Report - TradeMark Southern Africa

advertisement

Distr.

LIMITED

CS/CM/XXXII/2

February 2014

Original: ENGLISH

COMMON MARKET FOR EASTERN AND

SOUTHERN AFRICA

Thirty Second Meeting of the Council of Ministers

Kinshasa, Democratic Republic of Congo

22 – 24 February 2014

REPORT OF THE THIRTY SECOND MEETING

OF THE COUNCIL OF MINISTERS

(AM/MK/FM/AD/SS/MK/AKM)smz/lm

CS/CM/XXXII/2

Page 2

ACRONYMS

ACTESA

ACBF

AfDB

AFOLU

AFSTA

AGOA

APF

ASHTRIP

:

:

:

:

:

:

:

:

ASYCUDA

ATI

AU

CAADP

CAF

CBT

CCA

CET

CEMES

CO

CSA

CU

CVTFS

DDA

DEvCO

DfID

EAC

EAPP

e-COs

EDF

EPA

ESA

EEAS

EU-ACP

FAO

FDI

FEMCOM

FRL

FTA

GDP

GIS

HCPI

HIV/AIDS

ICGLR

ICT

IMF

IMTS

IOM

LLPI

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

Alliance for Commodity Trade in Eastern and Southern Africa

African Capacity Building Facility

African Development Bank

Agriculture, Forestry and Sustainable Land Use

African Seed Trade Association

African Growth and Opportunity Act

Africa Partnership Forum

ACTESA Seed Harmonization and Trade Regulations Implementation

Programme

Automated System of Customs Data and Management

African Trade Insurance Agency

African Union

Comprehensive Africa Agriculture Development Programme

COMESA Adjustment Facility

Cross Border Trade

Corporate Council on Africa

Common External tariff

COMESA Electronic Market Exchange System

Certificate of Origin

Climate Smart Agriculture

Customs Union

COMESA Virtual Trade Facilitation System

Doha Development Agenda

European Development Cooperation

Department for International Development (UK)

East African Community

Eastern Africa Power Pool

Electronic Certificates of Origin

European Development Fund

Economic Partnership Agreements

Eastern and Southern Africa

European External Action Services

European Union-African Caribbean and Pacific grouping

Food and Agricultural Organization of the United Nations

Foreign Direct Investment

Federation of Women in Business in Eastern and Southern Africa

Fiscal Responsibility Law

Free Trade Area

Gross Domestic Product

Geographic Information System

Harmonized Consumer Price Indices

Human Immune Virus/Acquired Immune Deficiency Syndrome

International Conference of the Great Lakes Region

Information and Communication Technology

International Monetary Fund

International Merchandise Trade Statistics

International Organisation of Migration

Leather and Leather Products Institute

CS/CM/XXXII/2

Page 3

MFIs

:

MDGs

:

MSMEs

:

NEPAD/APRM:

NIMCC

OECD

OSBP

PEFA

PFM

PTA Bank

PCMS

RAERESA

:

:

:

:

:

:

:

:

RCTG

REPSS

RFBS

RIA

RISM

SADC

SPS

STR

TFTA

TIFA

TMSA

TWG

UN

UNAIDS

UNCTAD

UNECA

UNFCCC

UNICEF

WHO

WTO

ZEP-Re

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

:

Micro Financing Institutions

Millennium Development Goals

Micro, Small and Medium Enterprises

New Partnership for Africa’s Development - African Peer Review

Mechanism

National Inter-ministerial Coordinating Committee

Organization for Economic Cooperation and Development

One Stop Border Post

Public Expenditure and Financial Accountability

Public Financial Management

Trade and Development Bank for Eastern and Southern Africa

Passenger Cargo Manifest System

Regional Association of Energy Regulators for Eastern and Southern

Africa

Regional Customs Transit Guarantee

Regional Exchange Payments and Settlement System

Regional Food Balance Sheet

Regional Investment Agency

Regional Integration Support Mechanism

Southern Africa Development Community

Sanitary and Phytosanitary Standards

Simplified Trade Regime

Tripartite Free Trade Area

Trade and Investment Framework Agreement

Trade Mark Southern Africa

Technical Working Group

United Nations

United Nations Joint Programme on HIV&AIDS

United Nations Conference on Trade and Development

United Nations Economic Commission for Africa

United Nations Framework Convention on Climate Change

United Nations Children’s Fund

World Health Organization

World Trade Organization

COMESA Re-Insurance Company

CS/CM/XXXII/2

Page 4

Table of Contents

ACRONYMS ……………………………………………………………………………………………..1

INTRODUCTION ………………………………………………………………………………………..5

OPENING OF THE MEETING …………………………………………………………………………5

ELECTION OF THE BUREAU ………………………………………………………………………..7

ADOPTION OF AGENDA AND ORGANISATION OF WORK …………………………………….8

CONSIDERATION OF THE CONSOLIDATED REPORT ON THE STATUS OF

IMPLEMENTATION COMESA PROGRAMMES AND COMESA INSTITUTIONS ……………..8

REPORT ON THE STATUS OF TRANSPOSITION BY MEMBER STATES ………………….8

TRADE AND CUSTOMS …………………………………………………………………………….15

THE COMESA MICRO, SMALL AND MEDIUM ENTERPRISES (MSME) STRATEGY ……….31

AGRICULTURE ……………………………………………………………………………………….40

INFRASTRUCTURE …………………………………………………………………………………..44

LEGAL AFFAIRS …………………………………………………………………………………….60

CLIMATE CHANGE …………………………………………………………………………………..61

STATISTICAL DEVELOPMENT …………………………………………………………………….64

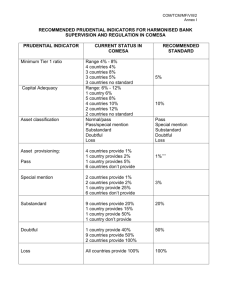

COMESA MONETARY COOPERATION PROGRAMME ………………………………………..67

GENDER AND SOCIAL AFFAIRS ………………………………………………………………….70

COMESA INNOVATIONS AWARDS ………………………………………………………………..71

PARTNERSHIP WITH COOPERATING PARTNERS ……………………………………………..76

REPORTS OF COMESA INSTITUTIONS ON THEIR OPERATIONS …………………………..82

THE COMESA FUND …………………………………………………………………………………82

THE COMESA INFRASTRUCTURE FUND (CIF) INTERIM BOARD REPORT (II)) ………….82

THE COMEA ADJUSTMENT FACILITY (CAF) AND THE REGIONAL INTEGRATION

SUPPORT MECHANISM (RISM) ……………………………………………………………………83

THE COMESA BUREAU ON THE THIRD PARTY MOTOR VEHICLE INSURANCE SCHEME

……………………………………………………………………………………………………………87

THE COMESA COURT OF JUSTICE ……………………………………………………………….90

COMESA LEATHER AND LEATHER PRODUCT INSTITUTE …………………………………92

PTA RE-INSURANCE COMPANY (ZEP-RE) ………………………………………………………92

PTA BANK ……………………………………………………………………………………………..94

COMESA CLEARING HOUSE ………………………………………………………………………98

COMESA REGIONAL INVESTMENT AGENCY .…………………………………………………102

AFRICA TRADE INSURANCE AGENCY…………………………………………………………..107

COMESA BUSINESS COUNCIL …………………………………………………………………..110

FEDERATION OF NATIONAL ASSOCIATIONS OF WOMEN IN BUSINESS IN EASTERN

AND SOUTHERN AFRICA …………………………………………………………………………113

COMESA COMPETITION COMMISSION …………………………………………………………114

THE ALLIANCE FOR COMMODITY TRADE IN EASTERN AND SOUTHERN AFRICA…....120

COMESA MONETARY INSTITUTE ……………………………………………………………….123

CLOSED SESSION OF INTERGOVERNMENTAL COMMITTEE ON ADMINISTRATIVE AND

BUDGETARY MATTERS ……………………………………………………………………………125

CS/CM/XXXII/2

Page 5

INTRODUCTION

1.

