FBE 440 - USC Marshall

advertisement

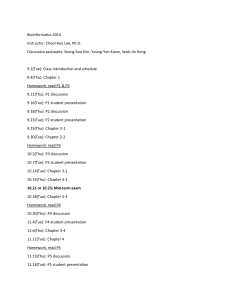

FINANCE, REAL ESTATE, AND LAW DEPARTMENT CAL POLY UNIVERSITY, POMONA SYLLABUS FOR FRL 440 – EVALUATION OF FINANCIAL POLICY WINTER 2006 Dr. J. “Kash” kashefi Office Tel.: (909) 869-2396 E-mail: dkashefineja@csupomona.edu Jkashefi@cox.net Office Location: BLDG. 66-211 Office Hours: W 3:00 – 4:00 PM by appointment, T&R 1:00 – 3:00 PM A. COURSE DESCRIPTION This course examines key issues, principles, and methods of analysis that arise in financial decision-making through the vehicle of case studies. Emphasis is on understanding, from a managerial perspective, the complex environment of corporate financial problems and business situations. The focus is on the creation of value for the business firm. PREREQUISITES: Course prerequisites are FRL 367 and all the prerequisites to that course. It will be assumed that students have a good basic knowledge of the finance concepts, theories, and methods of analysis that are covered in the prerequisite courses for FRL 440. B. METHOD OF INSTRUCTION The case method is the primary vehicle of instruction in this course. In a case class, the instructor serves as a catalyst for generating discussion and a directive role for keeping it focused. However, students also play an active role. Since much of the learning takes place from an interchange of ideas in the classroom, it is imperative that students become familiar with the issues and facts of the assigned case, give careful thought to how to evaluate them, and be prepared for in-class discussion. Students must participate in the discussion and critique of the cases. Failure to attend class and participate in class discussion will result in a poor grade for participation. Students will be called on and are expected to be ready to provide well thought out answers to questions posed. C. EXPECTATIONS: Each student is expected to have a good understanding of the following topics: TOPICS FOR REVIEW: 1. Financial Analysis, Planning, and Forecasting 2. Capital Budgeting 3. Returns and Risk 4. Cost of Capital 5. Capital Structure and Leverage 6. Bond and Stock Valuation 7. Dividend Policy 8. Mergers and Acquisitions Assignment, Presentation, and Discussion of the cases The eight written case analyses are to be done in groups. The due dates and the requirements for each case are set forth in the class schedule and penalties for late cases are stated under Grading Policy in part E. Each written case analysis will be graded on 1-5 point bases, and is worth 5% of the course grade (total 40%). There are two individual reports that are to be done alone and each is worth 5% (total 10%). Group can be of varying size, but not more than four. Written cases are due on the date the case is scheduled for presentation. It is expected that each team member will be prepared to present the assigned case in an informative manner and be able to show all the necessary work (computations) during the presentation and to explain the work if asked to do so. Your presentation should be professional using PowerPoint that is “readable” by everyone in the classroom. When you preset in class, a written paper is not required. However you must submit the following on the day that you present: A printed one page Executive Summary. Typically this summary should cover the tenet of the paper. The PowerPoint presentation itself (on a disk or CD). An outline of the speakers in the group along with the topics each will cover. Your own peer evaluation (see the website for the form). All of the relevant data used in completing the paper on a disk or CD as noted above. One meeting will be devoted to discussing the general principles involved in particular cases prior to the due date for the presentation. More detail will be provided about each case as they come due. If you have questions about the written case analyses, please raise your questions in class. Since these assignments are graded on a competitive basis, it would be unfair to give special help to any one individual or group during office hours or by e-mail. If the written case analyses are due on a day that you cannot attend class, it is your responsibility to ensure a team member handed the case in. In the unlikely event that all team members are absent, and you want credit for the assignment, it is necessary to e-mail the assignment directly to me before class begins. D. TEXT: Fundamental of Corporate Finance, Ross, Westerfield, and Jordan 7th edition, Irwin McGraw-Hill, 2005. Corporate Finance, Ross, Westerfiled, and Jaffe 7th edition, Irwin McGraw-Hill, 2005 E. GRADING: The course grade will consist of four parts: Case Analyses Case Presentation Individual Report Final Exam 40% 20% 10% 10% 2 Participation and Peer Evaluation 10%* 100% Participation includes attendance and discussion in the class. Each member must submit a “Peer Evaluation” form with each case. The grade of each member is based on the grade given to the case and peer evaluation (See www.drkash.com/courseoutline). PENALTY for LATE CASES: First day late 75% of the total points Second day late 25% of the total points Third day late FORGET IT — 100% of the total points NOTE: Any sources used in your written analysis, other than from the case, should be cited either as a footnote or endnote. Failure