Information Memorandum

advertisement

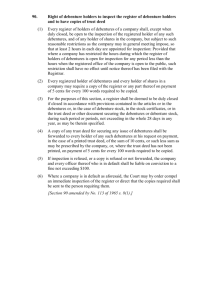

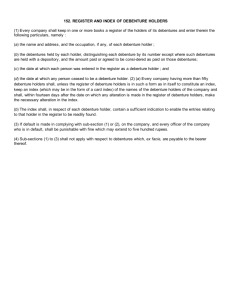

Information Memorandum / Disclosure Document Private & Confidential Not For Circulation Information Memorandum/ Disclosure Document (For Private Circulation only) Already issued 8,299 Rated Taxable Redeemable Non-Convertible Debentures of Face Value of Rs. 1,00,000/- each, aggregating upto Rs. 82.99 Crore on a Private Placement basis in the Financial Year 2009-10. Credit Rating LBBB- by ICRA GENERAL RISKS Investment in debt and debt related securities involve a degree of risk and investors should not invest any funds in the debt instruments, unless they can afford to take the risks attached to such investments. For taking an investment decision, the investors must rely on their own examination of the Company and the Issue including the risks involved. The Debentures have not been recommended or approved by Securities and Exchange Board of India (“SEBI”) nor does SEBI guarantee the accuracy or adequacy of this document . ISSUER’S ABSOLUTE RESPONSIBILITY The Issuer, having made all reasonable inquiries, that the information contained in this Information Memorandum/ Disclosure Document is true and correct in all material respects and is not misleading in any material respect, that the opinions and intentions expressed herein are honestly held and that there are no other facts, the omission of which makes this document as a whole or any of such information or the expression of any such opinions or intentions misleading in any material respect ISSUE SCHEDULE November 30,2009 November 30,2009 ISSUE OPENED ON ISSUE CLOSED ON CREDIT RATING The Debentures have a long term rating of LBBB- by ICRA. The rating is not a recommendation to buy, sell or hold securities and investors should take their own decision. The rating may be subject to revision or withdrawal at any time by the assigning rating agency and each rating should be evaluated independently of any other rating. The rating agency has a right to suspend or withdraw the rating at any time on the basis of factors such as new information or unavailability of information or any other circumstances which it believes may have an impact. LISTING The Debentures are proposed to be listed on the wholesale debt market segment of the Bombay Stock Exchange Limited (“BSE” or the “Stock Exchange”) ISSUER DEBENTURE TRUSTEE Starlight Systems Private Limited IDBI Trusteeship Services Limited Regd Office: 5-9th Floor, C-21 , Housefin Bhavan,Bandra Kurla Coomplex ,Bandra (East),Mumbai 400 051 Asian Building, Ground Floor 17, R. Kamani Marg Ballard Estate, Mumbai – 400 001 Corp Office: 5th Floor ,Centre 3740,Subhash Road,Vile Parle (E),Mumbai Tel: +91 26267800 Fax: +91 26267890 Email: cosec@sunteckindia.com Website: www.sunteckindia.com Contact Person:Ms. Rachana Hingarajia REGISTRAR TO ISSUE Adroit Corporate Services Private Limited 19/20, Jafferbhoy Industrial Estate, 1st Floor, Makwana Road, Marol Naka, Andheri (E), Mumbai – 59 Tel: +91 22 40807000 Tel:+91 22 2859 4060 Fax: +91 22 66311776 Email: brindha@idbitrustee.co.in Website: www.idbitrustee.co.in Contact Person: Ms. Brindha Venkatraman Fax:+91 22 28503748 Email: veenashetty@adroitcorporate.com Website : www,adroitcorporate.com Contact person: Mrs. Veena Shetty - Director NOTE: This Information Memorandum/ Disclosure Document of private placement is neither a prospectus nor a statement in lieu of a prospectus.This information Memorandum/Disclosure Document has been prepared for the purpose of listing of the Non-Convertible Debentures 1 issued by the Company This is only an information brochure intended for private use and should not be construed to be a prospectus and/or an invitation to the public for subscription to Debentures under any law for the time being in force. Information Memorandum / Disclosure Document Private & Confidential Not For Circulation DEFINITIONS AND ABBREVIATIONS The Company / Issuer / Starlight Systems/ Starlight / Starlight Systems Private Limited Starlight Systems Private Limited, A Company incorporated under the Companies Act, 1956 and having with its registered office at C-21 Housefin Bhavan, Bandra Kurla Complex, Bandra (East), Mumbai 400051 “we”, “us”, “our” Unless the context otherwise requires, the Company, its Subsidiaries, and joint ventures. Allotment Intimation An advice informing the allottee of the number of Letter(s) of Allotment/Debenture(s) allotted to him in Electronic (Dematerialised) Form Allot/Allotment/Allotted Unless the context otherwise requires or implies, the allotment of the Debentures pursuant to the Issue. Articles Articles of Association of the Company Board Board of Directors of the Company or a Committee thereof Credit Rating Agency ICRA or any other Rating Agency, appointed from time to time Coupon Payment Date Date of payment of interest on the Debentures Date of Allotment The date on which Allotment for the Issue, has been made Debentures Rated, Taxable, Redeemable Non-Convertible Debenture(s) of face value of Rs.1,00,000/- each aggregating to Rs. 82.99 crores issued and allotted by the Issuer Debentureholder(s) The investors who have been Allotted Debentures. Debenture Trustee Trustee for the Debenture holders, in this case being IDBI Trusteeship Services Limited (ITSL) Depository/ies National Securities Depository Limited (NSDL) / Central Depository Services (India) Limited (CDSL) Designated Account A separate account opened for the purpose of servicing the interest and principal payments on the Debentures DP Depository Participant FEMA Regulations The Regulations framed by the RBI under the provisions of the Foreign Exchange Management Act, 1999, as amended from time to time FII Foreign Institutional Investor (as defined under the Securities and Exchange Board of India (Foreign Institutional Investors) Regulations, 1995) registered with SEBI I.T. Act The Income-tax Act, 1961 as amended from time to time Information Memorandum/ Disclosure Document This Information Memorandum Issue Rated,Redeemable,Taxable and Non-Convertible Debentures issued on a Private Placement basis ISIN International Securities Identification Number Memorandum / MoA Memorandum of Association of the Company 2 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation Mn Million Mutual Fund A mutual fund registered with SEBI under the Securities and Exchange Board of India (Mutual Funds) Regulations, 1996. NCD(s) Rated, Taxable, Redeemable Non-Convertible Debenture(s) of face value of Rs.1,00,000/- each aggregating to Rs. 82.99 crores issued and allotted by the Issuer NRI A person resident outside India, who is a citizen of India or a person of Indian origin and shall have the same meaning as ascribed to such term in the FEMA Regulations. Overseas Corporate Body / OCB A company, partnership, society or other corporate body owned directly or indirectly to the extent of at least 60% by NRIs including overseas trusts, in which not less than 60% of beneficial interest is irrevocably held by NRIs directly or indirectly as defined under FEMA Regulations. OCBs are not permitted to invest in the Debentures under this issue. Pay In Date The date on which the Debenture-holders shall make payment for subscription to the Debentures. Registrar/Registrar to the Issue Registrar to the Issue, in this case being Adroit Corporate Services Private Limited. ROC The Registrar of Companies, Maharashtra RTGS Real Time Gross Settlement, an electronic funds transfer facility provided by RBI RBI The Reserve Bank of India SEBI Securities and Exchange Board of India constituted under the Securities and Exchange Board of India Act, 1992 (as amended from time to time) SEBI Regulations The Securities and Exchange Board of India (Issue and Listing of Debt Securities) Regulations, 2008 issued by SEBI Stock Exchange The Bombay Stock Exchange Limited The Act The Companies Act, 1956 (as amended from time to time) Transaction Document/(s) Debenture Trustee Agreement / Deed and / or any other documents 3 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation TABLE OF CONTENTS DISCLAIMER .................................................................................................................. 