ASSOCIATION BETWEEN STRATEGIC VALUES AND E

advertisement

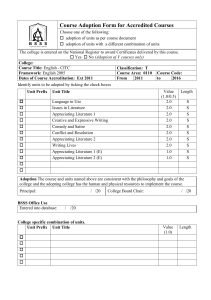

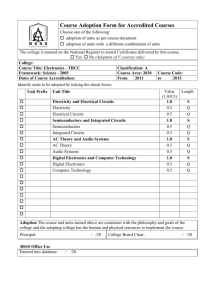

ASSOCIATION BETWEEN STRATEGIC VALUES AND EBANKING ADOPTION IN IRANIAN BANKS Dr. Mohammad Aghdassi, Dr. Lennart Persson, Roja Ghasemi ABSTRACT This paper attempts to understand strategic value of e-banking for Iranian banks and examine the causal effect of perceiving e-banking as a value and its adoption. We propose an e-banking adoption model that is identifying five factors that have been found to be influential in the perception of strategic value of IT: performance support, operational support, managerial productivity, and strategic decision aids. We also identified eight factors that influence electronic banking adoption: organizational readiness, Infrastructural readiness, external dependency, Intangible pressure, persuasive pressure, perceived ease of use, and perceived usefulness. Data are collected via a questionnairebased survey from Decision maker unit of Iranian Banks. We can express the result of this study such that bank managers' perception through e-commerce is very positive and effective in their adoption trend. This perception will help them accelerate the adoption process. Keywords: Perception, Adoption, Strategic value, Banking industry, DMU Dr. Mohammad Aghdassi: Associate professor of Tarbiat Modarres University (Iran), aghdasim@modares.ac.ir Dr. Lennart Persson: Assistant Professor of Luleå University of technology (Sweden), Lennart.Persson@ltu.se, Roja Ghasemi: Master student of marketing and e-commerce: Luleå University of technology (Sweden) and Tarbiat Modarres University (Iran), roja.gh@gmail.com 1. INTRODUCTION “Among the myriad of computer- and telecommunication-based applications in the modern era, the advent of e-commerce is having the biggest impact on organizations. E-commerce is changing the way organizations perform their tasks, interact with customers and, in general, do their business. E-commerce enables firms to reduce telecommunication costs, minimize warehousing expenses, and cut down the distribution chain (Quaddus & Achjari 2005)”. “Technological developments particularly in the area of information technology are revolutionizing banking industries (Sohail & Shanmugham 2003) ”. E-commerce adoption in a bank means using all electronic means of data transmission and financial transaction bank to bank, bank to customer and customer to customer. It is not always the matter of monetary transaction sometimes banks grant a credit for someone or for some companies that is very valuable in a business network. On the other hand E-banking means to provide facilities for staff to enhance their efficiencies in offering bank services in a branch and also among branches and other banks all over the world. Along with providing hardware and software facilities for customers such that they can work with bank and use any services safety, without being there 24h a day. By adopting e-commerce, banks can work as facilitators and accelerators for different industries and firms in several scales, small and large, so the business world will find a new definition and the global market will become realistic. By the adoption of ecommerce their traditional ways of doing business has changed to a highly dynamic communication that not only is cost-effective but also is revenue generating. In this regard many banks and financial institutions are actively developing new way of transaction for themselves and their customers throughout the world but still it is a very new market to enter and to work in. In spite of the many potential advantages of ebanking, its adoption by Iranian Banks remains limited or none. It is very limited in service channels and very incomplete in offering e-banking services to customers. Because of this shortcomes, e-banking in Iran causes many duplications in work processes and causes customer dissatisfaction. Does this mean that top managers/ owners of Banks do not realize the strategic value of e-banking to their organization? This study may identify main factors which facilitate the adoption process by managers and experts. This study would be one of the first studies that examine the Iranian managers’ attitudes towards e-commerce adoption in Iranian banks. The aim of this study is to examine the determinant factors of strategic value and adoption of electronic commerce as perceived by managers and experts in Iranian banking industry using the model which is proposed by Grandon and Pearson (2004) for e-commerce adoption. By using this model of e-commerce adoption, we examined the causal relationship between determinant factors of strategic value and adoption of electronic commerce as perceived by decision maker unit of Iranian Banks. The observed research model consists of two main concepts: perception and adoption. Three factors have been found to be influential in the perception of strategic value of information technologies in previous researches: operational support, managerial productivity, and strategic decision aids, along with five factors that influence electronic commerce adoption according to literature: organizational readiness, compatibility, external pressure, perceived ease of use, and perceived usefulness. We hypothesized a causal link between the perceived strategic value of electronic commerce and electronic commerce adoption. To validate the research model, we collected data from decision maker unit of Iranian Banks, both governmental and private, that contains Top managers, assistant, managers and co-assistants by using a survey. 