figure 2: Innocent’s own form of concept testing YES No Raising money When it comes to financing a business, there are two basic types of funding: debt and equity. Loans are debt financing; you borrow money and must pay it back, with interest, within a certain timeframe. With equity funding, you raise money by selling a portion of your ownership in the company. This is the traditional route for people wishing to fund a start up business with friends and family probably the most common form of debt financiers; others are: banks, finance companies, credit unions, credit card companies, and private corporations. Taking out a business loan allows the owners to remain in control of the company and not answer to investors. Getting a loan is also usually faster than searching out investors. Professional investors review thousands of investment opportunities each year, and only invest in a small fraction. Another benefit of debt financing is that as a firm repays its debts so it builds creditworthiness. This makes the business more attractive to lenders in the future. Overall, debt financing is typically cheaper than equity financing because the firm only pays interest and fees, and retains full ownership of the company. Equity financing Selling equity means taking on investors and being accountable to them. Many small business owners raise equity by bringing in relatives, friends, colleagues, or customers who hope to see their businesses succeed and get a return on their investment. Other sources of equity financing include venture capitalists, which are professional investors willing to take risks on promising new businesses. These investors include individuals with substantial net worth, corporations, and financial institutions (this is the group highlighted in the BBC television programme ‘Dragons Den’). Most investors do not expect an immediate return on their investment, but they would expect the business to be profitable in three to seven years. Equity investors can be passive or active. Passive investors are willing to offer capital but will play little or no part in running the company, while active investors expect to be heavily involved in the company’s operations. Personality conflicts can arise in either arrangement. Equity financing is not cheap: investors are entitled to a share of the business’s profits indefinitely. Conversely, small business owners who may have difficulty securing a traditional loan or are comfortable sharing control of their business with partners may find equity financing a mutually beneficial arrangement. Venture capital is a widely used phrase that few people properly understand. It typically refers to investment funds or partnerships (and, increasingly, venture capital divisions within large corporations) that focus on investing in new, promising start-up and emerging companies. Venture capitalists (VCs) have invested in some of today´s most famous corporate names, including Apple, Genentech, Intel, and Compaq. Typically, the investment is in company stock -- the venture capitalist gets an ownership interest for the money invested. Beyond supplying the company with money, the VC also provides assistance and expertise with business planning -- bringing industry knowledge, experience in growing businesses and expertise in taking the company public some day. Entrepreneurs should be wary, venture capitalists´ primary motive is to make a lot of money on their intended investment. Furthermore, most venture capitalists are interested only in businesses that can grow very big. So, if you´re a small grocery store you should seek funds elsewhere. Fortunately, the founders of Innocent benefited from very good educations and had many business contacts from over four years working in advertising and management consultancy; hence it was not long before they were in touch with venture capitalists. Eventually Maurice Pinto, a wealthy American businessman invested £250,000 and became the fourth shareholder in the group, retaining a 20 per cent stake. The money provided salaries for the three entrepreneurs, office space, cash to buy production capacity at bottling plants, promotional material and labelling for the bottles. Product development and growing the business While on the surface this new business venture may seem slightly unusual and the three founders would probably very much like to think that there business is unique, the development of their Fruit Smoothie product follows the well-documented process from concept to commercialisation (see Figure 3). Figure 3: new product development process Idea screening Concept testing Prototype development Market testing Launch and promotion Generation of new product concepts The three founders of Innocent had been exploring and planning starting their own business ever since they met at university. They had even tried a few crazy ideas including a gadget that would prevent baths from over flowing. It was the Fruit Smoothie concept, however, that seemed to appeal to the three founders the most, this is probably largely due to the fact that they were developing a new product for people like them: young urban professionals who wanted a healthy lunch-time drink to go with their sandwich. In many large cities across Europe and the US lunch for most is a sandwich. And when buying your sandwich most people usually buy a drink to wash it down. Idea screening Having a new product concept is a long way from a commercially successful new product. Moreover, this was not a completely new product; Fruit Smoothies had been on the market for several years, hence, Innocent was entering an established market albeit a relatively new one. Their challenge was to become more successful than the existing players. To do this they believed their product had to be different. They were able to achieve this through clever and very different forms of promotion. In many ways they were developing the whole Fruit Smoothie market, without realising it at the time. The main purpose of screening ideas is to select those that will be successful and drop those that will not – herein lies the difficulty. Trying to identify which ideas are going to be successful and which are not is extremely difficult. Screening product ideas is essentially an evaluation process. It occurs at every stage of the new product development process and involves such questions as: 1. Do we have the necessary commercial knowledge and experience? 