The Thirty Second Meeting of the Council of Ministers was held on 22 and 23 February,

2014 at the Grand Hotel, Kinshasa, in the Democratic Republic of Congo. The main purpose of

the meeting was to consider the progress of implementation of the integration agenda towards

achievement of the vision of COMESA of being a fully integrated regional economic community,

that is internationally competitive and prosperous with high living standards particularly for the

ordinary people, and that is fully part of the continental integration process.

2.

3.

The meeting was attended by:

a.

The following Member States: Burundi, Comoros, Democratic Republic of Congo,

Djibouti, Egypt, Eritrea, Ethiopia, Kenya, Madagascar, Malawi, Mauritius,

Rwanda, Seychelles, Sudan, Swaziland, Uganda, Zambia, and Zimbabwe;

b.

The following COMESA institutions: Alliance for Commodity Trade in Eastern and

Southern Africa, African Trade Insurance Agency, COMESA Brussels Liaison

Office, COMESA Business Council, COMESA Clearing House, COMESA

Competition Commission, Court of Justice, COMESA Federation of National

Association of Women in Business, Leather and Leather Products Institute,

COMESA Monetary Institute, COMESA Regional Investment Agency and PTA

Re-Insurance Company; and

c.

The following International Organisations: African Capacity Building Foundation,

African Union Commission, European Union, International Conference on the

Great Lakes Region, International Organisation for Migration, United Nations

Economic Commission for Africa, United Nations Economic Commission for

Africa; and

d.

The following observers: Japan, Nigeria, Sweden, and United Kingdom.

The list of participants is attached as Annex 1 to this Report.

OPENING OF THE MEETING (Agenda Item 1)

4.

The opening ceremony of the Thirty-Second Meeting was presided over by the

Chairperson of the Council of Ministers, Honourable, Amelia Kyambadde, the Minister of Trade,

Industry and Co-operatives, Uganda. She welcomed the Hon. Ministers and all the delegates to

the meeting and highlighted the achievements and the focus areas of the Bureau as outlined by

the Summit of COMESA Heads of State and Government.

5.

Honourable Kyambadde gave the background as to why the Heads of State and

Government at the Summit in their wisdom decided to prioritize mobilisation of resources for

regional infrastructure development; development of a framework for micro, small and medium

enterprises support; and strengthening gender mainstreaming in regional integration.

6.

On Infrastructure development, Honourable Kyambadde stated that they organized a

High Level Infrastructure Conference in Uganda in September 2013 to showcase projects at the

Member State and regional level that were ready for financing in order to attract potential

funding for these projects. The Bureau and COMESA Secretariat also participated in the Brazil,

Russia, India, China and South Africa (BRICS) Summit in Durban, South Africa in March 2013;

CS/CM/XXXII/2

Page 6

organized the COMESA-Dubai Business Forum held in Dubai in May 2013; and participated in

the Tokyo International Conference on African Development (TICAD) V which agreed to

accelerate infrastructure development.

7.

On the Micro, Small and Medium-Sized Enterprises (SMEs), COMESA developed a draft

Regional Micro, Small and Medium Enterprises MSMEs Development Policy which was to be

submitted to Council for adoption.

8.

Under the third priority of Strengthening Gender mainstreaming in Regional Integration,

COMESA was in the process of reviewing the COMESA Gender Mainstreaming Strategy and

Action Plan to align it with the African Union ‘Gender is My Agenda Campaign,’ and international

best practices.

9.

On the administrative front, she informed Council that the Bureau worked closely

towards the rehabilitation of the COMESA Centre that was gutted by fire. The Bureau had also

developed an appraisal mechanism for the executive arm of the Secretariat as directed by the

Summit.

10.

Honourable, Kyambadde concluded her remarks by thanking the Government of the

Democratic Republic of Congo for accepting to host the 2014 Policy Organs’ Meetings and for

the excellent preparations. She thanked Honourable Sosten Ngwengwe, the Malawi Trade

Minister; and Honourable Raymond Tshibanda, the DRC Foreign Affairs Minister with whom she

had worked as Vice-Chair and Rapportuer of the Bureau respectively. She also expressed her

sincere appreciation to the Secretary General and the COMESA Secretariat for the support,

guidance and leadership given to COMESA.

Statement of the Guest of Honour

11.

The Guest of Honour, Honourable Raymond Tshibanda N’Tungamulongo, the Minister

of Foreign Affairs, International Cooperation and Francophonie, of the Democratic Republic of

Congo (DRC) welcomed all delegates to Kinshasa in particular, and to the Democratic Republic

of Congo in general.

12.

He said that the 32nd Meeting of the Council of Ministers was an important one in the

history of the integration of the region because COMESA Member States shared a common

vision for development and regional integration, as established by the COMESA Treaty.

13.

“We have all continued to cooperate in the building of our Common Market, as we labour

through the establishment of the COMESA Free Trade. There is cooperation in COMESA trade

facilitation programmes, regional infrastructure programmes, common trade in service

negotiations, among others,” he said.

14.

Honourable Tshibanda said that the regional integration path had its fair share of

challenges. In particular he highlighted the fact that the region is yet to meet the timeframe of

achieving the Customs Union, a goal that was set to be achieved by June 2012. He reminded

the meeting that although the transition period was extended by two more years to June 2014,

this new timeline was not far.

15.

In view of the common aspirations, Honourable Tshibanda said that it was time for the

Council of Ministers to seriously consider the core reasons that had prevented the institution

CS/CM/XXXII/2

Page 7

from making progress in certain areas of regional integration. In order to move into a fully

operational Common Market by 2015, COMESA had to find lasting solutions to unlock the

constraints to the establishment of the Customs Union.

16.

Honourable Tshibanda said that he had every confidence that together the Member

States would overcome the challenges that they faced. He added that COMESA as a large

regional economic community that is well respected all over Africa and the world, and was a trail

blazer in initiating and operating pioneer integration programmes and institutions. COMESA had

over the years successfully established programmes in Non-Tariff Barrier elimination, the Yellow

Card insurance scheme, Harmonized Road Transit Charges, the COMESA Carrier License

scheme, air transport liberalization, harmonized standards and many more. It is, therefore, no

surprise that others had emulated COMESA.

17.

COMESA had signed and ratified several protocols and other legal instruments. As

result, the free movement of goods was already a reality. The investment regimes were largely

open, and what was needed was to harmonize them by committing to a common area for

investment.

18.

Honourable Tshibanda said that going by the zeal and faithfulness that many of our

Member States had exhibited in meeting their contributions in COMESA and in our sister

organisations, he believed the institution could be greatly improved if the Member States

thought and acted creatively. COMESA Member States’ over-dependence on external aid could

not continue indefinitely, and Member States had to take concrete steps to operationalize and

implement innovative financing mechanisms, such as the Common Market Levy. He called upon

the Honourable Ministers to join hands and forge ahead in addressing the fundamental issue of

establishing sustainable funding for the integration programmes. The region could build on the

strengths of the free movement of goods and services, and the commitment of the leaders to

enhancing trade and investment, agriculture and industrial development, among others.

19.

On the theme for this year’s Summit of: Consolidating intra-COMESA trade through

Micro, Small and Medium Scale Enterprise Development, the Honourable Minister said that the

Government of the Democratic Republic of Congo paid its respect to the Government of

Uganda, the outgoing Chair of COMESA, for selecting the theme of: “Enhancing intra-COMESA

trade through MSME Development”, for 2012. He added that COMESA’s programmes should

benefit MSMEs, which comprise more than 90% of the private sector in the region. He

concluded that COMESA was in position to establish dedicated financing mechanisms for

MSMEs, and to provide a framework for a wide group of partners that indicate their willingness

to work with COMESA in this area.

20.

The Honourable Minister wished the delegates fruitful deliberations, and declared the

meeting open.

