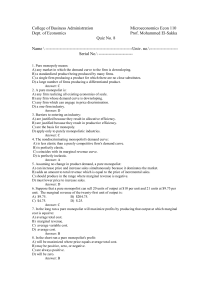

market models – 1

advertisement

4th (autumn) trimester, 2005-2006 acad.year Lecture 5 (abstract) Lecture 5 (abstract) MARKET MODELS – 1 Table 1 Characteristics of the four basic market models1 Characteristics Number of firms Type of product Control over price Conditions of entry [and exit] Non-price competition Typical examples Pure competition Market models Monopolistic competition Oligopoly Pure monopoly A very large number Many Few One Homogenous, standardized Differentiated Homogenous of differentiated Unique, no close substitutes No control. Firms accept the current price (“price-takers) Some control, within a narrow limits Very easy, no obstacles Relatively easy None Considerable emphasis on advertising, brand names, trade marks, etc. Agriculture, stock market, currency market Computer software products, clothes, footwear Limited by interdependence; significant with collusion (under conspiracy) Significant obstacles Very common, especially with product differentiation Cars, farm machinery, diamonds, oil, steel Significant, considerable Blocked Mostly public relations advertising Local utilities Characteristics of pure competition: 1.) Very large number of suppliers (as well as of buyers) – every supplier’s output amounts to an insignificant part of the total output; 2.) Suppliers accept the price as it is. None of them can affect the market price. In the competitive markets, the suppliers are “price-takers” (сторони, що приймають ціну). Market has the power over suppliers; 3.) Standardized (homogenous) product – to buyers it does not matter from whom to buy the product. Homogeneity of the product rules out the so called …. 4.) “Non-price” competition (competition based on different modifications, brand names, supplementary services, etc); 5.) Easy entry to [and exit from] the market – no legal, technological, financial or other significant obstacles. In the conditions of the pure competitive market the demand for a single producer’s product is very close to absolute inelasticity. A single supplier’s demand curve is horizontal in the short-term period (short run). The competitive market demand curve is descendant (down-sloping). 1 Based on the table form McConnell-Brue handbook. 1 4th (autumn) trimester, 2005-2006 acad.year Lecture 5 (abstract) If a supplier reaches the amount of output that lets him/her affect the market price (i.e. exert market power2), then we have a market model different form pure competition. Profit maximization in the short-term can be measured in two ways: 1.) TR-TC approach; 2.) MR-MC approach. Total-revenue-total-cost (TR-TC) approach reveals 3 types of situation: 1.) Profit maximization – TR exceeds TC. TR less TC equals to Economic Profit; 2.) Loss minimization – TC exceeds TR, the total loss does not exceed FC. In this case it is cheaper to continue the business operation than to stop it; 3.) Close-down – TC exceeds TR, the total loss exceeds FC. In this case the supplier ought to suspend producing, since it will be cheaper to produce zero units than any at all. Таблиця 2 Q P TR=Q*P AR= MR= FC VC TC= Profit= TR/Q dTR/dQ FC+VC TR-TC 5 0 x x 3 0 3 -3 5 5 5 5 3 2 5 0 5 10 5 5 3 5 8 2 5 15 5 5 3 9 12 3 5 5 20 5 3 14 17 3 5 25 5 5 3 20 23 2 5 30 5 5 3 27 30 0 5 35 5 5 3 35 38 -3 5 40 5 5 3 44 47 -7 0 1 2 3 4 5 6 7 8 AVC ATC MC x 3,00 1,50 1,00 0,75 0,60 0,50 0,43 0,38 X 2,00 2,50 3,00 3,50 4,00 4,50 5,00 5,50 x 5,00 4,00 4,00 4,25 4,60 5,00 5,43 5,88 X 2 3 4 5 6 7 8 9 Fig.2 : Total costs (TC), fixed cost (FC), and variable cost (VC) Fig.1 : Total revenue (TR, price (P), average revenue (AC) and marginal revenue (MC) 45 AFC 50 40 40 30 35 P=AR=MR TR 25 20 cost price and revenue 45 35 15 30 FC 25 TC 20 VC 15 10 10 5 5 0 0 0 1 2 3 4 5 6 7 0 8 1 2 3 4 5 6 7 8 quantity quantity Profit is maximized at the output quantity of 3 and 4 units. If, for example, the fixed cost rises from 3 up to 9, the losses will be maximized under the same quantity of output (Fig.4). 2 “Market power: The ability to alter the market price of a good or service.” Bradley R. Schiller 2 4th (autumn) trimester, 2005-2006 acad.year Lecture 5 (abstract) Fig.3 : Profit maximization via TR-TC approach (FC=3) Рис.4 : Loss minimization via TR-TC approach (FC=9) 50 45 60 40 50 30 40 25 TR 20 TC TC, TR TC, TR 35 15 TR 30 TC 20 10 5 10 0 0 1 2 3 4 5 6 7 8 0 quantity 0 1 2 3 4 5 6 7 8 quantity Fig.6 : Production suspended, stopped Fig.5 : Loss minimization, production continuing 60 80 70 50 60 40 TR 30 TR 50 TC TC 40 FC FC VC 30 VC 20 20 10 10 0 0 0 1 2 3 4 5 6 7 0 8 1 2 3 4 5 6 7 8 THE OTHER APPROACH: Marginal-Revenue–Marginal-Cost Approach. Profit is maximized in the point in which MR and MC curves cross. Fig.7 : Profit maximization via MR-MC approach Fig.8 : Loss minimization via MR-MC approach 10 12 9 10 8 7 MR 8 5 MC AFC 6 4 AVC 6 MC AFC AVC ATC 3 MR 4 ATC 2 2 1 0 0 0 1 2 3 4 5 6 7 0 3 1 2 3 4 5 6 7 4th (autumn) trimester, 2005-2006 acad.year Lecture 5 (abstract) IN THE LONG RUN Fig.9 : Optimization of the output quantity via MR-MC approach Fig.10 : Long-term optimum for a firm under pure competition 10 10 9 revenues, costs 9 8 7 P=5 6 MC 5 P=3 4 P=7 3 2 8 7 6 5 P 4 AC 3 MC 2 1 1 0 0 0 1 2 3 4 5 6 7 0 1 2 3 4 5 6 7 8 quantity MC curve is in fact a long-term supply curve (Fig.9). Long-term position of a firm is possible on the condition equal average prices, average costs, and marginal costs, i.e. three points are