partner selections in the formation of multi-partner alliances

advertisement

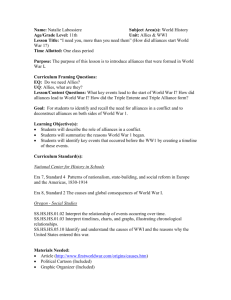

PARTNER SELECTIONS IN THE FORMATION OF MULTI-PARTNER ALLIANCES: A GROUP APPROACH Xiaoli Yin Department of Management Baruch College The City University of New York New York, NY 10010-5585 Tel: 646- 312- 3679 Email: Xiaoli.Yin@baruch.cuny.edu Jianfeng Wu Business School University of International Business and Economics Beijing, China 100029 Tel: +86 10 6449-4303 Email: strategywu@gmail.com The authors are indebted to Arnie Cooper, Joe Galaskiewicz, Steve Green, Tim Pollock, Mark Shanley, Wei Shen, and Lihua Wang, Kathy Williams for comments on earlier versions of this paper. 1 PARTNER SELECTIONS IN THE FORMATION OF MULTI-PARTNER ALLIANCES: A GROUP APPROACH Abstract This study examines focal firms’ choices of one group of partners over others in the formation of multi-partner alliances. We consider the entire multi-partner alliance as a group and explore factors influencing a focal firm's decision to form the group. With a sample of industrysponsored e-marketplaces (ISMs), we find that while social ties and relational heterogeneity significantly influence a focal firm’s choice of partners, their effects are also moderated by the size of the multi-partner alliance. 2 Prior research suggests that organizations are subject to high uncertainty when forming exchange relations with others (e.g., Gulati & Singh, 1998; Pfeffer & Salancik, 1978; Podolny, 1994; Simon, 1957; Thompson, 1967; Williamson, 1975, 1985). One way to avoid market uncertainty is to adopt a social orientation by adhering to a principal of exclusivity in selecting exchange partners (Podolny, 1994). For instance, investment banks tend to select partners with whom they have transacted in the past and partners of similar status to reduce uncertainty (Podolny, 1994). This principal of exclusivity is commonly applied in strategic alliances. Based on social network theory, prior research on dyadic alliances suggests that firms manage to reduce uncertainty by partnering with their prior social ties (Gulati, 1998; Gulati & Gargiulo, 1999). Multi-partner alliances or alliance constellations formed by three or more partners, however, face new challenges in responding to uncertainty during the partner selection process. As three or more partners collaborate, there is no direct reciprocity among them and social exchanges become generalized. Subsequently, uncertainty and risks of free-riding are higher in multi-partner alliances than in dyadic alliances (Das & Teng, 2002). More important, uncertainty increases as the number of participants of a constellation (i.e., group size) increases (Kanter, 1977; O’Reilly, Caldwell & Barnett, 1989). Given the high level of uncertainty and the complex nature of multiparty exchanges, it is no longer sufficient to merely apply social network theory to examine how firms choose a group of partners in multi-partner alliance formation. Multi-partner alliances should be examined as a distinctive type of alliance both for theoretical development and empirical testing. We focus explicitly on multi-partner alliances for two reasons. First, multi-partner alliances provide a rare opportunity to test the relationship between uncertainty and exclusivity. This study investigates a unique type of uncertainty that stems from variations in alliance size. 3 We do not focus on external environmental or market uncertainty. Instead, uncertainty in this study refers to the difficulty and complexity of collaborating with a group of partners. As the number of alliance participants increases, uncertainty increases, and it becomes more difficult for focal firms to manage the potential conflicts and free-riding behaviors of their alliance partners. Specifically, we examine whether focal firms become more exclusive in their partner selection process as the size of alliance constellations increases. Second, multi-partner alliances have increasingly gained attention in the past decade (e.g., Das & Teng, 2002; Doz & Hamel, 1998; Gomes-Casseres, 1996; Makino & Beamish, 1999; Sakakibara, 1997; Zeng & Chen, 2003). Among strategic alliances, it is not uncommon to observe that three or more partners collaborate with each other to achieve the same goal. For example, Makino and Beamish (1999) found that in their sample of 737 joint ventures, 55 percent had more than 2 partners. Popular types of alliance constellations include R&D consortia, joint bidding, product bundling, horizontal keiretsu, and industry-sponsored e-marketplaces (ISMs) (Das & Teng, 2002). In spite of the growing consensus about its importance, theoretical and empirical investigation of multi-partner alliances is rather limited. The few existing studies assume that multi-partner alliances already exist, and none of them address the issue of with whom to form multiple-partner alliances. The main objective of this study is to explore: When a focal firm decides to form a new multi-partner alliance, why will it choose one group of partners over others? This question is quite significant as the behavior of alliance partners is a key factor in the success of an alliance (Gulati, 1995). Firms face high uncertainty and high risks of opportunistic behaviors in inter-organizational collaborations such as those seen in strategic alliances and R&D consortia (Browning, Janice, & Shetler, 1995; Gulati & Gargiulo, 1999). In fact, the normal life span for most alliances is usually 4 no more than five years (Kogut, 1988). The considerable uncertainty associated with entering cooperative ties makes it imperative to decide with whom to build those ties. To answer this question, social network theory should be coupled with group dynamics theory to address the unique challenges and uncertainties in multi-partner alliances. In other words, social network theory only provides a partial explanation for partner selections in constellation formation. As alliance constellations involve a group of partners, group dynamics theory is also relevant. One of the key contributions of this study is to introduce group dynamics theory to examine the direct and moderating effects of group factors on partner selections in multi-partner alliances. This study also contributes to alliance research by adopting a group approach to examine a focal firm’s collaboration with a group of partners in forming a multi-partner alliance. Most previous alliance research focuses on the dyadic level of analysis. We adopt a group approach to uncover important group attributes of multi-partner alliances that are neglected or masked by a dyadic approach. Instead of examining each pair of firms in a multi-partner alliance, this study takes a holistic view considering the entire multi-partner alliance as a group and explores factors influencing a focal firm's decision to form the group. By adopting a group approach to study partner selections in multi-partner alliances, we advance our understanding of these important yet underdeveloped topics. This study relies on social network theory, group dynamics theory, and a group approach to investigate what determines a focal firm’s choice of partners in multi-partner alliances. Specifically, we examine to what extent prior social ties, relational heterogeneity, and interactions with group size contribute to a focal firm’ propensity to cooperate with one group of partners over others in forming multi-partner alliances. The study suggests that focal firms are 5 more likely to choose a group of partners with whom they share more prior ties and who are more similar to themselves. The study also suggests a contingency perspective, that the size of multi-partner alliances (i.e., anticipated group size) will moderate the effect of prior social ties and relational heterogeneity on focal firms’ choice of partners. As the alliances have more partners, indirect ties have diminishing effect on partner selections, and the effect of relational heterogeneity becomes more pronounced. We study a unique type of collaborative venture in the new information economy: industry-sponsored e-marketplaces (ISMs). Specifically, we examine 19 ISMs (with a total of 189 founding firms) established in the year 2000 in four different industries (i.e., aerospace, chemical, energy, and metal). Empirical results show considerable support for our hypotheses, that both social networks and group dynamics factors have main and interacting effects on partner selections in multi-partner alliances. THEORETICAL FRAMEWORK AND HYPOTHESES Multi-partner Alliances and Uncertainty Most previous research on strategic alliances has focused on alliances between two firms. Research attention on multi-partner alliances has been sporadic, because most researchers have not regarded multiple-partner alliances as distinctive from dyadic alliances (Das & Teng, 2002). As Das and Teng (2002) point out, however, multiple-partner alliances are a particular, yet complex form of strategic alliances. Recently some researchers begin to look into collaborative organizations involving three or more members and examine issues of collective strategies among members, membership continuity, motives for cooperation, social control and management challenges, and cooperation of alliance constellations (Barnett, Mischke, & Ocasio, 2000; Das & Teng, 2002; Olk & Young, 1997; Sakakibara, 1997; Zeng & Chen, 2003). 