Chapeter 3 Lecture-2

advertisement

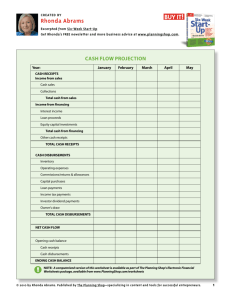

Chapter 3 Lecture (Part II) The Cash Budget It is vital that the firm’s management attempt to forecast the cash flow (cash in less cash out) of the firm. The reason is that firms need to estimate when they will have excess cash balances (so they can invest it) and when they will have cash deficits (so they can plan to finance the deficit well in advance). A firm attempting to borrow funds on very short notice is not likely to get a very sympathetic hearing from a bank. First, “surprise” deficits needing to be financed on an emergency basis are symptomatic of poor planning by the firm’s managers. Second, if the amount to be borrowed is large, it may take some time for the bank to raise the needed funds. The planning tool financial managers use to anticipate both excess cash and cash deficits is the cash budget. The cash budget attempts to forecast the cash receipts and cash disbursements of the firm over a specific period such as six months. To do this, the financial manager must have access to the sales forecast (provided by marketing managers – an interesting question for marketing majors is the following: which comes first? The marketing plan or the sales forecast). Forecast sales will depend on the economic forecast, the competitive environment, the advertising budget, discounts, availability of credit for customers, and the focus of the sales team. Of these, the sales forecast is the most important part of cash budget. Next, the financial manager tries to guess the timing of the firm’s cash receipts using a tool called the cash receipts schedule. The manager then tries to anticipate when the cash disbursements of the firm will be paid using another tool called the cash disbursement schedule. A template of the cash budget is shown in Table 3.7 (page 105 in your text). The top line of the cash budget is cash receipts and the second line is cash disbursements. These two lines are the key items in the budget and separate schedules (mentioned above) are used to generate them. A sample cash receipts schedule is shown in Table 3.8 (page 107 in your text). The difference between cash receipts and cash disbursements is net cash flow. Referring back to Table 3.7, the next step is to add the cash at the beginning of the month to net cash flow. The sum of beginning cash and net cash flow is ending cash. Notice the ending cash for a given month is the beginning cash for the next month. Because of this, the figures appearing after the beginning cash lines are really a sort of running total. For example, the beginning cash for February in Table 3.7 reflects the ending cash of January, which in turn reflects January’s cash receipts and cash disbursements. This means February’s ending cash, in part, reflects January’s cash receipts and cash disbursements. Next the firm’s minimum cash balance is subtracted from ending cash. You may be asking yourself three questions: 1) What is the minimum cash balance? 2) Since cash provides a zero return for shareholders, why would a rational firm hold cash at all? 3) Why is the minimum cash balance subtracted from ending cash? The minimum cash balance reflects the minimum cash the firm wants on hand at all times. The reasons firms hold cash are not all that much different from the reasons you hold cash. So ask yourself, why do you hold cash? Most of us (and corporate firms as well) have three motives for holding cash: 1) the transactions motive; 2) the speculative motive; and 3) the precautionary motive. The transactions motive relates to the need to have cash on hand to meet the need for day-to-day transactions. The speculative motive relates to the need to have cash to take advantage of an unexpected opportunity such as a sale. The precautionary motive requires the firm to hold cash in the event of some unexpected need for cash such as a plant fire or a natural disaster. The cash balance is not to fall below management’s minimum unless there is some pressing need for it to do so. Once the minimum cash balance has been deducted, the forecast will result in either a positive number or a negative number. A positive number means the firm can expect excess cash that month. The firm should make plans to invest that cash on a short-term basis, perhaps by buying marketable securities. A negative number means the firm can expect a cash deficit that month. The firm should approach a bank, well in advance of the expected deficit, to arrange financing. Table 3.10 (page 110 in your text) shows a completed cash budget. Look at the bottom two lines of the cash budget. The cash budget shows the firm expects to generate more cash than it needs in October the amount of $22,000. The firm should plan on investing that cash in marketable securities. The firm also expects cash deficits of $76,000 in November and $41,000 in December. This brings up an interesting question: How much should the firm plan on borrowing for the next three months? a) $41,000 b) $76,000 c) $117,000 ($41,000 + $76,000) Remember what I said about the figures on the cash budget being a running total? The maximum the firm will need to borrow from October to December will be $76,000. The $41,000 deficit for December already has the $71,000 deficit for November embedded in it so there is no need to add the two deficits together (as done in answer c). The sequence of events will therefore be: October: invest $22,000 in marketable securities. November: sell the $22,000 in marketable securities and borrow $76,000 December: payoff $35,000 of the $76,000 debt incurred in November leaving $41,000 in debt outstanding at the end of December. You might wonder where the $35,000 used to payoff debt in December originated. It came from the net cash flow generated in December. As an example of how to compute a cash budget, look at problem P3-9 on page 127 of your text. The problem provides us with actual sales from September and October of 2007 and a forecast of sales for the months November to April 2007. Information on other cash receipts, purchases, and other cash disbursements are also provided. We are told that 20% of sales are for cash, 40% of sales are received as cash one month after the sale and the remaining 40% of sales are received as cash two months after the sale. The firm pays cash for 10% of its purchases in the month of purchase, it pays for 50% of its purchases one month after the purchase date and the remaining 40% of its purchases two months after the purchase date. Spend a few minutes reading the problem before going through the solution I have prepared below. Solution to problem P3-10 The first step in preparing the cash budget is to estimate cash receipts by constructing a cash receipts schedule. The second step is to estimate cash disbursements by constructing a cash disbursements schedule. The final step is to finish the process by constructing the cash budget. To view the complete solution to the problem, double click on the excel worksheet shown below. Since the maximum cash deficit shown is $37,000 (in April), this is the amount the firm should borrow between November and April. Xenocore, Inc Cash Receipts Schedule $ September 210,000.00 $ October 250,000.00 $ November 170,000.00 $ December 160,000.00 $ January 140,000.00 $ February 180,000.00 $ March 200,000.00 $ $ 34,000.00 100,000.00 $ $ 32,000.00 68,000.00 $ $ 28,000.00 64,000.00 $ $ 36,000.00 56,000.00 $ $ 40,000.00 72,000.00 $ 84,000.00 $ 100,000.00 $ 218,000.00 $ 200,000.00 $ $ $ 68,000.00 15,000.00 175,000.00 $ $ $ 64,000.00 27,000.00 183,000.00 $ $ $ 56,000.00 15,000.00 183,000.00 Cash Disbursements Schedule $ September 120,000.00 $ October 150,000.00 $ November 140,000.00 $ December 100,000.00 $ January 80,000.00 $ February 110,000.00 $ March 100,000.00 $ $ 14,000.00 75,000.00 $ $ 10,000.00 70,000.00 $ $ 8,000.00 50,000.00 $ $ 11,000.00 40,000.00 $ $ 10,000.00 55,000.00