24 February 2006

advertisement

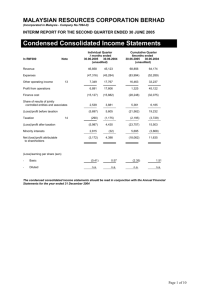

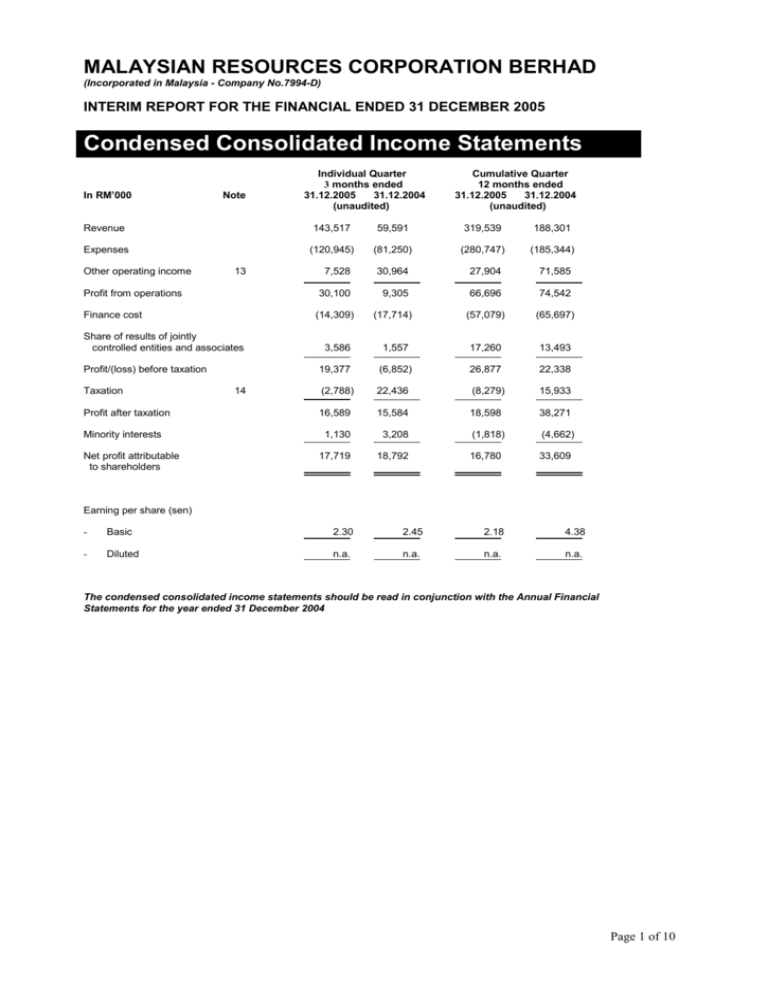

MALAYSIAN RESOURCES CORPORATION BERHAD (Incorporated in Malaysia - Company No.7994-D) INTERIM REPORT FOR THE FINANCIAL ENDED 31 DECEMBER 2005 Condensed Consolidated Income Statements In RM’000 Note Individual Quarter 3 months ended 31.12.2005 31.12.2004 (unaudited) Cumulative Quarter 12 months ended 31.12.2005 31.12.2004 (unaudited) Revenue 143,517 59,591 319,539 188,301 Expenses (120,945) (81,250) (280,747) (185,344) 7,528 30,964 27,904 71,585 30,100 9,305 66,696 74,542 (14,309) (17,714) (57,079) (65,697) 3,586 1,557 17,260 13,493 19,377 (6,852) 26,877 22,338 (2,788) 22,436 (8,279) 15,933 16,589 15,584 18,598 38,271 1,130 3,208 (1,818) (4,662) 17,719 18,792 16,780 33,609 Other operating income 13 Profit from operations Finance cost Share of results of jointly controlled entities and associates Profit/(loss) before taxation Taxation Profit after taxation Minority interests Net profit attributable to shareholders 14 Earning per share (sen) - Basic 2.30 2.45 2.18 4.38 - Diluted n.a. n.a. n.a. n.a. The condensed consolidated income statements should be read in conjunction with the Annual Financial Statements for the year ended 31 December 2004 Page 1 of 10 MALAYSIAN RESOURCES CORPORATION BERHAD (Incorporated in Malaysia - Company No.7994-D) INTERIM REPORT FOR THE FINANCIAL ENDED 31 DECEMBER 2005 Condensed Consolidated Balance Sheets In RM’000 Property, plant and equipment Investment properties Land held for property development Associates Jointly controlled entities Other investments Goodwill on consolidation Deferred tax assets Current Assets Inventories Properties development cost Trade and other receivables Marketable securities Bank balances and deposits Current Liabilities Trade and payables Other payables Short term borrowings Bonds Taxation Net Current Assets Capital and Reserves Share capital Reserves Shareholders’ equity Minority interests Non Current Liabilities Bonds Long Term borrowings Other long term liabilities Deferred tax liabilities Net tangible assets per share (sen) As at 31.12.2005 (unaudited) As at 31.12.2004 (audited) 22,869 172,911 878,844 274,975 5,364 8,172 10,000 3,877 20,624 176,912 823,962 266,592 5,299 9,405 10,000 3,193 1,377,012 1,315,987 24,236 168,890 184,121 26,482 251,707 32,155 164,217 160,586 86,468 151,320 655,436 594,746 164,238 96,590 104,127 80,000 805 108,201 118,261 235,018 89 445,760 461,569 209,676 133,177 1,586,688 1,449,164 768,186 (285,176) 768,186 (301,077) 483,010 467,109 81,904 82,881 714,684 293,703 10,344 3,043 793,672 95,555 7,786 2,161 1,586,688 1,449,164 61.6 59.5 The condensed consolidated balance sheets should be read in conjunction with the Annual Financial Statements for the year ended 31 December 2004. Page 2 of 10 MALAYSIAN RESOURCES CORPORATION BERHAD (Incorporated in Malaysia - Company No.7994-D) INTERIM REPORT FOR THE FINANCIAL ENDED 31 DECEMBER 2005 Condensed Consolidated Cash Flow Statements In RM’000 Operating activities Cash receipts from customers Cash paid to suppliers and employees 12 months ended 31.12.2005 31.12.2004 (unaudited) 344,619 (277,368) 390,296 (193,340) Cash from operations Interest and other bank charges paid Taxes refund 67,251 (98,452) 9,692 196,956 (116,041) 16,233 Net cash (used)/generated in operating activities (21,509) 97,148 Investing activities Equity investments Non-equity investments (3,808) 60,402 23,379 4,214 Net cash from investing activities 56,594 27,593 Financing activities Borrowings (net) Placement of restricted cash 65,113 (95,657) (118,174) (5,871) Net cash used in financing activities (30,544) (124,045) Net increased in cash and cash equivalent Cash and cash equivalents at beginning of the financial year 4,541 73,378 696 72,682 Cash and cash equivalent at end of year 77,919 73,378 For the purpose of the cash flow statements, the cash and cash equivalents comprised the following: Bank balances and deposits Bank overdraft Less: Bank balances and deposits held