Fall 2002 Syllabus

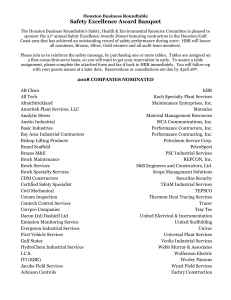

advertisement

BRIGHAM YOUNG UNIVERSITY Business Management 499 Strategic Management Fall Semester, 2002 David J. Bryce Telephone: 422-2963 Strategy Group Office: 769 TNRB Department of Organizational Leadership and Strategy email: dbryce@byu.edu Marriott School Office Hours: MW 2:00-3:00 ________________________________________________________________________________ Course Description Strategic management has the goal of helping firms achieve and sustain superior performance. In this course, you will acquire tools, insights, frameworks, and experience that will aid you in helping organizations in a variety of circumstances achieve this goal. There are many considerations in determining how best a firm may sustain superior performance—or what we often call “competitive advantage.” These include the nature of the industry in which the firm competes, i.e. the numbers of buyers, sellers, or competitors for a firm’s product; the internal capabilities of the firm and the resources upon which it may draw to achieve its goals; the nature and extent of its cooperative relationships with other firms; the diversity, or scope, of the activities it undertakes, or where it locates its operations. The course systematically considers these dimensions as we work to build a comprehensive understanding of how to strategically manage the enterprise. You will be placed in the role of key decisionmaker and be asked to suggest a course of action—a strategy—that you believe will best achieve the firm’s goal of superior performance in a particular situation. We will also examine revolutionary strategies and spend some time discussing the challenges posed by discontinuous technological change. The Internet, for example, represents a fundamentally new technology that many firms have attempted to exploit with the result of abject failure. These lessons have been harsh for some; however, we are now the fortunate beneficiaries as the boom and bust help to clarify some of the most important fundamentals of strategy on the Internet. In the last part of the course, we turn to examining strategy in the global firm and develop understanding about how differences in environmental context affect competitive advantage and strategic decision marking. Indeed, the emergence of a truly integrated global economy has rendered an understanding of international economic forces an essential element of almost any firm’s strategic planning. The course concludes by examining the factors that make an industry a likely candidate for globalization as well as the sources of competitive advantage that can be derived from being a global competitor. The ultimate objective of the course is for you to develop a solid foundation upon which to conceive of creative strategic options for firms both large and small and to understand which options among many are likely to be the most successful in leading to superior performance for the firm. This will be achieved as you acquire analytical approaches, learn basic principles, and grapple with the complexities and ambiguities of actual business situations. As you do this, you will become skilled strategic analysts, capable of assessing or developing good strategy in any given business situation. 1 Strategy and the Gospel During our discussions we may encounter situations in which we discover important tensions that are worth deeper exploration in the context of our individual efforts to live the Gospel. I encourage explicit discussion of these tensions when they arise. The business world repeatedly presents opportunities for individuals to test their integrity, to challenge their moral stance, to choose actions that are consistent or inconsistent with their character, values, or beliefs. I hope that this course can, in some small way, help you prepare to weather such storms with your integrity intact. While the strategic situations we will discuss do not usually present ethical dilemmas, some may wonder what actions an “ethical strategist” should take in a particular situation. Others may claim that “ethical strategist” is an oxymoron since efforts to secure advantage relative to others are problematic in the first place. I encourage you to think carefully about these issues as the class proceeds and reconcile your answers with your own values through class discussion and personal reflection. Course Format The course consists of conceptual material and cases. In about half of the class sessions, you will need to be prepared to discuss a case. These cases are indicated in the syllabus and are available in the course pack. Most of the conceptual reading material comes from the Harvard Business Review and many of the cases come from the Harvard Business School. The Harvard Business Review (HBR) is a good source for conceptual material because the articles are typically “management versions” of research conducted by