to cite sources is a form of plagiarism. Plagiarism is a serious offence and, depending on it severity, will result in a failing grade for the case, and possibly for the course. F. DROP POLICY: Last day to drop this class without a petition is the third week of the quarter; and withdrawal after that day is permitted “only for emergency clearly beyond control of the student.” G. Case assignment, due dates, and reading. Case Assignment Course administration; and Introduction to the analysis and discussion of cases Investment Decision: First National Bank First National bank Boston Chicken part A Group presentation: Boston Chicken part A Boston Chicken Part B Group presentation: Boston Chicken part B Due Date Tue, Jan. 3 Reading (website: www.drkash.com) http://www.drkash.com/corpfinance/Capital.Budegting.and.Project.Analysis.ppt http://www.drkash.com/corpfinance/Capital.Budgeting.and.Risk.Analysis.ppt http://www.drkash.com/corpfinance/Cost.of.Capital.ppt http://www.drkash.com/corpfinance/COST.of.CAPITAL.doc Thu, Jan. 5 Tue, Jan. 10 Thu, Jan. 12 Tue, Jan. 17 Thu, Jan. 19 Tue, Jan. 24 Individual report Understanding Business Model Evaluating Earnings Quality Comparative Financial Statement Analysis Ratio Analysis RWJ Chapters 3 &4, Thu Jan. Cash Flow Analysis RWJ Chapter 2 Boston Chicken part C Group presentation: Boston Chicken part C 26 Tue, Jan.31 http://www.drkash.com/cases/Finincial.Forecasting.Model.doc.dot 3 Capital Structure, An Introduction to Debt Policy Group presentation: An Introduction to Debt Policy Can Salton Swing? Group presentation: Can Salton Swing? Determinants of Valuation Ratios: The Restaurant Industry in 1997 Group presentation: Restaurant Industry Intel Corporation Group presentation: Intel Corporation Royal and Carnival Cruise Part A and B Group presentation: Royal and Carnival Cruise part A Part B Final exam case due, discussion of final case Thu, Feb. 2 Tue, Feb. 7 Thu, Feb. 9 Tue, Feb. 14 Thu, Feb. 16 Tue, Feb. 21 Thu, Feb. 23 Tue, Feb. 28 Thu, Mar. 2 Tue, Mar. 7 Thu, Mar. 9 Thu, Mar. 14 http://www.drkash.com/corpfinance/A.Note.on.Capital.Structure.doc http://www.drkash.com/corpfinance/CAPITAL.STRUCUTRE.xls http://www.drkash.com/corpfinance/The.Financing.Decision.ppt http://www.drkash.com/corpfinance/Modigliani.Miller.Capital.Structure.EPS.EBIT.xl Individual Report http://www.drkash.com/cases/Business.Valuation.Models.doc http://www.drkash.com/cases/Factors.Considered.Valuations.doc http://www.drkash.com/cases/BUSINESS.VALUATION.ppt http://www.drkash.com/cases/Business.Valuation.Models.doc http://www.drkash.com/cases/Discounted.Cash.Flow.Valuation.doc http://www.drkash.com/cases/Business.Valuation.Models.doc http://www.drkash.com/cases/BUSINESS.VALUATION.ppt 11:30 am--1:30 pm G. CRITERIA FOR GRADING THE WRITTEN CASE ANALYSES and THE ORAL PRESENTATION: The written case analyses should be a maximum of four typewritten pages plus appendices (exhibits). Good writing is expected. Lack of neatness and errors in grammar, spelling, punctuation, and syntax will adversely affect the case grade. More detailed guidelines for preparing cases are provided in sections H and I below. Each written case analysis will be evaluated based on the following criteria: The overall organization and coherence of the report Neatness, quality of writing, and professional appearance of report How well the main problems/issues of the case are defined and how well you demonstrate that you comprehend them The quality of the analyses (quantitative and qualitative) of the main issues/problems Logic and clarity of assumptions made in the analysis and demonstration of the sensitivity of outcomes to assumptions employed 4 How clearly the assumptions about the key drivers of the outcomes of the analysis are identified and how clearly the sensitivity of outcomes to these key assumptions is demonstrated How clearly the alternative choices regarding the key issues and problems are identified and assessed. How clearly the recommended solutions/course(s) of action are stated, and how well these recommendations are supported by the analysis The basic purpose of an oral presentation is to effectively communicate your ideas, the results of your analyses, and your recommendations to the class. With this purpose in mind, your oral case presentation will be evaluated based on the following criteria: The overall organization and coherence of the presentation How well you identify and define the main problems faced by the decision-maker and the finance issues they imply How clearly the analysis of the problems/issues of the case is presented to the class, how well you demonstrate knowledge of the conceptual and analytical tools that you apply to the analysis, and the presentation quality of your exhibits and how well you use them to convey your ideas and results How clearly you identify the key assumptions that drive the results of the analysis, and how well you show the sensitivity of the results to the key assumptions How well you define, how clearly you present, and how well you assess the alternative choices that can be made to the decision problem(s) How clearly and definitively you present your recommendations, and how well they are supported by the analysis H. PREPARING THE CASE – General Suggestions A case is a glimpse of a real-world situation where