ELECTION OF THE BUREAU (Agenda Item 2)

21.

The meeting elected the following Bureau:

Chair:

Democratic Republic of Congo

Vice Chair: Ethiopia

Rapporteur: Uganda

CS/CM/XXXII/2

Page 8

ADOPTION OF AGENDA AND ORGANISATION OF WORK (Agenda Item 3)

22.

The meeting adopted the following agenda:

1.

2.

3.

4.

Opening of the Meeting

Election of the Bureau

Adoption of Agenda and Organisation of Work

Open Session of Council - Report of the Intergovernmental Committee on:

(a)

(b)

(c)

5.

6.

7.

The Status of Implementation of COMESA Programmes

Reports of COMESA Institutions

Statements by Co-operating Partners

Closed Session of Council on Administrative and Budgetary Matters

Any Other Business

Adoption of Report and Closing of Meeting

CONSIDERATION OF THE REPORT OF THE TWENTY SECOND MEETING OF THE

INTERGOVERNMENTAL COMMITTEE ON THE STATUS OF IMPLEMENTATION OF

COMESA PROGRAMMES AND COMESA INSTITUTIONS (Agenda Item 4)

23.

The Rapportuer, Honourable Amelia Kyambadde, the Minister of Trade, Industry and

Co-operatives (Uganda) presented the Report of the Thirty Second Meeting of the

Intergovernmental Committee (IC) that was held from 18 – 21 February 2014 in Kinshasa,

Democratic Republic of Congo. The report (document reference: CS/IC/XXXII/5) was prepared

in compliance with the provisions of the Treaty to facilitate deliberations and decision making by

the Council and Authority. The reports of sectoral ministerial committee meetings were

submitted to Council for consideration and endorsement.

24.

The Council also included the reports of COMESA semi-autonomous and autonomous

Institutions. Pursuant to the provisions of Article 10 of the Treaty the IC Report groups the

various recommendations under Regulations, Directives, Decisions, Recommendations and

Opinions. The section of the report on transposition explains how these legislative requirements

are given the force of law at the COMESA level and in Member States.

REPORT ON THE STATUS OF TRANSPOSITION BY MEMBER STATES (Agenda Item 4(a))

25.

Council was informed that the COMESA Treaty, “Having regard to the principles of

international law governing relations between sovereign states, and the principles of liberty,

fundamental freedoms and the rule of law”, holds the Members of the Common Market bound

by it. The Treaty, therefore, established the legislative mandate for the COMESA region. It is

underpinned by international law.

26.

In international relations, treaties, as a source of international law provide a solid

foundation for the development of peaceful cooperation among nations globally hence are

regarded as the supreme law that binds countries and states that are a signatory to them. Under

international law, a State gives its expressed consent to be bound by a Treaty through signing,

exchanging instruments constituting a Treaty, ratification, acceptance, approval or accession or

through any other means agreed between the contracting parties (Article 11, 1969 Vienna

Convention on the Law of Treaties). Further, a contracting party to a Treaty is under a Treaty

CS/CM/XXXII/2

Page 9

obligation to perform its obligations in good faith (Article 26, Vienna Convention) and is stopped

from invoking provisions of its internal law to resile from performing its Treaty obligations (Article

27, Vienna Convention). These provisions are respected and fully upheld by the COMESA

Treaty.

27.

Council was further informed that when the Common Market was established, the

contracting Member States that signed its Treaty expressed their intention to be bound by the

Treaty. The COMESA Treaty, therefore, places important obligations upon the 19 States that

currently make up the Regional Economic Community’s Membership. The Member States are

bound to its provisions and obligations, which are to be upheld as provided for under Article 5,

which says:

“The Member States shall make every effort to plan and direct their development policies

with a view to creating conditions favourable for the achievement of the aims of the

Common Market and the implementation of the provisions of the Treaty and shall

abstain from any measures likely to jeopardize the achievement of the aims of the

Common Market or the implementation of the provisions of this Treaty.

Each Member State shall take steps to secure the enactment of and the continuation of

such legislation to give effect to this Treaty.”

28.

Council was reminded that the legislative and policy functions of COMESA are exercised

by the COMESA Council of Ministers as provided for under Article 9(2)(d) of the Treaty which

provides that:

“It shall be the responsibility of Council to: make regulations, issue directives, take

decisions, make recommendations and give opinions in accordance with the provisions

of this Treaty.”

29.

Since its formative years, the COMESA Council of Ministers has discharged its Article

9(2)(d) mandate resulting in a number of instruments being issued. The Thirty First Meeting of

the Council of Ministers of COMESA, which was held in Kampala, Uganda from 19 - 20

November 2012 received the 2012 Report on the Status of Transposition of Decisions by

Member States (document reference: CS/IC/XXXII/11). In consideration thereof, it was a

decision of that meeting which mandated the COMESA Secretariat to update the findings on

how far Member States have gone with implementing Regulations, Directives and Decisions of

the COMESA Council and present the updated finding in a Report on Transposition.

30.

Council was reminded that a decision issued by the COMESA Council of Ministers is

binding upon those to whom it is addressed. This is provided for under Article 10(4) of the

Treaty. Such Decision may be addressed to the Secretariat, or a Member State or a third

party/individual. Article 9(3) on Decisions provides that:

“Subject to the provisions of this Treaty, the…..decisions of the Council taken or given in

pursuance of the provisions of this Treaty shall be binding on the Member States, on all

subordinate organs of the Common Market other than the Court in the exercise of its

jurisdiction and on those to whom they may under this Treaty, be addressed.”

31.

Bearing in mind the above, the Common Market Gazette contains all the decisions taken

by the Council in accordance with the provisions of Article 10(1) of the COMESA Treaty. Over

the period 2009-2012, Council took a total of 217 decisions (Table 1), as reflected in the

CS/CM/XXXII/2

Page 10

Gazette. Out of this, 114 decisions (53%) were for implementation by Member States and 44

decisions (20%) were addressed to the COMESA Secretariat; a further 29 (13%) decisions were

not addressed to any party. In cursory analysis of the quality of decisions taken by Council and

reflected in the Gazette reveals that 45 decisions (21%) across the categories listed in Table 1

were in effect not decisions. One hand, 29 of the decisions had no party to whom they were

addressed and could therefore not be taken as decision per se. The rest were all

recommendations, opinions, suggestions, requests, commendations, et cetera, which,

according to Article 10(5) of the Treaty: “…shall have no binding force” and thus could not be

treated as decisions.

Table 1: Decisions in the Common Market Gazette, 2009-2012

Party to

addressed

which

Decisions

were Decisions

Gazette

in

the (%)

Member States

114

53%

COMESA Secretariat

44

20%

3rd Parties

5

2%

Joint Sec-MS

19

9%

Joint MS-3rd Party

1

0%

Joint Sec-3rd party

2

1%

Joint Sec-MS-3rd party

3

1%

Not addressed to any party

29

13%

Total Decisions

217

100%

Sec = Secretariat; MS = Member States

32.

Council was informed of the following critical issues that emerged from the above

statistical observations, which require systematic and diligent attention in order for the COMESA

region to enhance its decision making and improve its record of implementation:

(a) Number of decisions addressed to Member States: the large number of decisions

addressed to Member States over the years has created a back-log in

implementation. This back-log has to be cleared. The starting point should be to

establish, as a matter of fact, which decisions out of the 114 that were addressed to

Member States have been implemented and which ones are still outstanding. The

work programme for establishing the status of implementation should be guided by

Article17 (8)(j),(k)1 and Article 17(9)2 of the Treaty, starting in 2014 and should,

1The

Secretary General shall: (j) on his own initiative or as may be assigned to him by the Authority or the Council,

undertake such work and studies and form such services as relate to the aims of the Common Market and to the

implementation of the provisions of this Treaty; and (k) for the performance of the functions conferred upon him by

this Article, collect information and verity matters of fact relating to the functioning of the Common Market and for that

purpose may request a Member State to provide information relating thereto.