academics and often published in more strenuous academic journals. Editors at HBR are particularly good at translating difficult concepts into language that is easily understood with business examples that illustrate the key points. Harvard Business School is in the business of case publication and remains one of a handful of sources for good business cases. Readings typically offer theoretical insights into the general problem or issue being addressed and the case analysis provides practice in applying concepts to concrete organizational situations. It is imperative that you thoroughly prepare the cases and readings assigned for each class in advance. Directions for Accessing HBR Articles You can access articles in Harvard Business Review (and many other journals) by going to the BYU library home page: www.lib.byu.edu/hbll/ and then click on the “Article Indexes” tab along the top. Then click on the following items in sequence: 1. 2. 3. 4. Alphabetical List of Periodical Indexes Business Source Premier (EBSCO) "Advanced Search" (tab/menu item along the top of the page) Search for the desired article by listing words for author, title, and/or journal title combinations in the search fields. Example: Type “porter” in the first field and select AU Author; then type “strategy” in the second field and select TI Article_title; then type “harvard business review” in the third field and select “SO Journal_name.” The resulting search list includes the first HBR reading, “What is Strategy?” by Michael Porter. 5. Click on search to get a list of articles fitting the criteria you specify. 6. You may read articles on-line, download, or print. Note: Copies of class presentations and select other documents indicated on the syllabus will be available on the web at the following site: marriottschool.byu.edu/teacher/bm499/bryce 2 Group Work Each student will join (or be assigned to) a group in the second week of the semester. Please be thinking about who you would like to associate with in your groups during the first few class sessions. You are welcome and even encouraged to work together in groups on case preparation, but this is your choice. Some groups may prepare for every case together. Other groups may meet to prepare only some of the cases depending on the needs of group members. Regardless of the approach you take, each individual must be prepared to answer questions or to suggest and defend actions pertaining to the case in class. Falling back on the group in these circumstances, or providing support for your recommendations by appealing to the group’s work in lieu of a reasoned response, e.g. “well, that’s what my group came up with,” is not acceptable. Course Materials Course Pack containing mostly case readings to be picked up at BYU Bookstore Course Evaluation 1. Class Participation 2. One Group Written Assignment – Dell Corporation 3. Two Quizzes 4. Final Examination 20% 20% 30% 30% Class Participation Effective participation is accomplished by focused comments that develop insights that are not immediately discernable from the cases or readings and that demonstrate mastery of reading and case materials. Effective participation is also accomplished by avoiding simple repetition of case facts. Comments might elucidate how a particular strategic concept can be applied for benefit in the case or how substantive problems presented in the case are made tractable by particular approaches to thinking or analysis. Students who review with the class a good quantitative or qualitative analysis that leads to certain conclusions while ruling out others contribute much to class discussion. Quality, not quantity of comments, is emphasized in class participation. Written Assignment One case—Dell Corporation—must be prepared and written up as a group assignment. THE GROUP WRITTEN CASE ASSIGNMENT IS DUE ON OCTOBER 24. I will provide more details on the format and content for this assignment in the first few weeks of the course. Following the written assignment, each individual will have the opportunity to rate the contributions of other group members (on the written assignment only). Except in the case of extenuating circumstances, the average of the grade supplied by your group peers will become part of the individual class participation grade. Quizzes Two quizzes will be given during class time on September 24 and October 17. These quizzes will cover concepts discussed during previous sessions or since the previous quiz. Final Exam The final exam will be 2 hours and is typically a combination of short answer and short essay (with possibly a mini-case). 3 CLASS SCHEDULE AND ASSIGNMENTS I. Introduction to Business Strategy Session 1: Sep 3 Reading: Competition and Business Strategy in Historical Perspective Session 2: Sep. 5 Reading: Case: What is Strategy? (Porter, HBR) Wal-Mart Stores Discount Operations Discussion Questions: 1. Why is Wal-Mart so successful? How would you characterize its strategy? 