Year 11 accounting term 2 unit notes

advertisement

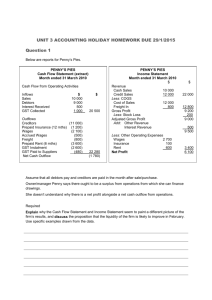

ALDRIDGE STATE HIGH SCHOOL YEAR 11 ACCOUNTING CORE STUDIES TWO – END OF PERIOD REPORTS Many assumptions or conventions underlie the preparation of accounting records. For accounting purposes, the accounting period assumption assumes that the life of a business is divided into arbitrary time periods. Unfortunately, many business transactions do not fit nearly into these various accounting periods. Business transactions flow through the life of the business, and are interrupted by the accounting period. Some adjustments, called balance day adjustments, must, therefore, be made to recorded figures at the end of the accounting period, on a day called the balance day (usually June 30). During every accounting period, the aim is to calculate a profit figure that is as accurate as possible. Profit is obtained by matching revenue for the period with the expenses incurred in earning that revenue. This is called the matching principle. Revenue is money coming into the business. Revenue is generally recognized when it has been earned. For a service business, this occurs when the service has been performed. For a trading business, this is when the goods have been delivered. ACCRUAL ACCOUNTING The accrual basis of accounting recognizes transactions and events when they have an economic impact on the entity rather than when the associated cash flows occur. This means that assets, liabilities, revenues and expenses arising from transactions or other events will be recognized in the financial statements of an entity when the effects occur (that is, when revenue is earned and expenses are incurred), rather than when amounts are received or paid. The adoption of accrual accounting will result in balance day adjustments being made to ensure that assets, liabilities, revenues and expenses are recognized in the correct reporting period. Accrual accounting is to be contrasted with cash accounting, where the effects of transactions are recognized, only when cash is received or paid out. BALANCE DAY ADJUSTMENTS Balance day adjustments are entries made at balance day in order to match the revenues and expenses accurately so that profit (or loss) can be determined, and to bring into account assets and liabilities not previously recorded. Common balance day adjustments are made for accrued expenses, accrued revenues, prepaid expenses and unearned revenues. D:\533566772.doc 1 Accrued expenses are: ___________________________________________________________________ _________________________________________________________________ Accrued expenses are amounts owed by the business and are therefore liabilities. Take an example! The business pays wages every Tuesday. The last pay day was Tuesday June 27. Balance date is Friday June 30. Total wages is $200 a day. At balance date, $600 in Wages has been incurred by the business but has not yet been paid. According to the Matching Process, this $600 must be recorded in this year’s profit determination. So far the Ledger looks like this: Wages Account June06 13 20 27 DR 1 000.00 1 000.00 1 000.00 1 000.00 Cash at Bank Cash at Bank Cash at Bank Cash at Bank CR BALANCE 1 000.00 2 000.00 3 000.00 4 000.00 N DR DR DR DR It is obvious that we need to add the $600 in Wages for the three days (June 28, 29, 30) into the Wages Account in the Ledger and therefore wages is debited. It is necessary to credit some other Account to complete the double entry. This liability account is called Accrued Expenses. The general journal entry to effect this is: General Journal June 30 Wages Accrued Expenses Dr Cr 600.00 600.00 (Wages incurred but not yet paid) Post this entry to the Wages account and Accrued Expenses account. Accrued Expenses Account DR D:\533566772.doc CR BALANCE N 2 Accrued revenues are: ___________________________________________________________________ ___________________________________________________________________ Accrued revenues are amounts owing to the business and are therefore assets. Look at this example. The business receives Commission of $200 each fortnight. The last receipt was June 23. At balance date of 30 June, a week’s commission of $100 has been earned but not yet received. The matching process says this must be recorded in this year’s profit determination. So far as the Ledger looks as follows: Commission Revenue Account DR CR 200.00 200.00 June 9 Cash at Bank 23 Cash at Bank BALANCE 200.00 400.00 N CR CR If the $100 needs to be included in this year’s profit determination, then we need to add the $100 Commission that has been earned (but not yet received) into the Commission Revenue Account in the Ledger in the credit column. The corresponding debit entry is Accrued Revenue. The general journal entry to effect this change is: General Journal June 30 Accrued Revenue Commission Revenue Dr Cr 100.00 100.00 (Commission earned but not yet received) Post this entry to the Commission Revenue account and Accrued Revenue account. Accrued Revenue Account DR D:\533566772.doc CR BALANCE N 3 Prepaid expenses are: ______________________________________________________________________________ ______________________________________________________________________________ Prepaid expenses are amounts owing to the business and are therefore assets. Benefits from these prepayments will occur over the next accounting period(s). On January 1 we paid a full year’s Insurance of $500. Six months later on balance date, June 30, only half of that Insurance expense belongs in this year’s profit determination, while the other half belongs in next year’s profit determination. So this time, instead of adding it in, we take what we don’t need out and put it aside until next year’s profit determination. The ledger looks like this so far: Jan 1 Insurance Account DR 500.00 Cash at Bank CR BALANCE 500.00 N DR If $250 of this Insurance expense has to be removed from this year’s profit determination, we have to show it being removed from the Insurance Account by crediting Insurance. The general journal entry to effect this change is: General Journal June 30 Prepaid Expenses Insurance Dr Cr 250.00 250.00 (Insurance paid but not yet incurred) Post this entry to the Insurance account and Prepaid Expenses account. Prepaid Expenses Account DR D:\533566772.doc CR BALANCE N 4 Unearned revenues are: ___________________________________________________________________ ___________________________________________________________________ Unearned revenues are amounts owed by the business and are therefore liabilities. Look at this example. The business received a week’s rent in advance of $140 on June 28. By balance date two days later, June 30, only $40 of that $140 has been earned for this year’s profit determination. The other $100 will be earned in next year’s profit determination. So again, we are not adding but removing! The ledger looks like this so far: Rent Revenue Account DR June 7 14 21 28 CR 140.00 140.00 140.00 140.00 Cash at Bank Cash at Bank Cash at Bank Cash at Bank BALANCE 140.00 280.00 420.00 560.00 N CR CR CR CR If $100 of the Rent Revenue has to be removed from this year’s profit determination, we have to show it being removed from the Rent Revenue Account by debiting Rent Revenue. The general journal entry to effect this change is: General Journal June 30 Rent Revenue Unearned Revenue Dr Cr 100.00 100.00 (Revenue received but not yet earned) Post this entry to the Rent Revenue account and Unearned Revenue account. Unearned Revenue Account DR CR BALANCE N Exercises: Kirkwood, Page 112, Ex 4.4, 4.5, 4.6, 4.7 D:\533566772.doc 5 Prepare general journal entries for each of the following balance day adjustments: a) $200 subscription paid in advance b) $2600 registration of vehicles prepaid for the next accounting period c) $900 insurance expense has been paid in advance d) $10000 advertising expense has been incurred but not yet paid e) $1200 interest on loan is owing f) $500 commission revenue has been received in advance g) $600 rent is paid one month in advance h) $350 commission revenue is owing i) A tenant is $600 behind on their rent j) $200 interest revenue has been earned but not yet received k) Rent earned but not yet received is $230 l) Commission received in advance is $218 m) Wages to be paid are $2300 n) $210 of the electricity bill has been prepaid o) Rent of $600 was received in advance. PROFIT DETERMINING ACCOUNTS To determine whether a profit or loss has been made for the accounting period, an additional two ledger accounts, the Trading account and the Profit and Loss account are introduced. These accounts match the revenue for the period with the expenses incurred in earning that revenue. The trading account shows whether a business selling goods has made a gross profit or a gross loss. Gross profit or gross loss is the difference between the revenues earned from the sale of inventories and the cost of goods sold. To prepare the trading account, ledger accounts for sales, sales returns and cost of goods sold are transferred to the Trading account. These transfers are done by means of closing entries. Exercises: Kirkwood, Page 116, Ex 4.8 Net profit or net loss is the final profit or loss made by a business