2 The Member States agree to co-operate with and assist the Secretary-General in the performance of his functions

set out in paragraph 8 of this Article and agree in particular to provide any information which may be requested under

sub-paragraph (k) of paragraph 8 of this Article.

CS/CM/XXXII/2

Page 11

among other things, seek to use the approach and the presented draft template as

the means to establish the status of implementation.

(b) Quality of decisions: the large number of decisions as well as the observations that

as many as 13% of them were not addressed to any party and 21% were not proper

decisions raises fundamental questions about the quality of decisions that end up

being made by the Council and thus published in the Common Market Gazette.

Therefore another important exercise in parallel with clearing the back-log of

decisions should be to improve the quality of future decisions through a process of

distilling the decisions and determining which ones are indeed decisions in

accordance with the Treaty and are actionable at the policy level of the Council. This

should be another component of the work programme in 2014.

33.

Council was further informed that Article 10(2) of the Treaty provides that a Regulation

issued by the COMESA Council of Ministers is binding on all Member States in its entirety. This

essentially means that the question of domestication of Regulations that have been passed by

Council is a non-issue as Council Regulations are ipso juris facto binding upon passing. Further,

a Treaty obligation is placed upon Member States by Article 5(2)(b) to give Council Regulations

the force of law in their territories as it provides that:

“Each Member State shall take steps to secure the enactment of and the continuation of

such legislation to give effect to this Treaty and in particular: to confer upon the

regulations of the Council the force of law and the necessary legal effect within its

territory.”

34.

Article 9(3) of the Treaty provides as follows:

“Subject to the provisions of this Treaty, the regulations……of the Council taken or given

in pursuance of the provisions of this Treaty shall be binding on the Member States, on

all subordinate organs of the Common Market other than the Court in the exercise of its

jurisdiction and on those to whom they may under this Treaty, be addressed.”

35.

Council noted the examples of Regulations that had been passed by Council over the

period 2009-2012.

36.

Council was informed that establishing the status of domestication of the regulations,

which Council adopted and which are binding on all the Member States in their entirety requires

both compliance with Article 5(2)(b), which gives the regulations the force of law in the territories

of the Member States; and also that Member States, in compliance with Article17(8)(j),(k) and

Article 17(9) of the Treaty, deposit their national legislative instruments, which confer upon the

regulations the force of law and the necessary legal effects within the territories of the Member

States. The latter provides the evidence that Member States are in compliance with the relevant

provisions of the Treaty.

37.

With regards to the published rules and regulations of 2009-2012, it was noted that none

of the Member States had deposited their national legal instruments as evidence of enforcing

the regulations in their territories. Going forward, the work programme on transposition should

focus on ensuring that Member States routinely deposit their legal instruments. All future reports

on the status of transposition will reflect the status on rule and regulations based on the

deposited evidence from the Member States.

CS/CM/XXXII/2

Page 12

38.

On the Directives of the COMESA Council of Ministers, Council was informed that Article

10(3) of the Treaty provides that a Directive issued by the COMESA Council of Ministers is

binding upon each Member State to which it is addressed as to the result to be achieved but not

as to the means of achieving it. Further, Article 9(3) of the Treaty provides as follows:

“Subject to the provisions of this Treaty, the….directives…of the Council taken or given

in pursuance of the provisions of this Treaty shall be binding on the Member States, on

all subordinate organs of the Common Market other than the Court in the exercise of its

jurisdiction and those to whom they may under this Treaty, be addressed.”

39.

In the current format of the Common Market Gazette (2009-2012), a clear separation

between decisions and directives has not been done in so far as the presentation is concerned.

However, the content of the Gazette allows for a cursory analysis to distinguish between

decisions and directives. For example, at the Member State level, out of the 114 decisions of

the Council, 25 (22%) were actually directives addressed to specific Member State not to all the

Member States of the region. The future work programme on transposition should endeavor to

re-orient the Common Market Gazette to a format that draws clear distinctions between

decisions and directives, in the way these are presented.

40.

As of end December 2013, the status of signing and ratification of legal instruments was

as shown in Table 2. A total of 9 legal instruments (or 75%) out of the total of 12 instruments

considered in the table had been signed by the majority (more than 50%) of Member States

while 5 instruments (42%) has been ratified. The only instruments that had received significant

amounts of consideration by more than 90% of Member States were the COMESA Treaty, the

Agreement on Privileges and Immunities, and the Charter establishing the Federation of

National Associations of Women in Business in Eastern and Southern Africa. Overall, the region

fared well above average (i.e., above 50%) in terms of signing of legal instruments and

marginally below average in terms of the ratification of legal instruments. The status saw no

marked changed between 2012 and 2013.

41.

The status on the signing and ratification of COMESA instruments is clear because the

Member States have complied with the Treaty provision that the instruments be deposited with

the COMESA Secretary General.

Table 2: Summary on status of signing and ratification of legal instruments

Numbers

Percentages

Legal Instrument

Signed Ratified

Signed

Ratified

1

COMESA Treaty

19

19

100%

100%

2

Customs Bond Guarantee

10

9

53%

47%

3

Charter on the Regime of Multinational 9

Industrial Enterprises (MIE)

2

47%

11%

4

Agreement on Privileges and Immunities 19

to be recognized and granted

Binding 100%

on

all

MS

Binding

on all MS

5

Protocol on the gradual relaxation and 17

eventual elimination of visas

17

89%

89%

CS/CM/XXXII/2

Page 13

Legal Instrument

Numbers

Percentages

Signed Ratified

Signed

Ratified

6

Protocol on establishment of the Fund for 14

Cooperation,

Compensation

and

Development

13

74%

68%

7

Charter establishing the Federation of 18

National Associations of Women in

Business in Eastern and Southern Africa

18

95%

95%

8

PTA Bank Charter

13

13

68%

68%

9

ZEP-RE Charter

12

9

63%

47%

1

0

COMESA Common

(CCIA) agreement

0

0%

0%

1

1

Charter on the

Institute (CMI)

…

63%

…

1

2

Protocol on free movement of persons, 4

labour,

services,

the

right

of

establishment and residence

1

21%

5%

Investment

COMESA

Summary

Statistics

Instruments

on

Area 0

Monetary 12

Legal

1

3

Signed/ratified by more than 75% of 3

Member States

3

25%

25%

1

4

Signed/ratified by more than 50% of 9

Member States

5

75%

42%

1

5

Signed/ratified by less than 25% of 2

Member States

3

17%

25%

In all cases the total of 19 Member States was considered

A total of 12 legal instruments were considered

… means no data available at the time of drafting.

42.

Council was also informed that the decisions of the COMESA Court of Justice should

are instructive towards the interpretation of decisions, directives, regulations (and rules) and

COMESA instruments. The Court’s decisions have significant implications in particular for

Member States and the COMESA Secretariat. For example, the COMEA Court of Justice in the

matter of Polytol Paints & Adhesives Manufacturers Co. Ltd versus the Republic of Mauritius,

Reference 1/2012 to a large extent dealt with the issue of domestication of COMESA

instruments. Their Lordships in the matter reasoned that:

“Any Member State that acts contrary to the Treaty cannot, therefore, plead the nature of

its legal system as a defence when citizens or residents of that State are prejudiced by

its acts. This is clearly stipulated in Article 27 of the Vienna Convention on the Law of

Treaties, 1969 which provides that “[a] party may not invoke the provisions of its internal

law as justification for its failure to perform a treaty.”

CS/CM/XXXII/2

Page 14

43.

The Court’s ruling, as alluded to above, underscored the fact that once a Member State

has signed the COMESA Treaty, it is under an obligation to implement it and cannot raise

issues of internal law as a justification from rescinding from implementation. By extension, once

the COMESA Council of Ministers has issued its different instruments, Member States to whom

the type of instrument issued is addressed, with the exception of Regulations that are binding on

all Member States, are under a Treaty obligation to implement same.

Discussion:

44.