2. Do we have the technical know-how to develop the idea further? 3. Would such a product be suitable for our business? 4. Are we sure there will be sufficient demand? From here more detailed evaluation check-lists can be drawn up such as the one in Table 1. Table 1: Simple evaluation check-list Evaluation Criteria 1 Technical abilities 2 Competitive rationale 3 Patentability 4 Stability of the market 5 Integration & synergy 6 Market: growth & competition 7 Channel fit 8 Manufacturing 9 Financial 10 Longer term strategic fit Concept testing Innocent had already proved to themselves with their unusual form of product testing using bins, that their target market liked the product. Nonetheless, starting a company from scratch is daunting. There's little room for error so the product has to be pitched in exactly the right way. Given that this was a crowded market, Innocent Drinks realised early on that the product had to stand out on the shelf. Packaging is a critical issue especially in fmcg markets. Innocent decided to develop something different. A friend of the three founders was hired to look after branding. Once again a great deal of emphasis was placed on the fact that the three founders belonged to the target market and decisions were made based on their own thoughts and ideas, despite a lack of branding experience. Indeed, Innocent confessed in interviews with the press that ‘our user testing was done on people we knew. We'd email our friends with packaging designs'. Nonetheless, the company has always sought advice and expertise from external experts; for example, Turner Duckworth designed the original bottle shape. Innocent also used an agency for an advertising campaign in Ireland. Design has played a big role in the product's success, from the logo and shape of the bottles to the delivery vans (see Figure 1.1). Careful consideration of design and packaging has contributed to the success of the business. The brand was totally unknown so Innocent had to rely on people being intrigued enough to try the product. It is not cheap drink, so it had to appeal to the consumer and it had to stand out and look like something you would want to pick up. Finally, like all beverage producers Innocent relied on the taste to be sufficiently good to ensure a repeat purchase.' Prototype development Given that the three founders were the target market: young (they were all in their mid twenties), urban office workers (they all worked in central London), affluent (they all had very well paid jobs), identifying what would appeal was simply a question of asking themselves: What do we like? They wanted to emphasise the purity and naturalness of the product, which is made completely from fresh fruit. This is a key point because most fruit drinks are made from concentrated juice with water - and perhaps sweeteners, colours and preservatives- added. Innocent wanted to offer pure fruit juice. This had significant manufacturing implications and problems as they later discovered. They also wanted a bottle that would sit easily in the hand for the ‘grab-a-sandwich’ crowd and they wanted to introduce an element of fun. Lacking any kind of knowledge about the design process or how to go about finding and developing the right image, the company was forced to use external experts and keep things simple. According to Innocent the logo, which resembles an apple with a halo, or a person with a halo depending on how you look at it, was sketched on a serviette in felt tip pen (see Figure 1). The creation of a brand image is crucial here, and especially so for products in FMCG markets. For all new entrants into an exiting market the aim is to try to get existing users to change to your brand of Fruit Smoothie and to try to attract new buyers who currently purchase bottled water or Coca-Cola, for example. The brand image developed and carefully nurtured by innocent is one based on fun, and an almost hippie approach to life. This is reflected in the packaging, promotion and logo used for the product (see Figures 1 and 4). Another interesting point is that due to the high raw material costs and high production costs, initially the product offered was relatively expensive three or four times as much as lunch-time beverage alternatives. Market testing Fruit is sourced from all over the world, and regular sampling conducted at Innocent’s test kitchen to ensure that only the most flavoursome varieties are used in the drinks. Recipes created in the kitchen at their London offices are tested on people in surrounding office buildings. Once approved, the drinks are manufactured by one of four independent manufactures in the UK and sold in outlets across the UK and Europe. The smoothies, which appeal to consumers whom Innocent describe as "slightly more female, slightly more affluent, slightly younger," are priced at the high end of the fruit juice market, selling for £1.70 to £1.80 in "on the go" plastic bottles, and for £2.99 in larger take-home cartons. Innocent has also recently launched a childrens' range, retailing at 70p. Launch and promotion Having developed their idea the three founders then ran into numerous other operational difficulties that meant the launch of the product took much longer than expected. They encountered barriers, including various experts who told them their idea would not work. In particular this was because the product's shelf life was too short. Arguments then ensued about whether or not to include preservatives or additives to lengthen its life. Ignoring most of the expert advice, Innocent created a range of smoothies made from 100% pure and fresh fruit. Careful quality controlled production methods and the latest packaging technology gave it the longest possible shelf life. Their first foray into the market was very modest. 