BA 071 - PRINCIPLES OF FINANCIAL ACCOUNTING

advertisement

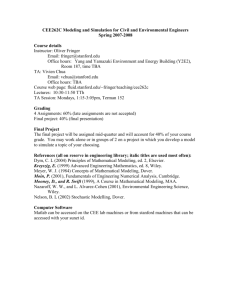

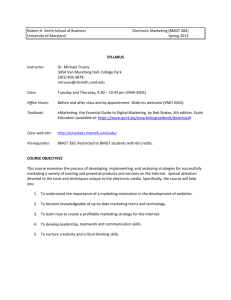

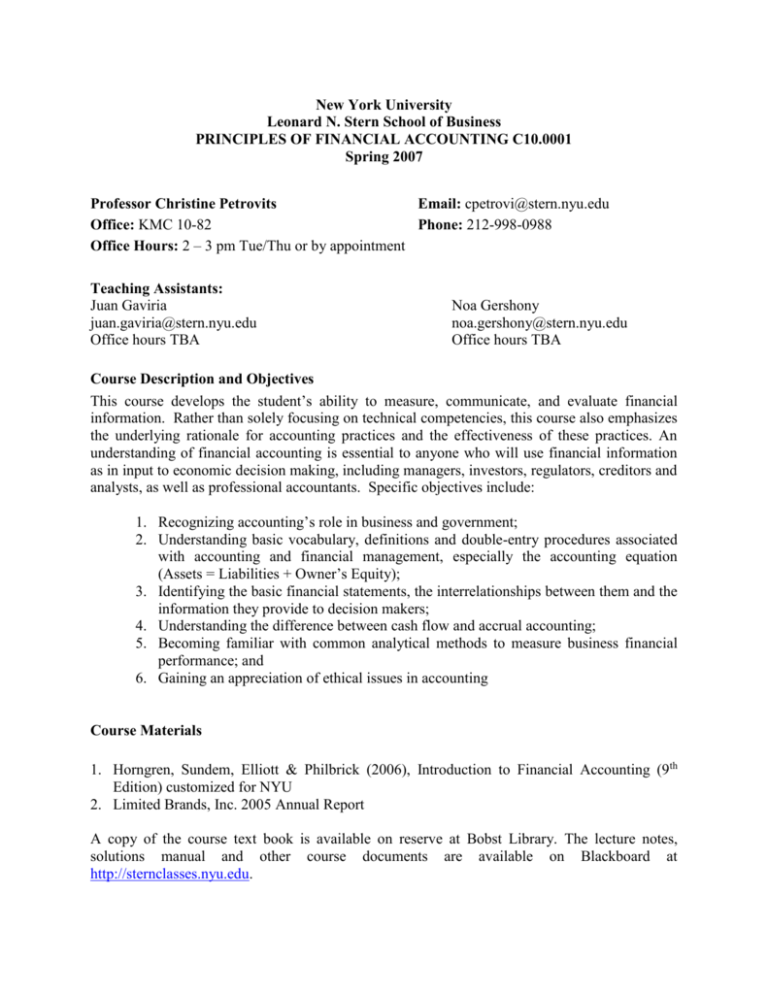

New York University Leonard N. Stern School of Business PRINCIPLES OF FINANCIAL ACCOUNTING C10.0001 Spring 2007 Professor Christine Petrovits Email: cpetrovi@stern.nyu.edu Office: KMC 10-82 Phone: 212-998-0988 Office Hours: 2 – 3 pm Tue/Thu or by appointment Teaching Assistants: Juan Gaviria juan.gaviria@stern.nyu.edu Office hours TBA Noa Gershony noa.gershony@stern.nyu.edu Office hours TBA Course Description and Objectives This course develops the student’s ability to measure, communicate, and evaluate financial information. Rather than solely focusing on technical competencies, this course also emphasizes the underlying rationale for accounting practices and the effectiveness of these practices. An understanding of financial accounting is essential to anyone who will use financial information as in input to economic decision making, including managers, investors, regulators, creditors and analysts, as well as professional accountants. Specific objectives include: 1. Recognizing accounting’s role in business and government; 2. Understanding basic vocabulary, definitions and double-entry procedures associated with accounting and financial management, especially the accounting equation (Assets = Liabilities + Owner’s Equity); 3. Identifying the basic financial statements, the interrelationships between them and the information they provide to decision makers; 4. Understanding the difference between cash flow and accrual accounting; 5. Becoming familiar with common analytical methods to measure business financial performance; and 6. Gaining an appreciation of ethical issues in accounting Course Materials 1. Horngren, Sundem, Elliott & Philbrick (2006), Introduction to Financial Accounting (9th Edition) customized for NYU 2. Limited Brands, Inc. 2005 Annual Report A copy of the course text book is available on reserve at Bobst Library. The lecture notes, solutions manual and other course documents are available on Blackboard at http://sternclasses.nyu.edu. Class Format and Grading This course consists of a combination of lecture and class discussion of assigned homework problems. I will attach homework practice problems to the lecture notes. You should read the material and attempt the homework practice problems before class. I will ask for volunteers during class to review certain homework problems. While I do not currently plan to collect homework, I reserve the right to ask the class to turn in a written assignment with prior notice if class participation is unsatisfactory. The importance of doing homework on a regular basis cannot be overemphasized. Historically students who do poorly in this course are the ones who do not keep up with the