you are limited in what you know by the brief information contained on a few pages. Sometimes the case issues are clear, and sometimes they are not. However, you should be able to identify the problems that need to be addressed and to determine the kinds of decisions needed to solve these problems. A lack of complete information is not an excuse for avoiding dealing with the case issues. The general steps in preparing a case are described next. First, read the case to get an overall understanding of the situation, supporting facts, and the key issues and questions that should be addressed. Do not take notes or become overly concerned with details in this first reading. The purpose of the first reading is to become familiar with the problem(s) and with the overall situation so that you obtain a broad picture of what is going on. Second, reread the case again for details and fuller understanding. When you reread the case (perhaps several times), take notes about key facts, assumptions, and issues. Examine the quantitative information provided in the case for information content and insights that they may contain. Assess how the information may be relevant and useful to your analysis. Reflect on the case questions, and use these to formulate ideas about how to approach your analysis. Third, select analytical techniques that are appropriate for dealing with the problems you identified 5 (e.g., discounted cash flow analysis, pro forma financial statements, ratio analysis, averaging of comparable data, valuation by multiples, financial forecasting, etc.), and determine how best to use them to produce recommended solutions and courses of action. In the process of selecting an analytical technique, ask yourself, how appropriate is it to the problem(s) at hand, and what do I hope to learn from its application? Fourth, be sure you fully understand what you hope to achieve before you try to work on numerical analyses. Otherwise, you will find yourself engaged in mindless number crunching. Fifth, be careful to differentiate between facts, estimates, assumptions, and conjecture. Finally, avoid rushing to a conclusion as you read a case. If you do, you might overlook important information or you may distort information to fit some preconceived idea. As you read, and yes, reread the case, ask yourself a broad range of questions. What are the problems and opportunities here? What has been going on – what are past trends or patterns of behavior? What is likely to happen if these trends continue, or if they change? Why are the problems still unresolved? Who or what seem to be the main impediments to solution or resolution? What is happening among the people in this company; that is, what are the interpersonal dynamics? Furthermore, you should be very careful not to confuse a problem with its symptoms. For example, a decline in sales is probably a symptom of an underlying problem and not itself the problem per se. Depending on the case, to identify and define the key problem (s) you might have to discuss factors both inside the organization (finance, management team, marketing issues, production and so on) and outside the organization (industry makeup, foreign competition, economic conditions, government regulations and so on). The more a problem is related to strategic planning issues, the more it will be important to identify the competitive positioning of the firm, its strengths and weaknesses relative to its competition, and opportunities and risks it faces given the external environment. When conducting an analysis, ask yourself, how sensitive are the results to the assumptions employed? Further, how realistic are these assumptions? What additional assumptions and/or estimates must be made to fill in information gaps and to apply specific techniques? In planning how to respond to a case, at a minimum address the questions asked in the case and added by the instructor. These questions do need to be addressed, but you should not be limited by the specific questions asked in the case or the instructor, nor should you feel bound to address specific questions in a lock step manner. You should also attempt to insightfully use the case situation as a springboard for addressing relevant finance and wider business issues that can usefully be brought into the analysis. If a case contains several parts, your response to each part should reflect your approach to the case as a whole and therefore your analysis of and response to each part should be consistent with what was done in the other parts. For example, if a case has four sequential parts, your answers to each part should be consistent with your approach to the case as a whole and with what is done in each of the other parts. Very often, the most difficult problem that students grabble with in preparing case studies is that usually there is no clear-cut “right” answer. In most case studies there will be large gray areas for 6 the application of judgment. Although a solution or suggested course of action should not be implausible or illogical, the important part of case analyses is the information, reasoning, and methods of analysis used to arrive at proposed solutions to the problem as defined. Since a case in many instances will extend textbook presentations, do not expect that you can easily find ready references to specific ideas and techniques appropriate for your analysis. You might have to integrate several ideas and/or techniques from several sources. Creativity and resourcefulness are important to successful case analysis. I. CASE WRITING GUIDELINES The following are more specific guidelines for preparing a written case report. 