The meeting observed that:

a.

In the case of the conflict between national law and the COMESA Treaty, it is the

obligation of Member States to take the necessary steps to align the domestic law in

accordance with Article 5(2) of the COMESA Treaty;

b.

The identification of capacity constraints and capacity building needs at the national

level, as well as the building of the necessary in-country capacity for domestication

and implementation, is the responsibility of the Member States;

c.

While the Secretariat may provide the necessary technical assistance on

domestication upon a request by Member States, Member States are obliged to

domesticate and implement the decisions addressed to them;

d.

The Secretariat should ensure that decisions, directives, regulations,

recommendations and opinions are distinguished and categorized in reports;

e.

The Common Market Gazette should be updated such that all regulations and

decisions are captured in line with the COMESA Treaty provisions;

f. The recommendations, opinions, commendations and other such operatives that have

no binding force should not be included in the Gazette; and

g.

There is need to review instruments that were adopted by Council but have not

entered into force due to lack of the requisite signatures and ratifications.

Decisions:

45.

Council:

i.

Directed the Secretariat to provide a compendium of all decisions,

regulations and directives for implementation by Member States not later

than 31 March 2014;

ii.

Urged Member States to domesticate the COMESA Treaty and all Protocols

and submit the instruments to the Secretary General not later than 31

December 2014;

iii.

Urged Member States to domesticate all outstanding regulations by 31

December 2014;

CS/CM/XXXII/2

Page 15

iv.

v.

Urged Member States that are not in a position to comply with these

decisions on domestication of the COMESA Treaty, all Protocols and

instruments and all outstanding Regulations to notify the Secretary General

of their respective positions, with justifications explaining why they cannot

do so.

Directed the Secretariat to obtain from Member States:

a.

b.

c.

d.

Copies of legal instruments that have not been deposited with the

COMESA Official Depository;

Copies of legal instruments that were previously submitted but

destroyed or damaged as a result of the fire in 2011 upon request by

Secretariat;

Copies of Gazettes through which the domestication of legal

instruments of COMESA were published; and

Copies of other bilateral trade and investment agreements that

Member States have notified to COMESA.

vi.

Urged Member States that are not able to domesticate the COMESA Treaty and all

protocols including regulations to notify the Secretariat and state the reasons thereof.

TRADE AND CUSTOMS (Agenda Item 4(a) (ii))

46.

Council was informed that the COMESA Trade liberalization programme is grounded in

provisions under Chapter VI of the COMESA Treaty, which enjoins Member States to cooperate

in trade liberalization and development. The trade liberalization programmes envisaged the

progressive reduction and eventual removal of tariffs for intra-COMESA trade, the gradual

establishment of the Common External Tariff (CET) and provision for the definition of products

originating in the Member States. In addition, Article 49 calls on “Member States to remove

immediately upon entry into force of the Treaty all then existing NTBs and thereafter refrain from

imposing any further restrictions or prohibitions on regional goods”.

47.

Council received the report of the 29th Meeting of the Trade and Customs Committee

(document reference: CS/TCM/TCM/XXIX/13), which contains details of the deliberations and

recommendations made. The key elements of the report include the following:

48.

Council was informed that the FTA was attained in 2000 with nine Member States and

since then five more Member States have joined bringing the total number to fourteen. The

existence of the FTA has in part led to a rise in intra-COMESA trade from US $3.1 billion in

2000 to US $19.3 billion in 2012, reflecting a 523 percent growth rate over the period or 44

percent per annum on average.

49.

It was further noted by Council that global trade for the COMESA countries in 2012 grew

by 9 percent from US $240 billion in 2011 to US $262 billion in 2012. Total exports rose by 12

percent from levels of US $96 billion in 2011 to US $108 billion in 2012, while imports on the

other hand also registered a 7 percent growth, from US $144 billion in 2011 to US $155 billion in

2012.

CS/CM/XXXII/2

Page 16

50.

At country level, some of the countries that greatly contributed to the overall 12% total

exports growth in the region were Libya (108% growth), Burundi (24% growth), Rwanda (22%

growth), Swaziland (18% growth) and Congo DR (12% growth). Notably among the countries

that registered negative growth in their total exports in the year 2012 is Sudan with a decline of

63%. On the import side, among the countries that contributed to the overall 7% growth in 2012

are Libya, Ethiopia, Zambia and Uganda with growth rates of 46%, 36%, 23% and 19%

respectively. Others were Kenya (10% growth) and Egypt (9% growth). On the other hand,

Sudan and Seychelles are among the countries that experienced drops in levels of their global

imports with declines of 35% and 38% respectively.

51.

Intra-COMESA total trade grew by 5% in 2012 over 2011 levels, from US $18.4 billion in

2011 to $19.3 billion in 2012. Among the countries contributing to this growth were Libya,

Zambia and Rwanda, all with growths in both intra-exports and intra-imports in 2012.

52.

Other notable contributors with positive growth in their intra-COMESA exports are Egypt,

Malawi, Zimbabwe and Uganda also contributed to the intra-COMESA growth with positive

growths in their intra-COMESA imports.

53.

Whereas over 98% of Libya’s intra-COMESA trade is with Egypt with imports comprising

of different products, Libya’s exports to Egypt are mainly petroleum oils and oils obtained from

bituminous minerals and these amounted to over US $92 million in 2012. Zambia’s imports from

Congo DR in 2012 amounted to over US $1.2 billion, and these were mainly copper ores and

concentrates, copper powders and flakes and cobalt oxides. Zambia’s major intra-export

product was maize corn to Zimbabwe worth over US $240 million in 2012. Rwanda’s major

intra-export products were mainly tea and coffee to Kenya and Uganda (worth over US $126

million in 2012) while her major intra-COMESA imports comprised of Portland cement, animal

and vegetable fats and palm oil all from Uganda.

54.

Malawi’s major intra-COMESA imports were petroleum gases and oils from Zambia and

these amounted to almost US $300 million in 2012 while Zimbabwe’s intra-COMESA imports for

maize and tobacco from Zambia were worth over US $374 million in 2012 (almost 60% of her

intra-imports). Over 83% of Uganda’s intra-COMESA imports are from Kenya and these are

various products topped by Portland cement and petroleum oils among others.

55.

As for the top-most traded products within the region in value terms, Copper ores and

concentrates were still ranked as number one for the third year running from 2010 as illustrated

in the table below. Ranked second after the Copper ores and concentrates was black tea,

previously ranked number one in 2009 and 2008. Portland cement and cobalt ores and

concentrates were ranked in the third and fourth positions respectively in 2012.

56.

According the UNCTAD report on Economic Development in Africa 2013, in the period

from 2007 to 2011, the share of manufacturing in trade between regional economic communities

was highest in EAC (58.3 percent), followed by SADC (51.4 percent), COMESA (44.8 percent),

IGAD (39.1 percent), AMU (35.2 percent), CEN-SAD (34.3 percent) and ECOWAS (25.7

percent). These variations in numbers are associated with the differing levels of manufacturing

development of the member countries of the regional blocs.

57.

Compared to other RECs, COMESA does not fare very well in terms of the share of

intra-regional trade to total trade as shown in the table below. However, COMESA is the only

REC which experienced a sustained increase in intra-trade from 5.1% during the period 1996-

CS/CM/XXXII/2

Page 17

2000 to 6.7% during the period 2007-2011 suggesting that the existence of the FTA has a

beneficial effect on intra-COMESA trade. For the eight RECs recognized by the African Union,

during the period 2007-2011 SADC had the highest intra-trade of 12.9%, followed by EAC at

12% , ECOWAS at 9.4% and COMESA was fourth at 6.7%.

58.

Council noted that the low intra-COMESA trade is in part due to the low trade

complementarity among COMESA countries. Trade complementarity helps to get a measure of

how a country’s (or region’s) export supply fits into the import demand of its trading partners.