2. LITERATURE To reach e-commerce objectives, many studies were done to find the problem of e-commerce adoption in different industries. In this regard, numbers of influencing factors were developed among them for example in the study of (Quaddus & Achjari, 2005) Key factors impacting e-commerce are differentiated according to their contribution to the success of e-commerce and to the locus of impact. Or in the study of (Hong & Zhu 2005), which was for better positioning of firms when adopting e-commerce for revenue generation, a conceptual model is developed upon technology diffusion theory, TOE framework, for assessing ecommerce adoption and migration, incorporating six factors in the technology-context (technology integration, web spending, and web functionalities, electronic data interchange (EDI) use, outsourcing partner usage, and perceived obstacles). It was also attempted to identify those factors which affect the adoption of e-commerce among SMEs in the study of (Ching & Ellis 2004). These factors were described within 3 in dependent variables: 1- Decision maker characteristics (Age, Education, and Cosmopolitanism) 2- Innovation characteristics (Relative advantage, Compatibility, Complexity, Cost effectiveness) 3- Environmental characteristics (Supplier incentives, Customer pressure, and Competitive intensity). In the study of (Grandon & Pearson 2004) a research model was developed that suggested three factors that had been found to be influential in the perception of strategic value of other information technologies: operational support, managerial productivity, and strategic decision aids. They also identified four factors that influence electronic commerce adoption: organizational readiness, external pressure, perceived ease of use, and perceived usefulness. A causal link between the perceived strategic value of electronic commerce and electronic commerce adoption is hypothesized. The model that they proposed then was completed by adding compatibility to adoption factors as follows in figure 1: Figure 1: Grandon and Pearson model of adoption The factors influencing e-commerce adoption in this study have been extracted from several studies in IT adoption. In addition the main structure of (Grandon & Pearson)'s model corresponds to the structure of models, theories and frameworks such as TAM (technology acceptance model, TPB (theory of planned behavior), Diffusion theory and TOE (Technology-organization-environment) framework. Consequently, it was interesting to investigate (Grandon & Pearson)'s model as the research model of this study. Therefore, this study is an investigation of causal effect of perception on e-banking adoption in banking industry in Iran by using (Grandon et. al)'s adoption model which has been tested before in SMEs in US. This study is a combination of two different studies that have been represented in an adoption model. The former has been studied by Subramanian and Nosek (2001) and others (Barua et. Al 1995, Chan 2000) while the latter has been investigated by Davis (1989) and others (e.g. Adams et. al 1992, Igbaria et. al 1997, Lederer et. al 2000 and Venkatesh et. al 1996) primarily through the technology acceptance model (TAM). 3. METHODOLOGY 3.1 Sample We targeted top managers, assistant, managers, co-assistants and experts of private and Governmental banks in Iran. Co-assistants are those people who have high responsibility after managers in a certain department in a bank. In this study Experts are those people who have more than 10 years work experience and works sometime as managers' arm in implementing their decision but they have lower position than managers and higher than other typical experts. Qualified persons were introduced to us by research and development department in each bank. In this study 4 private banks and 2 Governmental banks were chosen. Banks were chosen according to their accessibility and willingness of corporation. 3.2 Data Collection We used a self-administered questionnaire method for collecting primary data. More importantly we were replicating a study that had been done in United state with (Grandon et al. 2004)'s questionnaire. Hence in this research we also replicated the same questionnaire. First, we deduced the questionnaire from the tables that were presented in (Grandon et al. 2004) paper. The questionnaire then was translated into Farsi. A covering letter was also provided for the first page. Two hundred questionnaires were distributed to respondents and One hundred and sixty individuals completed the survey for a response rate of 80%. To make such high response rate we were delivering questionnaires individually by making an appointment. 