operational controls - The Irish League of Credit Unions

advertisement

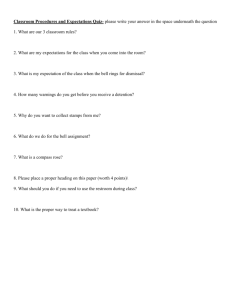

Irish League of Credit Unions €2 SAVE BY STAMP Ballyra Credit Union Limited CREDIT UNION INITIAL €€ ININITIAL SAVINGS STAMPS - €2 OPERATIONAL CONTROLS FOR 1 Irish League of Credit Unions SAVINGS STAMPS 2 Irish League of Credit Unions OPERATIONAL CONTROLS FOR SAVINGS STAMPS. CONTENTS PAGE Overview-Savings Stamps 3 Introduction of a Saving Stamps Scheme 4 Printing / Purchase of stamps and cards 5 Controls on printing of stamps 7 Issue of books of stamps to tellers 8 Sale of stamps 9 Cashing of stamps 12 Member’s Savings Stamps Cards 12 Supervisory Committee role 13 Accounting Procedures 13 Conclusion 14 3 Irish League of Credit Unions 1. OVERVIEW In recent years the sale of saving stamps is an additional facility offered by many credit unions to help their members accumulate savings. At the direction of the League Board the operation of saving stamps schemes has been reviewed and consideration given to the weaknesses that could exist. Attention has also been given to the internal controls that should be implemented in order to overcome these weaknesses. By their nature saving stamps schemes can be susceptible to fraud. This is due to the fact that they tend to be peripheral to the main business of the credit union. Consequently, they are not always subject to the same level of controls that govern the main activity of the credit union. There also tends to be a lack of awareness that stamps are effectively CASH. Stamp schemes require their own special system of control and checks. This booklet is published to create a greater awareness of the need for adequate controls on the operation of saving stamps schemes and to suggest suitable controls. It should be read in conjunction with the League published booklet “Internal Controls”. 4 Irish League of Credit Unions 2. INTRODUCTION OF A SAVING STAMPS SCHEME. The decision to introduce a saving stamps scheme should only be taken after careful consideration by the Board of the credit union in consultation with the Auditor and the Irish League of Credit Unions. Following these consultations a full programme of planning and internal control should be drawn up. Lack of proper planning or control in either the purchase, issue, cashing or recording of stamps, can lead to inherent weaknesses and possible financial loss to the credit union. Having agreed upon a suitable and adequate system of internal control the Board should ensure the following: a) It should have a written record of the controls to be installed and implemented. b) The persons responsible for operating these controls should be made aware of their responsibilities. c) Such persons should be given adequate training and instruction. It is imperative that the Board delegates overall responsibility for the operation and control of the saving stamps scheme to an individual. This individual could be the manager, treasurer or some other responsible person. 5 Irish League of Credit Unions 3. PRINTING / PURCHASE OF STAMPS AND CARDS. A specific authorisation for the purchase or printing of books of stamps and stamp cards in the prescribed layout should be made by the Board or duly authorised officer. Some control features to be included would be: a) Pre-numbering of stamp books on outside book cover. Fig. 1 b) Pre-numbering of each sheet of stamps on perforated spine in stamp book. c) Printed stamp control record on the stamp book inside or outside covers. CONTROL RECORD OPENING VALUE OF STAMPS IN BOOK VALUE OF STAMPS SOLD CLOSING VALUE OF STAMPS IN BOOK INITIALS Book Number DATE STAMP Numbered Saving Stamps Book with Stamp Control Record on Cover. FIG. 1. 6 Irish League of Credit Unions On delivery of the order from the printer the Manager/Treasurer/Officer responsible should physically inspect and count the stamp books. Having satisfied himself/herself as to the quantities received he/she should then record the quantity in the Stamp Book Stock Control Record. (Fig. 2). The books of stamps should then be secured by the responsible officer in the safe. Because these books of stamps represent money access to them should be restricted at all times to the responsible officer or person authorised by him/her. All the above controls should be applied in any subsequent printing or purchase of stamps. Date Stock of Books on Hand Books Received Books Issued Closing Stock of Books Reference No. of Books Issued Initials Books Book(s) Received By. Issued By Checked By FIG. 2 Stamp Book Stock Control Record This record may be maintained on a printed form or preferably in a bound analysis book (such as Collins Cathedral Analysis) with the above headings written in. 7 Irish League of Credit Unions 4. CONTROLS ON PRINTING OF STAMPS. Artwork for stamps, ideally, should be prepared by a person other than the printer and retained in a secure location when printing is completed. Each book of stamps should be bound by heavy duty staples with the pre-numbered perforated spine remaining in the book after issue of each page of stamps. A responsible person from the credit union should be delegated to oversee the printing of the stamps. This person should recover the artwork/printing plates for return to the credit union office. He/She should remove any