6 While previous research contributes to our understanding of multi-partner alliances, it does not address the issue of how a focal firm chooses one group of partners over others in forming a multiple-partner alliance. There are some basic questions remained to be answered: How would a focal firm choose one group of partners over others in the formation of multipartner alliances? If we treat an alliance constellation as a group, how will the group attributes affect an individual member’s decision to jointly form that constellation? The distinctiveness and complexity of partner selections in multi-partner alliances should be explored further in the research of strategic alliances. For instance, one important distinction of multi-partner alliances is that uncertainty is higher in alliance constellations than in dyadic alliances. When there are two partners in an alliance, social exchanges are restricted and reciprocal as there are direct exchanges of favors between the two partners. As there are three and more partners involved in an alliance, social exchanges become generalized as there is no direct reciprocity among multiple partners (Das & Teng, 2002). The key feature of generalized exchanges is the lack of one-to-one correspondence between the giver and the receiver (Das & Teng, 2002). There are major differences between restricted and generalized social exchanges (Ekeh, 1974). First, individual members have more incentives to free-ride in generalized exchanges. In restricted social exchanges, two parties directly exchange favors with each other and thus it is relatively easy to observe and remedy freeriding. In generalized exchanges, a group-based exchange relationship makes it harder to detect and thus prevent free-riding. Second, the need for trust is especially high in generalized social exchanges as exchanges are carried out by multiple members who do not directly reciprocate with each other. Trust among exchange parties not only helps reduce uncertainty and anxiety associated with potential free-riding, but also encourages cooperation and enhances the overall 7 benefits of the group. Dyadic alliances are characterized by restricted exchanges. Alliance constellations are characterized by generalized social exchanges and thus experience a higher risk of free-riding and higher need for trust (Das & Teng, 2002). Given the higher uncertainty in multi-partner alliances as compared to dyadic alliances, it would be important to examine if similar predictors of alliances between two firms (i.e., prior ties and homophily) would also lead to a focal firm’s choice of a group of partners in multiple-partner alliances. Meanwhile, the other key distinction of multi-partner alliances is that uncertainty increases as the number of alliance participants increases. From a group perspective, multipartner alliances vary in group size or number of alliance participants. Group research found that group size has significant implications to firm behaviors. As group size increases, face-to-face interactions become more difficult, and group cohesiveness and performance start to deteriorate (House & Miner, 1969). Further, increase in group size also makes group members more prone to free-ride (Albanese & Van Fleet, 1985). In the case of multi-partner alliances, as there are more firms participating in an alliance constellation, uncertainty increases and solidarity and trust become increasingly important in a focal firm’s partner selection process. The unique group dynamics of multi-partner alliances provide an appropriate setting to study whether firms become more exclusive in partner selections as uncertainty increases. Put together, even though multiple-partner alliances share many similarities with dyadic alliances, “greater numbers of participants also complicate alliance design and governance” (Doz & Hamel, 1998: 224). Compared to dyadic alliances, multiple-partner alliances face higher uncertainty and have higher needs for trust. Meanwhile, as the number of participants increases, uncertainty increases in alliance constellations. Multi-partner alliances should be treated as a distinctive type of alliances for theoretical development and empirical testing. To address the 8 unique challenges and uncertainties in multi-partner alliances, social network theory should be coupled with group dynamics theory to study partner selections. Based on social network perspective and group dynamics theory, the study tests whether the most common determinants of partner selections in dyadic alliances (i.e., prior ties and homophily) would replicate themselves in the context of alliance constellations. More important, the study investigates how a focal firm’s choice of a group of partners might be moderated by the anticipated size of the alliance. This study adopts a group approach to examine a focal firm’s collaboration with a group of partners in multi-partner alliance formation. When three or more partners collaborate, a focal firm will not only consider its relationship with individual partners, but also will evaluate the characteristics of the other partners as a group in constructing an alliance. In this study, we treat each multi-partner alliance as a group and examine how group level characteristics such as social network ties and group heterogeneity affect a focal firm’s decision to jointly found that group. We know of only one prior study that assesses partner selections directly from a group approach.1 There may be significant heterogeneity in the overall attributes of each group of partners, and this important source of variation is neglected in research that simply examines each pair of firms within multi-partner alliances. Based on social network theory, group dynamics literature, and a group approach, we hope to uncover important distinctions of partner selections in multi-partner alliances. We examine our research questions in the setting of ISMs. Industry analysts define ISM as a separate legal entity formed by three or more established companies to create a B2B net market (Temkin, Kafka, King, Freiden, & Hurd, 2001). Building an ISM is extremely expensive 9 and may cost more than 100 million US dollars. Therefore, most ISMs are endorsed by large industry incumbents. There are five major functions targeted by an ISM: (1) support buy and sell transactions; (2) supply chain optimization; (3) developing industry-wide e-business standards; (4) strategic sourcing; and (5) collaborative product development (Temkin et al., 2001). For example, in the aerospace industry, two of the major ISMs are Exostar and Aeroxchange. Exostar was established on March 28, 2000, by four major leaders in the industry: BAE Systems, Boeing Company, Lockheed Martin Corporation, and Raytheon. Each founding member contributes equal equity for this new entity. Its main objective is to bring both industry customers and suppliers together to streamline supply chain management. Aeroxchange was established in October 2000 by 13 member airlines from Asia-Pacific region, North America, and Europe. This global e-commerce marketplace is dedicated to transform the complex aviation industry supply chain by integrating buyers and sellers, reducing transaction costs, and facilitating information transparency. Compared to traditional R&D consortia or collective organizations, the prospect of ISMs is quite uncertain. It remains unclear whether this new collaborative platform is a viable organizational form. Most ISMs emerged within a few months in 2000 and thereafter experienced a lot of restructuring and consolidations. Even some of the most successful ISMs, such as Metalsite and Scrapsite which were once rated as best B2B exchange sites by Forbes, ceased operation in June 2001, due to the lack of funding and were later acquired by Metal Supply Alliances. In general, most ISMs haven’t yet generated profits. Cash insufficiency is still a big problem plaguing managers of ISMs. Although these ISMs promise many solutions for supply chain management, new product development, and distribution, there is still no solid 1 Dialdin and Gulati (2004) took a triadic approach and examined how configural and geometric characteristics of 10 evidence indicating that these benefits have been realized. We suggest that when there is high uncertainty about the viability of collective ventures, industry players become more exclusive in selecting partners to jointly found ISMs. Therefore, studying the unique challenges and uncertainties faced by individual firms in ISMs might present a rare opportunity to examine the relationship between uncertainty and exclusivity in inter-organizational cooperation. Social Network Theory Previous studies on alliance formation have applied various theoretical perspectives including social network theory (Gulati, 1998). Social network theory not only helps us explain whether firms would choose to form ties with other firms, it also predicts with whom to form such alliances (Gulati & Gargiulo, 1999). Among all interdependent organizations, some firms are more familiar with each other due to previous interactions or affiliations. To avoid uncertainty of potential partnerships, firms tend to choose partners they find trustworthy. Social networks can provide differential information advantages through relational embeddedness and structural embeddedness (Granovetter, 1992). Relational embeddedness suggests that direct cohesive ties between organizations help firms gain common information of each other. Cohesive ties also help create trust and solidarities which tend to lead to subsequent cooperation between organizations (Gulati & Gargiulo, 1999). Structural embeddedness goes beyond direct ties and instead focuses on the structure of relations around organizations (Granovetter, 1992). The next section explores the effects of direct ties and indirect ties on a focal firm’s choice of one group of partners over others in founding an ISM. We take a group approach to study social network effects on partner selections and consider the entire ISM as a group. Instead of examining prior ties between each pair of firms, we study how the total number of prior ties each triad affect alliance formation. 