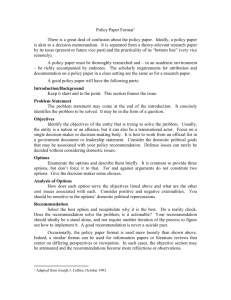

Management Response to Audit Findings

advertisement

Management Response to Audit Findings FY 2004 Audit (6/30/04) IC04-1. Finding: During the audit, we noted the City did not record all capital assets and in certain instances, assets were recorded twice. Recommendation: Fixed assets recorded by the City should be closely monitored in the system to ensure that they are not duplicated and that City capital assets have been properly entered into the City’s system records. Management Response: There may have been a few instances where an asset was recorded twice because manual entries were necessary to split the assets into the proper enterprise fund. The City will continue to review all new capital assets that are added through the H.T.E. interface to ensure they are not duplicated. Also, manual entries will be carefully scrutinized to ensure duplicates are not added this way. IC04-2. Finding: During the audit, we noted that the City does not have an adequate process in place to recognize which expenditures should be recorded as capital assets, and which assets should be retired. Recommendation: We recommend the City implement a process to better track Capital projects and recognize when long-term projects become depreciable assets. The City should implement a process where each invoice is reviewed to identify which items should be recorded as a fixed asset. The City should also implement a review process of old assets that may be disposed of. Management Response: The Controller’s Office will work with OPM and the departments to determine when projects are complete and assets are placed in service. We will also review old assets that should be deleted from the list. Last year, we completed that process for computer equipment and vehicles. This year, we will review all land and buildings. We will also look at the older equipment and machinery to determine if they are still in use. IC04-3. Finding: During the audit, we noted that the City did not complete their main disbursement account monthly bank reconciliations on a timely basis. Recommendation: We recommend that all bank reconciliations should be completed once the bank statements are received, and are reviewed by management. Management Response: We have resolved one technical issue (downloading and uploading of cleared check activity into the H.T.E. system) that caused delays in the bank reconciliation. Wachovia Bank has changed their on-line reporting capabilities and we are working with the technical support team to get the reports we need. Once this technical issue is resolved, we will post the Controlled Disbursement Account activity on a weekly basis. Because this account has the bulk of activity, we expect that this will expedite the monthly reconciliation process. The Treasury Accountant, Controller and Account Clerk are working together to ensure the reconciliation process is completed timely and make changes to the process if needed. We have completed the bank reconciliation through November. As soon as we have the banking reports we need, we expect to quickly bring the rest of the months up to date by the end of March. Then going forward, they will be completed within the timeline outlined in the accounting manual (within 4 weeks of the end of the month). IC04-4. Finding: While performing our audit procedures, it was noted that not all transactions are recorded on the City’s HTE system. Items noted were the WPCA Revenue Bond activity, and general obligation bonds. Recommendation: We recommend all transactions be recorded with adequate documentation and support. Management Response: All transactions/activity is being recorded on the H.T.E. system on a monthly basis and all are supported by adequate documentation. 2 Management Response to Audit Observations FY 2004 Audit (6/30/04) Observation #1: While performing our audit procedures, it was noted that the City does not maintain copies of invoices for false fire alarms sent to the customer. The only support maintained is the billing database. Recommendation: The City should maintain copies of invoices sent to the customer for false fire alarms in order to properly record and collect monies outstanding. Management Response: The City does not agree with this recommendation. The City sends out approximately 600 alarm bills each month. We have the ability to view on-line and reprint invoices (or customer history) at any time. The city also has a detailed receivable report as well as collection reports that support monies billed and collected. We don’t believe there is added value in keeping copies of invoices. Observation #2: During testing at the Smith House, it was noted that there were significant receivable balances older than a year. Recommendation: The Smith House accounts receivable balance needs to be reviewed and analyzed regularly to ensure that balances that are not collectible are written-off. Management Response: The City agrees that there should be a process in place to regularly review receivable balances and write off those that are un-collectible. The contract with the new management company, Premier Healthcare Resources, Inc., contains language that specifically addresses their responsibility in this area. The City will work with them to set up a procedure to periodically review the aged receivables and write off those we believe we cannot collect. 