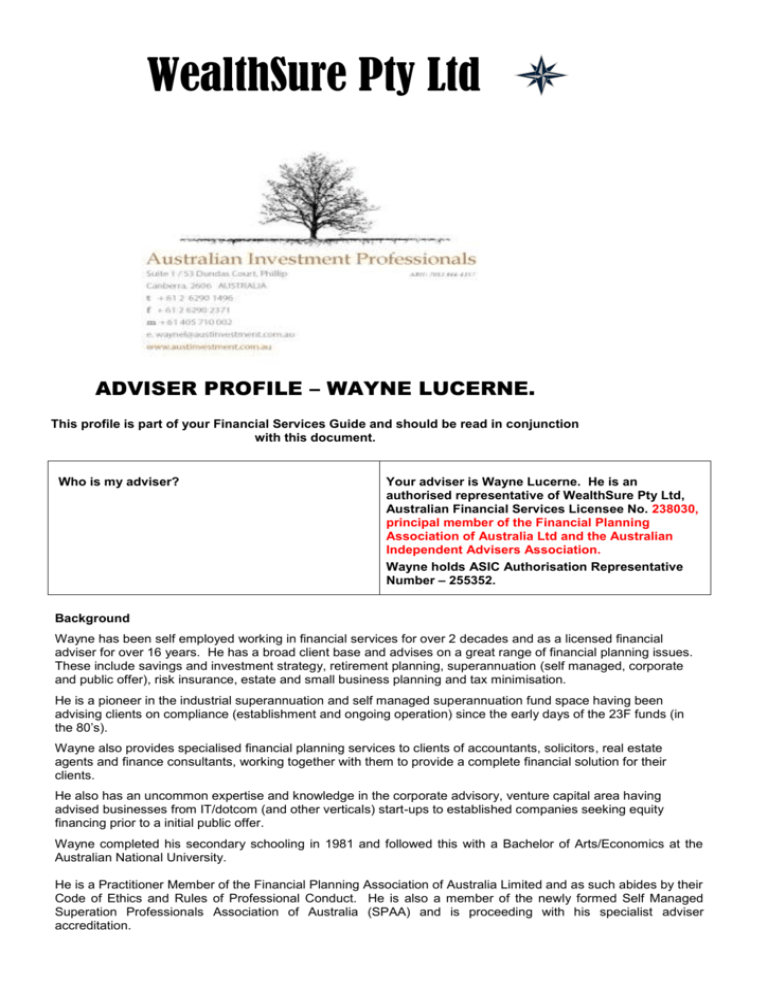

Wealth Sure Pty Ltd - Wholistic Financial Solutions

advertisement

WealthSure Pty Ltd ADVISER PROFILE – WAYNE LUCERNE. This profile is part of your Financial Services Guide and should be read in conjunction with this document. Who is my adviser? Your adviser is Wayne Lucerne. He is an authorised representative of WealthSure Pty Ltd, Australian Financial Services Licensee No. 238030, principal member of the Financial Planning Association of Australia Ltd and the Australian Independent Advisers Association. Wayne holds ASIC Authorisation Representative Number – 255352. Background Wayne has been self employed working in financial services for over 2 decades and as a licensed financial adviser for over 16 years. He has a broad client base and advises on a great range of financial planning issues. These include savings and investment strategy, retirement planning, superannuation (self managed, corporate and public offer), risk insurance, estate and small business planning and tax minimisation. He is a pioneer in the industrial superannuation and self managed superannuation fund space having been advising clients on compliance (establishment and ongoing operation) since the early days of the 23F funds (in the 80’s). Wayne also provides specialised financial planning services to clients of accountants, solicitors, real estate agents and finance consultants, working together with them to provide a complete financial solution for their clients. He also has an uncommon expertise and knowledge in the corporate advisory, venture capital area having advised businesses from IT/dotcom (and other verticals) start-ups to established companies seeking equity financing prior to a initial public offer. Wayne completed his secondary schooling in 1981 and followed this with a Bachelor of Arts/Economics at the Australian National University. He is a Practitioner Member of the Financial Planning Association of Australia Limited and as such abides by their Code of Ethics and Rules of Professional Conduct. He is also a member of the newly formed Self Managed Superation Professionals Association of Australia (SPAA) and is proceeding with his specialist adviser accreditation. He is currently completing his final unit of the Diploma of Financial Planning through Deakin University and the Financial Planning Association of Australia prior to receiving the status of Certified Financial Planner (CFP). Wayne was employed as a policy analyst, ministerial speechwriter and protocol officer within the Commonwealth Public Service for over 15 years. What kinds of financial services are you authorised to provide to me and what kinds of products do these services relate to? Financial planning advice Life Insurance advice Superannuation and Rollover advice and strategies Tax planning strategies Wealth accumulation advice Retrenchment service Estate planning advice Self managed superannuation advice Share market investment advice Asset allocation advice Ongoing review and service Gearing strategies Asset management advice Social Security advice WealthSure Pty Ltd provides advice on a comprehensive range of products including Unit Trust products, superannuation, rollovers, annuities, allocated pensions, shares, debentures, term deposits, trauma, income protection and a full range of risk insurance products (all of which are referred to in this document as ‘products’). Your Adviser will explain the range of products they can advise on. How will I pay for the service? An initial meeting to discuss your financial circumstances is free of charge. At this meeting Wayne will establish how he can assist you and gather information required to prepare a comprehensive financial plan or an offer of services document. He will discuss the fee basis with you and agree on the method of charging prior to proceeding. Payment will be either by way of fee based on estimated time or a percentage of funds under advice or from the brokerage paid by the product issuers whose products are recommended. A fee for portfolio preparation or if investment recommendations are not implemented may also be charged. Ongoing advice and portfolio reviews are charged according to the portfolio size and structure. All fees are fully disclosed and agreement is reached prior to any charges being incurred. On specific capital raisings WealthSure Pty Ltd may be paid a placement fee which will also be disclosed. If you decide to proceed with the adviser’s recommendation WealthSure Pty Ltd may also be remunerated by receiving initial commissions from the fund manager or life company whose product you acquire, calculated as a percentage of the assets invested. All of these fees and commissions are set out in detail (including percentages or dollar amounts or both) in the financial plan or disclosure statement you will receive and if you do not understand them, you should ask your Adviser for clarification. Do any relationships or associations exist which might influence you in providing me with the financial services, other than the relationship with Personal Choice masterfund outlined within the Financial Services Guide? ------- No. WealthSure Pty Ltd ABN: 93 097 405 108 Australian Financial Services License No 238030 Suite 1, 34 Hasler Road, Herdsman Business Park, OSBORNE PARK WA 6017 Postal Address: PO Box 357, STUART HILL WA 6939 Telephone: (08) 9446 7496 Facsimile: (08) 9446 9681 Email: admin@wealthsure.com.au

![Literature Option [doc] - Department of French and Italian](http://s3.studylib.net/store/data/006916848_1-f8194c2266edb737cddebfb8fa0250f1-300x300.png)