1. Your approach to the preparation of the case should be from the perspective of a member of management or of a consultant to management. Your case analysis should be addressed to a key member, or members, of the organization. That person is the audience for whom you are preparing the case. The case should be prepared as a formal document, not as an informal memo or presentation. 2. Each report should be neat, and in general should appear as if prepared by a highly qualified finance professional. The logical presentation of your ideas and the accuracy of your calculations also matter. Points are deducted for sloppy and poorly prepared work. In short, the reports should be professional in substance and appearance. Attachments involving drawings of some sort (e.g., graphs, charts, etc.) need not be typewritten, but, at a minimum, should be neatly drawn or printed. Excel makes excellent graphs, charts, etc., with relatively little extra effort. Tables should be typed. 3. The text of your report should be written in the form of an executive summary. The text of the report (the executive summary) should be typed and double-spaced, and it should not exceed four pages. The report should be well written (following rules of good grammar and syntax). The executive summary should not include computations, tables or figures. The latter should be placed in exhibits attached as appendices to the report. 4. Each exhibit (appendix) that is included in your report should be clearly labeled and titled. It should also be appropriately referenced in the body of the text in a manner that clearly indicates its contribution to your analysis, your line of argument, or your recommendations. The included appendices should be prepared by you to reflect the "story" that you want to tell, to show numerical calculations summarized in the executive summary, or to illustrate/support particular points you want to make. Do not simply attach or copy tables, figures, and other exhibits “as is” from the case (these can be simply referenced). You can, however, include as exhibits additions or modifications to the case exhibits. 5. Section headings should be used to separate different sections of the report. Section headings help to form transitions between sections and help the reader know where you are going. In addition, they provide a good framework for your analysis and help you write a more organized paper. 7 6. You should begin the report with an introduction in which you clearly define the problem(s) that your analysis will be addressing. The introduction should also include some brief case background information. It is important to clearly define the problem(s) for which you will seek solutions. How you define the problem(s) suggests what type of answer(s) or solution(s) you will be seeking. Including some case background information can be useful for providing context for the problem(s). 7. The analysis of the situation is the central part of the case write-up. You should discuss how you approached the analysis and how you reached your proposed solution(s) to the case problems. Your analysis should combine appropriate elements of finance theory with quantitative techniques. Quantitative techniques of some type will generally be necessary to obtain estimates of variable values. The calculations employed to obtain estimates of key values or to support recommendations should be shown in appendices (referenced in the text of the report) and explained if not obvious. Finally, do not make assertions without evidence or well-reasoned argument to support them. 8. You should also clearly identify key assumptions that influence the outcomes of your analyses, and demonstrate and/or explain the sensitivity of outcomes on key variables to different assumptions. 9. You should also identify feasible alternative solutions or courses of action open to the decision-maker. Discuss why they were rejected in favor of your proposed solution. 10. Your recommended solutions or courses of action should be clearly and definitively stated. The bases for your recommendation(s) should be explained, and you should clearly explain why your proposed solution is the best alternative. Make sure that your proposed solution(s) has been supported with appropriate analysis (qualitative as well as quantitative). Your recommendations, in other words, should not just drop out of the sky. They should logically follow from your analysis. 11. The report should include a conclusion that summarizes your analysis. Your conclusion should not present new material, but only summarize the problem(s) addressed, the main results of your analysis, and recommended solution(s) to the problem(s). If problems remain unanswered, suggest what could be done to deal with them. J. 1. 2. 3. A SHORT LIST OF REFERENCE BOOKS: Brealey and Myers, Principles of Corporate Finance, Brigham and Gapenski, Intermediate Financial Management, Brigham and Houston, Fundamentals of Financial Management, 8