3.3 Questionnaire design The questionnaire is designed to poll the opinion of bankers with respect to: 1- Their perception of e-commerce adoption in their banks as a strategic value. 2- Their attitude towards factors affecting e-commerce adoption in their banks. Respondents were required to complete the survey that had the following major sections (see Appendix A). Eight demographic questions (respondent’s gender, age, education, years of work in present position, years of work in present firm, department, position in the department, and department responsibility ). Two questions about the technology in the organization (presence of web site, and utilization of ecommerce). Sixteen questions asking the extent to which e-commerce is perceived as contributing to strategic value. Twenty-nine questions to measure the factors involved in e-commerce adoption. A seven-point Likert scale (from strongly disagree to strongly agree) was utilized to measure the questions about perceived strategic value and adoption of e-commerce. 3.4 Pilot testing As this questionnaire was verified and used before, a pilot was not required. However as it was translated into Farsi, we sent it out to 25 people, all experts and specialized in IT, EC and Banking to make certain that no problem was raised during the translation process. Having the pilot testing completed and feed back received, some changes were made through the questionnaire. We also added seven questions according to the responders’ feedback: i. E-banking should support linkage with other network suppliers ii. Having skillful human resource is an important factor in our decision to adopt e-banking iii. Having require under structure is an important factor in our decision to adopt e-banking iv. Adopting e-banking is depends on infrastructure of organizational process v. Having legal infrastructure readiness is an important factor in our decision to adopt e-banking vi. Having telecommunication infrastructure readiness is an important factor in our decision to adopt e-banking vii. Having technical infrastructure readiness is an important factor in our decision to adapt e-banking 3.5 Reliability and validity As we dispensed the questionnaires directly or indirectly to the qualified persons and had a chance to be with them while they were filling out the questionnaires or a contact number to call them after distribution we really did not face the subject error. For reducing the subject bias we tried to make sure that their answers were considered confidential. Since the questionnaire was designed in a survey format we did not face with observer error or the observer bias. Table 1 shows that alpha values range from 0.73 to 0.75 for the perceived strategic value and 0.7 to 0.90 for the adoption of e-banking factors. “The scale reliabilities are unusually good compared to the acceptable 0.7 level for field research (Nunnally, 1978)”. Table 1 reliability analysis, alpha test Variables Organizational Support (OS) Managerial Productivity (MP) Decision Aid (DA) Organizational readiness (OR) Compatibility (CC) External Pressure (EP) Ease of Use (EU) Perceived Usefulness (PU) Reliability 0.75 0.73 0.74 0.74 0.81 0.70 0.84 0.90 4. RESULTS 4.1. Demographics and descriptive statistics The 160 surveys were returned over an 8-week period. Results indicated that the DMU's of banks were well educated, with over 50% holding a bachelor degree or a master's degree. The majority were male and between 20 and 40 years of age. Table 2 shows other demographics. Table 2: demographics graphics of responders Variable Governmental Private Classification of Variable Frequency Percentage Frequency Percentag e Female 15 26.8% 35 34% Male 38 67.9% 68 66% Missing 3 5.3% 0 0 Diploma 11 19.6% 4 3.9% Higher Diploma 4 7.1% 3 2.9% Bachelor 30 53.6% 66 64.1% Master 8 14.3% 26 25.2% PhD 3 5.4% 2 1.9% Missing 0 0 2 2% 20-30 16 28.6% 52 50.5% 31-40 23 41.1% 20 19.4% 41-50 6 10.7% 14 13.6% 51-60 1 1.8% 16 15.5% Missing 10 17.8% 1 1% Gender Educational Level Age 4.2. Statistical analysis The instrument used in this study was adopted from Grandon et al's (2004) study. In order to test the model, a statistical analysis was conducted in two stages. The first step employed factor analysis to measure whether the number of factors and loadings of items involved in the two main constructs (perceived strategic value and adoption) conform to the proposed model. Since we were also interested in exploring how the perceptions of strategic value influence the decision to adopt e-commerce, canonical analysis was utilized in the second step. This technique involves developing a linear combination of independent variables (strategic value variables) and dependent variables (adoption variables) to maximize the correlation between the two sets (J.F. Hair, et al. 1998). This method was also conducted in the (Grandon et al.)'s study to investigate the causal relationship between variables. 