doc - Citizens Information Board

advertisement

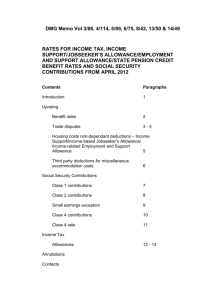

Getting back to work: information for jobseekers and people who want to start a business Contents Getting a jobseeker's payment The way back to work Education and training Benefits and work Starting a job Your rights in work Setting up a business Money matters This booklet is published by the Citizens Information Board. The information in this booklet is intended as a general guide only and is not a legal interpretation. The Citizens Information Board is the national agency responsible for supporting the provision of information, advice and advocacy on social services and for the provision of the Money Advice and Budgeting Service. November 2014 How to use this booklet This booklet provides an overview of entitlements and schemes for jobseekers and people who want to start a business, so that you can quickly find out about the range of services and supports that are available. It has been written to complement the Citizens Information Board website, gettingbacktowork.ie. Graphic: If you see a term printed in bold in this booklet, you can go to our gettingbacktowork.ie website to find out more. [[New QR code]] If you have a QR code scanner you can go straight to gettingbacktowork.ie using this code. You can also get information on all the topics covered in this guide from citizensinformation.ie, from the network of Citizens Information Centres and from the national Citizens Information Phone Service on 0761 07 4000. [[Graphics: Map of Ireland and telephone graphics as per ‘Guide to entitlements for over sixties’.]] Getting a jobseeker's payment If you lose your job, are laid off, are working fewer days or are made redundant, you may be entitled to Jobseeker's Benefit or Jobseeker's Allowance. Jobseeker's Benefit is a weekly payment from the Department of Social Protection for people who are out of work and who are covered by Pay Related Social Insurance (PRSI). Jobseeker's Allowance is also a weekly payment from the Department of Social Protection. It is a means-tested payment where your family income and savings are assessed. If your means are below a certain level, you may qualify for Jobseeker's Allowance. If you are a younger jobseeker (24 years of age or under) and living with your parents, a certain amount of your parents' income may also be assessed in the means test. Young people (25 and under) without children get a lower rate of Jobseeker’s Allowance. If you take part in an employment support scheme or a training or education programme you may get a higher rate. A Youth Guarantee is being introduced that will support all young jobseekers and give access to training, education, work experience or full-time employment. You must meet a number of conditions to get a jobseeker's payment, for example, you must be available for and genuinely seeking work. It is possible to work and get Jobseeker's Benefit or to work and get Jobseeker's Allowance – in both cases you can work up to a maximum of three days a week. If you are self-employed and the amount of work you are getting has reduced or your business has closed, you may qualify for a jobseeker's payment. PRSI paid by self-employed people does not cover Jobseeker's Benefit, but you may still qualify if you worked previously as an employee. You may qualify for Jobseeker's Allowance if you are self-employed. You do not have close your business to qualify. If you do not qualify for a jobseeker's payment, you can make voluntary PRSI contributions to maintain your PRSI record. If you are getting a jobseeker's payment, you may qualify for extra benefits such as Rent Supplement to help you with the costs of private renting. You may also be able to get a medical card or GP Visit Card. The process of claiming a jobseeker’s payment is known as signing on. To sign on you go to your local Intreo centre or social welfare local office. It is important that you make your claim as soon as you know you are entitled to the payment. If you qualify for a payment, you may be able to get an increase in your payment for an adult dependant (who can be your spouse, civil partner or cohabitant). You may also be able to claim an increase in your payment for dependent children. If you are refused Jobseeker's Allowance or Jobseeker's Benefit you can appeal this decision. The way back to work When you first sign on for a jobseeker’s payment your individual needs are assessed to establish the best way to help you get back to work. The Department of Social Protection provides a range of employment services for jobseekers. Many Department of Social Protection (DSP) social welfare local offices and employment services offices are now called Intreo centres. In your local Intreo centre you can get jobseeking advice, information on job vacancies and income support (your weekly payment) all in one place. Employment schemes Employment schemes and internships aim to prepare you for full-time work by supporting you to update your skills, learn new skills and be mentored in a workplace environment. Each scheme has different rules about who is eligible, so it is important to check the detailed information about each scheme. If you are participating in one of these schemes your social welfare payment may be affected in different ways, depending on the scheme. People getting