2. What is Wal-Mart’s competitive advantage? How likely is it that Wal-Mart can sustain its advantage over time? 3. Why are Wal-Mart’s costs lower than its competitors? Examine each element of the cost structure (e.g., COGS, labor, rent, advertising, etc.) to determine as best you can where WalMart’s cost advantage comes from. Why don’t Wal-Mart’s competitors (e.g., K-Mart, Target) imitate Wal-Mart and realize similarly high profits? 4. Why don’t Wal-Mart’s competitors (e.g., K-Mart, Target) imitate Wal-Mart and realize similarly high profits? 5. Note: Wal-Mart's labor costs were calculated at 10.1 percent of sales versus an industry average of 11.2 percent in 1990. II. Industry Analysis and the Structural Attractiveness of Industries Session 3: Sep. 10 Reading: Case: How Competitive Forces Shape Strategy (Porter; HBR). Cola Wars Continue: Coke vs. Pepsi in the 1990s Discussion Questions: 1. Analyze the structure of the soft drink industry in the mid 1980s. Why are Coke and Pepsi so profitable? What prevents other firms from entering this industry and accessing some of those high profits? 2. Compare the economics (costs and profits) of soft drinks (concentrate) versus bottlers? Why are Coke & Pepsi in the bottling business? 3. Calculate the size of the barrier to entry into the soft drink (concentrate) industry? What would it cost a new entrant to build a competitive position (market share) similar to Pepsi or Coke? Session 4: Sep. 12 Reading: Profit Pools: A Fresh Look at Strategy (Gadeish & Gilbert; HBR). Discussion Questions 4 1. 2. Compare and contrast the various views we discussed regarding how industry structure influences firm performance (in particular, the 5 forces model and the model described in the Profit Pools reading). Can you think of any other industry factors (not included in the Porter model) that may indicate whether an industry is more, or less, attractive? III. Firm-Specific Resources and Capabilities & Generic Strategies Session 5: Sep. 17 Reading: “The Core Competence of the Corporation” (Prahalad and Hamel; HBR). Discussion Questions 1. Think of an example, other than those supplied in the article, where you think a company had a good understanding its core competency in the article and exploited it (Some of you will be asked to share your example in class). 2. How is approaching the internal capabilities of a corporation in this way useful? How is it not so useful? 3. Does this concept apply equally well to single unit and multi-unit, or diversified, firms? Session 6: Sep. 19 Case: Intel Corporation: 1968-1997. Discussion Questions 1. Why has Intel been so successful? What are its sources of competitive advantage? 2. What are the company’s most valuable resources and capabilities? 3. Is Intel’s competitive advantage sustainable? What sustains its advantages? Session 7: Sep. 24 Reading: Case: Discovering New Points of Differentiation. (MacMillan & McGrath; HBR). Harley Davidson, July 1998. Discussion Questions: 1. Harley-Davidson almost went bankrupt in the late 1970s during the invasion of Japanese motorcycle manufacturers (Honda, Yamaha, Kawasaki) into the U.S. market. With such a great brand name, why do you think Harley almost went bankrupt? 2. After almost going bankrupt, Harley-Davidson has re-emerged as a highly successful, and profitable, motorcycle manufacturer. What have been the keys to Harley's success? 3. Looking into the future, what threats does Harley face (from key rivals such as Honda and BMW)? What opportunities does it have? How might Harley modify its strategy to respond to its opportunities and threats? 4. How would you conduct a segmentation analysis of motorcycle customers? Analyze the needs and the consumption chain for different segments of motorcycle customers. In what ways do you think Honda attempts to differentiate its products relative to Harley Davidson? 5 Session 8: Sep. 26 In-class quiz (mini-test) on materials from the first 7 class sessions. IV. Cooperative Strategy Session 9: Oct. 1 A. Vertical Alliances Reading: Case: How Chrysler Created an American Keiretsu (Dyer; HBR) General Motors Supplier Management Dilemma Discussion Questions: 1. Should Jim Taylor continue with the aggressive arms-length competitive bidding practices initiated by Lopez? If yes, why? What are the strengths of this approach to managing suppliers relative to the partnership approach being implemented by Chrysler? What are the weaknesses? 2. Should Taylor attempt to imitate what Chrysler is doing with regard to developing supplier partnerships? Do you think this approach will work at GM? What are the specific challenges that Taylor must overcome to create effective partnerships with suppliers? 