The analysis of COMESA country bilateral complementarity reveals only partial complementarity

in all cases of bilateral trade. An index between 50% and 60% is achieved in nine cases out of a

total of 342 possible bilateral trade combinations This is with regard to bilateral trade mainly

between Egypt as an exporter and the following countries as importers; Ethiopia, Kenya,

Madagascar, Malawi, Mauritius, Seychelles, Swaziland, Uganda and Zimbabwe. An index of

between 40% and 50% is achieved in eleven cases. Once again this is mainly between Egypt

as an exporter and the following countries as importers; Democratic Republic of Congo,

Djibouti, Eritrea, Libya, Rwanda, Sudan and Zambia. While the complementarity index is low, it

is important to mention that it is not a static situation. As countries move up the value chain

ladder and as industries are set up and mature, the complementarity index has the potential to

change for the better. The table below shows the complementarity Index with the coloured

entries showing a complementarity index of above 40%.

59.

The COMESA region’s export concentration index increased from 32% in the mid-1990s

to 42% in 2012. This increase in concentration is attributed to the larger role played by

commodity exports among regional member countries in their overall export profile. However at

a country level, the following countries’ indices decreased in the period under review, reflecting

exports that were less concentrated in few sectors; Uganda, Ethiopia, Egypt, Rwanda, Malawi

and Zambia.

Discussion:

60.

The meeting made the following observations:

a.

The Private sector has a vital role to play in promoting value addition and intraCOMESA trade in order to improve trade complementarity in the region;

b.

The study on preference utilization, which has been done by the Secretariat, should

be circulated to Member States. In this regard, account should be taken of trade that

takes place under other FTAs;

c.

The statistics of the Member States should disaggregate the figures of Sudan and

South Sudan, starting from the year 2012 when the latter became a separate

Member State; and

d.

There is need for the region to have a common industrialization policy.

CS/CM/XXXII/2

Page 18

Decisions

61.

Council:

i.

Directed the Secretariat to prepare a paper on the common industrialization

policy to advance the industrialization of the COMESA region by 30 June

2014;

ii.

Directed the Secretariat in collaboration with Member states to ensure that

COMESA trade statistics reflect the actual trade done under COMESA Trade

Regime taking into consideration multiple memberships in different RECs;

and

iii.

Directed the Secretariat to work with Member States to assess the

constraints to increasing intra-COMESA and global trade and recommend

appropriate solutions not later than 30 September 2014.

Participation in the FTA

62.

The meeting received an update on the Member States participation in the FTA.

63.

DR Congo had made the decision to join the COMESA FTA following the impact

assessment study recommendations. The instrument of accession that was developed for that

country was before the legislature and it was expected that DR Congo would finalise its internal

consultation processes and join the FTA as soon as possible. The meeting was informed that

the Secretary General would receive communication once Parliament resumes and finalises the

legal instruments.

64.

The State of Eritrea reduced tariffs for COMESA trade by 80 percent. A national

workshop on COMESA Programmes focusing on Rules of Origin and benefits of FTA is planned

to be held in 2014 with a view to enhancing capacity as the country prepares to participate fully

in the COMESA FTA.

65.

Ethiopia conducted an FTA impact assessment study in 2011 to address key areas

including the Macro-economic framework for competitiveness, trade and investment, industry,

agriculture, and agro-industries competitiveness and Institutions and infrastructure. A national

validation workshop was held on 16 May 2013 to validate the report. Following the comments

made at the workshop, the consultants reviewed and finalised the study report and Ethiopia is

expected to make a decision regarding participating in the FTA soon. The meeting was informed

that the study recommended two scenarios including one for a phased in approach..

66.

Uganda is at 80% tariff reduction for COMESA trade and had made significant progress

in its bid to join the COMESA FTA after the President of Uganda made the announcement to

that effect at the last Summit in November 2012. The meeting noted that internal processes

were almost complete and that Uganda would be participating in the FTA from July 2014. The

meeting was informed that the Finance Bill would be deposited with the Secretariat once it is

passed by Parliament by September 2014.

CS/CM/XXXII/2

Page 19

67.

Swaziland was under derogation which Council at its 28th Meeting decided that it

(derogation) be extended beyond December 2010 and that it be linked to the establishment of

the Tripartite FTA when Swaziland would participate in the Tripartite FTA.

Decisions:

68.

Council decided that:

i.

The Republic of Uganda should deposit with the Secretariat its instruments

of accession to the FTA by December 2014.

ii.

The Democratic Republic of Congo should deposit its instruments of

accession to the FTA with the Secretariat by December 2014; and

iii.

The Federal Republic of Ethiopia should deposit its instruments of

accession to the FTA with the Secretariat by September 2014.

Non-Tariff Barriers (NTBs)

69.

The meeting noted that Article 49 of the COMESA Treaty provides that each Member

State undertakes to remove all existing Non-Tariff Barriers to intra-COMESA trade upon entry

into force of the Treaty. That notwithstanding, the region has witnessed the proliferation of all

forms of NTBs that stifle the free flow of intra-COMESA trade thereby impacting negatively on

volumes and values. These NTBs that are usually arbitrarily imposed could pose a challenge in

future investments in the affected products. In an effort to effectively deal with this challenge,

COMESA has developed mechanisms to identify, report and monitor the elimination of NTBs

including the on-line Reporting and Monitoring Mechanism and the SMS NTB reporting tool that

are under use by the Tripartite Member/Partner States.

70.

The above noted NTB on-line reporting and monitoring mechanism had by December

2013, 461 reported 461 NTBs out of which 378, (representing 82%) have been resolved

whereas 83 (representing 18 %) still remain unresolved. It should be noted that the Tripartite

NTB on-line reporting and monitoring mechanism as well as the SMS NTB reporting tool have

contributed positively to fast tracking the NTB resolution process and hence, the impressive

percentage of resolution of reported NTBs. It was noted that despite the measures so far in

place to address NTBs including the establishment of Institutional structures on NTBs that

included Focal Points and National Monitoring Committees (NMCs) both at regional and

national levels, the challenge of imposition of unpredictable NTBs still persists in COMESA.

71.

In order to ensure compliance with the various provisions of the Treaty, the Council of

Ministers agreed on the need to develop Non-Tariff Barriers Regulations that provide for

institutional and legal mechanisms of enforcement. In the past three years the technical

committees have by and large discussed and agreed on NTB Regulations which will be

submitted in 2014 to the committee of legal experts and Ministers of Justice/Attorneys General

for finalization.

Discussion:

72.

Council made the following observations:

CS/CM/XXXII/2

Page 20

a.

The draft NTB regulations should be adopted by the Trade and Customs Committee

before being submitted to the Legal Drafting Sub-committee.

b.

Egypt received the Kenya verification delegation and considered the matter to be

finalised. On the other hand, Kenya advised that there was need for another mission

that would cover the sugar factories and would include the Secretariat and the

private sector.

c.

Swaziland had proposed an extra-ordinary meeting where the issue of exportation of

fridges from Swaziland to Zimbabwe would be deliberated; and Zimbabwe proposed

bilateral consultations on the issue.

d.

Mauritius raised the issue of its exports of window and door frames to Burundi,

which are facing restrictions, despite a Secretariat mission to assist resolve the

matter.

73.

Burundi informed the meeting that it had issued a Statutory Instrument rescinding the

statutory instrument that had instructed duties and taxes on door and window frames and that

the documentation would be availed to the Secretariat.

Decisions:

74.

Council directed that:

i.

The draft NTB regulations should be adopted by the Trade and Customs

Committee before being submitted to the Legal Drafting Sub-committee;

ii.

The Secretariat should carry out an audit and impact assessment of

existing NTBs by 31 August 2014 and prepare a schedule for immediate

removal;

iii.

Kenya and Egypt should agree on mutually acceptable dates for another

verification mission to ascertain the originating status of white milled sugar

and LG products by 31 October 2014;

iv.

The Secretariat should facilitate a bilateral meeting between Swaziland and

Zimbabwe on the exportation of fridges by 30 April 2014;

v.