5 GENERAL INFORMATION .......................................................................................... 7 (a) Name & Address of the Registered Office ................................................................ 7 (b) Board of Directors....................................................................................................... 7 (c) Company Secretary / Compliance officer ................................................................. 7 (d) Auditors ....................................................................................................................... 8 (e) Debenture Trustee ....................................................................................................... 8 (f) Registrar to the Issue ................................................................................................... 8 ISSUER PROFILE ........................................................................................................... 9 MAJOR EQUITY / DEBT HOLDERS - ...................................................................... 14 DEBT – EQUITY RATIO .............................................................................................. 15 SERVICING OF EXISTING DEBT, PAYMENT OF DUE INTEREST ON DUE DATES ON TERM LOANS AND DEBT SECURITIES -……... .............................. 15 PERMISSION /CONSENT FOR FIRST PARI-PASSU CHARGE .......................... 15 MATERIAL CONTRACTS, AGREEMENTS INVOLVING FINANCIAL OBLIGATIONS OF THE ISSUER............................................................................... 15 MATERIAL EVENTS ................................................................................................... 16 BRIEF OFFER DETAILS ............................................................................................. 17 (a) The Issue .................................................................................................................... 17 (b) Utilisation of the Issue Proceeds .............................................................................. 17 (c) Listing ......................................................................................................................... 17 (d) Rating ......................................................................................................................... 17 (e) Redemption Price ...................................................................................................... 17 (f) Redemption : .............................................................................................................. 17 (g) Early Payment : ......................................................................................................... 17 (h) Period of Maturity .................................................................................................... 17 (i) Coupon Rate ............................................................................................................... 17 (j)Discount / Effective Price to Investor ........................................................................ 18 (k) Security ...................................................................................................................... 18 DEBENTURE TRUSTEE .............................................................................................. 18 OFFERING INFORMATION....................................................................................... 19 OTHER REGULATORY AND STATUTORY DISCLOSURES.............................. 25 ANNEXURE II : UNDERTAKING BY THE COMPANY ........................................ 29 4 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation DISCLAIMER This Information Memorandum/ Disclosure Document is neither a Prospectus nor a Statement in lieu of a Prospectus. The issue of Debentures to be listed on the Bombay Stock Exchange Limited has been made strictly on a private placement basis.This information Memorandum/Disclosure Document has been prepared for the purpose of listing of the Non-Convertible Debentures issued by the Company.It does not constitute and shall not be deemed to constitute an offer or an invitation to subscribe to the Debentures to the public in general. This Information Memorandum/ Disclosure Document should not be construed to be a prospectus or a statement in lieu of prospectus under the Companies Act. This Information Memorandum/ Disclosure Document has been prepared in conformity with the SEBI (Issue and Listing of Debt Securities) Regulations, 2008. Therefore, as per the applicable provisions, copy of this Information Memorandum/ Disclosure Document has not been filed or submitted to the SEBI for its review and/or approval. Further, since the Issue has been made on a private placement basis, the provisions of Section 60 of the Companies Act shall not be applicable and accordingly, a copy of this Information Memorandum/ Disclosure Document has not been filed with the RoC or the SEBI. This information Memorandum/Disclosure Document has been prepared for the purpose of listing of the Non-Convertible Debentures issued by the Issuer.This Information Memorandum/ Disclosure Document has been prepared to provide general information about the Issuer..This Information Memorandum / Disclosure Document does not purport to contain all the information that any potential investor may require. Neither this Information Memorandum/ Disclosure Document nor any other information supplied in connection with the Debentures is intended to provide the basis of any credit or other evaluation and any recipient of this Information Memorandum/ Disclosure Document should not consider such receipt a recommendation to purchase any Debentures. Each investor contemplating purchasing any Debentures should make its own independent investigation of the financial condition and affairs of the Issuer, and its own appraisal of the creditworthiness of the Issuer. Potential investors should consult their own financial, legal, tax and other professional advisors as to the risks and investment considerations arising from an investment in the Debentures and should possess the appropriate resources to analyze such investment and the suitability of such investment to such investor's particular circumstances. The Issuer confirms that, as of the date hereof, this Information Memorandum/ Disclosure Document (including the documents incorporated by reference herein, if any) contains all information that is material in the context of the Issue and sale of the Debentures, is accurate in all material respects and does not contain any untrue statement of a material fact or omit to state any material fact necessary to make the statements herein, in the light of the circumstances under which they are made, not misleading. No person has been authorized to give any information or to make any representation not contained or incorporated by reference in this Information Memorandum/ Disclosure Document or in any material made available by the Issuer to any potential investor pursuant hereto and, if given or made, such information or representation must not be relied upon as having been authorized by the Issuer. 