after taking into account all revenues and expenses for an accounting period. The closing entries, prepared at the end of the accounting period, perform two functions: They close off individual revenue and expense accounts ready for the next accounting period They transfer the balances of the revenue and expense accounts relating to goods to the Trading account so that gross profit or loss can be determined and transfer the balances of other expenses and revenues to the Profit and Loss account so net profit or net loss can be determined. Exercises: Page 119-120, Ex 4.11, 4.13, 4.15 D:\533566772.doc 6 INCOME STATEMENT The net profit or loss for the year is disclosed by the Profit and Loss account. However, this account is in the ledger and not available for viewing by outside parties. An Income Statement is a report prepared outside the ledger, for presentation to interested parties, detailing the various revenues and expenses for a period and calculating the resultant profit or loss. Sample Income Statement of Aldridge Traders For the year ended 30 June 2013 Sales Less Sales Returns LESS COST OF GOODS SOLD Gross Profit ADD OTHER REVENUE Rent Revenue LESS OTHER EXPENSES Wages Advertising Delivery Vehicle Expenses Office Wages Insurance Electricity Interest Expense Net Profit 10000 500 200 1 400 400 50 1 000 600 100 500 9 500 2 100 7 400 200 7 600 4 050 $3 550 BALANCE SHEET A Balance Sheet is a detailed expression of the accounting equation for a business at a certain point in time. It is a major report that lists the various asset, liability and owner’s equity items. It can be presented in Account form or Narrative form. In order to determine the net amount of GST that is payable or refundable for a period and to show this as one figure in the Balance Sheet, the GST Collected and the GST Credits Received accounts are cleared to the GST Clearing account. D:\533566772.doc 7 Sample Narrative Style Balance Sheet of Aldridge Traders As at 30 June 2013 ASSETS Cash at Bank Inventories Accounts Receivable Accrued Revenues Prepaid Expenses Delivery Vehicle Land Goodwill LESS LIABILITIES Accounts Payable GST Clearing Accrued Expenses Unearned Revenues Loan from Finance Co NET ASSETS OWNER’S EQUITY Capital Add Net Profit 2 000 11 000 2 500 25 50 26700 50 000 12 500 2 000 3 000 125 50 17 000 86 450 3 550 90 000 7 400 Less Drawings 104 775 22 175 $82 600 $82 600 Sample Account Style Balance Sheet of Aldridge Traders As at 30 June 2013 ASSETS Cash at Bank Inventories Accounts Receivable Accrued Revenues Prepaid Expenses Delivery Vehicle Land Goodwill LIABILITIES Accounts Payable GST Clearing Accrued Expenses Unearned Revenues Loan from Finance Co 2 000 11 000 2 500 25 50 26 700 50 000 12 500 OWNER’S EQUITY Capital Add Net Profit Less Drawings $104 775 D:\533566772.doc 2 000 3 000 125 50 17 000 22 175 86 450 3 550 90 000 7 400 82 600 $104 775 8 GST Clearing Entries In order to determine the net amount of GST that is payable or refundable for a period, and to show this as one figure in the Balance Sheet, the GST Collected account and the GST Credits Received account are cleared to the GST Clearing account. Although these entries are not balance day adjustments, as they do not affect profit, they are necessary to complete the accounting process and to show the net amount of GST in the Balance Sheet. These clearing entries, generally prepared at the end of each month, perform two functions: They clear the individual GST accounts reading for the next period. They transfer the balances of the GST accounts to the Clearing account so that the GST Clearing account in the Balance Sheet will show the resulting GST at the end of this period, and the amount to be paid or refunded at the appropriate time during the next period. The general journal entries are: General Journal June 30 GST Collected GST Clearing Dr Cr (GST Collected transferred to Clearing account) GST Clearing GST Credits Received Dr Cr (GST Credits Received transferred to Clearing account) Exercises: Kirkwood, Page 128, Ex 4.25 – 4.29 REVERSING ENTRIES A reversing entry needs to be made at the beginning of a new accounting period, usually 1 July, for two reasons: To ensure the correct amounts for revenue and expenses are taken into account in the period to which they actually refer To cancel the temporary asset and liability accounts created on balance day by balance day adjustments (i.e., prepayments and accruals) Exercises: Kirkwood, Page 147-148, Ex 4.33, 4.34 D:\533566772.doc 9 ANALYSIS AND INTERPRETATION OF REPORTS Three financial reports, Income Statement, Balance Sheet and Statement of Cash Flows, are generally