The Secretariat should lead all future NTB verification missions to the

Member States and submit the reports; and

vi.

Burundi should deposit the instruments rescinding import duties and taxes

on doors and window frames to the Secretary by 31 March 2014.

Electronic Certificate of Origin (e-COs)

75.

Council noted that the Trade and Customs Committee had also considered and

accepted a proposal to replace the manual certificates of origin with the electronic certificates of

origin in a bid to speed up the process of certification as well as facilitate trade in real time. The

e-COs assist in keeping pace with the rapid worldwide shift to e-business, and many

CS/CM/XXXII/2

Page 21

international Chambers of Commerce and Industry are now issuing COs electronically,

complete with digital rubber stamp and signatures, to provide CO in a secured documentation

environment. The benefits of the e-COs are not only to facilitate and provide secured trade, but

it also saves time and labour cost; increases transparency and efficiency; improves productivity;

reduces paperwork through online data exchange and integration; minimizes data inaccuracy

through data sharing; fights forgery; provides 24/7 convenience and the convenience of online

application tracking; and provides the convenience of having a direct link to banks for Letters of

Credit clearance and Customs for speedy Customs clearance.

76.

Council noted that the Member States that are ready to commence operationalisation of

the electronic certificate of origin should do so.

Decisions:

77.

Council:

i.

Urged Member States that are ready to accept and use the electronic

certificate of origin by 31 July 2014;

ii.

Urged Member States whose legal systems do not provide for e-COs should

to enact enabling laws as soon as possible; and

iii.

Directed the Secretariat to ensure that an additional Section for Payment

through REPSS is inserted in the COMESA e-Certificate of Origin by 30 May

2014.

Simplified Trade Regime

78.

Council noted that the Simplified Trade Regime has been put in place between

contiguous Member States in order to enable small scale cross-border traders to benefit from

the COMESA trade preferences. The passenger cargo manifest system (PCMS) had been

piloted between Zambia and Zimbabwe. The STR was being implemented in seven COMESA

countries (Burundi, Kenya, Malawi, Rwanda, Uganda, Zambia and Zimbabwe) while the PCMS

is under pilot in two Member States i.e. Zambia and Zimbabwe. An analysis of the

implementation of the STR and the PCMS in the region was undertaken.

Decisions:

79.

Council:

i.

Directed Member States to apply a processing fee of a maximum of $1 for all

STR transactions by 31 December 2014;

ii.

Directed the Secretariat to prepare an expanded list of commonly traded

products by 30 June 2014;

iii.

Urged Member States to raise the STR threshold to a minimum of US $2,000 by

31 December 2014;

iv.

Directed Member States to implement the newly introduced Passenger and

Cargo Manifest system by 30 October 2014;

CS/CM/XXXII/2

Page 22

v. Directed the Secretariat to facilitate the meeting between Kenya and Ethiopia

to conclude the STR between them; and

vi. Directed Member States to conduct awareness meetings for traders and

refresher training workshops for staff on matters relating to STR and PCMS in

order to ensure smooth operations at border stations.

The Customs Union

80.

Council noted that since the Authority launched the Customs Union in June 2009 and

agreed on a three-year transition period during which each Member State, pursuant to the

provisions of Article 10, 11 and 12 of the treaty, was to enact the following Common Market

legislation: the Common Tariff Nomenclature (CTN); the Common External Tariff (CET); and the

Common Market Customs Management Regulations (CMRs); to date not a single Member

State has domesticated the Common Market legislation for the Customs Union with the result

that the process of operationalizing the customs union has not commenced. Further, the

Authority in November 2012, noted that the Common Market legislation on the Customs Union

was still pending and extended the transition period for a further two years to June 2014 to

enable Member States to domesticate the Customs Union Legislation.

81.

Council also noted that the Fourth Meeting of the Committee on the Customs Union held

on 10-12 June 2013 reviewed the status of implementation of the Customs Union. The Meeting

finalized the draft COMESA CTN/CET transposition from HS 2007 to 2012 which is

recommended for adoption by Council through the IC. On the basis of the agreed HS2012

Member States are in the process of finalizing their lists and schedules of tariff alignment.

82.

The progress on implementation of the key instruments by Member States during the

transition period is summarized as follows: on the implementation of the CTN, six Member

States (three of them with indicative time line, 2014 - 2015) reported that they are in the process

of migrating to the COMESA CTN (DR Congo, Eritrea, Madagascar, Malawi, Mauritius, and

Zambia). Similarly, on migration to the CET, five Member States (two of them with indicative

time line, 2015) reported that they are in the process of adopting their national tariff into the

COMESA CET (Comoros, Eritrea, Madagascar, Malawi, and Zambia). With regards to the

submission of list of sensitive products, so far ten Member States have submitted their list of

sensitive products (Burundi, Comoros, Eritrea, Kenya, Madagascar, Mauritius, Rwanda, Sudan

and Uganda); and two Member State have submitted their final list of sensitive products (Malawi

and Swaziland)). Finally, on domestication of CMRs, two Member States reported that they

have already incorporated the CMRs in their national customs Laws (Seychelles and Sudan);

and nine Member States reported that they were in the process of domesticating the CMRs

(Comoros, DR Congo, Egypt, Eritrea, Madagascar, Malawi, Mauritius, Zambia and Zimbabwe).

83.

On the challenges, Member States reported that in order to implement regional

decisions, there were adjustment costs associated with alignment to the Common Tariff

Nomenclature (CTN) and the Common External Tariff (CET) including injury caused to local

industry. It also involves financial resources used to change laws, conducting consultations with

stakeholders such as the private sector and civil society. Similarly, poor institutional coordination

on regional integration matters, for a long time matters have been handled by diverse

institutions. Some Member States reported that they experience serious challenges relating to

sensitivity of some tariff lines to trade liberalization. For instance, Malawi stated that a good

CS/CM/XXXII/2

Page 23

component (35%) of Malawi’s tax revenue comes from trade taxes (customs duties); hence,

trade liberalization has led to loss of revenue collected from such taxes. Similarly, resource

constraints in the form of financial, human resource and material are also another major

challenge in implementation and domestication of COMESA programmes.

84.

Concerns were raised by Member States that needed to be addressed before the

implementation of the Customs Union such as fear of loss of customs revenues, reviewing the

studies on the 5% and the substantial tariff lines below the CET issues (already Secretariat

reviewed the two studies) to provide concrete policy recommendations for Member States on

how they can participate in the Customs Union. For instance, some Member States have more

than 50% of their national tariff lines at 0% rate and are finding it very difficult to move them

upwards due to their impact on competitiveness as well as impact on consumer goods prices.

Other Member States also have bound several tariff lines at zero percent at WTO and as

signatory to the Information Technology Agreement. Any re-alignment to the COMESA CET

would entail re-negotiation of their tariff bindings at the level of the WTO in order to compensate

those members that would be negatively affected by the tariff change. Similarly, there is the

issue of exemption regimes that need harmonization or approximation in order to enforce the

CET efficiently and effectively.

85.

Regarding the harmonization of the instruments of the Customs Union between

COMESA and EAC, a meeting was held on 03-05 September 2013 during which the four

COMESA/EAC Member States concluded, amongst others, that: under the principle of variable

geometry and in light of the substantial convergence between the two customs unions (80% of

the two CETs already harmonized), they can already implement the elements of the COMESA

customs union that are in harmony with the EAC customs union; the EAC Customs

Management Act (CMA) is the national customs law of the four partner/ member states, and can

be used as such in implementing the COMESA CMRs where the COMESA CMRs refer to the

national laws of member states; and there is need for formally tabling the issue of joining the

customs union before the EAC relevant organs for consideration; in this regard, one of the four

member/ partner states that will do so should be supported by the others.

Discussion:

86.

Council noted the following:

a.