11 between a focal firm and a group of partners affects the focal firm’s decision to form an ISM with that group. Prior direct ties. One way of building trust and accessing information about potential partners is through previous direct cooperation. Through direct interactions with each other, firms obtain valuable information about their partners’ capabilities, needs, and reliability. Firms tend to develop mutual trust among partners through repeated interactions (Gulati, 1995). Firms are also more likely to become aware of the opportunities for future collaborations through their previous partners. The increased information and trust between firms due to previous direct ties help firms overcome uncertainties when forming exchange relations. As a result, firms are more likely to choose to collaborate with partners with whom they have more prior interactions. In the case of ISMs, a focal firm is more likely to choose one group of partners over others to jointly form an ISM as the total number of direct ties it shares with that group increases. We thus propose that: H1: The likelihood of a focal firm to jointly found an ISM increases with the number of prior direct ties between the focal firm and other founding members within that ISM. Prior indirect ties. While prior direct interactions can be important in gathering information about potential partners, indirect contacts can also provide such information and reputation benefits (Ahuja, 2000; Gulati & Gargiulo, 1999; Mizruchi, 1989). When two firms are tied to a common partner, they can access information about each other’s capability and reputation through their common third-party tie (Gulati, 1995). In other words, common thirdparty ties can serve as an information conduit, passing information back and forth across their partners (Ahuja, 2000). Further, when there are new opportunities for collaboration, a focal 12 firm’s common third-party ties can refer their other partners to the focal firm. Given the information, reputation, and referral benefits associated with indirect ties, we expect that the more prior indirect ties a focal firm shares with a group of partners, the more likely that the focal firm will choose that group over others in founding an ISM. We thus propose that: H2: The likelihood of a focal firm to jointly found an ISM increases with the number of prior indirect ties between the focal firm and other founding members within that ISM. Group Dynamics Theory Previous research on dyadic alliances tends to apply social network theory to study partner selections. However, unlike dyadic alliances, the focal firm takes into account its relationship with multiple partners in forming alliance constellations and faces higher uncertainty during the process. Apart from social network theory, group dynamics literature is also relevant to study partner selections in multi-partner alliances. This study applies group dynamics theory and suggests that relational heterogeneity and group size are two of the most prominent group factors influencing firm behaviors. Relational heterogeneity. Demography and diversity literature claims that variations in group composition affect individual and group behaviors. Group heterogeneity, for example, is a commonly used indicator of group characteristics. Both social categorization and similarity/attraction frameworks predict that firms have a strong preference to construct homogeneous groups, as a result of in-group favoritism and attraction towards similar others (Byrne, 1971; Tajfel, 1981; Turner, 1987; Williams & O’Reilly, 1998). According to social categorization theory (Tajfel, 1981; Tajfel & Turner, 1986; Turner, 1987), individuals define themselves through a process of self-categorization, in which they 13 classify people into social categories using salient characteristics like age, gender, educational and functional background (Tajfel, 1981; Tajfel & Turner, 1986; Turner, 1987). The process of self-categorization increases the tendency of individuals to construct homogeneous groups of similar others to maintain or enhance self-esteem and identity (e.g., Messick & Massie, 1989). On the other hand, in heterogeneous groups, self-categorization leads to more stereotyping, polarization, and anxiety, which in turn lead to increased dissatisfaction, turnover, and conflict (e.g., Crocker & Major, 1989; Triandis, Kurowski, & Gelfand, 1994). The similarity/attraction paradigm argues that individuals are attracted to those who are similar to themselves in attitudes, values, and demographic variables (e.g., Berscheid & Walster, 1978; Byrne, 1971). Individuals who are similar might find it easier to relate and communicate to each other. Members similar in backgrounds tend to have similar values, share common life experiences, and thus reinforce their attitude and beliefs (Milliken & Martins, 1996). If individual group members feel dissimilar from other members, they are less likely to communicate and cooperate, and are more likely to exit from the group. Diversity in group composition might create divisive effects of increased conflict, factionalism, and communication difficulties. Empirical research on diversity and demography tend to support social categorization theory and similarity/attraction framework (Williams & O’Reilly, 1998). For example, based on an experimental study on how nationality, race, and gender diversity affected the interrelationship among co-workers, Chatman, Polzer, Barsade, and Neale (1998) found that increased heterogeneity led to decreased interaction. Empirical studies also found that tenure, education, and experience heterogeneity increased the probability of member exit (Alexander, Nuchols, Bloom, & Lee, 1995; Ucbasaran, Lockett, Wright, & Westhead, 2003). 14 Meanwhile, previous research suggests that the principle of homophily is important in forming exchange relations (Blau, 1977; Podolny, 1994). Podolny (1994) proposes the concept of status-based homophily under conditions of high uncertainty and finds that firms are more likely to ally with those of similar status. Podolny (1994) suggests that to respond to uncertainty, organizations adhere to a principal of exclusivity in selecting exchange partners. As firms generally avoid affiliating with firms of lower status, they tend to form exchange relations with those of equivalent status. Therefore, the greater the uncertainty, the more likely that organizations engage in transactions with those of similar status (Podolny, 1994). The majority of empirical research on group diversity has focused on how individuals in groups are different from other group members (Williams & O’Reilly, 1998), a notion referred to as relational demography (Tsui & O’Reilly, 1989; Tsui, Egan, & O’Reilly, 1992). In this study, we focus on the effects of relational heterogeneity, which refers to how a focal firm defines itself as different from other firms in a group. Based on social categorization theory, the similarity/attraction paradigm, and the homophily principal, we suggest that a focal firm is more likely to choose a group of partners similar to itself to jointly found an ISM. H3: The likelihood of a focal firm to jointly found an ISM is negatively related to the relational heterogeneity between the focal firm and other founding members within that ISM. The contingency effects of group size. As we discussed above, one prominent difference between dyadic alliances and multi-partner alliances is the number of participants, or alliance size. Group dynamics literature suggests that there is an inverse relationship between group size and group cohesion, consensus, and member satisfaction (see House & Miner, 1969 for a review). In addition, increase in group size makes group members more prone to free-ride. 15 Specifically, as the group size increases, (1) it is harder to notice any free-riding behavior; (2) group members tend to believe that their individual contributions will make no perceptible difference to the group as whole; and (3) the relative share of the public good each member receives becomes too small to elicit public-good contributions from group members (Albanese & Van Fleet, 1985).2 As group size increases, it is more difficult for members to communicate with each other, coordinate activities, and monitor free-riding behaviors. In other words, individual members face higher uncertainty and higher risks of negative group processes such as free-riding behaviors and coalition formation when forming a larger group. Given