certain disability payments may also qualify for the schemes and there are a number of employment supports for people with disabilities. The Community Employment scheme provides long-term unemployed people with training and work experience through part-time, temporary placements in jobs based within local communities. The Rural Social Scheme allows low-income farmers and fishermen/women who are unable to earn an adequate living from their farm holding or from fishing to earn a supplementary income. They work on projects that benefit rural communities managed by local organisations. Tús is a community work placement initiative providing work opportunities which benefit the community. Placements are provided by community and voluntary organisations in both urban and rural areas. Jobseekers who are eligible to participate in the scheme are selected and contacted by the Department of Social Protection. Gateway is a local authority scheme providing work opportunities for long-term unemployed people who have been on the Live Register for over two years. The work opportunities are to benefit the local area. Jobseekers who are eligible to participate in the scheme are selected and contacted by the Department of Social Protection. JobBridge provides internship placements for unemployed people in private, public, community and voluntary organisations. You must have been on the Live Register for three months and the internships last from six to nine months. If you take up an internship you will keep your social welfare payment and will get an extra €50 a week. The Work Placement Programme provides nine months’ work experience for unemployed people. The Programme provides places in the private, public, community and voluntary sectors. You do not have to be getting a social welfare payment but if you have been getting certain social welfare payments for three months, you may keep your payment. There are also schemes and services for employers including JobsPlus, a new employer incentive that encourages and rewards employers who employ jobseekers on the Live Register. Education and training There are many courses for jobseekers and people who wish to retrain. You should register with your local Intreo centre or employment services office to find out about and apply for available courses. There are different sources of funding for education and training. Most courses for jobseekers are free. Some schemes give you a training allowance and others allow you to keep your social welfare payment when you are taking part in the course. Courses and training programmes for jobseekers The Back to Education Allowance Scheme helps people who are unemployed, are getting a One-Parent Family Payment or have a disability, to attend approved full-time second-or third-level education courses. You can also do part-time or short courses under the Back to Education Programme. Further Education and Training (FET) courses provide an opportunity to develop or upgrade your skills. You may be eligible for an allowance while you are doing a FET course. Apprenticeships are also offered under SOLAS. Springboard provides free higher education places for jobseekers. Springboard courses target areas where there are job opportunities and growth. The courses are mainly part-time but there are also some full-time Springboard courses. Momentum provides education and training courses for long-term unemployed people. The scheme includes access to education and training projects, work placement and support. The Vocational Training Opportunities Scheme (VTOS) provides an opportunity to return to full-time education if you are unemployed or getting certain social welfare payments. Courses are designed to meet the education and training needs of unemployed people and are particularly suitable if you have been out of school for some time. Post Leaving Certificate (PLC) courses are open to school-leavers and adult participants, offering a mixture of practical work, academic work and work experience. If you are between 15 and 20 years of age and have left school without any formal qualifications, the Youthreach programme provides basic education, personal development, vocational training and work experience. Skillnets training is offered to eligible unemployed people by private sector companies who have set up training networks to deliver a range of accredited and industry-recognised programmes. You can search for training courses on the Skillnets website, skillnets.ie. Qualifax.ie provides comprehensive information on further and higher education and training courses. Skillstowork.ie is a guide for jobseekers and employers to Springboard, Momentum, JobBridge, JobsPlus and Skillnets. Benefits and work It may be possible to keep part of your social welfare payment if you are returning to work. You may also be able to keep your extra benefits or you may qualify for additional supports. You can use the Benefit of Work Ready Reckoner from the Department of Social Protection to help you assess the financial consequences of taking up full-time work: http://www.welfare.ie/en/Pages/Benefit-of-Work-Ready-Reckoner-Introduction.aspx. If you are working part-time (up to three days a week), you may be able to work and get Jobseeker's Benefit or work and get Jobseeker's Allowance. If you find part-time work (less than 24 hours a week) and you