The need to implement the Council decision on the Customs Union particularly on

the implementation of the Customs Management Regulations and the Common

Tariff Nomenclature; as well as the need for Member States that have challenges in

implementing the CET to seek derogation.

b.

The noted the need for consultations among senior officials and ministers of the four

COMESA/EAC Member States to discuss and give guidance on the way forward on

the harmonization of the two CETs and Customs Laws.

Decisions:

87.

Council:

i.

Adopted the revised draft COMESA CTN/CET HS 2012 and the draft

regional specific and general exemptions;

CS/CM/XXXII/2

Page 24

ii.

Directed that Industrial exemptions should be discussed separately; and

iii.

Urged Member States to domesticate the COMESA Customs Management

Regulations and the Common Tariff Nomenclature (CTN) that were

approved by the COMESA Summit in June 2009.

Relations with Third Parties

88.

Council noted that the African Growth and Opportunity Act (AGOA), relations with India

and multilateral trade negotiations under the WTO are of interest in COMESA’s relations with

third countries. Under AGOA, Member States with other African AGOA eligible countries

attended the 12th AGOA Forum in Addis Ababa, Ethiopia and raised the issues relating to the

extension of AGOA and inclusion of products of export interest to the eligible list. With regard to

relations with India, a preparatory meeting was held. With regard to the WTO, implementations

of the decisions of the 8th Ministerial meetings as well as issues for the 9th WTO Ministerial

meeting were discussed.

89.

Council noted that it is paramount for COMESA to focus on a common negotiating

position before the Member States can engage the third parties. An impact analysis should be

prepared and a report produced so that when COMESA is negotiating with Third Parties, the

common position is taken.

90.

Council noted that the 9th WTO Ministerial Conference held in Bali in December 2013

adopted the Trade Facilitation Agreement and the need to analyse this agreement and develop

appropriate national and regional work programmes for implementation.

Decisions:

91.

Council:

Africa Growth and Opportunity Act (AGOA):

i.

Urged Member States to devise and implement a lobbying strategy for the

seamless extension of AGOA beyond 2015 on a predictable basis targeting

USTR, and key congress men/women and in this regard the Member States

should work with the Secretariat to proactively engage the US Government;

ii.

Urged AGOA eligible countries to lobby for the expansion of the scope of

AGOA by including products of export interest to them and improving the

rules of origin;

iii.

Urged the United States of America to enhance the capacity of AGOA eligible

countries to comply with the SPS, TBT and other standards so as to be able

to access the US market; and

iv.

Urged the United States of America to consider the preference erosion to

AGOA eligible countries before extending similar preferences to LDCs in

other regions.

CS/CM/XXXII/2

Page 25

COMESA –India Relations

i.

Directed the Secretariat to conduct and complete the study on the impact of

either a comprehensive Economic Partnership Agreement (EPA) or an FTA

with India, including issues such as trade diversion, by 30 June 2014.

World Trade Organisation (WTO):

i.

Urged the LDC Members of COMESA to carry out the analytical work that

would enable them to benefit from the LDC waiver on services during the

period for which the Waiver subsists by identifying the services sectors of

export interest to them; and

ii.

Urged the LDC Members of COMESA that are in the process of acceding to

the WTO to take advantage of the streamlined procedures and benchmarks

that were agreed to by the General Council in July 2012 with regard to their

offers on goods and services schedules.

Trade in Services

92.

Council was informed that the COMESA Treaty, particularly Article 3(b), as read with

Article 4(4)(c), provides for the removal of obstacles to the free movement of services within the

Common Market. Article 164 of the Treaty, among other things, provides for the free movement

of services, and Articles 148, 151 and 152 provide a mandate for work to be done in the

liberalization of trade in services.

93.

Further, it was noted that trade in commercial services (imports plus exports) was at US

$52 billion in 2007, and rose to US $72 billion in 2012. This represented an increase of 38.5

percent. The commercial services imports which were at US $26.7 billion in 2007 rose to a peak

of US $37.7 billion in 2011 before subsiding to US $35 billion in 2012. The commercial services

imports were dominated by transportation (over 45% of total services imports) reflecting the high

transport costs as most of the COMESA Member States are land-linked. Other business

services and travel also occupied a significant share of the commercial services imports as

indicated in the table below.

94.

With regard to commercial services exports, the region exported US $27.4 billion

services in 2007, and this trended upward to US $36.9 billion in 2012. The bulk of these exports

were travel (over 45% of total services exports) showing the importance of travel and tourism in

the region. At second position was transportation (40% of total services exports) again reflecting

that due the fact that the majority of COMESA Member States are land-linked, those who import

goods from the region have to pay high transport costs.

95.

The Trade in Services programme has the objective of reducing and eventually

eliminating barriers to trade in services in order to promote regional services trade, contribute to

economic growth and employment. The main beneficiaries of liberalization are the competitive

service suppliers as well as service consumers. The Fifth Meeting of the Committee on Trade in

Services that was held on 05-07 June 2013 in Kampala, Uganda. The Committee conducted

negotiations on schedules of specific commitments in the four priority service sectors of

transport, communication, tourism and financial. Fifteen Member States submitted their

CS/CM/XXXII/2

Page 26

schedules of specific commitments fourteen of which were negotiated. The schedule for one

country was not discussed since the Member State did not attend the meeting.

96.

Council was informed that the Fifth meeting of the Committee on Trade in Services

realised that the schedules of specific commitments needed to be looked at again to take

account of the comments and requests made during the meeting and to ensure that the Central

Product Classification (CPC) codes were inserted in each sub-sector of services that was in the

schedule(s) as well as the use of the correct WTO-GATS language.

97.

Noting that the use of Economic Needs Tests (ENTs) could act as disguised restrictions

to trade in services, there was need to ensure that wherever ENTs were required, it was

essential to specify the institution administering them as well as the criteria and timeframe for

the results of the ENT to the conveyed to the applicant ENT service suppliers.

Decisions:

98.

Council decided that:

i.

Wherever ENTs are required, Member States should clearly specify the

institution that would be administering them and the criteria and timeframe

for the results of the ENT to be conveyed to the applicant service suppliers;

ii.

Member States should submit reviewed schedules to the Secretariat by 30

July 2014;

iii.

Member States should by 30 July 2014 provide CPC codes in their schedules

of specific commitments, including the Annex on Financial Services in the

banking services, and also provide the accepted GATS language where that

has not been done to consistently maintain uniformity in all Member States

schedules of specific commitments; and

iv.

Member States that have commitments in the telecommunication sector

should adopt the WTO Reference Paper as an Annex attached to the

schedules of specific commitments for all COMESA Member States.

COMESA-EAC-SADC Tripartite

99.

Council was informed that the Tripartite framework was borne out of a realisation that

the regional integration processes of COMESA, EAC and SADC were similar and in some

cases identical. With overlaps in the membership of these 3 RECs, it was seen prudent for the

3 RECs to co-operate and harmonise their programmes. The Tripartite is anchored on three

pillars, namely: Infrastructure Development, Market Integration and Industrial Development.

100. The Second Tripartite Summit held in Sandton, Johannesburg in June 2011 launched

the Tripartite FTA negotiations which have two phases. The first phase which deals with trade in

goods and movement of business persons spans to June 2014 while the second phase which

will deal with other trade related issues, trade in services, competition and intellectual property

will commence after completion of phase one negotiations. Egypt offered to host the Third

Tripartite Summit.

CS/CM/XXXII/2

Page 27

Progress on the Market Integration Pillar

101. Council was informed that only 12 Tripartite Member States are ready with their tariff

offers and the rest were urged to finalized their tariff offers as soon as possible. Seychelles had

submitted their tariff offers, which cover 5,549 tariff lines. 95.78% of the tariff lines will be

liberalised upon entry into force of the agreement, 0.51% over an eight (8) year period and the

remaining 3.71% of the tariff lines represent an exclusion list.

102. DR Congo and Angola could not present their tariff offers since they were not ready.

Given that this was the last but one TTNF session, it does not appear that the two countries will