4.3. Factor analysis 4.3.1. Perceived strategic value construct A factor analysis was run using SPSS 13. The factor analysis used principal components in order to extract the maximum variance from the items. To minimize the number of items that have high loading on any given factor, a varimax rotation was utilized. All items measuring the perception of strategic value of ecommerce were considered during the first run and by using the Kaiser Eigenvalues criterion over 1 (see table 3); we extracted three factors that collectively explained 66.13% of the variance in all items in one factor, organizational support. Hence, Organizational Support was broke up into three main factors, Performance support, Operational Support and Relationship Support respectively, that each of them can be considered to be a value of e-banking. Table 4 shows rotated component matrix of these three factors: and Bartlett's Test test TableKMO 3: KMO and Bartlett's Kais er-Meyer-Olkin Measure of Sampling Adequacy. Bartlett's Tes t of Sphericity Approx. Chi-Square df Sig. .687 315.895 28 .000 Table 4: components' loadings (Organizational Support) component Factor 1 Factor 2 Factor 3 .114 .081 0.861 .151 .104 0.823 .128 .154 0.554 0.209 -.038 0.805 0.049 .146 0.771 0.295 .427 0.600 0.128 .228 0.849 0.145 -.002 0.849 OS2 OS3 OS1 OS8 OS4 OS5 OS6 OS7 Managerial productivity and Strategic Decision aids' item were both covering marginally 60% of the cumulative variance of all items and remained the same as before. Therefore the model of the Perceived Strategic Value factors of e-banking would be as shown in figure 2, in this figure also each factors loading has been shown: Performance Support Operational Support 0.722 Relationship Support Managerial Productivity 0.663 0.662 Perceived Strategic Value 0.831 Strategic Dec. Aids 0.764 Figure 2: PSV revised model after factor analysis 4.3.2. Adoption construct As well as Perception variables, Adoption variables were also analyzed using principal component factor analysis. By using the Kaiser Eigenvalues criterion, we extracted two factors that collectively explained 63.73% of the variance in all items in Organizational Readiness factor. Hence, Organizational Readiness was broke up into two main factors, Organizational readiness and Infrastructural Readiness respectively, that each of them can be considered to be influencing in e-banking adoption (Table 5). Table 5: components' loadings (Organizational Readiness) component Factor 1 Factor 2 -.040 OR4 .884 .069 OR2 .844 .140 OR3 .744 .202 OR1 .620 .112 OR6 .871 .145 OR5 .870 .043 OR7 .644 Using the Kaiser Eigenvalues criterion External Pressure was also broke up into three main factors, Intangible Pressure, External Dependency and Persuasive Pressure that correspondingly explained 71% of the cumulative variance of all items (Table 6). Table 6: components' loadings (External Pressure) component Factor 1 Factor 2 Factor 3 0.221 -0.053 EP5 0.837 -0.056 0.102 EP6 0.834 0.001 -0.055 EP1 0.893 0.170 0.424 EP4 0.633 -0.035 0.088 EP2 0.846 0.565 0.008 EP3 0.568 Other factors in adoption construct, Compatibility, Perceived Ease of Use and Perceived Usefulness, were marginally covering 60%, 62 and 68% of the cumulative variance of all items in each factor respectively. Therefore the model of factors affecting e-banking in Iran with related loading would be as shown in figure 3: Organizational readiness 0.709 Intangible Pressure Persuasive Pressure 0.543 Adoption 0.723 Compatibility 0.626 Perceived Usefulness 0.590 0.549 Ease of Use External Dependency 0.569 0.409 Infrastructural Readiness Figure 3: Adoption revised model after factor analysis 4.4. Canonical analysis Considering the fact that perception was independent variable in the Grandon and Pearson's model and adoption was the dependent one, we had to consider the impact of perception factors on adoption factors and among several statistical tools and techniques the canonical analysis was the most suitable ones. The “Canonical analysis is a multivariate statistical model that studies the interrelationships among sets of multiple dependent variables and multiple independent variables. By simultaneously considering both, it is possible to control for moderator or suppressor effects that may exists among various dependent variables (Mahmood et al. 1993)”. In canonical analysis there are criterion variables (dependent variables) and predictor variables (independent variables). “The maximum number of canonical correlations (functions) between these two sets of variables is the number of variables in the smaller set (Green et al. 1966)”. In our case, the number of variables for the perception of strategic value construct is five while the number of variables in the adoption construct is eight (figure 4). Thus, the number of canonical functions extracted from the analysis is five; i.e., the smallest set. Canonical correlation is a measure to interpret the canonical functions. Canonical correlation size also gives the measures of overall model fit given. PS 0.709 OS 0.543 IP 0.569 E D 0.663 OR 0.722 0.409 R S MP 0.662 PSV Adoption 0.590 0.831 0.723 DA IR C PP 0.549 EU 0.764 0.626 PU Figure 4: the revised model after factor analysis In order to answer research question (Is there any association between factors of perceived strategic value and adoption?) and to investigate