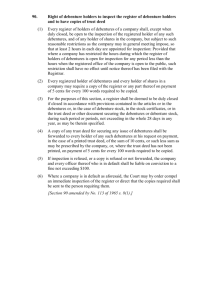

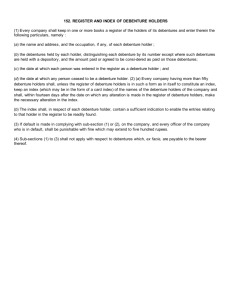

part ii. other information

advertisement