5 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation This Information Memorandum/ Disclosure Document and the contents hereof are restricted for only the intended recipient(s) who have been addressed directly and specifically through a communication by the Company. All investors are required to comply with the relevant regulations/guidelines applicable to them. It is not intended for distribution to any other person and should not be reproduced by the recipient. The person who is in receipt of this Information Memorandum/ Disclosure Document shall maintain utmost confidentiality regarding the contents of this Information Memorandum and shall not reproduce or distribute in whole or part or make any announcement in public or to a third party regarding the contents without the consent of the Issuer. Each person receiving this Information Memorandum/ Disclosure Document acknowledges that: Such person has been afforded an opportunity to request and to review and has received all additional information considered by it to be necessary to verify the accuracy of or to supplement the information herein; and Such person has not relied on any intermediary that may be associated with issuance of Debentures in connection with its investigation of the accuracy of such information or its investment decision. The Issuer does not undertake to update the Information Memorandum/ Disclosure Document to reflect subsequent events after the date of the Information Memorandum/ Disclosure Document and thus it should not be relied upon with respect to such subsequent events without first confirming its accuracy with the Issuer. Neither the delivery of this Information Memorandum/ Disclosure Document nor any sale of Debentures made hereunder shall, under any circumstances, constitute a representation or create any implication that there has been no change in the affairs of the Issuer since the date hereof. This Information Memorandum/ Disclosure Document does not constitute, nor may it be used for or in connection with, an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. No action is being taken to permit an offering of the Debentures or the distribution of this Information Memorandum/ Disclosure Document in any jurisdiction where such action is required. The distribution of this Information Memorandum/ Disclosure Document and the offering and sale of the Debentures may be restricted by law in certain jurisdictions. Persons into whose possession this Information Memorandum comes are required to inform themselves about and to observe any such restrictions. The Information Memorandum/ Disclosure Document is made available to investors in the Issue on the strict understanding that the contents hereof are strictly confidential. 6 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation GENERAL INFORMATION (a) Name & Address of the Registered Office Starlight Systems Private Limited 5-9th Floor, C-21, House Fin Bhavan, C-Block, Bandra Kurla Complex, Bandra (East) Mumbai – 400 051 Phone: +91 26267800 Email: cosec@sunteckindia.com Address of Corporate Office 5th Floor, Sunteck Centre, 37-40, Subhash Road, Vile Parle E, Mumbai - 400057 (b) Board of Directors Name Position Kamal Khetan Director Manisha Khetan Nominee Director Khushru Jijina Nominee Director Shanti Shrigopal Khetan Director Address 505, Acme Plaza, Andheri Kurla Road, Andheri (East), Mumbai – 400 059 Ph. No. 91-22-22924676, 2831464 505, Acme Plaza, Andheri Kurla Road, Andheri (East), Mumbai – 400 059 Ph. No. 91-22-22924676, 28314646 Piramal Tower, Ganpatrao Kadam Marg, Lower Parel, Mumbai -400013 Ph. No. 91-22-3044640 505, Acme Plaza, Andheri Kurla Road, Andheri (East), Mumbai – 400 059 Ph. No. 91-22-22924676, 28314646 (c) Company Secretary / Compliance officer Ms. Rachana Hingarajia Administrative Office Address : 5th Floor, Sunteck Centre, 37-40, Subhash Road, Vile Parle E, Mumbai - 400057 Tel Fax Email : +91 26267800 : +91 26267890 : cosec@sunteckindia.com Investors can contact the compliance officer in case of any post-Issue related problems such as nonreceipt of letters of allotment, credit of debentures, interest on application money etc in the respective beneficiary account or refund orders, etc. 7 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation (d) Auditors Shankarlal Jain & Associates , Chartered Accountants Address :12 , Engineer Building ,265 Princess Street ,Mumbai 400 002 Tel Fax : +91 22 2203 6623 : +91 22 2208 6269 (e) Debenture Trustee IDBI Trusteeship Services Ltd. Address :Asian Building, Ground Floor, 17. R. Kamani Marg, Ballard Estate Mumbai 400 001 Tel Fax : +91 22 4080 7000 : +91 22 6631 1776 Contact Person: Ms.Brindha Venkatraman Email: Brindha@idbitrustee.co.in Website: www.idbitrustee.co.in (f) Registrar to the Issue Adroit Corporate Services Private Limited Address : 19/20, Jafferbhoy Industrial Estate, 1st Floor, Makwana Road, Marol Naka, Andheri (E), Mumbai – 59 Tel Fax : +91 22 2859 4060 : +91 22 2850 3078 Contact person: Ms. Veena Sheety, Director Email : veenasheety@adroitcorporate.com 8 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation ISSUER PROFILE Brief summary of the business/activities of the Company & its line of business Starlight Systems Private Limited is a real estate development and construction company which is engaged in developing Residential and commercial spaces. The Company is also operating Corporate Business Centres in Mumbai catering to specific office requirements of various MNC’s and Indian corporate. The main business activities of the company are as under: Real Estate Services Corporate Business Centres Construction & developing infrastructure The Company is a subsidiary company of Sunteck Realty Limited, a company incorporated under the Companies Act, 1956 and having its equity shares listed at National Stock Exchange of India Limited and Bombay Stock Exchange Limited. Currently, the Company is developing two residential projects – Signature Island on Plot R.1.2 and R.1.3, G Block, Bandra Kurla Complex, Mumbai – 400051 and Signia Isles on Plot R.1.4, G Block, Bandra Kurla Complex, Mumbai – 400051. It also manages Leased Asset at 5th – 9th Floors, Housefin Bhavan, C – 21 Bandra Kurla Complex, Mumbai – 400051. Brief history of the Company since its incorporation