as security value 251,707 (822) 151,320 (633) 250,885 (172,966) 150,687 (77,309) 77,919 73,378 The condensed consolidated cash flow statement should be read in conjunction with the Annual Financial Statements for the year ended 31 December 2004. Page 3 of 10 MALAYSIAN RESOURCES CORPORATION BERHAD (Incorporated in Malaysia - Company No.7994-D) INTERIM REPORT FOR THE FINANCIAL ENDED 31 DECEMBER 2005 Condensed Consolidated Statement of Changes in Equity Share __Capital Reserve on consolidation 768,186 79,332 (380,409) Deferred tax liability on pre-acquisition revaluation surplus - - (879) Net profit for the financial year - - At 31 December 2005 (unaudited) 768,186 At 1 January 2004 In RM’000 At 1 January 2005 Accumulated losses Total 467,109 (879) 16,780 16,780 79,332 (364,508) 483,010 768,171 79,332 (430,569) 416,934 ─────── 768,171 ─────── 79,332 18,701 ─────── (411,868) 18,701 ─────── 435,635 15 - Deferred tax liability on pre-acquisition revaluation surplus - - (2,150) (2,150) Net profit for the financial year - - 33,609 33,609 768,186 79,332 (380,409) 467,109 Prior year adjustments As restated Issuance of share capital At 31 December 2004 (audited) - 15 The condensed consolidated statement of changes in equity should be read in conjunction with the Annual Financial Statements for the year ended 31 December 2004. Page 4 of 10 MALAYSIAN RESOURCES CORPORATION BERHAD (Incorporated in Malaysia - Company No.7994-D) INTERIM REPORT FOR THE FINANCIAL ENDED 31 DECEMBER 2005 Notes to the Interim Report 1. Basis of preparation The financial report has been prepared in accordance with FRS134, Interim Financial Reporting and Chapter 9 part K of the Listing Requirements of Bursa Malaysia Berhad, and should be read in conjunction with the Group’s financial statements for the financial year ended 31 December 2004. The accounting policies and methods of computation adopted for the financial report are consistent with those adopted for the annual financial statements for the financial year ended 31 December 2004. 2. Audit report of the preceding annual financial statements The audit report of the Group’s preceding annual financial statements was not subject to any qualification. 3. Seasonality or cyclicality of operations The businesses of the Group were not materially affected by any seasonal or cyclical fluctuations during the current financial year. 4. Items of unusual nature, size or incidence There were no other items of unusual nature, size or incidence affecting the assets, liabilities, equity, net income or cash flows. 5. Material changes in estimates of amounts reported There were no changes in estimates of amounts reported in prior financial year that would have a material effect in the current financial year. 6. Debt and equity securities There were no issuances, cancellations, repurchases, resale and repayments of debt and equity securities for the current financial year. 7. Dividends There were no dividends paid during the current financial year. Page 5 of 10 MALAYSIAN RESOURCES CORPORATION BERHAD (Incorporated in Malaysia - Company No.7994-D) INTERIM REPORT FOR THE FINANCIAL ENDED 31 DECEMBER 2005 Notes to the Interim Report 8. Segmental reporting In RM’000 12 months ended 31.12.2005 Profit/(Loss) from Revenue operations 12 months ended 31.12.2004 Profit/(Loss) from Revenue operations Malaysia Engineering and construction Property development Infrastructure Building services Investment holding and others Segment totals Inter-segment elimination 9. 171,554 250,673 12,680 12,302 1,633 6,305 75,776 356 1,952 (4,923) 59,646 140,928 10,286 9,895 14,965 (1,637) 42,762 (54) 417 39,206 448,842 (129,303) 79,466 (12,770) 235,720 (47,419) 80,694 (6,152) 319,539 66,696 188,301 74,542 Valuations of property, plant and equipment The valuations of property, plant and equipment have been brought forward without any material amendments from the previous financial statements. 10. Material events subsequent to the financial year There are no material subsequent events to be disclosed other than as mentioned in note 17. 