the causal relationship between two set of variables and factors in the model, we uses canonical correlation running STATISTICA 5.5A. In order to test the significance of the canonical functions we followed the same path in Grandon and Pearson's canonical analysis section that was also followed the guidelines given by Hair et al. They suggest three different measures to interpret the canonical functions: (a) The significance of the F-value given by Roy’s gcr (see table 7) (b) The measures of overall model fit given by the size of the canonical correlations (see table 8); and (c) The redundancy measure of shared variance (see table 9). Table 7: multivariate test of significance Note that the strength of the relationship between the canonical covariates is given by the canonical correlation (Grandon et al. 2004). Even though the multivariate test of significance shows that the canonical functions, taken collectively, are statistically significant at the 0.01 level, from the overall model fit (Table 8) it can be concluded that only the first canonical function is significant (P < 0.01). This conclusion is consistent with the canonical R² values showed in Table 8. Table 8: Measures of overall model fit For these data, in the first canonical function the independent variables explain approximately 42% of the variance in the dependent variables; the second canonical function explains approximately 19%, the third one explains 17%, the forth function (MP) explains 10% and the fifth one explains only 11%. This is not unusual since typically the first canonical function, "Performance Support", is far more important than the others. Even though the first canonical function was deemed to be significant, it has been recommended that redundancy analysis be utilized to determine which functions to use in the interpretation. Redundancy is the ability of a set of independent variables, to explain the variation in the dependent variables taken one at a time. Table 9: canonical redundancy analysis Table 9 summarizes the redundancy analysis for the dependent and independent variables for the five canonical functions. The results indicate that the first canonical function accounts for the highest proportion of total redundancy (81.7% including both dependent and independent variables), the second one accounts for 60.2%, the third one accounts for 35.1%, the forth and the fifth ones accounts for 30.5 and 24.73% respectively. In addition, the redundancy indexes are higher for the first canonical function than for the second. Therefore, only the first canonical function is considered for interpretation. 5. DISCUSSION In this model adoption of e-commerce is considered as a dependent variable which is also conceptually consist of several factors and is caused by the perception of the adopters. It means that the perception of the adopter of e-commerce in any industry through e-commerce as a strategic value caused an organization to adopt it. And those banks who perceived e-banking as adding strategic value to the firm have a positive attitude toward its adoption. With this definition of the model, e-commerce perception has overwhelmed its adoption. But according to the findings of this study it appears that, in a developing country like Iran and a big industry like banking, although the items of this model are applied, the story is a bit different. In this country the e-commerce adoption specifically e-banking adoption is in its beginning stages. And still there are lots of gaps. These gaps could be technological, economical, socio-cultural, geopolitical and other gaps. Iranian Bankers are informed about the strategic values that are brought by e-banking. Although they are not grown with e-banking step by step but they want to reach these values. They try to change some of the bank's processes and services by providing them electronically, yet they still have so many problems. These new services are inefficient and not integrated. Another issue related to e-banking in Iran is returning to the factors of adoption. Although the factors in the (Grandon et al, 2004)'s model were examined, yet there are other factors that can be put in the model. However six other factors were replaced with two factors (Organizational Support) and (External Pressure) in the model as a result of factor analysis, three to the PSV (Performance Support, Operational Support and Relationship Support) and three to the Adoption (Infrastructural Readiness, Intangible pressure, Persuasive pressure, External dependency). 6. CONCLUSION, IMPLICATIONS, LIMITATIONS AND SUGGESTIONS We can express the result of this study such that bank managers' perception through e-commerce is very positive and effective in their adoption trend. It can defiantly make their steps towards such an important issue faster and help them to remove impediments more rapidly. Thus, interventions toward changing managers’ perceptions about the strategic value of e-banking can be devised in order to increase the adoption/utilization of electronic banking by banks. As a final point, the confirm model of e-banking adoption in this study has been shown in figure 5: Figure 5: the improved model of e-banking adoption in Iran 6.1. Implications In order to adopt e-banking, managers should know about the internal attitude toward e-banking adoption. This study will help them: 1- To understanding that how their organization thinks and perceive e-banking. 