and changes in its capital structure and borrowings, if any Starlight Systems Private Limited was incorporated on March 29, 2000 as a private limited company under the Companies Act, 1956. The Company is a real estate development and construction company which is engaged in developing residential and commercial spaces. Year of Acquisition 2001 Project Name, Location Sunteck Certainty, BKC 2006 Signature Island 2008 Signia Isles Project Type Built Office Luxury Residential Premium Residential Acquisition Mode Government Tender Government Tender Government Tender Capital Structure of the Company as at September 30, 2009 Share Capital Amount (Rs.) A. Authorized Capital 500,000 Equity shares of Rs. 10/- each 5,000,000 B. Issued, Subscribed and Paid-up Capital 400,000 Equity shares of Rs. 10/- each 4,000,000 C. Paid Up Capital after the present issue 400,000 Equity Shares of Rs. 10/- each 9 4,000,000 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation Details of the changes in the share capital structure of the Company since inception are given below: History of Authorized Share Capital Sr. No Date 1. March 29, 2000 2. September 28, 2002 3. February 13, 2006 Particulars Incorporation Increase in Authorized Share Capital Increase in Authorized Share Capital Authorized Capital (In Rs.) Rs. 100,000/- divided into 10,000 Equity Shares of Rs. 10/- each. Rs. 1,000,000/- divided into 100,000 Equity Shares of Rs. 10/- each Rs. 5,000,000/- divided into 5,00,000 Equity Shares of Rs. 10/- each History of Issued, Subscribed and Paid-Up Capital: Sr. No 1. 2. 3. Event Allotment to the subscribers to Memorandum & Articles of Association of the Company Issue and Allotment of Shares Issue and Allotment of Shares Face Value per share Amount (In Rs.) Nature Date No. of shares Equity 29.03.00 20 10 200 Equity 30.09.02 87,500 10 875,000 Equity 17.02.06 312,480 10 3,124,800 10 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation Starlight Systems Private Limited: Unaudited Balance Sheet as on September 30, 2009 11 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation Starlight Systems Private Limited: Unaudited Profit & Loss Account as on September 30, 2009 12 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation DETAILS OF SECURITIES ISSUED, ALLOTTED AND SOUGHT TO BE LISTED Instrument Rated, Taxable, Redeemable Non-Convertible Debenture(s) issued by the Issuer Denomination of the Instrument/ Face Value Rs 1,00,000/- per Debenture Issue Price At Par No. of Debentures 8,299 (Eight Thousand Two Hundred & Ninety Nine) Debentures Tenor 4 years from the Date of Allotment Coupon 15%p.a Issue Amount 82.99 Crores Rating LBBB- by ICRA Security Unsecured Redemption Bullet repayment Redemption Price The NCDs will redeem at a Premium. Such premium will be decided by the Issuer and the Debentureholders prior to full principal repayment of the NCDs. Interest Frequency Annually Mode of Placement Private Placement Dematerialized Yes Day Count Basis Actual / Actual Business Days Mumbai Purpose The proceeds from the issue shall be utilised for general corporate purposes 13 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation DETAILS OF PAST BORROWINGS Loan Amount (Rs.) Secured Loans Central Bank of India 20,000,000 Unsecured Loans From Body Corporate 360,050,000 From Others 40,475,200 Application Money for Optionally Convertible Debentures 646,400,000 Unsecured Debentures Issued and Allotted by the Company as of 30 November, 2009 4,446 Series B Non-Convertible Debentures of Rs 100,000 /- each 444,600,000 2,074 Optionally-Convertible Debentures of Rs 100,000 /- each 207,400,000 Debt Securities issued (i) for consideration other than cash, whether in whole or part. (ii) at a premium or discount, or (iii) in pursuance of an option The Company till date has not issued any debt securities for consideration other than cash or discount or premium in pursuance of an option. MAJOR EQUITY / DEBT HOLDERS Details of highest ten holders of each kind of securities of the Company as on date : Equity Shares : Name & Address of the Shareholder No. of Shares Held Sunteck Realty Limited 240,000 of Rs 10 each 5th floor, Sunteck Centre, 37/40, Subhash Road, Vile Parle (E), Mumbai – 57 Piramal Sunteck Realty Private Limited 160,000 of Rs 10 each 4th floor, Piramal Tower Annexe, Ganpatrao Kadam Marg, Lower Parel, Mumbai -13 Total 400,000 14 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation DEBENTUREHOLDERS OF THE COMPANY: Non Convertible Debentures (NCDs): Sr. No. Name of Holders 1 Infina Finance Private Limited 2 Piramal Sunteck Realty Private Limited the Address of the Holders 7th Floor, Dani Corporate Park, CST Road, Kalina, Santa Cruz (E), Mumbai – 98 4th floor, Piramal Tower Annexe, Ganpatrao Kadam Marg, Lower Parel, Mumbai -13 No. of Securities 8,299 of Rs 100,000 each 4,446 of Rs 100,000 each Optionally Convertible Debentures (OCDs): Sr. No. 1 Name of the Holders Address of the Holders No. of Securities Kotak Alternate Opportunities India Fund INGS Point Bilding, 5th Floor, Plot No. 8, Near University campus, CST Road, Kalina, Santacruz (East), Mumbai - 98 2,074 of Rs 100,000 each DEBT – EQUITY RATIO Ratio Prior to the current Issue (as at September 30,2009) Post the current Issue (as at November 30,2009) 12.33 27.12 SERVICING OF EXISTING DEBT, PAYMENT OF DUE INTEREST ON DUE DATES ON TERM LOANS AND DEBT SECURITIES There has been no default in payment of due interest and company is honoring its present commitments. The Company undertakes to discharge all liabilities in time and that there would be no default in payment of interest and principal amounts. PERMISSION /CONSENT FOR FIRST PARI-PASSU CHARGE In the event any permission / consent is required to be obtained, the same shall be done prior to the creation of the security. MATERIAL CONTRACTS, AGREEMENTS INVOLVING FINANCIAL OBLIGATIONS OF THE ISSUER Our Company, in the ordinary course of its business, enters into various agreements, including loan agreements and joint venture agreements, which may contain certain financial obligations and/or provisions which may have an impact on its financial condition. Such contracts or agreements may be inspected at the Registered Office of the Issuer from 10.00am to 1.00pm on all working days 15 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation Material Contracts / Agreements: 1) Copy of Construction Agreement entered into with Shapoorji Pallonji and Co. for Signature Island 2) Copy of Loan Agreement with Central Bank of India for Construction Financing for Signature Island dated July 31, 2009 Material Documents: 1) Copy of the letter from Adroit Corporate Services Private Limited to the Company giving their consent to act as the Registrar and Transfer Agent to the issue. 2) Copy of letter from IDBI Trusteeship Services Limited to the Company giving their consent to act as Debenture Trustee to the issue. 3) Debenture Trust Deed executed / to be executed with IDBI Trusteeship Services Limited 4) Documents pertaining to allotment letter for leasehold rights over land allotted by Mumbai Metropolitan Region Development Authority 5) Memorandum and Articles of Association of the Company, as amended from time to time 6) Copy of Certificate of Incorporation of the Company dated March 29, 2000 7) Certified True Copy of the Resolution empowering the Board of Directors dated November 28, 2009 for the issuance of debentures and empowering other related matters. 