11. Changes in the composition of the Group The Company had on 17th January 2005 entered into three (3) separate share sale agreements with other shareholders of Sibexlink Sdn. Bhd. (Sibexlink) namely Malaysia South-South Corporation Berhad, Telekom Malaysia Berhad and South Investment, Trade and Technology Data Exchange Centre for the acquisition of 1,000,000, 1,450,000 and 1,000,000 ordinary shares of RM1.00 each respectively. The purchase consideration for each acquisition is RM1.00. The acquisitions were completed on 27th July 2005 and as a result, Sibexlink is now a wholly owned subsidiary of the Company. Other than the abovementioned, there were no other changes in the composition of the Group during the current financial year. 12. Contingent liabilities or contingent assets The Group’s contingent liabilities, which comprised trade and performance guarantees, amounted to RM61.4 million as at 31 December 2005 (as compared to RM59.9 million as at 31 December 2004). There are no material contingent assets to be disclosed. Page 6 of 10 MALAYSIAN RESOURCES CORPORATION BERHAD (Incorporated in Malaysia - Company No.7994-D) INTERIM REPORT FOR THE FINANCIAL ENDED 31 DECEMBER 2005 Notes to the Interim Report 13. Other operating income Included in other operating income for the current interim period are the following material exceptional gains: - 12 months ended 31.12.2005 RM’000 Reversal of provisional cost on property development that was no longer required Forfeiture of down payment deposit Gain on disposal of marketable securities 14. 4,291 2,750 1,059 8,100 Taxation Individual Quarter 3 months ended 31.12.2005 31.12.2004 In RM’000 Cumulative Quarter 12 months ended 31.12.2005 31.12.2004 In Malaysia Taxation - current year - (over)/under provision in prior years Deferred taxation Share of taxation of associates 15. (1,728) 3,578 (1,501) (22,513) (1,824) 4,402 (749) (23,508) (682) 1,620 (1,074) 2,652 (682) 6,383 1,986 6,338 2,788 (22,436) 8,279 (15,933) Profit/(Loss) on sale of unquoted investments and/or properties There were no profit or loss on sale of unquoted investments and/or properties outside the ordinary course of business of the Group for the financial year under review. 16. Purchases and disposals of quoted securities a) Total purchases and disposal of quoted securities are as follows: 3 months ended 31.12.2005 31.12.2004 RM’000 RM’000 Purchase Disposal Gain on disposal - 12 months ended 31.12.2005 31.12.2004 RM’000 RM’000 - 54,000 1,059 - Page 7 of 10 MALAYSIAN RESOURCES CORPORATION BERHAD (Incorporated in Malaysia - Company No.7994-D) INTERIM REPORT FOR THE FINANCIAL ENDED 31 DECEMBER 2005 Notes to the Interim Report 16. Purchases and disposals of quoted securities (continued) b) Investment in quoted securities (including quoted shares of an associate) are as follows: - As at 31.12.2005 RM’000 At cost At carrying value At market value 17. 158,551 293,613 214,414 As at 31.12.2004 RM’000 218,537 350,739 233,461 Corporate Proposals The proposed disposal of office block, Menara MRCB for a cash consideration of RM55.0 million to Idaman Unggul Bhd. has been terminated with the 5% deposit duly forfeited. There were no other corporate proposals announced but not completed during the current financial year under review. 18. Group borrowings The tenure of the Group borrowings classified as short and long term is as follows: - As at 31.12.2005 RM’000 Short term - secured Short term - unsecured Long term - secured 176,133 7,994 1,008,387 As at 31.12.2004 RM’000 235,018 889,227 The Group borrowings are all denominated in Ringgit Malaysia. Page 8 of 10 MALAYSIAN RESOURCES CORPORATION BERHAD (Incorporated in Malaysia - Company No.7994-D) INTERIM REPORT FOR THE FINANCIAL ENDED 31 DECEMBER 2005 Notes to the Interim Report 19. Off balance sheet financial instruments The Group did not enter into any contract involving financial instruments with off balance sheet risk. 20. Changes in material litigation The Group is engaged in various litigations arising from its businesses, the claims thereon amounting to approximately RM59.9 million. The Board of Directors has been advised on those claims for which reasonable defences exist and claims that are pending amicable settlement. On this basis, the Board of Directors is of the opinion that the said litigations would not have a material effect on the financial position or the business of the Group. 