the inevitable uncertainties associated with larger groups, individual members become more exclusive in partner selections. Individual members may favor similar partners in order to minimize uncertainty, ensure efficient and frequent communications, and enhance social integration (O’Reilly et al., 1989). The desire to minimize uncertainty may derive from the belief that choosing demographically similar others can facilitate socialization attempts (Kanter, 1977; O’Reilly et al., 1989). As Kanter noted in a discussion of general management promotion criteria: “One way to ensure acceptance and ease of communication was to limit managerial jobs to those who are socially homogeneous. Social certainty could compensate for some of the other sources of uncertainty in the tasks of management” (1977: 58). In the context of multi-partner alliances, we propose that the relative importance of prior social relationships and preference for homophily is contingent upon the overall size of an 2 One might argue that a larger group may have more resources and skills, which lead to better problem-solving capabilities and group performance (Gibb, 1951; Taylor & Faust, 1952). While additional members may increase the resources and skills of a group and enable it to solve a variety of problems more effectively, there comes a point after which the addition of new members brings diminishing returns (Hare, 1952). Empirical evidence suggests a 16 alliance. As the expected size of an alliance increases, uncertainty increases, and the need for trust and familiarity becomes more important. In this study, we focus on focal firms’ anticipated size of multi-partner alliances. In other words, we assume that when focal firms choose one group of partners over others to form alliance constellations, they already anticipate the number of participants in those alliances. Their anticipations of alliance size will moderate the factors by which they select their alliance partners. In the next sections, we discuss such moderating effects on social ties and relational heterogeneity. Direct ties indicate the number of previous collaborations that a focal firm has established with a group of other partners in a multi-partner alliance. The higher the number of direct ties, the higher the level of trust, cohesion, and solidarity between the focal firm and its other partners in an alliance constellation. Group size, as argued earlier, is negatively related to group cohesion, consensus, and member satisfaction (House & Miner, 1969). Group members are also more likely to free-ride as group size increases (Albanese & Van Fleet, 1985). As the number of participants in an alliance constellation increases, uncertainty and risks of negative group processes go up. The increased information and trust between focal firms and their partners due to prior direct ties may help alleviate some of the uncertainties and risks associated with large group size. Therefore, focal firms rely more on direct ties in their choice of one group of partners over others as the alliance size increases. This suggests: H4: As the anticipated size of an ISM increases, a focal firm’s reliance on its prior direct ties to choose a group of partners increases. Indirect ties reflect the structure of relations around firms (Granovetter, 1992). The existence of an indirect tie between two firms indicates that these two firms have had a common point of diminishing returns as group size increases, as the extra resources are obtained at the price of decreasing 17 third-party partner in the past. A focal firm can access valuable information about the capability and reputation of its potential partner, when the two firms share common third-party ties. In the case of multi-partner alliances, a focal firm will be likely to choose a group of partners with whom it shares more common third-party ties. However, direct ties and indirect ties might function differently in terms of information flow, timeliness, and level of trust (Burt, 1992). Information obtained through common third-party ties is not as fine-grained as information obtained through direct ties. A focal firm would not trust its indirect ties as much as it trusts its immediate partners. As alliance size increases, uncertainty increases and there is a higher need for trust and solidarity. When there are potentially more firms likely to form a multi-partner alliance, it will become more difficult for the focal firm to monitor the behaviors of its other partners and trust that its indirect ties will not behave opportunistically. Therefore, a focal firm relies less on indirect ties in its choice of a group of partners as alliance size increases. This suggests: H5: As the anticipated size of an ISM increases, a focal firm’s reliance on its prior indirect ties to choose a group of partners decreases. Based on social categorization theory, the similarity/attraction paradigm, and the homophily principal, individuals are more likely to construct homogeneous groups of similar others to maintain self-esteem and identity, and to reduce conflicts and communication problems. How alliance participants might define themselves as similar to or different from other alliance partners will affect the overall communication, integration, and cohesion of the alliances. One might also argue that diverse skills and resources are critical for the survival and success of multi-partner alliances. A focal firm is also motivated to choose partners that are group cohesion and satisfaction, and increased difficulty to reach consensus (House & Miner, 1969). 18 different from itself to gain access to complementary skills and resources. However, the need for diverse information and skills is typically satisfied by having one or two partners that are different from the focal firm. Afterwards, diversity creates diminishing value to added information. In other words, while diversity in general increases information availability, some initial diversity has more value than subsequent increments (Williams & O’Reilly, 1998). Therefore, as group size increases, uncertainty increases, and the need for coordination, cohesion, and control outweighs the need for diverse skills and information. When the number of participants of an alliance increases, uncertainty increases, and a focal firm’s preference for homophily might increase as well. When an ISM has fewer participants, uncertainty is lower and opportunistic behavior would be relatively easier to discern and prevent. In this situation, a heterogeneous composition of an ISM may be more attractive and tolerable to a focal firm as a diverse group of partners can bring in complementary resources and skills, as well as enhance creativity (Bantel & Jackson, 1989). However, as the size of an ISM increases, uncertainty increases, and it would be more difficult for its participants to reach consensus and prevent free-riding. In this situation, a homogenous group may reduce uncertainty and alleviate free-riding, as similar partners are more likely to communicate and cooperate with each other (Williams & O’Reilly, 1998). Combining the above arguments, we would expect a negative interaction effect between group size and relational heterogeneity on a focal firm’s choice of alliance partners. As an ISM has more participants, uncertainty increases, firms become more exclusive by choosing a homogeneous group of partners. We thus suggest: H6: As the anticipated size of an ISM increases, a focal firm’s preference for homophily in choosing a group of partners increases. 19 METHODS Sample and Data We test our hypotheses in a sample of 19 U.S.-based ISMs established in the year 2000. To get a full list of ISMs in the chosen time period, we managed to identify several important sources in e-businesses activities, including Jupiter Research, Lexis-Nexis, www.nmm.com, and www.platts.com. We collected detailed information about each ISM by examining both the popular press and ISM websites. Because the objective of this study is to explore a focal firm’s choice of one group of partners over others in founding an ISM, we focused only on those industries with multiple ISMs. Four industries are chosen as they have at least three ISMs which were established in the year 2000: aerospace, energy, metal, and chemical. We defined founding members as industry incumbents that make equity investment in ISMs. We included only firms that have founded at least one ISM in its focal industry. As a result, we get 19 ISMs with a total of 189 firms from 4 different industries. We identified alliances that each founding member had formed between 1995 and 1999 (one year prior to the formation of ISMs) from SDC Platinum Database. We compiled information on the input and output relationships of the sampled firms using 1997 Standard Make and Use Tables from the Bureau of Economic Analysis at www.bea.gov. Financial data are collected from Standard & Poor’s COMPUTSTAT Database. Dependent variable. The study examines the factors that affect a focal firm’s choice of partners in founding a multi-partner alliance (i.e., ISM). Our dependent variable (“Joint founding”) is an indicator of the formation of an ISM by a focal firm and a group of other firms in a particular industry. Since the unit of analysis is the firm-ISM relationship, we create a record for each firm and each ISM within the industry