8) Audited Accounts of the Issuer for the year ended March 31, 2009 and Limited Review statement as at September 30, 2009. 9) Certified True Copy of the Resolution appointing M/s. Shankarlal Jain and Associates , Chartered Accountants as the statutory auditors of the company MATERIAL EVENTS Any material event/development or change at the time of issue or subsequent to the issue which may affect the issue or the investor’s decision to invest/continue to invest in the debt securities : In the opinion of the Company, except the general market risks, there have been no circumstances that materially and adversely affect or are likely to affect the business of the Issuer or the value of its assets or its ability to pay its liabilities, within the next twelve months. 16 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation BRIEF OFFER DETAILS (a) The Issue Starlight Systems Private Limited has Issued and allotted 8,299 Rated, Taxable, Redeemable Non-Convertible Debentures of Face Value of Rs. 1,00,000/- each, aggregating upto Rs.82.99 Crores, issued on a Private Placement basis in the Financial Year 2009-10. (b) Utilization of the Issue Proceeds The proceeds of the issue of Debentures would be utilized for general corporate purposes. The Main Objects Clause of the Memorandum of Association of the Company enables it to undertake the activities for which the funds have been raised through the issue and also the activities which the Company has been carrying out till date. (c) Listing The Non-Convertible Redeemable Debentures (NCDs) are proposed to be listed on Wholesale Debt Segment (WDM) of The Bombay Stock Exchange Limited, Mumbai (BSE). (d) Rating The company has obtained Long Term Rating of LBBB- from ICRA (e) Redemption Price The NCDs will redeem at a Premium. Such premium will be decided by the Issuer and the Debentureholders prior to full principal repayment of the NCDs. (f) Redemption Bullet repayment (g) Early Payment : Full amount of the NCDs or part thereof (h) Period of Maturity 4 years from the Date of Allotment (i) Coupon Rate 15% p.a , payable Annually 17 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation (j)Discount / Effective Price to Investor The Debentures have been issued at face value and no discount has been offered on the Debenture (k) Security Unsecured DEBENTURE TRUSTEE The Company has appointed IDBI Trusteeship Services Limited (ITSL) as the Debenture Trustee. All the rights and remedies of the Debentureholders shall vest in and shall be exercised by the Debenture Trustee without referring to the Debentureholders. All investors are deemed to have irrevocably given their authority and consent to IDBI Trusteeship Services Limited to act as their debenture trustee and for doing such acts and signing such documents to carry out their duty in such capacity. Any payment by the Company to the Debenture Trustee on behalf of the Debentureholders shall discharge the Company pro tanto to the Debentureholders. Resignation/retirement of the Debenture Trustee shall be as per terms of the trust deed to be entered into between the Company and the Debenture Trustee. A notice in writing to the Debentureholders shall be provided for the same. The Debenture Trustee shall duly intimate the Debentureholders on occurrence of any of the following events: (a) default by the Company to pay interest on the Debentures or redemption amount; (b) failure of the Company to create a charge on the assets for the secured Debentures if any; (c) revision of credit rating assigned to the Debentures. ITSL has given its written consent for its appointment as debenture trustee to the Issue under Regulation 4(4) of the SEBI Regulations and inclusion of its name in the form and context in which it appears in this Information Memorandum/ Disclosure Document In case of any contradiction between this Information Memorandum / Disclosure Document and the Transaction Document/(s) to be signed / already signed with the Debenture Trustee (ITSL), the contents of the latter shall prevail. 18 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation OFFERING INFORMATION Terms of the Issue Starlight Systems Private Limited has issued & allotted 8299 Rated Taxable Redeemable NonConvertible Debentures of Face Value of Rs. 1,00.000/- each, aggregating upto Rs.82.99 Crores, issued on a Private Placement basis in the Financial Year 2009-10. Listing Details The Non-Convertible Redeemable Debentures (NCDs) are proposed to be listed on the wholesale debt segment (WDM) of the Bombay Stock Exchange Limited (BSE). Nature of Instrument Rated, Taxable, Redeemable, Non-Convertible Debentures issued on a private placement basis Credit Rating The Issuer has obtained a Long Term Rating of LBBB- from ICRA for the current issue Face Value The Face Value of the Debentures shall be Rs. 1 Lakh per Debenture. Issue Price The Issue Price of the Debentures shall be Rs. 1 lakhs per Debenture. The amount payable at the time of subscription shall be @ Rs.1 Lakhs per Debenture Discount / Effective Price to Investor The Debentures have been issued at face value and no discount has been offered on the Debenture . Market Lot The minimum lot size for trading of the Debentures on the Stock Exchange is proposed to be one Debenture. Coupon Rate 15% p.a , payable Annually 19 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation Redemption Price The NCDs will redeem at a Premium. Such premium will be decided by the Issuer and the Debentureholders prior to full principal repayment of the NCDs. Redemption Bullet Repayment Early Payment : Full amount of the NCDs or part thereof Period of Final Maturity 4 years from the Date of Allotment Minimum Number of Debentures A minimum of one Debenture and in multiples of one Debenture thereafter. Who can apply Nothing in this Information Memorandum/Disclosure Document shall constitute and/or deem to constitute an offer or an invitation to an offer, to be made to the Indian public or any section thereof through this Information Memorandum/Disclosure Document, and this Information Memorandum/Disclosure Document and its contents should not be construed to be a prospectus under the Companies Act. This Information Memorandum/Disclosure Document and the contents hereof are restricted for only the intended recipient(s) who have been addressed directly through a communication by or on behalf of the Company. The categories of investors eligible to invest in the Debentures, when addressed directly, include banks, financial institutions including development financial institutions, companies and bodies corporate, insurance companies, Mutual Funds and such other category of investor as expressly authorised to invest in the Debentures. Furthermore, NRIs, OCBs, and other persons resident outside India are not eligible to apply for or hold the Debentures. All investors are required to comply with the relevant regulations/guidelines applicable to them for investing in this Issue. Issue Programme ISSUE OPENED ON ISSUE CLOSED ON DATE OF ALLOTMENT November 30 ,2009 November 30,2009 November 30,2009 Procedure and Time of Schedule for Allotment and Issue of Certificates The Debentures under this offer have already been allotted by such persons as are authorized by the Board from time to time by way of a Letter of Allotment. 