acc_8_2013_unit3_timeline mn

advertisement

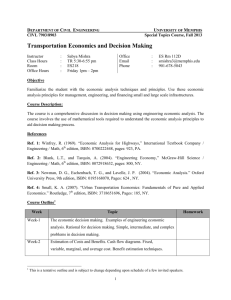

ACCOUNTING UNIT 1 Course outline and timeline for Accounting Unit 3 for 2014 Week Area of study/key knowledge Assessment Relevant accounting principles, qualitative characteristics, accounting elements. Area of Study 1: ‘Recording financial data’ Term 1 Week 1 29-31 Jan. INTRODUCTION Week 2 3-7 Feb BALANCE SHEET Ref: Ch 1 Box Accounting Elements, 2-Fold effect, Balance Sheet, Accounting Principles and Qualitative Characteristics, Historical cost v Agreed Value Ref: Ch 2 Box Week 3 10-14 Feb GST/SOURCE DOCUMENTS Week 4 17–21 Feb STOCK Source documents, GST Clearing, Reliability Ref: Ch 3 Box FIFO, Perpetual method, Stock Cards, Stock Loss/Gain, Theory, Stock Control Account Ref: Ch 9 Box Week 5 24–28 Feb. RECORDING TRANSACTIONS Special journals, Post journals to ledger, Foot and balance ledger, Trial balance, Subsidiary Ledger, Theory Ref: Ch 5 Box Outcome 1.1 assessment task: Folio of exercises – Documents (7 marks) Outcome 1.2 assessment task: Folio of exercises – Stock (23 marks) Week 6 3-7 Mar. RECORDING TRANSACTIONS Ref: Ch 6 Box Week 7 10-14 Mar. RECORDING TRANSACTIONS Ref: Ch 8 Box Week 8 Recording Transactions – establishing double entry, © VCTA Published October 2013 page 1 ACCOUNTING UNIT 1 Week Area of study/key knowledge 17-21 Mar. GENERAL JOURNAL contributing/withdrawing assets other than cash by the owner, donations of stock, bad debts, correcting entries Week 9 24-28 Mar Assessment Ref: Ch 7 Box Revision of recording, Finishing off Outcome 1 Outcome 1.3 assessment task: Folio of exercises – General Journal (22 marks) Outcome 1.4 assessment task: Folio of exercises – Recording transactions (48 marks) Week 10 31 Mar – 4 Apr. CLOSING THE GENERAL LEDGER P/L Summary account, closing a ledger account, closing entries, transfer entries Ref: Ch 10 Box 5–21 Apr. Mid-semester break Term 2 The income statement, preparing an income statement, The line between profit and the balance sheet, evaluating a net profit figure, costs of goods sold and gross profit, reporting discounts. Ref: Ch 11 Box Week 11 22–24 Apr. INCOME STATEMENTS Week 12 28 Apr. – 2 May DEPRECIATION Week 13 5–9 May BALANCE DAY ADJUSTMENTS Area of Study 2 Balance Day Adjustments and reporting and interpreting accounting information The meaning of depreciation, the meaning of cost, straight-line depreciation, adjusting entry for depreciation, depreciation and the balance sheet, depreciation and the income statement. Ref: Ch 13 Box Profit determination, accrual accounting, prepaid expenses, accrued expenses, stock losses and gains Ref: Ch 14 Box Outcome 2.1 assessment task: Structured questions - The Balance Sheet and Depreciation (25 marks) Week 14 Outcome 2.2 assessment task: Structured questions 12–16 May © VCTA Published October 2013 page 2 ACCOUNTING UNIT 1 Week Area of study/key knowledge Assessment - Accrued expenses and Prepaid expenses (25 marks) Week 15 19–23 May CASH FLOW STATEMENTS Week 16 Role of the cash flow statement, classification of cash flows, concept of cash, format of the cash flow statement, preparing a cash flow statement, cash flows and decision-making Ref: Ch 12 Box Finishing off cash flow statements 26–30 May Outcome 2.3 assessment task: Structured questions - Cash flow statement, Balance Day Adjustments and the Income Statement, Balance Sheet extract (50 marks) Week 17 Revision Unit 3 2–6 June Week 18 GAT 10–13 June Week 19 Begin Unit 4 16–20 June Week 20 Unit 4 continued 23–27 June © VCTA Published October 2013 page 3