where the focal firm is located. Hence, the 20 dependent variable “Joint Founding” is coded as “1” if a focal firm chooses to jointly found a specific ISM with a group of other firms in that industry and “0” otherwise. Independent variables. Direct ties are measured at the firm-ISM level and calculated as the total number of alliances that a firm has formed with all other founding members in an ISM between 1995 and 1999. Here we use a five-year window when counting the number of direct ties (Gulati, 1999) because previous research suggests that the normal life span for most alliances is usually no more than five years (Kogut, 1988). For example, United Technologies collaborated with three other companies to co-found MyAircraft (i.e., one of the ISMs in the Aerospace industry) in the year 2000. If United Technologies had previously formed four alliances directly with each of its three partners of MyAircraft over the five-year period from 1995 to 1999, then the number of direct ties between United Technologies and MyAircraft would be 4+4+4 = 12. Indirect ties indicate the extent to which a focal firm and other ISM founding members share common third-party partners. Due to the weakening or decay in tie strength between firms that are connected by increasingly large path distance, we count only two-step-distant ties (i.e., firms that are linked to the focal firm through only one intermediary firm when using the shortest path between the two firms) (Ahuja, 2000). For each firm-ISM record, we compute the number of other firms in each ISM that the focal firm was tied to at path distance of two from 1995 to 1999, which thus excludes direct ties. To take into account industry effects, we divide the measures of direct ties and indirect ties by the average number of direct ties and indirect ties of the sampled firms for each industry. Relational heterogeneity captures the extent to which an individual firm perceives itself as different from all other partner firms of an ISM. As used by O’Reilly et al., (1989), we measure relational heterogeneity by a variant of the Euclidean distance based upon firm sales: 21 n Heterogeneityik [ j 1 (S i S j ) 2 n ] 1 2 where Si indicates the annual sales of firm i, Sj is the annual sales of firm j in ISM k which contains n founding members. There are two main reasons why we choose to measure relational heterogeneity based on firm sales, which is typically a proxy for firm size. First, we focus on firm size because it is a visible, salient characteristic for every firm in an industry. Individuals or firms tend to define themselves as similar or different from their group members based on salient characteristics (Byrne, 1971; Tajfel, 1981; Turner, 1987; Williams & O’Reilly, 1998). One of the most salient features that firms know about their peers in a focal industry is how big their peers are and how much sales they might bring in.3 Second, firm size is a good indicator of resources. Large firms tend to have more resources and more money to invest in the multi-partner alliances. One of the main reasons that firms found ISMs is to pool resources and reduce transaction costs. As building an ISM is extremely expensive and highly risky, most ISMs are founded by large industry incumbents (Temkin et al., 2001). Given the specific context of this study, how a focal firm defines itself as different from a group of potential partners in firm size is one of the most relevant factors influencing the focal firm’s decision to form an ISM with that group. Moderating variable. We use the interaction approach (Van de Ven & Drazin, 1985) to test the contingency effect of anticipated number of founding firms within each ISM. We use actual ISM group size as a proxy for anticipated group size of an ISM. Specifically, we multiply anticipated group size with direct ties, indirect ties, and relational heterogeneity, and use the product terms as the interaction variables. 3 While we measure relational heterogeneity based on firm size in this study, future research can study other salient firm characteristics, such as firm age, location, and country of origin. 22 Control variables. Interdependence refers to the extent that a focal firm relies on other founding members in terms of input and output purchase. While the primary focus of this study is the role of network ties and relational heterogeneity in firms’ choice of partners, there may also be significant resource considerations that would explain the partner selections in multi-partner alliances. Previous studies suggest that an organization might collaborate with others to gain access to complementary assets and make up for its own resource deficiency (e.g. Barringer & Harrison, 2000; Pfeffer & Salancik, 1978). We use a variant of Caves and Bradburd’s (1982) cost importance measure to operationalize Interdependence. The following formula measures the interdependence of firm i on ISM j: n n m 1 m 1 Interdependenceij Wkm Dkm where k is the primary six-digit NAICS (North American Industry Classification System) code for firm i; m is the 6-digit NAICS code in ISM j; n is the total number of unique six-digit NAICS codes in ISM j; Wkm is the input percentage of industry k from industry m; and Dkm is the output percentage of industry k to industry m. We also control for the effects of firm sales and firm alliances. Firm sales are measured as a focal firm’s annual sales at time (t-1). Firm alliances are calculated as the total number of alliances that a focal firm has formed with any firms between 1995 and 1999. Similarly, we control ISM sales, which are measured by the total sales of all founding firms of each ISM at time (t-1). We also control ISM alliances, which are measured by the total number of alliances of all founding firms of each ISM between 1995 and 1999. To take the industry effect into consideration, we divide all the above control variables by the industry means of the sampled 23 firms. Finally we create three industry dummy variables for the aerospace, chemical, and energy industries, using the metal industry as the reference industry. Table 1 reports the descriptive statistics and correlations for the variables used in this study.4 Insert Table 1 about here Analysis We chose random-effects logit models to test H1 through H6. Specifically, we used random-effects regression models (Judge, Griffith, Hill, Lutkepohl, & Lee, 1982; Sayrs, 1989) to examine the factors that affect a focal firm’s choice of partners in founding an ISM. We used the firm-ISM relationships in each industry as the unit of analysis. Each firm can choose from four to five ISMs in its focal industry. A record was created for each firm-ISM combination in the industry where the focal firm is located. In our final dataset, there were 793 firm-ISM relationships. Since there are repeated observations for the same firm, unobserved heterogeneity would be a potential problem. Unobserved heterogeneity might occur because each firm contributes to multiple observations over different ISMs that might not be independent of each other. Unobserved heterogeneity can be ruled out if the model is completely specified, but such full specification is typically unattainable (Petersen & Koput, 1991). Fixed-effects models and random-effects models address the problem of unobserved heterogeneity by inserting an error 4 For the three interaction variables, the correlations between the component terms and the interaction terms were high. To address the potential problem of multicollinearity, we rerun the analysis after centering all component variables on their means prior to constructing the interaction terms (Ahuja 2000; Cronbach, 1987; Jacquard, Turrisi, & Wan 1990). This transformation significantly reduced the correlation between the component terms and the interaction terms in all cases. For the transformed (mean-deviated) variables the correlations between the component terms and the interaction terms were .50 and -.04 (versus .96 and .20 earlier) for anticipated group size x direct ties; .88 and .003 (versus .99 and .17 earlier) for anticipated group size x indirect ties; and -.07 and .08 (versus .77 and .58 earlier) for anticipated group size x relational heterogeneity. Based on the transformed variables, we calculated the conditional number of the variance-covariance matrix to test overall stability of the regression coefficients (Belsley, Kuh, & Welsch, 1980: 100-107). Belsley et al. (1980) suggest that a conditional number of below 10 would indicate no multicollinearity problem while a conditional number of above 30 indicates that there might be a 24 term that is either assumed to be a constant over different ISMs for each firm (fixed-effect models) or to vary randomly over different ISMs for each firm (random-effects models). Maddala (1987) notes that the choice of regression model depends upon the statistical properties of the implied estimators. When the number of cross-section (i.e., number of firms) is large and the number of observations (i.e., number of ISMs in a particular industry) per firm is small, it is not possible to consistently estimate a fixed-effects model. We used maximumlikelihood, random-effects logit models with M-point Gaussian quadrature (Butler & Moffitt, 1982; Conway, 1990) to test H1 to H6, since the dependent variable in those models were dichotomous (we also found similar results using random-effects probit models). Random-effects models were computed using STATA 8. RESULTS Table 2 reports the results of random-effects logit models on our sampled data to test Hypotheses 1 to 6. Model 1 includes all control variables as the baseline model; Model 2 adds the direct ties variable; Model 3 adds the indirect ties variable; Model 4 adds the relational heterogeneity variable; Model 5 add the interaction between anticipated group size and direct ties; Model 6 adds the interaction between anticipated group size and indirect ties; and Model 7 adds the interaction between anticipated group size and relational heterogeneity. The amount of incremental variance explained by the newly added variables in each model represented the unique contribution of each new set of variables over the variables already in the regression (Darlington, 1968; Weaver, Trevino, and Cochran, 1999). We calculate and then check the significance of the incremental change in Chi-sq. model fit from Model 1 to Model 7 of Table 2. problem. We found that the conditional index is 3.15, which is below the critical limit of 10, indicating that there is no multicollinearity problem. 