20 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation After completion of all legal formalities, the Company will issue the Debentures certificate(s)/credit the DP account of the allottees against surrender of the letter(s) of Allotment within three month(s) of the Date of Allotment or such extended period, subject to obtaining the approvals, if any. Basis of Allotment The Company has the sole and absolute right to allot the Debentures to any applicant. Dispatch of Refund Orders if any The Company shall ensure dispatch of refund orders by registered post. Loss of Interest Cheques/Refund Cheques If any Loss of interest cheques/refund cheques should be intimated to the Company along with request for duplicate issue. The issue of duplicates in this regard shall be governed by applicable law and any other conditions as may be prescribed by the Company. Interest on Application Money Wherever applicable ,interest at applicable coupon rate will be paid on the application money to the applicants. Such interest will be paid for the period commencing from the date of realization of the cheque(s)/demand drafts (s) up to but excluding the Date of Allotment. The interest payable on application money will be dispatched by registered post/courier the next Working Day after the Date of Allotment. The letters of Allotment/Allotment advice/refund orders, as the case may be, will be sent by registered post/courier/hand delivery within seven days from the Date of Allotment to the first/sole applicant, at the sole risk of the applicant. The payment will be subject to tax deducted at source at the rates prescribed under the provisions of the IT Act or any other statutory modification or re-enactment thereof. Computation of interest Interest for each of the interest periods shall be computed on Actual/Actual day count basis, on the principal outstanding on the Debentures at the coupon rate from the Date of Allotment or the last Coupon Payment Date. Interest at the coupon rate will be paid only to the Debenture holders registered in the Register of Debenture holders or to the Beneficial Owners.Such interest will be paid Annually. If such interest is not paid by the Issuer to the Debentureholders then the same shall be compounded annually at the coupon rate with no additional penal interest is required to be paid by the Issuer . In the case of joint holders of Debentures, interest shall be payable to the first named Debenture holder.For the purpose of registering a transfer of Debentures prior to the Record Date, the Debenture certificate(s)/letter(s) of the Allotment, a duly stamped transfer deed and all supporting documents must reach the Company at its Registered Office at least seven Working Days before the Record Date. The provisions of the Depositories would be compiled by the Registrar for facilitating interest payment by the Company on the Coupon Payment Date. Tax as applicable under the IT Act or any other statutory modification or re-enactment thereof will be deducted at source on the interest payable on the Debentures. Tax exemption certificate/document/form, under Section 193 of the IT Act if any, must be lodged at the Registered Office of the Issuer, at least 15 days before the relevant interest payment becoming due. 21 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation Payment on Redemption Payment of the redemption amount (including redemption premium, if any as decided by the Debentureholder & the Company) of the Debentures, on maturity or in case of early repayment for full amount or part thereof, will be made by our Company to the beneficiaries as per the beneficiary list provided by the Depositories as on the Record Date. However, the redemption of full principal can not be made until the Debentureholders (acting directly or through the Debenture Trustee) and the Company arrive at the redemption premium payable on redemption of these NCDs. The Debentures shall be taken as discharged on payment of the redemption amount (including redemption premium ,if any as decided by the Debentureholder and the Company) by our Company to the beneficiaries as per the beneficiary list. Such payment will be a legal discharge of the liability of our Company towards the Debentureholders. On such payment being made, our Company will inform the Depositories and accordingly the account of the Debentureholders with Depositories will be adjusted. Our Company’s liability to the Debentureholder in respect of all their rights including for payment or otherwise shall cease and stand extinguished after the maturity date or any such date as may be decided by the Debentureholder and the Company , in all events save and except for the Debentureholder’s right of redemption as stated above. Upon dispatching the payment instrument towards payment of the redemption amount as specified above in respect of the Debentures, the liability of our Company shall stand extinguished. Splitting and Consolidation Splitting and consolidation of the Debentures is not applicable in the demat mode form since the saleable lot is one Debenture. Power of Company to exercise right to re-purchase and/or re-issue the Debentures The Company will have the power, exercisable at its sole and absolute discretion from time to time, to re-purchase a part or all of its Debentures from the secondary markets or otherwise, at any time prior to the maturity date, subject to applicable law and in accordance with the prevailing guidelines/regulations issued by the RBI, the SEBI and other authorities. In the event of a part or all of its Debentures being repurchased as aforesaid or redeemed under any circumstances whatsoever, the Company shall have, and shall be deemed always to have had, the power to reissue the Debentures either by reissuing the same Debentures or by issuing other debentures in their place. Further, in respect of such re-purchased/re-deemed Debentures, the Company shall have the power, exercisable either for a part or all of those Debentures, to cancel, keep alive, appoint nominee(s) to hold or reissue at such price and on such terms and conditions as it may deem fit and as permitted by law. Eligible Holders and Mode of Transfer The Company will not register any transfers of the Debentures to any NRIs, OCBs, or any persons resident outside India, unless appropriate regulatory approvals are obtained. The Company shall not be duty bound to take interest or trust in or over the Debentures. The title to the Debentures shall pass by execution of duly stamped transfer deed(s) accompanied by the Debentures certificate(s) together with necessary supporting documents. The transferee(s) should deliver the Debenture certificates to the Company for registration of transfer in the Register of Debentureholders at the Registered Office. The Company on being satisfied will register the transfer of such Debentures in its Register of Debentureholders. The person whose name is recorded in the Register of Debentureholders shall be deemed to be the owner of the Debentures. 