have been getting Jobseeker’s Allowance for at least 390 days (15 months), you may be eligible for the Part-time Job Incentive Scheme. You may have to pay tax on your social welfare income when you take up work. If you are returning to work for more than 19 hours a week and you have children, you may be able to claim Family Income Supplement (FIS). FIS is a weekly tax-free payment for people on low pay. If you are getting One-Parent Family Payment (OFP), you can earn a certain amount each week and keep your payment. You can claim FIS while you are getting OFP. If you are parenting alone and no longer qualify for the One-Parent Family Payment, you may qualify for a Jobseeker’s Allowance Transition payment. You can work part-time while you are getting this payment. A new Back to Work Family Dividend will be introduced for one parent and long-term jobseeker families with children who find or return to work from January 2015. The Qualified Child Increase will be paid in full for the first year in employment and half of the increase will be paid for the second year. It can be paid in addition to FIS. It is expected that the Back to Work Family Dividend will start in April 2015 and will open for applications in January 2015. If you are getting a means-tested disability payment, such as Disability Allowance or Blind Pension, you may earn a certain amount from work without it affecting your payment. If you are getting Illness Benefit (for at least 6 months) or Invalidity Pension, you can apply for Partial Capacity Benefit and keep part of your payment, depending on how restricted your capacity for work is. If you are getting a carer’s payment, you can generally work up to 15 hours a week and keep your payment. The After-School Child Care Scheme (ASCC) provides subsidised after-school childcare places if you have children of primary school age and you find work, increase the number of days you work or take up a place on an employment scheme. Keeping your extra benefits when you return to work If you are returning to work through an employment scheme, you can generally retain any extra benefits you have, but you may have to pay tax and PRSI on your income from the scheme. The Universal Social Charge (USC) does not apply to employment schemes. If you are returning to full-time work (over 30 hours a week), you may be able to keep your Rent Supplement if you have been accepted by your local authority as being in need of accommodation under the Rental Accommodation Scheme. However, you will be reassessed for Rent Supplement and if you do qualify for Rent Supplement, you may get a different rate. A new Housing Assistance Payment (HAP) has been introduced in some areas. If you have a long-term housing need and qualify for social housing support, you may be able to get a HAP payment when you return to full-time work. If you are unemployed and you are returning to full-time or part-time work, you may be able to keep your medical card for three years. You must have been getting certain social welfare payments for 12 months or more or have been on an employment scheme or educational opportunity scheme. You must be getting a social welfare payment to qualify for extra benefits such as Fuel Allowance and the Household Benefits Package. If you are working part-time and claiming a social welfare payment, you may be able to keep these extra benefits. The Back to School Clothing and Footwear Allowance helps you meet the cost of uniforms and footwear for children going to school. In general you must be getting a social welfare payment to qualify. People getting Family Income Supplement can qualify for the Allowance. Starting a job There are many different types of employment, including part-time work and casual work as well as full-time work. If you are starting a job, it is important to check that you are an employee, as most employment protection legislation does not apply to self-employed people. Whether you are currently in work, unemployed or in education, the process of finding and applying for a job is similar. When you are looking for a job it is important to research all possible sources of information. When you decide to apply for a job, you will normally need to send a well-prepared job application with a relevant CV (curriculum vitae). Employment legislation on equality in the workplace aims to ensure that you are not discriminated against when you are applying for a job and when you are in work. If you get a job, you will have a contract of employment, even if this is not in writing. While the complete contract does not have to be in writing, you must be given a written statement of terms of employment within two months of starting work. This should cover areas such as hours of work, breaks, paid leave, sick pay and period of notice. If you are registered as unemployed and you are starting work, you must contact your Intreo centre or social welfare local office and sign off. Your rights in work When you start work your employer is obliged to make sure that you get certain basic employment rights. These rights are governed by employment legislation and include the right to a minimum wage, annual leave, public holidays and maximum working hours. Parttime workers have the same employment rights as full-time workers. There are also employment laws to protect young people at work. There are