21. Comparison with preceding corresponding quarter’s results The Group recorded a profit before taxation of RM19.4 million for the 4th quarter ended 31 December 2005 as compared to a loss of RM6.9 million recorded in the preceding corresponding 4th quarter ended 31st December 2004. The higher profit in the current quarter was due to substantial increase in revenue of RM83.9 million which is more than 100 % higher compared to preceding corresponding quarter. The increase in revenue is mainly contributed from the realization of sales at Kuala Lumpur Sentral and engineering and construction activities of property development and infrastructure works. 22. Review of performance The Group recorded revenue of RM319.5 million for the current financial year ended 31 December 2005 as compared to RM188.3 million recorded in the preceding financial year ended 31 December 2004. The higher revenue in the current financial year was due to higher contributions from the engineering and construction and property development sectors. The property development sector is mainly driven by the on-going development at Kuala Lumpur Sentral. Accordingly, for the current financial year ended 31 December 2005, the Group recorded a higher profit before taxation of RM26.9 million compared to RM22.3 million recorded in the preceding financial year ended 31 December 2004. The net profit attributable to shareholders recorded in the current financial year of RM16.8 million was lower than the RM33.6 million achieved in the preceding financial year mainly due to the RM23 million adjustment of over provision of taxation in prior years recorded in the preceding financial year. 23. Prospects We expect property development especially with the promising outlook for sales at Kuala Lumpur Sentral and the engineering and construction businesses to continue to be the main drivers of the Group’s performance for the financial year 2006. Accordingly, barring any unforeseen circumstances, the Board is optimistic that the Group’s performance for the forthcoming financial year ending 31 December 2006 will continue to show improvement and growth in both revenue and profitability. Page 9 of 10 MALAYSIAN RESOURCES CORPORATION BERHAD (Incorporated in Malaysia - Company No.7994-D) INTERIM REPORT FOR THE FINANCIAL ENDED 31 DECEMBER 2005 Notes to the Interim Report 24. Variance on forecast profit/profit guarantee Not applicable. 25. Earning per share Basic The basic earning per share were computed as follows: Individual Quarter Cumulative Quarter 3 months ended 12 months ended 31.12.2005 31.12.2004 31.12.2005 31.12.2004 Net profit for the year (RM’000) Weighted average number of ordinary shares in issue (‘000) Basic earnings per share (sen) 17,719 18,792 16,780 33,609 768,186 768,186 768,186 768,183 2.30 2.45 2.18 4.38 Diluted The Group has no dilution in its earnings per share, as the fair value of the issued ordinary shares for the financial period is lower than the exercise price of the outstanding employees’ share options. Therefore, no consideration for adjustment in the form of increase in the number of shares was used in calculating the potential dilution of the earnings per share. 26. Net tangible assets per share The net tangible assets per share as at 31 December 2005 is calculated based on the Group’s net tangible assets of RM472,781,063 after deducting the Group’s intangible assets of RM10,075,197 and adjusting for the premium on acquisition of an associate of RM153,470 over the number of issued ordinary shares of 768,185,868 shares. By Order of the Board Mohd Noor Rahim Yahaya Company Secretary Shah Alam 24 February 2006 Page 10 of 10