22 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation Request for registration of transfer, along with the necessary documents, and all other communications, requests, queries and clarifications with respect to the Debentures should be addressed to and sent to the Registered Office. No correspondence shall be entertained in this regard at any other branches or any of the offices of the Company. In the event the Debentures are issued in physical form, the Company shall use a common form of transfer. The request from Registered Debentureholder(s) for splitting/consolidation of Debenture certificates will be accepted by the Company only if the original Debentures certificate(s) is/are enclosed along with an acceptable letter of request. No requests for splits below the Market Lot will be entertained. Transfer of debentures in dematerialised form would be in accordance to the rules/procedures as prescribed by the Depositories. Succession In the event of demise of a Registered Debentureholder, or the first holder in the case of joint holders, the Company will recognize the executor or administrator of the demised Debentureholder or the holder of succession certificate or other legal representative of the demised Debentureholder as the Registered Debentureholder of such Debentures, if such a person obtains probate or letter of administration or is the holder of succession certificate or other legal representation, as the case may be, from a court in India having jurisdiction over the matter and delivers a copy of the same to the Company.The Company may in its absolute discretion, where it thinks fit, dispense with the production of the probate or letter of administration or succession certificate or other legal representation, in order to recognize such holder as being entitled to the Debentures standing in the name of the demised Debentureholder(s) on production of sufficient documentary proof or indemnity. In case a person other than individual holds the Debentures, the rights in the Debentures shall vest with the successor acquiring interest therein, including liquidator or such any person appointed as per the applicable law. Issue of Duplicate Debenture Certificates If any Debenture certificate(s) is/are mutilated or defaced, then, upon production of such certificates at the Registered Office, the same will be cancelled and a new Debenture certificate issued in lieu thereof. If any Debenture certificate is lost, stolen or destroyed then, upon production of proof thereof to the satisfaction of the Company and upon furnishing such indemnity as the Company may deem adequate and upon payment of any expenses incurred by the Company in connection thereof, new certificate(s) shall be issued. A fee will be charged by the Company on each fresh Debenture certificate issued hereunder as per the provisions contained in the Articles of Association. Notices The Company agrees to send notice of all meetings of the Debentureholders specifically stating that the provisions for appointment of proxy as mentioned in Section 176 of the Companies Act shall be applicable for such meeting. The notices, communications and writings to the Debentureholder(s) required to be given by the Company shall be deemed to have been given if sent by registered post to the Registered Debentureholder(s) at the address of the Debentureholder(s) registered with the Registered Office. All notices, communications and writings to be given by the Debentureholder(s) shall be sent by registered post or by hand delivery to the Company at its Registered Office or to such persons at such address as may be notified by the Company from time to time and shall be deemed to have been 23 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation received on actual receipt of the same. Rights of Debentureholders The Debentureholder(s) shall not be entitled to any right and privileges of shareholders other than those available to them under the Companies Act and /or under the Transaction Document/(s).The Debentures shall not confer upon the holders the right to receive notice(s) or to attend and to vote at any general meeting(s) of the shareholders of the Company. Governing Laws and Jurisdiction The Debentures are governed by and will be construed in accordance with the Indian law. The Company, the Debentures and Company’s obligations under the Debentures shall, at all times, be subject to the directions of the RBI and the SEBI. The Debentureholders, by purchasing the Debentures, agree that the Mumbai High Court shall have exclusive jurisdiction with respect to matters relating to the Debentures. Effect of Holidays Should any of the date(s), including the Date of Allotment, maturity date, ,Coupon Payment Date or the Record Date, as defined in this Information Memorandum/Disclosure Document, fall on a Sunday or a public holiday or no high value clearing is available for any reason whatsoever at a place where the Registered/Corporate Office is situated, the next Working Day shall be considered as the effective date. In cases where it is not possible to determine disruption in high value clearing as stated above, one day prior to the Maturity Date, the next Working Day shall be considered as the effective date. Tax Deduction at Source Tax as applicable under the IT Act or any other statutory modification or re-enactment thereof will be deducted at source on the interest payable on the Debentures. Tax exemption certificate/document/form, under Section 193 of the IT Act if any, must be lodged at the Registered Office of the Issuer, at least 15 days before the relevant interest payment becoming due. Record Date The record date shall be Ten working days before each relevant payments (interest, principal repayments, redemption premium etc.) for determining the beneficiaries of the Debentures. 24 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation OTHER REGULATORY AND STATUTORY DISCLOSURES Stock Exchange Disclaimer Clause It is to be distinctly understood that filing of this Information Memorandum/ Disclosure Document with the Stock Exchange should not, in any way, be deemed or construed that the same has been cleared or approved by the Stock Exchange. The Stock Exchange does not take any responsibility either for the financial soundness of any scheme or the project for which the Issue is proposed to be made, or for the correctness of the statements made or opinions expressed in this Information Memorandum/ Disclosure Document. Listing The Debentures are proposed to be listed on the Wholesale Debt Market segment of the BSE. The Company shall comply with the requirements of the listing agreement to the extent applicable to it on a continuous basis and shall complete all formalities relating to listing of the Debentures. Disclaimer in respect of Jurisdiction Any disputes arising out of this Issue will be subject to the exclusive jurisdiction of the courts of Mumbai. This offer of Debenture is made in India to persons resident in India. This Information Memorandum/ Disclosure Document does not constitute an offer to sell or an invitation to subscribe to the Debentures herein, in any other