various employment supports to help employees with a disability to gain and retain employment. If you employ people or are setting up a business that will employ people, you need to be familiar with your responsibilities and your employees’ rights. A number of organisations can help you to enforce your employment rights. If you need information about employment law and your employment rights, you should contact Workplace Relations Customer Services – see workplacerelations.ie. Setting up a business When you become self-employed it means you are carrying on your own business rather than working for an employer. You will need to find out about a range of different areas including keeping accounts, income and corporation tax, VAT, PRSI and insurance. Business structures If you are interested in starting a business one option is to set up as a sole trader. If you are a sole trader and your business fails, your personal assets could be used to pay your creditors. Your main legal obligation is that you must register for income tax as a selfemployed person with Revenue. You can also run a business with other people as a partnership. In a partnership the partners are jointly responsible for running the business and if it fails all partners are jointly responsible for the debt. You can also set up a limited company. If a limited company gets into debt, the creditors generally only have a claim on the assets of the company. The company must be registered with the Companies Registration Office (CRO), which has detailed information about these different structures on cro.ie. You may carry on your business using your own name. If you wish to use a business name you must register the name with the Companies Registration Office. Supports for starting a business There are various supports available to help you when you are setting up a business. Local Enterprise Offices provide supports to microenterprises (10 or fewer employees) that are starting up or in development. You can find information about their training programmes, start your own business courses and financial supports on localenterprise.ie. If you are unemployed, you may be eligible for the Back to Work Enterprise Allowance Scheme or the Short-Term Enterprise Allowance Scheme. These schemes aim to encourage people getting certain social welfare payments to become self-employed. The Start Your Own Business scheme provides a two-year exemption from income tax for people who have been unemployed for at least 12 months before starting their own business. Supporting SMEs Online is a new guide to Government supports for start-ups and small businesses. It includes information on over 80 business supports available from a range of government departments and agencies: https://www.localenterprise.ie/Discover-Business-Supports/Supporting-SMEs-Online-Tool/ You can also find more information on supports available for starting a business on gettingbacktowork.ie. Some small businesses have difficulty getting credit. If you have a small or medium business and your application for credit is refused by one of the participating banks, you may apply to the Credit Review Office to have your case reviewed. In addition, the Credit Guarantee Scheme assists eligible applicants in obtaining a loan and in establishing a favourable credit history. Money matters When you return to work your new employer must deduct tax from your pay under the Pay As You Earn (PAYE) system. Your employer is also responsible for deducting your Pay Related Social Insurance (PRSI) contributions and Universal Social Charge (USC) from your pay. Your P60 certificate is issued at the end of each tax year and your P45 certificate is issued when you leave employment or change jobs. These are records of the amount you have been paid and how much tax, PRSI and Universal Social Charge you have paid. Taxation of benefits If you are working and getting a taxable social welfare payment, your social welfare payment is generally taxed by reducing your tax credits and standard rate cut off point. The only exception is Illness Benefit which is usually taxed against your earnings. If you are out of work due to illness or if you become unemployed, you may be due a tax refund. Tax for self-employed people If you are thinking about setting up a business and becoming self-employed, you will need to register as a self-employed person with Revenue and you will need to know about tax under the self-assessment system. Self-employed people pay Class S PRSI which entitles you to a limited range of social welfare payments – mainly pensions but also Maternity Benefit and Adoptive Benefit. Dealing with debt If you have problem debt you can take steps to manage your debt such as making a budget and contacting your creditors. The Money Advice and Budgeting Service (MABS) is a free and confidential service that helps people to address debt problems. You can find out more about MABS on mabs.ie. A number of different debt solutions have been set up to help people with serious debt problems to sort out their situation and get protection from their creditors. These are the Debt Relief Notice (DRN), Debt Settlement Arrangement (DSA) and Personal Insolvency Arrangement (PIA). Bankruptcy also remains an option. You can find out more about these options on the Insolvency Service of Ireland website, backontrack.ie.