3. Can you think of any other approaches that Taylor might use for supplier management? Session 10: Oct. 3 B. Horizontal Alliances Readings: “Collaborate with Your Competitors--and Win” (Hamel, Doz, and Prahalad; HBR). “Partner or Perish” (Forbes, May 21, 2001) and “Marital Blisters” from the same issue. Discussion Questions: 1. What was the strategic logic for the joint venture between P&G and Coke? 2. Do you think that the joint venture is the preferred option for both companies? (if so, why?) In what other ways could P&G or Coke have attempted to access the resources of the other company? 3. What advice would you give to the CEOs of P&G and Coke to help them ensure that this joint venture is a success? V. Strategy as “Revolution” Session 11: Oct. 8 Reading: Strategy as Revolution (Hamel, HBR) Case: Southwest Airlines 1993 A 6 Discussion Questions 1. What are the key sources of Southwest’s competitive advantage? 2. Are Southwest’s cost advantages sustainable? What prevents larger competitors (e.g., American, Delta, United) from imitating Southwest’s approach? What prevents new entrants from successfully imitating Southwest’s approach? 3. Create a chart that plots the relationship between relative market share in this industry and firm profitability. 4. Based upon the analysis to question 3: What role, if any, does the experience curve play in explaining competitive advantage in this industry? What role, if any, does the experience curve play in explaining Southwest’s cost advantage? Session 12: Oct. 10 Readings: Strategy and the Internet (Porter, HBR) Bullish on the Internet—Merrill Lynch (distributed in Class) Discussion Questions 1. How should Merrill Lynch respond to competitive threats from E-Trade, Ameritrade, and Schwab? 2. How should Schwab respond to E-Trade and Ameritrade? 3. How is strategy on the Internet different than strategy off of the Internet? How is it the same? 4. What do you think are the real sources of value on the Internet; i.e. what characteristics should Internet-based businesses (websites) possess in order to supply sustainable advantage? Or, do such characteristics actually exist? 5. Think about hugely successful Internet businesses such as eBay or Amazon. In what strategic ways do these differ from well-known failures? Session 13: Oct. 15 Case: Leadership Online: Barnes & Noble vs. Amazon.com (A) Discussion Questions 1. Why is Amazon.com’s market value so high relative to Barnes & Noble and Borders which have greater revenues, profits and assets? 2. Is Amazon.com’s online advantage sustainable? Why or why not? (Will Barnes & Noble and Borders be able to imitate Amazon.com’s business model?) 3. At what point in time do you project that Amazon.com will be profitable? Do you think it will be more profitable than Barnes & Noble? In which company would you prefer to own stock today? Session 14: Oct. 17 In-class quiz (mini-test) on materials from class sessions 9-13. 7 Session 15: Oct. 22 ****No regular class session on this day. You are free to meet with your groups to do the written case analysis on Dell Assignment #1: Group Case Analysis Case: Dell Corporation Note: You may want to gather other outside information on Dell. Format and content guidelines will be distributed in class. Session 16: Oct. 24 Turn in written case analysis at beginning of class Case: Dell Corporation VI. Strategic Interaction & Competitor Analysis Session 17: Oct. 29 Reading: Case: The Right Game: Using Game Theory to Shape Strategy (Brandenburger & Nalebuff, HBR). Bitter Competition: The Holland Sweetener Co. vs. Nutrasweet Discussion Questions 1. How should Vermijs expect NutraSweet to respond to the Holland Sweetener Company’s entry into the European, Canadian, and United States aspartame markets? 2. Specifically, how should Vermijs assess the relative likelihood of the two scenarios—price war and normal competition (accommodation)? More specifically, if you were running Nutrasweet, what (if any) would you drop your price to when Holland Sweetener Company enters Europe? What price would you drop to when they enter Canada? What price would you drop to when they enter the United States? Note: You can analyze this as a prisoner’s dilemma game with price war (low prices) being one option or accommodate (maintain higher prices) as a second option for each player (Nutrasweet or Holland Sweetener Company). Session 18: Oct. 31 Case/Reading: “Cold Competition: GE Wages the Refrigerator War." (Magaziner & Patinkin; HBR) Discussion Questions: 1. How does GE know they are at a cost disadvantage? What analysis was done to determine their relative cost position? How do you think the analysis was done? 2. In your opinion, is it important for GE to continue to manufacture compressors? Why or why not? Is it important for GE to manufacture compressors in the United States? Why or why not? 3. Do you think GE should have outsourced compressors? If so, which supplier(s) would you choose and why? 8 VII. Introduction to Corporate Strategy Session 19: Nov. 5 Reading: Creating Corporate Advantage (Collis and Montgomery, HBR) Discussion Questions: 1. How is corporate strategy different from business unit strategy? 