'Out to Lunch', the local sandwich shop round the corner from their office in Ladbroke Grove, agreed to stock a few of their drinks. They supplied twenty bottles and, when they checked later, found that the drinks had sold out. Indeed, most of their early sales were through local delicatessens and sandwich shops, but it was not long before Coffee Republic, also a young and growing business, agreed to stock Innocent drinks in their eight or nine shops. Innocent has not spent large sums of money on television, press or radio promotion. Emphasis is placed on packaging design and retailers who stock and shelf the product. Advertising copy tends to be witty and straightforward, as does other communications material, such as the humorous booklet. The Innocent Easy Health Guide, given to new retailers when they sign up. The relationship with retailers has been built up through regular communication, including a newsletter, which combines product information and fun stories. Each communication is intended to reinforce the unique brand image Innocent has built for itself. Each year on its birthday Innocent invites the 3,000 retailers on its database to a themed party and it also sends every retailer a Christmas present. One year it was a Christmas tree with instructions on how to plant it. The copy on the labelling is intended to break down the barriers between manufacturer and customer using humour. For example, the Juice Water labels have a section called Fruit Corner, which gives the fruit a personality while also explaining why it's good for you. Figure 4: One of Innocent Drinks Delivery Vans: An example of Innocent’s clever and effective promotion Future growth Growth for many businesses can cause problems and sometimes cause a firm to fail usually this is because it overstretches to expand borrows money and then runs into cash flow problems. Innocent was careful not to fall into this well-known trap despite its dramatic growth. Inncoent adopted a cautious approach with the national multiples such as Tesco and Sainsbury, despite the lure of multi-million pound orders. To begin with Innocent would only supply a few of the multiples stores and as sales grew and revenue came in so the production would be increased. This is a much slower approach to growth and can sometimes allow competitors to enter the market or allow the multiples themselves to develop own-label versions. Nonetheless, Innocent adopted the prudent approach, which seems to have paid off. Innocent now employs 46 people and has slowly expanded along the line of industrial units rented by the company. Innocent recorded turnover of £35m in 2004 and is growing at an annual rate of 50% to 60%. Innocent now supply most of the major supermarkets and this year became Britain's leading brand of smoothie selling about 40% of the 50m downed annually by British drinkers. If imitation is the sincerest form of flattery then Innocent's founders should feel very pleased. The refrigerated shelves of the nation's supermarkets are filled with own-label versions of some of the company's best sellers such as its yogurt, vanilla bean and honey "thickie". But this could present a serious challenge to the firm. Innocent would not be the first manufacturer to lose out to own-label multiples like Sainsbury, Tesco and Asda. There would also seem to be many opportunities for future growth. Innocent are still aware that while the business has grown extremely fast there are still plenty of people who have not yet tasted Innocent drinks. Innocent is continuing to extend its product line with new flavours of smoothies and a new product launched in 2003 called Juicy Water, whose packaging was designed by Coley Porter Bell. Innocent's main market is still the UK and Ireland, which accounts for 90 per cent of its sales, but its smoothies are also sold in the Netherlands, Belgium, Luxembourg and France. It eventually plans to expand within and beyond Europe. "We have the trademark registered in every country that we think it can become business relevant." These include the US, Australia, New Zealand, China, India and countries in South America. Like any growing business maintaining Innocent's internal culture as the company expands is going to be a challenge. Much will depend on the rate of growth and whether the company will be able to control this growth. Clearly employing the right people as the business expands, both in the UK and overseas, will be one of the significant challenges. Many analysts argue that Innocent is one of a new breed of Virtual Food and Drink companies. Such companies develop the brand and outsource production. There's a division of labour between the owner of the brand and the manufacturer. Other such firms include: Green & Black's, the organic chocolate company; Duchy Originals, which sells organic foods; and Gu Chocolate Puds. These smaller food companies have found there is demand for products made with natural or organic ingredients and low in fats, sugars and salts. While larger food companies have been altering product ingredients to try to address consumer concerns, smaller companies have been quicker at creating products that meet specific demands. The success of these companies in identifying changes in consumer tastes has made them attractive acquisition targets, for example, Green & Black's was bought by Cadbury Schweppes. PepsiCo enters the Smoothie Market In 2005 the maker of Pepsi