spoiled sheets of printed stamps and destroy them by shredding or burning. Sheets of printed adhesive stamps (10 stamps or multiples of 10 per sheet) should be bound in numbered page sequence on the spine (50 sheets per book), with the cover of each book numbered and books parcelled in lots of (five) books each. Book numbers and stamp values should be marked clearly on each parcel for ease of subsequent counting and balancing. Stamp design should include the name of the credit union, the credit union logo, and the value of the stamp. Good quality paper should be used and the use of two colours of ink considered to reduce the risk of counterfeiting. If it is intended to sell stamps of different values separate colours should be used for printing each value and members’ stamp cards should be colour coded accordingly so that only stamps of the same value are affixed to a card. 8 Irish League of Credit Unions 5. ISSUE OF BOOKS OF STAMPS TO TELLERS. Stamps should only be issued to tellers by an authorised person who is not a teller responsible for their sale. Full details of the issue should be recorded in the Stamp Book Stock Control Record (Fig 2) as follows: a) Date of issue b) Number of book(s) issued c) Closing stock of books d) Book(s) reference number e) Initials of person receiving f) initials of persons issuing. Books should always be issued in number sequence. The Stamp Book Stock Control Record should be safely stored at all times. 9 Irish League of Credit Unions 6. SALE OF STAMPS. There are two possible credit union office situations that ought to be considered: A. Where there are a limited number of regular tellers. B. Where there are a large number of different tellers operating on a weekly or monthly rota. Situation A: Full books of stamps are issued directly to the individual tellers and they are responsible for the book of stamps in their possession. The controls which would be appropriate in these circumstances are as follows: 1. In the Daily Cash Sheet the teller would record the proceeds from stamp sales for that day. (Fig. 3). 2. This amount should agree with the value of stamps issued from the book of stamps. 3. Details of the stamps sold would be recorded on the Stamp Control Record on the stamp book cover. 4. The details of the Stamp Control Record should be agreed to the Daily Cash Sheet by the cashier as part of the daily cash controls. 5. The cashier should initial the Stamp Control Record on the stamp book daily as evidence of this check. 6. Just as the cash float for the teller is locked away at the close of business so also should the stamp book be locked away. OPENING STAMPS ON HAND STAMPS RECEIVED CLOSING STAMPS ON HAND STAMPS SOLD STAMPS CASHED € € € € € NET STAMPS RECEIPTS/ CASHING € INITIAL FIG. 3 Daily Cash Sheet. 10 Irish League of Credit Unions Situation B: Where a large number of different tellers operate the stamp system it is essential that there is still full accountability by individuals for stamps issued to them and sold by them. In order to achieve this level of accountability it is necessary to introduce a further record of Stamps Issued to Tellers Record. (Fig. 4). 1. One individual should be deemed responsible for the issuing of stamps to these tellers. 2. A book of stamps would be issued to this individual on the same basis as Situation A. 3. This individual would then issue stamps from this book to the tellers. DATE TELLER TO WHOM STAMPS ARE ISSUED OPENING VALUE BOOKS OF STAMPS RECEIVED € € BOOK REFERENCE STAMPS ISSUED STAMPS RETURNED STAMPS SOLD CLOSING VALUE € € € € FIG. 4 Stamps Issued to Tellers Record. 11 Irish League of Credit Unions 4. This individual would record the details of all stamps issued to the tellers on a daily basis in the Stamps Issues to Tellers Record. (Fig. 4). 5. The tellers would complete their Daily Cash Sheet in a similar manner to Situation A. 6. The cashier, at the end of the shift or day would verify the details per the stamp summary on the Daily Cash Sheet and initial same if correct. 7. The Cashier would then take the unsold stamps and secure them on behalf of the person issuing the stamps. 8. That person subsequently, would recover the returned stamps and record their return in the Stamps Issued to Tellers Record in respect of each teller. The details of the unsold stamps would be included on the stamps summary on the Daily Cash Sheet and this record should be checked by the individual responsible for issuing stamps to tellers. It should be obvious from the above that where a large number of tellers are selling stamps it is necessary to have additional control features as outlined to minimise the risk of fraud. Where there is a likelihood that these controls would not be fully implemented then it is advisable to restrict the sale of stamps to a limited number of tellers, thus reducing the number of people to whom the control need be applied. 