25 Insert Table 2 about here The results of the random-effects logit models produce considerable support for the hypotheses. Hypothesis 1 proposes that prior direct ties have a positive effect on firms’ choice of partners in founding an ISM. In Model 2 of Table 2, the variable “Direct ties” is positive and significant, showing strong support for Hypothesis 1. Thus, a focal firm is more likely to choose those partners with whom they share more prior direct ties in jointly founding an ISM. In Hypothesis 2, we suggest a positive relationship between prior indirect ties and firms’ choice of partners in founding an ISM. In Model 3 of Table 2, the coefficient of “Indirect ties” is positive, which is consistent with the direction predicted by Hypothesis 2. However, the coefficient is not significant. The result indicates that given the presence of direct ties, indirect ties have no additional explanatory power in predicting a focal firm’s choice of partners in founding an ISM. Therefore, Hypothesis 2 is not supported. In Hypothesis 3, we propose that a focal firm is less likely to choose those partners that are different from itself in founding an ISM. This suggests a negative relationship between relational heterogeneity and the likelihood of jointly founding an ISM. In Model 4, the coefficient of “Relational heterogeneity” is negative and significant, showing strong support for Hypothesis 3. The result indicates that a focal firm tends to choose those partners that are similar to itself to jointly found an ISM. To test the contingency effects of anticipated group size, we entered the interaction terms in Model 5 to Model 7. In Hypothesis 4, we predict that anticipated group size should have a positive moderating effect on the relationship between prior direct ties and the likelihood of jointly founding an ISM. To test Hypothesis 4, we include the interaction term between 26 anticipated group size and prior direct ties in Model 5. The coefficient of the interaction term was positive but not significant. Therefore, Hypothesis 4 is not supported. In Hypothesis 5, we propose a negative moderating effect of anticipated group size on the relationship between prior indirect ties and the likelihood of jointly founding an ISM. To test Hypothesis 5, we include the interaction term between anticipated group size and prior indirect ties in Model 6. The coefficient of the interaction term was negative and significant, as predicted by Hypothesis 5. To plot the interaction effect, we constrained the variables in Model 6 to means except indirect ties and group size. Indirect ties and group size took the values of one standard deviation below (a low level) and above (a high level) the mean5. The plot is shown in Figure 1. Consistent with Hypothesis 5, Figure 1 illustrates clearly the interaction effect of anticipated group size and indirect ties. Suppose that a small ISM has six founding members (i.e., one standard deviation below the mean level of group size). If a focal firm shares one indirect tie (i.e., mean level of indirect ties) with members in that ISM, the probability that it will choose that group is .19. The probability increases to .42 when the number of indirect ties it shares with the group increases from one to six (i.e., one standard deviation above the mean level of indirect ties). On the other hand, in a large ISM with 16 founding members (i.e., one standard deviation above the mean level of group size), there is only a small increase in the likelihood of a focal firm to choose to co-found the ISM (from .29 to .33) when the number of indirect ties it shares with the group increases from one to six. The findings suggest that when the anticipated size of an ISM is small, a focal firm is more likely to choose a group of partners with whom it shares more indirect ties to co-found an ISM. However, as the anticipated group size increases, the effect of indirect ties is diminishing. 27 Insert Figure 1 about here In Hypothesis 6, we propose that anticipated group size would negatively moderate the relationship between relational heterogeneity and the likelihood of jointly founding an ISM. This hypothesis is tested in Model 7, which adds the interaction term between anticipated group size and relational heterogeneity. The coefficient of the interaction term is negative and significant, showing strong support for Hypothesis 6. Figure 2 illustrates the interaction effect of anticipated group size and relational heterogeneity. When the anticipated size of an ISM is small, how a focal firm defines itself as different from other potential partners is less important in the focal firm’s choice of partners. However, as the anticipated size of an ISM increases, the effect of relational heterogeneity become more pronounced. For instance, in a small ISM with six founding members, there is a small decrease in the probability of a focal firm to co-found the ISM (from .23 to .15) when the relational heterogeneity score increases from .27 (i.e., one standard deviation below the mean level of heterogeneity) to 1.73 (i.e., one standard deviation above the mean level of heterogeneity). However, in a large ISM with 16 founding members, there is a dramatic decrease of the probability of a focal firm to co-found the ISM (from .43 to .16) when the relational heterogeneity score increases from .27 to 1.73. The findings indicate that a focal firm is more likely to collaborate with a group of partners that are similar to itself as the anticipated group size increases. Insert Figure 2 about here 5 For indirect ties, one standard deviation below the mean is lower than the minimum value of indirect ties (i.e., 0). Therefore, we choose to use the minimum value of indirect ties as a low level when plotting interaction effects. 28 DISCUSSIONS AND CONCLUSIONS The study applies social network theory, group dynamics theory, and a group approach to study the choice of partners in the formation of multi-partner alliances. The study examines to what extent direct ties, indirect ties, relational heterogeneity, and their interactions with alliance size influence a focal firm’s choice of one group of partners over others in forming multi-partner alliances. Based on 19 ISMs in four industries established by a total of 189 firms, we find significant support for our hypotheses, that focal firms have a strong preference for prior direct ties and homophily in partner selections in forming multi-partner alliances. The study also finds that as the anticipated number of participants of alliances increases, focal firms rely less on indirect ties, yet have a stronger preference for homophily in their choice of partners. The study contributes to our understanding of multi-partner alliances. Based on social network theory, group dynamics literature, and a group approach, the study uncovers important distinctions of partner selections in the formation of multi-partner alliances. Social network ties, for instance, play different roles in partner selections in multi-partner alliances as compared to dyadic alliances. While previous research on dyadic alliance tends to suggest that both direct and indirect ties are significant predictors of alliance formation (Gulati & Gargiulo, 1999), indirect ties are no longer significant when direct ties are controlled for in multi-partner alliances. As focal firms gained first hand knowledge about the reliability and capability of their immediate partners, they would trust their direct ties more than indirect ties. This might explain why this study found a strong effect of direct ties and no significant effect of indirect ties on the formation of multi-partner alliances. Meanwhile, the study also finds that while direct ties remain an important factor regardless of alliance size, alliance size mitigates the effect of indirect ties in partner selections. 