crossed/tangent in one. In the long term period – 1.) Leaving the market (full stop): TR < TC TR/Q < TC/Q P < ATC 2.) Returning to the market Vice versa: P > ATC 3.) No incentives to leave, or return to, the market P = ATC In the long run: 1.) Entry of new firms leads to elimination of economic profits; 2.) Exodus of operating firms from the market leads to elimination of economic losses. PURE COMPETITION AND THE MARKET EFFICIENCY Pure competition ensures the most efficient use of resources for consumers’ satisfaction maximization: 1.) allocative efficiency (ефективність розподілу ресурсів) – If P>MC, then the product is produced in insufficient amounts. If P<MC, then it is produced in excess, i.e. too much resources are employed in this business. Therefore, the optimal output is the one for which the P=MC rule holds; 4 4th (autumn) trimester, 2005-2006 acad.year Lecture 5 (abstract) 2.) productive efficiency – in the long run, the firms have to target the amount of output incurring minimal average costs. Thus the P=AC rule holds as well. In most cases, the competitive market is able to renew the efficiency of the resources allocation, if it was affected by certain dynamic changes in the economy. PURE COMPETITION AND EQUITY 1.) 2.) 3.) 4.) Negative sides of pure competition: inability to ensure an equitable distribution of income; inability to resolve the issues related with market failures; inability to ensure the efficient use of production techniques; inability to satisfy consumers with a sufficient range of choice. PURE MONOPOLY MONOPOLY – in a broader sense – a situation under which a number of supplier is so small that it empowers any of them or some of them with an ability to affect the price level and the overall amount of output. OR – a situation when, even with a big number of suppliers, one or very few of them have obtained the market power. MONOPOLY – in a narrower sense (pure monopoly) – a market situation when there is one and the only one supplier. (If there is one and the only one buyer, then we have a MONOPSONY.) SEE Table 1 for the characteristics of the pure monopoly. Types of obstacles (barriers and limitations) for a business entity to entry: 1.) Legal barriers – patents and licenses, other legal limitations of competition; 2.) Ownership of essential resources, like DeBeers; 3.) Economic – this is related with the economies of scale: one and only one supplier can provide the good or services to fully meet the market demand at the lowest possible cost. (e.g. natural monopolies). This allows the producer to set a lower price, thus driving the competitors, whose amounts of output are not at minimum, out of the market. 4.) Unfair competition – dumping, negative advertising on the competitors’ products, moral and physical pressure, etc. NATURAL MONOPOLY Natural monopolies emerge in the fields where a competition is impossible, unreasonable, or inexpedient. A perfect example is public utility companies like water stations, natural gas suppliers, etc. Local governments have to regulate the operations of local monopolies. 5 4th (autumn) trimester, 2005-2006 acad.year Lecture 5 (abstract) MONOPOLY DEMAND The demand curve for a pure monopoly firm is descendant, since the demand for the monopolist’s product is equal to that for the total product: The monopolist is the only supplier. (A REMIND NOT: the demand for a single supplier’s product at the pure competition market is absolutely elastic) With an increase in output, a pure-competitive firm gains a marginal revenue equal to the price, the latter will be the same, since the firm cannot affect the price. The monopolist will have to lower the price, which will result in the marginal revenue still lower than the new price. Therefore, in the case of pure monopoly, the marginal revenue curve is steeper than the demand curve, i.e. “the MR curve lies below the demand (price) curve at every point but the first” (Schiller). The monopolist is not a “price-taker”, but a “price-maker”. The monopolist tends to avoid the inelastic part of the demand curve and reach a favorable price-quantity combination at the elastic part, where lowering the price leads to increase in the total revenues. The monopolist maximizes its revenues at the point MR=MC. The optimal quantity of output corresponds to the point of MR and MC curves intersection. The price? It’s on the Dcurve, right above the MR=MC point. Since the MR curve is located below the D-curve, the monopolist supplies less than optimal for the society and at a the price higher than optimal. ECONOMIC EFFECTS OF MONOPOLY 1.) Insufficient (from the society’s standpoint) quantity of output and worse-thanoptimal allocation of resources; 2.) Due to economies of scale, the monopolist can reach the lowest possible average costs and thus drive the competitors out of the market; 3.) The lesser the intensity of competition, the more room for X-inefficiency (when a firm intentionally keeps to the average costs higher than efficient); 4.) Larger financial resources facilitate implementation of the most advanced technologies. At the same time, the monopolistic position enables monopolistic firms to delay with inventions; 5.) Licenses, patents, etc. result in increase in the costs needed for maintaining a monopolistic position in the market; 6.) Monopolistic markets create grounds for the price discrimination. *************************************************************** 6