prepared to provide information to a wide variety of users. These reports are analysed and interpreted so that interested parties who wish to make decisions about the business are better informed. Analysis can be done in an objective way with the calculation of financial ratios. Interpretation is more subjective and involves judgement, recommendation and decision-making based on these ratios. The main ratios prepared by businesses are: Gross profit ratio Net profit ratio Return on owner’s equity These ratios are used to indicate the earning capacity or profitability of the entity. Gross profit ratio is the ratio or percentage of gross profit to net sales and is calculated: Gross profit x 100 Net sales It indicates the margin of profit available to cover expenses. Such a measure is important because a high gross profit ratio allows the business to cover all expenses, earn a reasonable profit and provide a satisfactory return to investors. A low ratio means that all expenses may not be covered, a net loss may be incurred and a satisfactory return cannot be given to investors. A business should use the current industry average as a benchmark for performance. A gross profit declining over a considerable period is cause for concern because the sale of goods is usually the major source of earnings. An opportunity should be taken to increase this ratio through: An increase in sales, with a less than proportional increase in the cost of goods sold (eg through a price increase or an advertising campaign) A decrease in cost of goods sold, with less than proportional decrease in sales (eg, through better buying or reducing theft or wastage) D:\533566772.doc 10 Net profit ratio is the ratio or percentage of net profit to net sales and is calculated: Net profit x 100 Net sales It shows how much of each dollar of sales represents net operating profit. If the ratio is high, it indicates the opportunity to make high profits. Too low a figure gives less opportunity for profits and indicates the need for investigation of factors such as: expense control methods, pricing practices, selling techniques. A business should use the current industry average as a benchmark for performance. Rate of return on owner’s equity is the ratio or percentage of net profit to average owner’s equity over the period and is calculated: Net profit Average owner’s equity x 100 This ratio indicates the rate of return on owner’s equity invested in the business. Business owners take risks. Return on owner’s equity should be considered relative to current interest rates, and the degree of risk, in order to evaluate profitability. When examined in terms of trends, inter-business comparisons and alternative investment opportunities, it enables a judgement to be made on how effectively invested funds are being employed, and whether investors should consider some of the alternative investment opportunities open to them. Most analysis is based on historical data. Therefore, it is important when interpreting data and making judgements and recommendations to be aware of any relevant changes in circumstances (technological changes, competition, management changes, etc) which may have affected performance or which may affect future performance. This allows ratios to be properly compared over time and trends to be observed. It will also allow further comparisons with other firms and industries and with industry averages or predetermined standards if they are available. Exercises: Kirkwood, Page 151-152, Ex 4.35, 4.36 D:\533566772.doc 11 Ex 4.40 From the following information for S Chan, who sells high quality furniture, and who is concerned about whether it is worthwhile continuing operating the business prepare: 1. 2. 3. 4. 5. Journal entries for the balance day adjustments and GST clearing Income statement Balance Sheet Ratios for earning capacity A letter advising on the earning capacity of the business, specific recommendations about whether to continue operating, and if so, how to improve profitability. Account Telephone Sales Capital Interest Revenue Commission Revenue Drawings GST Collected GST Credits Received Cash at Bank (Overdraft) Loan to Brown Brothers Accounts Payable Cost of Goods Sold Inventories Sales Returns Accounts Receivable Wages and Salaries Office Expenses Insurance Buildings Land Amount 400 110 000 118 000 1 000 2 000 40 000 10 000 5 000 4 000 13 000 16 800 58 000 5 000 450 1 000 23 950 3 000 2 000 50 000 60 000 Additional information: Prepaid insurance expenses are $500 Unearned commission revenue is $1 000 Accrued Wages expenses are $1 000 Accrued interest revenue is $600 D:\533566772.doc 12