29 Firms tend to rely more on their indirect ties to choose alliance partners when the alliances are small. As the size of the alliances increases, however, the importance of indirect ties is diminishing. Previous research on dyadic alliances found that indirect ties are important predictors of alliance formation (Gulati & Gargiulo, 1999). Dyadic alliances are the smallest possible alliances in terms of number of participants. The finding that focal firms rely more on indirect ties when there are fewer number of alliance participants is consistent with previous findings on dyadic alliances. More important, the study extends the findings of previous alliance research and suggests that as the number of participants in an alliance increases, the role of indirect ties is diminishing. This study introduces group dynamics literature to study both the direct and interaction effects of group attributes on partner selections in multi-partner alliances. Further, relational heterogeneity or how a focal firm defines itself as different from a group of partners determines the likelihood that the focal firm will form a multi-partner alliance with that group. Focal firms are more likely to choose a group of partners that are similar to themselves to jointly form multipartner alliances. Further, as alliance size increases, firms become more exclusive in partner selections and have stronger preferences to join a group of partners that are similar to themselves. The findings suggest that other than social relationship factors such as prior ties, group dynamics are also important in partner selections in multi-partner alliances. The study contributes to alliance research not only by applying group dynamics theory, but also by adopting a group approach to study multi-partner alliances. Rather than examining the relationship of each pair of firms, the study examines the entire multi-partner alliance as a group and explores what factors might influence a focal firm’s decision to jointly form that group. We adopt a group approach to study multi-partner alliances as there are important 30 variables that can only be uncovered at the group level. For example, group size, a key indicator of uncertainty, is neglected by a dyadic level of analysis. Uncertainty increases with group size and firms become more exclusive in their partner selections. In this study, we found that the overall size of the alliance enhanced the effect of homophily and mitigated the effect of indirect ties on alliance formation. Social network theory, group dynamics theory, and a group approach help us uncover important distinctions of partner selections in multi-partner alliances, as well as provide new directions for future alliance research. The findings of this paper have strategic implications for managers involved in interorganizational collaborations. The fundamental underlying question seems to be, what are the more important criteria for firms to choose collaborative partners? On the one hand, firms could be exclusive and rely on their previous exchange partners (i.e., direct ties) and those partners that are similar to themselves (i.e., homophily). Meanwhile, firms could also extend beyond their immediate ties and rely on the information acquired through common third-party ties (i.e., indirect ties) or through partners that are different from the focal firms (i.e., relational heterogeneity). In other words, there are two general principals according to which firms choose their alliance partners: trust and homophily vs. efficiency and diversity. While both principals are important, the need for trust and homophily may contradict the need for efficiency and diversity. The finding of focal firms’ reliance on prior exchange partners and the attention to homophily in this study indicates the importance of trust and exclusivity in the formation of multi-partner alliances. More important, one of the main objectives of this study is to offer insights into the relationship between uncertainty and exclusivity in multi-party exchanges. This study examines the important question of how uncertainty leads to exclusivity in partner selections in the formation of multi-partner alliance. The findings highlight the relationship between uncertainty 31 and exclusivity (Podolny, 1994), that as the anticipated size of the alliances increases, uncertainty increases, and firms subsequently become more exclusive in their partner selection process. As the number of participants of alliances increases, firms rely less on their indirect ties, yet have a stronger preference for a group of similar others in partner selections. One limitation of this study is that we focus on four industries where ISMs are most prevalent. Due to the nature of the research setting, it is only feasible to focus on industries with multiple ISMs. Caution is required when generalizing these results to other industries and contexts. Future research incorporating larger number of industries would provide more insights in partner selections in forming multi-partner alliances. While our study focuses on the formation of multi-partner alliances, we hope that our study will stimulate future research to consider theoretically and empirically the evolution and performance of multi-partner alliances. For instance, how do multi-partner alliances evolve over time in terms of their network relationships and overall group heterogeneity? As partners choose to stay or leave the multi-partner alliances over time, it would be interesting to examine if the network relationships among partners become more expansive and nonredundant or more exclusive and enclosed. It would also be important to study the stability and performance implications of different evolution processes of multi-partner alliances. 32 REFERENCES Ahuja, G. 2000. Collaboration networks, structural holes, and innovation: A longitudinal study. Administrative Science Quarterly, 45: 425-455. Albanese, R., & Van Fleet, D.D. 1985. Rational behavior in groups: The free-riding tendency. Academy of Management Review, 10: 244-255. Alexander, J., Nuchols, B., Bloom, J., & Lee, S. 1995. Organizational demography and turnover: An examination of multiform and nonlinear heterogeneity. Human Relations, 48: 1455-1480. Bantel, K., & Jackson, S. 1989. Top management and innovations in banking: Does the composition of the team make a difference? Strategic Management Journal, 10: 107-124. Barnett, W.P., Mischke, G.A., & Ocasio, W. 2000. The evolution of collective strategies among organizations. Organization Studies, 21: 325-354. Barringer, B.R., & Harrison, J.S. 2000. Walking a tightrope: Creating value through interorganizational relationships. Journal of Management, 26: 367-403. Belsley, D., Kuh, E., & Welsch, R. 1980. Regression Diagnostics: Identifying Influential Data and Sources of Collinerity. New York: John Wiley and Sons. Berscheid, E., & Walster, H. 1978. Interpersonal attraction. Reading, MA: Addison-Wesley. Blau, P. 1977. Inequality and heterogeneity. New York: Free Press. Browning, L., Janice, M.B., & Shetler, J.C. 1995. Building cooperation in a competitive industry: Sematech and the semiconductor industry. Academy of Management Journal, 38: 113-151. Burt, R.S. 1992. Structural holes: The social structure of competition. Harvard University Press: Cambridge MA. Butler, J. S., & Moffitt, R. 1982. A computationally efficient quadrature procedures for the one- 33 factor multinomial probit model. Econometrica, 50:761-764. Byrne, D. 1971. The attraction paradigm. New York: Academic Press. Caves, R.E., & Bradburd, R.M. 1988. The empirical determinants of vertical integration. Journal of Economic Behavior and Organization, 9: 265-279. Chatman, J., Polzer, J., Barsade, S., & Neale, M. 1998. Being different yet feeling similar: The influence of demographic composition and organizational culture on work processes and outcomes. Administrative Science Quarterly, 43: 749-780. Conway, M.R. 1990. A random effects model for binary data. Biometrics, 46: 317-328. Crocker, J., & Major, B. 1989. Social stigma and self-esteem: The self-protective properties of stigma. Psychological Review, 96: 608-630. Cronbach, L. 1987. Statistical tests for moderator variables: Flaws in analyses recently proposed. Psychological Bulletin 102: 414-417. Darlington, R.B. 1968. Multiple regression in psychological research and practice. Psychological Bulletin, 69:161-82. Das, T.K., & Teng, B.S. 2002. Alliance constellations: A social exchange perspective. Academy of Management Review, 27: 445-456. Dialdin, D., & Gulati, R. 2004. Multi-firm strategic alliance formation: Configural and geometric perspectives. Paper presented at the annual meeting of the Academy of Management, New Orleans. Doz, Y.L., & Hamel, G. 1998. Alliance advantage: The art of creating value through partnering. Boston: Harvard Business School Press. Ekeh, P.P. 1974. Social exchange theory: Two traditions. Princeton, NJ: Princeton University Press. 