society of women engineers

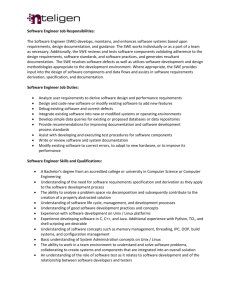

advertisement