2- Which factors are important than others. 3- This study is also giving a very valuable trend e-banking adoption of Governmental and Private Banks for the Government. Which factors are important from the viewpoint of each bank? And how they perceive e-banking adoption as a value added strategic issue for their organization. 4- The result of this study is also useful for the Central bank of Iran. Having understood each bank drivers and perception through e-banking, they can better decide about e-banking adoption strategies and instructions for other banks. Having understood this fact: 1) Managers can move easier toward adoption. 2) They can reduce the reluctant to change and make important drivers more controlling than before. Many bank's experts and managers believed that there must be several infrastructural readiness before adopting e-banking; consequently, Top-managers will try to solve the mentioned impediment so that they can adopt e-banking easier than before. 6.2. Limitations This research has a number of limitations. We use particular model of e-commerce adoption that may not be sufficiently inclusive. The finding reported here are snapshots in time. The e-commerce adoption in Iran demands several infrastructural readinesses that may effect the perception toward its adoption and change the adoption model. 6.3. Suggestions According to the above findings, it is interesting to know that Iranian banks have several drivers and impediments, internally and externally to adopt e-banking. In addition to the model factors of e-commerce and added items to this study after pilot test, there are some other items that are mentioned in the free question section of the questionnaire. This would be very interesting to consider them in the future study of e-banking in Iran. 7. REFERENCES Adams, D.A., Nelson, R.R., Todd, P.A. (June 1992) Perceived usefulness, ease of use, and usage of information technology: a replication, MIS Quarterly, pp. 227–247. Barua, A., Kriebel, C.H., Mukhopadhyay, T. (1995) Information technology and business value: an analysis and empirical investigation, Information Systems Research, pp. 3–23. Ching, H.L., Ellis P. (2004) Marketing in Cyberspace: What Factors Drive Ecommerce Adoption?, Journal of Marketing Management, pp. 409-429. Chan, Y.E. (2000) IT value: the great divide between qualitative and quantitative and individual and organizational measures, Journal of Management Information Systems, pp. 225–261. Davis, F.D., (1989) Perceived usefulness, perceived ease of use, and user acceptance of information technology, MIS Quarterly, pp. 319–340. Grandon, E.E., Pearson, J.M. (2004) Electronic commerce adoption: an empirical study of small and medium US businesses. Green, P.E., Halbert, M.H., Robinson, P.J. (1966) Canonical analysis: an exposition and illustrative application, Journal and Marketing Research pp. 32–39. Hair, J.F., Anderson, R.E., Tatham, R.L., Black, W.C. (1998) Multivariate Data Analysis, Prentice-Hall, New Jersey. Hong, W., Zhu K., (2005) Migrating to internet-based e-commerce: Factors affecting e-commerce adoption and migration at the firm level, Information & Management. Igbaria, M., Zinatelli, N., Cragg, P., Cavaye, (1997) A. Personal computing acceptance factors in small firms: a structural equation model, MIS Quarterly, pp. 279– 302. Lederer, A.L., Maupin, D.J., Sena, M.P., Zhuang, Y. (2000) The technology acceptance model and the World Wide Web, Decision Support Systems , pp. 269–282. Mahmood, M.A., Mann, G.J. (1993) Measuring the organizational impact of information technology investment: an exploratory study, Journal of Management Information Systems, pp. 97–122. Nunnally, J.C., (1978) Psychometric Theory, McGraw-Hill, New York. Quaddus, M., Achjari, D. (2005) A model for electronic commerce success, Telecommunications Policy pp. 127–152. Subramanian, G.H., Nosek, J.T. (2001) An empirical study of the measurement and instrument validation of perceived strategy value of information systems, Journal of Computer Information Systems, pp. 64–69. Sadiq Sohail, M., Shanmugham, B. (2003) E-banking and customer preferences in Malaysia: An empirical investigation Venkatesh, V., Davis, F.D. (1996) A model of the antecedents of perceived ease of use: development and test, Decision Sciences, pp. 451–481.Wall Street Journal. Appendix - Questionnaire In The Name of God E-BANKING ADOPTION: A COMPARISON BETWEEN PRIVATE AND GOVERNMENTAL BANKS Among the myriad of computer- and telecommunication-based applications in the modern era, the advent of e-commerce is having the biggest impact on organizations. E-commerce enables firms to reduce telecommunication costs, minimize warehousing expenses, and cut down the distribution chain. E-commerce adoption in a bank means using all electronic means of data transmission and financial transaction among different