3 Observation #3: While performing our audit procedures, we noted that the City’s former Director of Administration was not properly removed as a check signer and replaced with the new Director of Administration. Recommendation: We recommend the City change the check signer immediately upon the dismissal of a former employee. The City should verify with the bank that the bank’s check signer records have been properly updated. Management Response: The bank records have been corrected. We believe the paperwork was submitted last year but was mishandled. In the future, we will ensure that proper check signers are reflected on all city accounts. Observation #4: During our testing of the student activity funds, it was noted that some invoices could not be located. Recommendation: We recommend that each school follow the policies regarding record retention of documentation supporting expenditures. All supporting documentation for both receipts and disbursements needs to be maintained to ensure proper recording and approval of transactions. Management Response: The Board of Education agrees with this recommendation. The building principals had previously been given notice (in a memo dated August 31, 2003) that all back-up documentation is to be retained for their student activity accounts. A second reminder will be sent to them confirming the need to retain paid bills for three years after the audit and check registers for six years after the audit. As an additional control, the Board of Education will begin reviewing building transactions on a quarterly basis to be assured that all back-up documentation is being kept and that proper approvals are given to each transaction. 4 Observation #5: During a review of the Board of Education and the City’s policies and procedures regarding medical benefits, the following was noted: 1. Once the original insurance forms are completed by the employee, there are minimal procedures in place to ensure the information included in the forms remains current and accurate. 2. There are no written policies regarding the need for employees to notify the City when spouses or dependents are no longer eligible for benefits. This requirement is only stated verbally during the employee’s orientation. 3. The Board of Education benefits administrator only reviews the third party administrator’s data on an annual basis even though quarterly and monthly statements are provided. Recommendation: We recommend both the City and Board of Education revisit their medical benefits policies and procedures to ensure only the proper employees and dependents are receiving benefits. Also that the BOE reviews the third party administrator’s data on a quarterly basis, at a minimum. Management Response from the Board of Education: Currently, the Board of Education Benefits Administrator is reviewing Anthem Blue Cross reports monthly to ensure that the BOE is covering everyone eligible to receive insurance benefits and that no coverage is provided to anyone ineligible for the program. The enrollment for our health insurance is compared to names and identification numbers that are provided on the Anthem Blue Cross billing. Any exceptions that are noted are followed up with the vendor as soon as possible. On an annual basis, dependent children between the ages of 19 and 25 are being verified by Anthem Blue Cross to determine if they are full-time students and still eligible for benefits. Since we have moved from a self-insured plan, the accuracy of enrollment has increased since all insured were recently verified during the conversion process. Dental plan claims from Cigna and prescription drug claims through Medco will be verified against our current enrollment on a quarterly basis by the Benefits Administrator. Management Response from the City: The City has drafted a memorandum reminding all employees of the need to keep us informed of changes in their personal status as it pertains to address changes, marriage, divorce, etc., and have issued a very strong directive that any failure to do so may result in failure to provide coverage or we will seek direct reimbursement of any costs expended on their behalf that should not have been. We have also implemented a “random” selection process whereby we will select a group of employees and perform an internal audit of all information, enrollments, etc. In addition, we regularly review each enrolled dependent for adherence to the age limit requirement consistent with each union contract. Additionally, each vendor is aware of this requirement and has the age limit programmed into their systems to be flagged whenever necessary. 5 Observation #6: The City should adopt a pension plans policy to follow when paying administrative costs and other expenditures. Recommendation: We recommend the policy for expenditures be written and implemented to improve internal controls. The policy should include uniform policies for all plans which limits expenses on meals and entertainment, administrative costs, and other expenses. There should also be policies for issuing checks and approvals for expenditures. The City does not currently have in place a pension plans policy to follow when paying administrative costs and other expenditures. Management Response: The City agrees with this recommendation. To date, two of the pension funds (Classified and Custodians) have adopted the City’s Travel Policy. The City will prepare a letter to each pension board recommending that they adopt selected portions of the City’s accounting policies that relate to administrative costs and other expenditures and policies for issuing checks and approval of expenditures. 6