jurisdiction to any person to whom it is unlawful to make an offer or invitation in such jurisdiction. Company Disclaimer Clause The Company certifies that the disclosures made in this Information Memorandum/ Disclosure Document are generally adequate and in conformity with the SEBI Regulations. Further, the Company accepts no responsibility for statements made otherwise than in the Information Memorandum/ Disclosure Document or any other material issued by or at the instance of the Company and anyone placing reliance on any source of information other than this Information Memorandum/ Disclosure Document would be doing so at his own risk. Cautionary Note No person including any employee of the Company has been authorized to give any information or to make any representation not contained in this Information Memorandum/ Disclosure Document. Any information or representation not contained herein must not be relied upon as having being authorized by or on behalf of the Company. Neither the delivery of this Information Memorandum/ Disclosure Document at any time nor any statement made in connection with the offering of the Debentures shall under the circumstances imply that any information/representation contained herein is correct at any time subsequent to the date of this Information Memorandum/ Disclosure Document. The distribution of this Information Memorandum/ Disclosure Document and the offer, sale, pledge or disposal of the Debentures may be restricted by law in certain jurisdictions. This Information Memorandum/ Disclosure Document does not constitute an offer to sell or an invitation to subscribe to the Debentures in any jurisdiction to any person to whom it is unlawful to make such offer or invitation in such jurisdiction. Persons into whose possession this Information Memorandum/ Disclosure Document comes are required by the Company to inform themselves about and observe any such restrictions. The sale or transfer of these Debentures outside India may require regulatory approvals in India, including without limitation, the approval of the RBI. 25 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation Issue of Debentures in Dematerialised Form The Debentures will be issued in dematerialized form. The necessary arrangements are being made with the Depositories for the issue of the Debentures in dematerialised form. Investors will have to hold the Debentures in dematerialised form as per the provisions of Depositories Act..The Company shall take necessary steps to credit the Debentures allotted to the depository account of the investor. Transferability of Debentures These Debentures are restricted in their transferability to investors other than Mutual Funds, eligible individuals, HUFs, Trusts, Banks, financial institutions under Section 4A of Companies Act and companies registered under the Companies Act. In the event the Debentures are issued in physical form, the Company shall use a common form of transfer. Trading of Debentures over the counter In the event the Debentures are traded over the counter, such trading shall be reported on the Bombay Stock Exchange Limited. Consents ITSL has given its written consent for its appointment as debenture trustee to the Issue under Regulation 4(4) of the SEBI Regulations and inclusion of its name in the form and context in which it appears in this Information Memorandum/ Disclosure Document The Non-Convertible Redeemable Debentures (NCDs) are proposed to be listed on Wholesale Debt Segment (WDM) of the Bombay Stock Exchange Limited, Mumbai (BSE). 26 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation ANNEXURE I : SUMMARY TERM SHEET FOR LISTING OF PRIVATELY PLACED RATED, TAXABLE, REDEEMABLE AND NONCONVERTIBLE DEBENTURES OF THE ISSUER Issuer Starlight Systems Private Limited Object of the Issue General Corporate Purposes Type of Instrument Rated, Taxable, Debentures Rating LBBB- by ICRA Mode of Placement Private Placement Form of Listed Issuance Dematerialised Aggregate issue amount Rs 82.99 Crores Tenor 4 years from the Date of Allotment Denomination Rs 1,00,000/- per Debenture Total Number of NCDs 8299 Market Lot One (1) Debenture Minimum Subscription The minimum subscription of NCDs is One (1) NCD and in multiples of 1 thereafter Issue Price 100% Redemption Price The NCDs will redeem at a Premium. Such premium will be decided by the Issuer and the Debentureholders prior to full principal repayment of the NCDs. Redemption Bullet repayment Redemption Date / Schedule November 29, 2013 Early repayment Full amount of the NCDs or part thereof Call Option None Put Option None Coupon to investor 15% p.a. payable Annually 27 Redeemable, Non-Convertible Information Memorandum / Disclosure Document Private & Confidential Not For Circulation Coupon payment date Annually Issue opened on November 30, 2009 Issue closed on November 30, 2009 Pay-in date November 30, 2009 Date of Allotment November 30, 2009 Settlement mode The payment of the due interest or principal shall be done by RTGS/cheque to the holders of the NCDs as on the Record Date Day count basis (Actual ⁄ Actual) Business days Mumbai Documentation Documentation shall be in form and substance customary for Transactions of this nature. Security Unsecured Debenture Trustee IDBI Trusteeship Services Limited Listing On the Bombay Stock Exchange Limited (BSE). The Issuer shall be responsible for the costs of such listing of the NCDs. Clearing / Depository National Securities Depository Limited / Central Depository Services (India) Limited Trading The trading in the NCDs shall be in de-mat mode only 28 Information Memorandum / Disclosure Document Private & Confidential Not For Circulation ANNEXURE II : UNDERTAKING BY THE COMPANY The Company undertakes that: In the event the Debentures are issued in physical form, the Company shall use a common form of transfer It will provide a compliance certificate duly certified by the Debenture Trustee to the Debentureholders, (on a yearly basis), in respect of compliance with the terms and conditions of Issue as contained in this Information Memorandum/ Disclosure Document; and Every credit rating obtained shall be periodically reviewed by the Credit Rating Agency and any revision in the rating shall be promptly disclosed by the Company to the Stock Exchange. Any change in rating shall be promptly disseminated to Debentureholders and prospective investors in such manner as the Stock Exchange may determine from time to time. All information and reports on the Debentures, including compliance reports filed by the Company and the Debenture Trustee, shall be disseminated to the Debentureholders and the general public by placing them on the website of the Company and shall through the Trust Deed, request the Debenture Trustee to place the same on its website The above Information Memorandum/ Disclosure Document is compliant with all disclosures required to be made for listing of non-convertible debentures on a private placement basis on a recognized stock exchange, as specified in Schedule I under Point 2 of the Securities and Exchange Board of India (Issuing and Listing of Debt Securities) Regulations, 2008 Authorized Signatory Starlight Systems Private Limited Ms. Rachana Hingarajia 29