dramatically entered the UK Smoothie market with the purchase of the British smoothie and fruit juice brand PJ Smoothies. PepsiCo UK did not reveal the price it paid for the business, based in Newark, Nottinghamshire. PJ, launched in 1994, founded the British smoothie market and has become its leading brand. PepsiCo said PJ Smoothies is the only major brand that produces its own 100% fruit smoothies. Between 1998 and 2004, PJ spent £4m developing the brand. It remains the top smoothie brand in terms of volume, with most of its sales in Britain. PJ was launched in the Irish Republic in 2003. PepsiCo UK said it would maintain PJ's operational structure and manufacturing would continue at Newark. It said the move would give it a significant presence in the rapidly growing premium juice market. PepsiCo said PJ, which has a 33% market share, would complement its existing drinks brands Tropicana and Copella. Pete and Johnny Smoothies have recently undertaken a major re-branding programme, with a new logo that is stronger, more modern and presents a clearer image. The PJ's re-branding is designed to maximise shelf impact and re-emphasise the company logo, which now incorporates different fruit for different blends. The reverse of the label carries humorous copy and cartoons, illustrating Pete and Johnny's adventures over the past ten years. In addition, PJ's is introducing a groundbreaking 500ml smoothie bottle in response to consumer demand. Conclusions Table 1: Smoothies brands (market value and market share) Market Market Market Value Share Value 2006 2006 2003 £M % £M Innocent 83 62 11.2 PJ 25 19 14.1 Own Labels 23 17 14.9 Others 3 2 1.2 Total 13.4 100 4.4 Source: Marketing (2006) Five a day helper, Dec 6, p32-33. Market Share 2003 % 27 34 36 3 100 Turnover has increased from £15m in 2003 to £35m in 2004 year and the company recently overtook P&J Smoothies as brand leader. The success of Innocent is remarkable partly because this is such a competitive market in which some of the worlds largest brands operate and partly because this success has been achieved unconventionally with minimal use of traditional advertising and promotional techniques. The development and launch of their business and new product in particular follows a conventional approach from concept to market, but Innocent has used some very different approaches along the way. According to Innocent there are some important factors that have contributed to its success these are: 1. Keeping your potential customer's tastes, lifestyle and personality clearly in view. 2. Keeping designs simple and practical and concentrating on the quality of the product can be the key to standing out in an overcrowded market. 3. The brand image has to consistently reflect the product and the company's values. 4. Getting the product, packaging and marketing design right before diversifying and expanding will help establish the product. Despite what the founders of Innocent would like us to believe they are not hippies who have emerged from a travelling caravan to start a drinks business and are now investing all the profits into third world social programmes. One needs to look carefully at the evidence: These friends had a privileged upbringing (one of them attending Winchester College, no less), gained even more knowledge from four years at university and then gained a further four years of practical experience working for large corporate city firms in London advising others on how to run a business. Furthermore, despite what the promotional material might suggest about a ‘devil may care’ attitude to life, the three were involved in meticulous planning of their business idea. For example, even when they had decided on their business idea and began planning it, they adopted an extremely cautious approach by negotiating two months leave from their employers as opposed to simply leaving employment. Should the founders sell the Innocent business and become multi-millionaires? There would be many who would take this route. Indeed, in a very similar scenario, but this time with Ice-cream, two self-confessed hippies built an Ice-cream brand in the 1980s on their socially conscious image: Ben & Jerry's "all natural" ice cream, . . . and then sold out to the conglomerate Unilever for $326m. Critics may argue this is exactly what Innocent is doing stressing its hippie image at every opportunity and spending relatively small amounts of money on socially conscious activities for maximum publicity; all with the intention of making a huge amount of money. References AC Nielsen Scantrack Total Market, 4 weeks to WE 30.10.04 Cummings L (2005) Just an Innocent business? BBC News Online: business, August 23. Wiggins J (2005) An Innocent making its way in the big bad world of health, FT.com August 22. Questions 1. Innocent are very clear about the image it wishes to project to the public. This is one based around being different, fun-loving and a care-free approach to life. This hippie style image has helped the brand become acceptable to the young urban professionals at which it is aimed. But, beneath the surface of this image there is evidence of a very different business that could be characterised as ruthless, single-minded, profit driven and very business orientated. Where is the evidence of the later? 2. The success of the business is partly based on extremely good communications with retailers. How is this achieved? 3. What type of financing did Innocent secure? Does it matter? 4. Would you sell-out to Coca-Cola for £400 million? As one of the three shareholders you could pocket £100 million. If not why not? 5. Innocent benefited from a key advantage what was this and explain how it helped in the product development process? 6. How is Innocent ‘virtual’ and how is this different from traditional food and drink manufacturers? What advantages and disadvantages does this provide?