banks, among different customers and among customers and bank. Thank you for your time and attention to this research, please fill out the forms bellow: Section 1: General information Gender Male Female Age 20-30 31-40 41-50 <50 Education High school 2-year college 4-year college Master/MBA Doctorate Other Years in present position Years with present Bank What is your department responsibility? What is your responsibility in your bank or relevant department? Does your firm have an Internet service provider? Yes No Does your firm have a web site? Yes No URL Does your firm utilize electronic commerce? Yes No Section 2: The following questions ask you about your perceptions of strategic value of electronic commerce. Please indicate your agreement with the next set of statements using the following rating scale. In order to provide strategic value to our bank, electronic commerce should help: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Reduce costs of business operations Improve customer services Improve distribution channels Reap operational benefits Provide effective support role to operations Support linkages with suppliers Support linkage with other network partners Increase ability to compete Provide managers better access to information Provide managers access to methods and models in making functional area decisions Improve communication in the bank Improve productivity of managers Support strategic decisions of managers Help make decisions for managers Support cooperative partnerships in the industry Strongly Disagree Somewhat disagree disagree 1 2 3 Neutral Somewhat Agree agree 4 5 6 Strongly agree 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 16 Provide information for strategic decision 1 2 3 4 5 6 7 Section 3: The following questions ask you about your perceptions of adopting electronic commerce. Please indicate your agreement with the next set of statements using the same rating scale above. 1 Having financial resources is critical in decision to adopt ebanking 2 Having technological resources is important to adopt e-banking 3 Having skillful human resources is important to adopt e-banking 4 Having Infrastructural readiness is important to adopt e-banking 5 Having telecommunication Infrastructure is important to adopt ebanking 6 Having regulation Infrastructure is important to adopt ebanking 7 Having technical Infrastructure is important to adopt ebanking 8 Our bank perceives that electronic commerce is consistent with culture 9 Our bank perceives that electronic commerce is consistent with values 10 Our bank perceives Strongly Disagree Somewhat disagree disagree 1 2 3 Neutral Somewhat Agree agree 4 5 6 Strongly agree 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 11 12 13 14 15 16 17 18 19 20 21 that electronic commerce is consistent with preferred work practices Electronic commerce would be consistent with our existing technology infrastructure Top management is enthusiastic about the adoption of electronic commerce Competition is a factor in our decision to adopt electronic commerce Social factors are important in our decision to adopt electronic commerce Banks' nature of process and procedures is important to adopt ecommerce We depend on other Banks and firms that are already using electronic commerce Our industry is pressuring us to adopt electronic commerce Our bank is pressured by the government to adopt electronic commerce Learning to operate electronic commerce would be easy for me I would find electronic commerce to be flexible to interact with My interaction with 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 22 23 24 25 26 27 28 29 electronic commerce would be clear and understandable It would be easy for me to become skillful at using electronic commerce I would find electronic commerce easy to use Using electronic commerce would enable my bank to accomplish specific tasks more quickly Using electronic commerce would improve my job performance Using electronic commerce in my job would increase my productivity Using electronic commerce would enhance my effectiveness on the job Using electronic commerce would make it easier to do my job I would find electronic commerce useful in my job 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 1 2 3 4 5 6 7 I would like to receive the aggregated results of this survey I am interested in participating further in this study Yes Yes No No Thank you for completing this survey. We recognize that your time is limited and we value your participation. Please complete the following section if you answered YES to either question 24 or 25 and you would prefer to be contacted at a different address than that shown on the cover sheet or if the person who completed this survey is not the same as the person to whom it was originally sent. Name: Telephone: Fax: E-mail: Address: URL Address: We will appreciate your suggestions: ……………………………………………………………………………… ……………………………………………………………………………… ……………………………………………………………………………… ……………………………………………………………………………… ……………………………………………………………………………… ……………………………………………………………………………… ……………………………………………………………………………… ……………………………………………………………………………… ………………………………