2. Can a diversified corporation have a “core competency” that stands apart from its individual business units? 3. What is the role of the corporate office in a diversified corporation? 4. How does a corporate office know whether it is adding value over and above what individual units could be accomplishing? Session 20: Nov. 7 A. Vertical Scope Case: International Sourcing in Athletic Footwear: Nike and Reebok Discussion Questions: 1. What are Nike and Reebok's key sources of competitive advantage relative to Adidas, the former worldwide leader in athletic shoes? 2. Calculate the cost advantage that accrues to Nike and Reebok from producing in Indonesia versus Adidas, which produced primarily in Germany? 3. How is sourcing different in footwear compared to automobiles? What do you think about its supplier management practices (i.e. pitting six factories against each other)? Do you think Nike or Reebok should adopt Chrysler’s supplier management practices? Why or why not? 4. How would you characterize the core competencies of Nike and Reebok? What prevents their subcontractors from entering the U.S. market to compete with them? Session 21: Nov. 12 B. Horizontal Scope (diversification) Reading: Case: “Not All M&As are Alike—and That Matters” (Bower, HBR). Time Inc.’s Entry into the Entertainment Industry (A) Discussion Questions: 1. How does the potential merger with Warner Brothers fit into Time’s overall corporate strategy? 2. Would the shareholders be better off accepting one of the other bids for Time Inc.? 3. Does the Time-Warner merger make sense from the sustainable-competitive-advantage perspective? 4. How large do the economies of scope have to be to justify the acquisition of Warner? 9 VII. Introduction to Global Strategy Session 22: Nov. 14 Reading: Diagnosing Industry Globalization Potential (Class Website) Discussion Questions: 1. What are the characteristics of an industry that make its products particularly attractive for globalization? 2. What kinds of firms should consider expanding beyond their own borders into international markets? Session 23: Nov. 19 A. Industry Globalization Potential Reading: Case: Furnishing the World (The Economist) Ingvar Kamprad and IKEA Discussion Questions: 1. What were the sources of IKEA's competitive advantage in furniture retailing in Sweden? How did IKEA change the rules of the game? 2. To what extent was the furniture a global industry in the 1950s? In the 1990s? What if anything has changed? 3. How important was internationalization to IKEA? What challenges did the company face in expanding abroad? How did it overcome them? 4. Why do you think IKEA ran into problems in the U.S.? What would you do? B. Country Comparative Advantage Session 24: Nov. 21 Reading: The Competitive Advantage of Nations (Porter, HBR) Discussion Questions: 1. Why are some countries advantaged relative to others? 2. What are the implications for firms who are expanding abroad or who are considering locational choices across the globe? 3. What are some of the important tensions involved in locational choices? ***NO CLASS the week of Thanksgiving; Friday classes are taught on Tuesday, Nov. 26 10 Session 25: Dec. 3 Case: The Japanese Facsimile Industry in 1990. Discussion Questions: 1. Why did Xerox lose its leadership position in the facsimile industry into the 1980s? 2. What are the important sources of competitive advantage in the facsimile industry? 3. Why did Japanese firms come to dominate the facsimile industry? 4. Why do you think this has become more of a global industry? 5. What does your analysis of the experience curve in this industry suggest about the importance of volume? Session 26: Dec. 5 C. International Strategy and Structure Case: Philips and Matsushita: International Strategy and Structure Discussion Questions: 1. How did Philips become a leader in the industry? How did Matsushita overtake Philips? What distinctive competencies/capabilities did each firm possess? 2. What were the key success factors in the industry during the 1930-1970 period when Philips was the world leader? How did those key success factors change during the 198090s time period? 3. What are the major problems/challenges facing each firm at the end of the case? What additional steps should each firm take to strengthen their respective competitive positions? Session 27: Dec. 10 D. Strategies for Foreign Market Entry Case: Reading: EuroDisneyland "Designing Entry Strategies for International Markets." (Root) Discussion Questions: 1. Do you agree with Disney's decision to build Disneyland in France rather than Spain? Why or why not? 2. Do you agree with Disney's decision to be a major owner, rather than simply a licensor as in the case of Tokyo's Disneyland? Why or why not? 3. Why do you think that EuroDisney has been relatively unsuccessful? What would you do if you were Eisner? Session 28: Dec. 13 Class Overview/Summary 11