34 Gibb, J.R. 1951. The effects of group size and of threat reduction upon creativity in a problemsolving situation. American Psychologist 6: 324. Gomes-Casseres, B. 1996. The alliance revolution: The new shape of business rivalry. Cambridge, MA: Harvard University Press. Granovetter, M. 1992. Problems of explanation in economic ecology. In N. Nohria & R. Eccles (Ed.), Networks and organizations: Structure, form, and action: 25-56. Boston: Harvard Business School Press. Gulati, R. 1995. Does familiarity breed trust? The implications of repeated ties on contractual choices in alliances. Academy Management Journal, 38: 85-111. Gulati, R., & Singh, H. 1998. The architecture of cooperation: Managing coordination costs and appropriation concerns in strategic alliances. Administrative Science Quarterly, 43: 781-814. Gulati, R. 1998. Alliances and networks. Strategic Management Journal, 19: 293-317. Gulati, R., & Gargiulo, M. 1999. Where do interorganizational networks come from? American Journal of Sociology, 104: 1439-1493. Gulati, R. 1999. Network location and learning: The influence of network resources and firm capabilities on alliance formation. Strategic Management Journal, 20: 397-420. Hare, A.P. 1952. A study of interaction and consensus in different sized groups. American Sociological Review 17: 261-267. House, R.J., & Miner, J.B. 1969. Merging management and behavioral theory: The interaction between span of control and group size. Administrative Science Quarterly, 14: 451-464. Jacquard, J., Turrisi, R., & Wan, C.K.1990. Interaction effects in multiple regression. Newbury Park, CA: Sage. Judge, G.G., Griffiths, W.E., Hill, R.C., Lutkepohl, H., & Lee, T.C. 1985. The theory and 35 practice of econometrics. New York: John Wiley and Sons. Kanter, R. 1977. Some effects of proportions on group life: Skewed sex ratios and responses to token women. American Journal of Sociology, 82: 965-990. Kogut, B. 1988. Joint ventures: Theoretical and empirical perspectives. Strategic Management Journal, 9: 319-332. Maddala, G.S. 1987. Limited dependent variable models using panel data. Journal of Human Resources, 22: 305-338. Makino, S., & Beamish, P.W. 1999. Characteristics and performance of international joint ventures with non-conventional ownership structures. Journal of International Business Studies, 29: 797-818. Messick, D., & Massie, D. 1989. Intergroup relations. Annual Review of Psychology, 40: 45-81. Milliken, F.J., & Martins, L.L. 1996. Searching for common threads: Understanding the multiple effects of diversity in organizational groups. Academy of Management Review, 21: 402-433. Mizruchi, M.S. 1989. Similarity of political behavior among large American corporations. American Journal of Sociology, 95: 401-424. Olk, P., & Young, C. 1997. Why members stay in or leave an R&D consortium: Performance and conditions of membership as determinants of continuity. Strategic Management Journal, 18: 855-877. O'Reilly, C.A., Caldwell, D.F., & Barnett, W.P. 1989. Work group demography, social integration, and firm performance. Administrative Science Quarterly, 34:21-37. Petersen, T., & Koput, K.W. 1991. Density dependence in organization mortality: Legitimacy or unobserved heterogeneity? American Sociological Review 56: 399-409. 36 Pfeffer, J., & Salancik, G.R. 1978. The external control of organizations. New York: Harper & Row. Podolny, J.M. 1994. Market uncertainty and the social character of economic exchange. Administrative Science Quarterly, 39: 458-483. Sakakibara, M. 1997. Heterogeneity of firm capabilities and cooperative research and development: An empirical examination of motives. Strategic Management Journal, 18: 143164. Sayrs, L.W. 1989. Pooled time series analysis. Newbury Park: SAGE Publications Simon, H.A. 1957. Administrative behavior. New York: MacMillan. Tajfel, H. 1981. Human groups and social categories: Studies in social psychology. Cambridge, England: Cambridge University Press. Tajfel, H., & Turner, J. 1986. The social identity of intergroup behavior. In S. Worchel & W. Austin (Eds.), Psychology and intergroup relations: 7-24. Chicago: Nelson-Hall. Taylor, D.J., & Faust, W.L. 1952. Twenty questions: efficiency in problem-solving as a function of group size. Journal of Experimental Psychology, 44: 360-368. Temkin, B.D., Kafka, S., King, L.A., Freiden, S., & Hurd, L. 2001. The industry consortia lifeline. The Forrester Report. Forrester Research Inc. Thompson, J.D. 1967. Organizations in Action. New York: McGraw-Hill Triandis, H., Kurowski, L., & Gelfand, M. 1994. Workplace diversity. In H. Triandis, M. Dunnette, & L. Hough (Eds.), Handbook of industrial and organizational psychology, 4: 769827. Palo Alto, CA: Consulting Psychologists Press. Tsui, A., & O’Reilly, C. 1989. Beyond simple demographic effects: The importance of relational demography in superior-subordinate dyads. Academy of Management Journal, 32: 37 402-423. Tsui, A., Egan, T., & O’Reilly, C. 1992. Being different: Relational demography and organizational attachment. Administrative Science Quarterly, 37: 549-579. Turner, J. 1987. Rediscovering the social group: A social categorization theory. Oxford, UK: Blackwell. Ucbasaran, D., Lockett, A., Wright, M., & Westhead, P. 2003. Entrepreneurial founder teams: Factors associated with member entry and exit. Entrepreneurship Theory and Practice 28: 107127. Van de Ven, A.H., & Drazin, R. 1985. The concept of fit in contingency theory. In L.L. Cummings & B.M. Staw (Eds.), Research in Organizational Behavior: 333-365. Greenwich, CT: JAI Press Inc. Weaver, G.R., Trevino, L.K., & Cochran, P.L. 1999. Corporate ethics programs as control systems: Influences of executive commitment and environmental factors. Academy of Management Journal, 42: 41-57. Williams, K.Y., & O’Reilly, C.A. 1998. Demography and diversity in organizations: A review of 40 years of research. Research in Organizational Behavior, 20: 77-140. Williamson, O.E. 1975. Markets and hierarchies. New York, NY: Free Press. Williamson, O.E. 1985. Economic Institutions of Capitalism. New York, NY: Free Press. Zeng, M., &Chen, X.P. 2003. Achieving cooperation in multiparty alliances: A social dilemma approach to partnership management. Academy of Management Review 28: 587-605. 38 TABLE 1 Descriptive Statistics and Correlation Variable Mean s.d. 1 2 3 4 5 6 1.Joint founding 0.24 0.43 1.00 2.Direct ties 1.00 3.46 0.23* 1.00 3.Indirect ties 1.00 4.69 0.14* 0.11* 1.00 4.Relational heterogeneity 1.00 0.73 -0.03 0.06 0.06 1.00 5.Anticipated group size *Direct ties 6.Anticipated group size *Indirect ties 7.Anticipated group size *Heterogeneity 8.Anticipated group size 13.41 49.23 0.23* 0.96* 0.11* 0.06 1.00 14.19 71.12 0.13* 0.10* 0.99* 0.07 0.13* 1.00 11.28 10.48 0.04 0.12* 0.13* 0.77* 0.16* 0.16* 1.00 11.05 5.30 0.15* 0.13* 0.13* 0.06 0.20* 0.17* 0.58* 1.00 9.Interdependence 1.00 2.25 0.11* 0.15* 0.09* 0.14* 0.11* 0.08* 0.13* -0.02 1.00 10.Aerospace 0.16 0.37 0.01 0.00 0.00 0.00 -0.03 -0.02 -0.18* -0.25* 0.00 1.00 11.Energy 0.30 0.46 -0.01 0.00 0.00 0.00 -0.01 0.01 0.10* 0.19* 0.00 -0.28* 1.00 12.Chemical 0.33 0.47 0.03 0.00 0.00 0.00 0.02 0.01 0.22* 0.34* 0.00 -0.31* -0.45* 13.Firm sales 1.00 1.39 0.04 0.19* 0.08* 0.66* 0.19* 0.08* 0.53* -0.01 0.15* 0.00 0.00 0.00 1.00 14.Firm alliances 1.01 1.69 0.06 0.31* 0.26* 0.08* 0.31* 0.26* 0.05 -0.01 0.05 0.02 0.00 -0.01 0.26* 1.00 15.ISM sales 1.00 0.73 0.13* 0.19* 0.18* 0.32* 0.22* 0.20* 0.56* 0.62* 0.06 0.00 0.00 0.00 -0.04 -0.02 1.00 16.ISM alliances 1.00 0.81 0.13* 0.21* 0.17* 0.05 0.24* 0.18* 0.36* 0.59* -0.05 0.00 0.00 0.00 -0.01 -0.05 0.78* * p<.05 39 7 8 9 10 11 12 13 14 15 16 1.00 1.00 TABLE 2 Random-Effects Logistic Regression Results 1 Main effects Direct ties 2 3 4 5 6 7 0.14*** (0.04) 0.14*** (0.03) 0.06 (0.03) 0.13*** (0.03) 0.06 (0.04) -0.61* (0.25) 0.13*** (0.04) 0.06 (0.04) -0.61* (0.25) 0.13*** (0.04) 0.14* (0.06) -0.59* (0.25) 0.13*** (0.04) ? 0.07 (0.04) -0.64** (0.25) Indirect ties Relational heterogeneity Interaction effects Anticipated group size *Direct ties Anticipated group size *Indirect ties Anticipated group size *Heterogeneity Control variables Anticipated group size Interdependence Aerospace Energy Chemical Firm sales Firm alliances ISM sales ISM alliances Constant No. of observations Log Likelihood Chi-square (d.f.) Incremental chi-squarea 0.00 (0.01) -0.02* (0.01) -0.06* (0.03) ? ? ? 0.08** (0.03) 0.11*** (0.03) 0.23 (0.29) -0.25 (0.30) -0.19 (0.31) 0.01 (0.06) 0.08 (0.05) -0.17 (0.22) 0.23 (0.18) -1.38*** (0.35) 0.08** (0.03) 0.09* (0.04) 0.18 (0.30) -0.30 (0.31) -0.25 (0.32) -0.03 (0.07) -0.01 (0.06) -0.19 (0.22) 0.12 (0.19) -1.06** (0.36) 0.08** (0.03) 0.09* (0.04) 0.18 (0.30) -0.30 (0.31) -0.24 (0.32) -0.04 (0.07) -0.05 (0.06) -0.22 (0.22) 0.09 (0.19) -0.96** (0.37) 0.05 (0.03) 0.08* (0.04) 0.21 (0.30) -0.15 (0.32) -0.05 (0.33) ? 0.19 (0.12) -0.08 (0.06) 0.33 (0.31) -0.16 (0.21) -1.58*** (0.45) 0.05 (0.03) 0.08* (0.04) 0.20 (0.31) -0.15 (0.32) -0.05 (0.33) ? 0.19 (0.12) -0.08 (0.06) 0.33 (0.31) -0.16 (0.21) -1.58*** (0.45) 0.06 (0.03) 0.08* (0.04) 0.08 (0.31) -0.29 (0.33) -0.20 (0.34) ? 0.19 (0.12) -0.08 (0.06) 0.30 (0.31) -0.20 (0.21) -1.34** (0.46) 0.05 (0.03) 0.09* (0.04) 0.13 (0.31) -0.15 (0.32) 0.01 (0.33) ? 0.22 (0.12) -0.09 (0.06) 0.36 (0.31) -0.15 (0.21) -1.63*** (0.44) 793 -417.3 35.25(9) 793 -406.0 44.63(10 ) 9.38 793 -402.9 47.47(11 ) 2.84 793 -399.8 51.83(12 ) 4.36 793 -399.8 51.85(13 ) 0.02 793 -397.4 54.60(13 ) 2.77 793 -397.4 55.24(13 ) 3.41 *** p<.001 ** p<.01 * p<.05 † p<.10 (two-tailed tests for all variables) a- The incremental values of chi-square of Models 5, 6, and 7 are derived by comparing to Model 4. 40 FIGURE 1 Moderating Effect of Group Size on Indirect Ties 0.8 0.7 0.70 0.6 0.5 Probability of Jointly 0.4 Founding 0.42 0.3 0.33 0.37 0.29 0.28 0.2 Large Group Size Small Group Size 0.19 0.15 0.1 0 0 1 5.7 10.4 Indirect Ties FIGURE 2 Moderating Effect of Group Size on Relational Heterogeneity 0.5 0.47 0.45 0.43 Large Group Size Small Group Size 0.4 0.35 0.3 0.27 Probability of Jointly 0.25 Founding 0.23 0.2 0.23 0.19 0.15 0.16 0.15 0.13 0.1 0.08 0.05 0 0.11 0.27 1 Relational Heterogeneity 41 1.73 2.46