material. Your course grade will be computed as follows: Class Participation / Homework Cases Exam 1 Exam 2 Final Exam 5% 10% 25% 25% 35% 100% Cases: The accounting department has implemented a case requirement that all introductory accounting students are required to complete. The cases are meant to serve as additional ‘real world” experience that will help you master the basics of financial accounting. I will provide more information about the cases in class. Exam Policy: You are expected to take all exams at the scheduled times. There will be no makeup exams for the two midterms. If you must miss a midterm, you must notify the professor before the exam is given. Failure to do so or lack of a valid reason for your absence will result in a score of zero for the missed exam. If you do have a valid reason for missing a midterm, your final exam grade will be used in place of the midterm grade. Exam 2 and the Final Exam will be cumulative, with an emphasis on material covered since the previous exam. Students who believe that an exam has been incorrectly scored should submit a written request for re-grading within two class days from the time the exam is returned. Honor Code Upon enrollment in this course, you agree to adhere to the NYU Stern Undergraduate College Student Code of Conduct, and accept the consequences of your actions should you violate that code. Any instances of academic misconduct will be immediately reported to the appropriate University authorities. Schedule Date Topic Chapter Suggested Additional Exercises from Horngren Tue, Jan 16 Introduction 1 1-4, 1-5, 1-15 Thu, Jan 18 Balance Sheet 1 1-7, 1-8, 1-25, 1-28, 1-36, 4-9 Tue, Jan 23 Income Statement 2 2-2, 2-9, 2-11, 2-23, 2-34, 2-35, 2-55, 3-6 Thu, Jan 25 Tue, Jan 30 Recording Transactions 3 3-17, 3-20, 3-23, 3-34, 3-40 Thu, Feb 1 Recording Transactions Tue, Feb 6 Thu, Feb 8 Accrual Accounting Thu, Feb 8 CASE 1 DUE Tue, Feb 13 Review Thu, Feb 15 EXAM 1 (Extended Office Hours Wednesday 3-5) Tue, Feb 20 Thu, Feb 22 Sales & AR 6 6-1, 6-2, 6-14, 6-17, 6-34, 6-48, 6-56, 6-59 Tue, Feb 27 Thu, Mar 1 COGS & Inventory 7 7-1, 7-8, 7-14, 7-16, 7-34, 7-41, 7-47, 7-74, 7-78 Tue, Mar 6 Thu, Mar 8 Tue, Mar 13 Thu, Mar 15 Tue, Mar 20 Depreciation & Fixed Assets 8 8-9, 8-12, 8-29, 8-31, 8-34, 8-35, 8-47 Thu, Mar 22 Review Tue, Mar 27 Thu, Mar 29 Tue, Apr 3 Thu, Apr 5 Tue, Apr 10 Thu, Apr 12 Tue, Apr 17 Thu, Apr 19 EXAM 2 (Extended Office Hours Monday 3-5) Case 1 4 3-45, 4-21, 4-22, 4-25, 4-27, 4-38 SPRING BREAK Intangible Assets 8 8-15, 8-53 Current & LT Liabilities 9 Current: 9-4, 9-31, 9-33, 9-34 LT: 9-10, 9-27, 9-41, 9-44, 9-50, 9-52, 9-56 Stockholder’s Equity 10 10-11, 10-26, 10-33, 10-36, 10-45, 10-57 Cash Flow Statement 5 5-2, 5-4, 5-11, 5-15, 5-30, 5-35, 5-41, 5-53, 5-58 Tue, Apr 24 Cash Flow Statement Case 2 Thu, Apr 26 Review Thu, Apr 26 Thu, May 3 CASE 2 DUE FINAL EXAM