Effective interest rate

advertisement

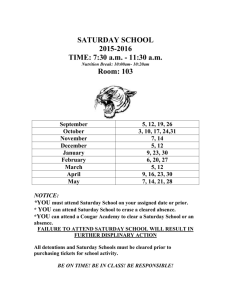

Mahidol University MGMG517 Investment Management (3/2552) Course descriptions A study of the problems and process of investment by applying up-to-date investment theories to decision-making concerning portfolio management. The course is designed to discuss on security markets, financial instruments - stock, bond, and financial derivatives, including the factors determining their yields and risks. The topics also include modern portfolio theories, security valuation models, market efficiency theory, portfolio performence measurement, spot rate vs. forward rate, theories of interest rate, duration, and bond portfolio immunization. A discussion will also cover the analysis of economy, industry, and company. Course Objectives : 1) Understanding the principle of investment analysis - theories, techniques, and tools; 2) Understanding the mechanism and the development the Thai financial market; 3) Practicing portfolio management through the simulation game. Instructor Dr. Nantaphol Pongspaibool, Ph.D. (Finance) e-mail: nantapho@bkk2.loxinfo.co.th Class date & time: Saturday 09.00-12.00 Class room 605 Core text book William F. Sharpe, Gordon J. Alexander, and Jeffrey V. Bailey. Investments. Prentice-Hall, latest edition. Additional text books Elton, Edwin J. and Martin J. Gruber, Modern Portfolio Theory and Investment Analysis. Fisher, Donald E. and Ronald J. Jordan. Security Analysis And Portfolio Management Analysis. Fisher, Donald E. and Ronald J. Jordan, Security Analysis And Portfolio Management. Prentice-Hall. Francis, Jack C. Investments: Analysis and Management. Prentice-Hall. Frank K Reilly and Keith C. Brown. Investment Analysis and Portfolio Management, Harcourt Jack C. Francis & Roger Ibbotson, Investments: A Global Perspective Suggested Web-sites 1) www.set.or.th 2) www.settrade.com 3) www.bot.or.th 4) www.sec.or.th 5) www.bloomberg.com 1 Grading 1) Class participation 2) Investment game 3) Investment project paper 4) Midterm Exam 5) Final Exam Total 10% 10% 20% 30% 30% 100% Class Date Topics 1 Saturday 16 Jan. 10 2 Saturday 23 Jan. 10 3 Saturday 30 Jan. 10 4 Saturday 6 Feb. 10 An Overview of the course - The course outline - Introduction on investment - Investment Environment & Process, Securities and Markets A Review of Statistical Tools - Variance, Covariance, and Correlation - Regression Equation Riskless Securities - Effective interest rate - Nominal VS real rate of interest - Pricing and Yield to maturity of bond - Spot and forward rate Theory of Interest rate - Term structure theory - Quality structure theory - Market Segmentation theory Efficient Market Theory - Efficient market : Theory and evidence 5 Saturday 13 Feb.10 6 Saturday 20 Feb. 10 7 Saturday 27 Feb. 10 The Valuation of Risky Securities - Calculation of holding-period returns - Calculation of Beta The Valuation of Common Stocks - Book Value - Net Asset Value - Dividend discounted model - Price-earning approach - Discounted cash flow method The Valuation of Common Stocks (continued) Date is to be scheduled Midterm Exam 8 Saturday 6 Mar.10 9 Saturday 13 Mar. 10 Fundamental & Technical Analysis - Analysis of Economy, Industry, and Company - Business Cycle Theory Technical Analysis Fundamental Analysis (continued) 10 Saturday 20 Mar. 10 11 Saturday 27 Mar.10 12 Saturday 3 Apr.10 The Portfolio Selection Problem - The Capital Asset Pricing Model (CAPM) - The Arbitrage Pricing Theory (APT) Capital Asset Pricing Model (continued) Performance Measurement Performance evaluation of mutual funds Sharpe, Treynor, and Fama approaches Bond Portfolio Management - Bond market efficiency - Bond-pricing theories - Duration and immunization - Bond VS Stocks: risk and return 2 13 Saturday 10 Apr.10 Options, Warrants - Put & Call Options, factors determining price of options - Black & Scholes Option Pricing Model - Binomial Option Pricing Model - Warrant Valuation 14 Saturday 17 Apr.10 Convertibles, and Financial Futures - Convertible bond valuation - Financial contracts Date is to be scheduled Final Exam 3