12 Irish League of Credit Unions 7. CASHING OF STAMPS Stamp cashings should be funded out of the general cash till in exchange for returned stamp cards. These cards should be retained by the tellers to support their daily cash reconciliation. The cards should be initialled on both sides and dated by the teller for subsequent checking. At the end of the day the teller would record the total value of cashings in the stamp cashed section of the Daily Cash Sheet. This figure, when taken along with the stamp sales for the day would give the net proceeds/payments from stamps. The cards and closing unsold stamps on hand would be presented to the cashier for checking together with the other cash and the Daily Cash Sheet. The cashier should check the total value of cashed stamps with the Daily Cash Sheet and when satisfied that the details are in order should cancel the cards to avoid their re-use. All Stamps should be cancelled by a distinctive colour marker or special stamp ensuring that all stamps on the card are marked. The cards for each individual teller should be stored together for each day and these should be safely secured for subsequent checking by the Supervisory Committee and Auditor. 8. MEMBERS SAVING STAMPS CARDS. All members participating in a Saving Stamps Scheme should be issued with a card to which stamps of the same value are affixed. The card should bear the name of the issuing credit union, the card number, the member’s name and credit union account number. For ease of counting and reconciliation, cards, should each accommodate 10, or a multiple of 10 stamps. 13 Irish League of Credit Unions 9. SUPERVISORY COMMITTEE ROLE. To ensure that the controls on the Saving Stamp Scheme are properly applied it would be an essential feature of the overall system of internal control that the Supervisory Committee would carry out regular tests and reviews of the operation of these controls. Such tests and reviews should be incorporated into a written work programme for the Supervisory Committee and evidence of the satisfactory completion of these checks along with details of any matters arising should be available for inspection. Rather than have the returned cards and used stamp books accumulate indefinitely it would be acceptable for the Supervisory Committee to oversee their destruction on an annual basis after the completion of the audit or (if agreed) more frequently. This destruction would only take place after the supervisors had satisfied themselves that the value of returned cards agreed with the total value of cashings for the period. They should also satisfy themselves that the total cash from the sales of stamps in the period agrees with the value of stamps issued per the Stamp Book Stock Control Record. Written details of the above totals should be retained. The level of testing to be carried out as above is a matter for each credit union to decide upon, given its size and circumstances. The test, however, should be comprehensive enough to cover all aspects of the internal control system. These tests should include such items as agreeing the physical stock of issued books of stamps to the Stamp Book Stock Control Record, tests for initials where appropriate, and agreeing the details per tellers Daily Cash Sheets with the details of the Stamps Issued to Tellers Record. (Fig.4). 10. ACCOUNT PROCEDURES. A general ledger account should be opened entitled “Savings Stamps held by Members” and posted in the normal manner from the receipts book or Journal Cash Record. 14 Irish League of Credit Unions 11. CONCLUSION. The danger which exists where a Saving Stamps Scheme is operated is that it would be perceived to be peripheral to the main business of the credit union. The value of stamp sales relative to the overall turnover may not be significant and the level of internal control applied to this operation would consequently tend to be inadequate. The problems that arise are due to the nature of the saving stamps schemes, rather than the scale of activity and value. This should be considered when setting up controls. In order for a strong system of internal control to be operated, all of the controls recommended in this booklet need to be implemented. While sole reliance upon the trustworthiness of the individuals operating the Saving Stamps Scheme may appear to be adequate the implementation, operation and objective assessment of proper controls is always essential. The existence of a system of strong internal control is a protection for honest volunteers/employees and a deterrent against fraud. If there is a breakdown in one of the internal controls which leads to a fraud it may be easier to detect the person responsible if the other controls are in place. If there is a likelihood of there being a breakdown in the implementation of the recommended internal controls due to either too many tellers operating the system or to the fact that the Supervisory Committee is not as vigilant as it might be, then the operation of the Savings Stamps Scheme should be restricted to one responsible person or even discontinued. Consideration should be given to changing the colour of stamps and stamp cards perhaps every two or three years. This should be done to facilitate an overall stamp reconciliation. The three overriding features of any internal control system concerned with Saving Stamps Schemes are: That there should be full accountability by individuals for transactions carried out by them. The saving stamps should be considered as being equivalent to cash and treated with the same level of control. Saving Stamps should be incorporated into the main cash recording system as far as possible and not dealt with in isolation. 15 Irish League of Credit Unions 16