Week 4

advertisement

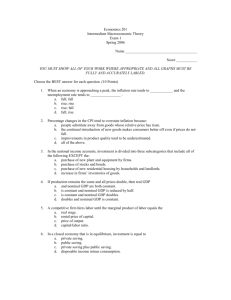

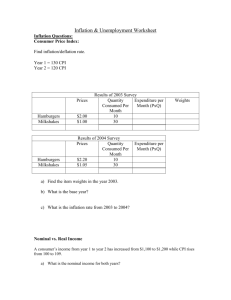

THE GLOBAL BUSINESS ENVIRONMENT: INTERNATIONAL MACROECONOMICS AND FINANCE Professor Diamond Class Notes: 4 MONEY, INFLATION, INTEREST RATES AND EXCHANGE RATES THE MONEY SUPPLY AND INFLATION Thus far we have examined inflation in the short run context of the business cycle. Now we wish to analyze it in the long run. Here we draw on the work of the Monetarists, which is a branch of the classical school of economic thought. Monetarists postulate that the money supply is all important in determining the health of the economy. The Monetarists begin with a simple concept - the Quantity Theory of Money. It can be expressed in the following equation: MV = PT where M V is the money supply is the transactions velocity of money - the rate at which money circulates in the economy P T is the price of a typical transaction is the transactions - the number of times a year that goods and services are exchanged for money. The equation is an identity. The money supply times its velocity by definition equals P times T - the number of dollars exchanged in a year. Since the number of transactions is difficult to measure, we substitute Y for T and rewrite the equation: MV = PY where Y P PY is (as usual) real GDP is the GDP deflator is the nominal GDP We now make the assumption that velocity is constant which is a reasonable approximation under most circumstances. The equation now reads: M V PY Since V is fixed, a change in the quantity of money M causes a proportional change in nominal GDP (PY). The quantity of money determines the dollar value of the economy's output. We can now establish three building blocks of a theory to explain what determines the economy's overall level of prices. They are: 1 1. The factors of production and the production function (the nation's productive capacity) determine the level of output Y. 2. The quantity of money determines nominal GDP (PY). 3. The price level P is the ratio of nominal GDP to the real level of output Y (the GDP deflator). Thus, this theory states that changes in the money supply leads to a proportionate change in nominal GDP. Since the nation's productive capacity has already determined real GDP, the change in nominal GDP must represent a change in the price level. Hence the quantity theory implies that the price level is proportionate to the money supply. Since the inflation rate is the percentage change in the price level, the quantity theory is also a theory of the inflation rate. Thus: % Change in M + % Change in V = % Change in P and % Change in Y Using the same reasoning as above we can conclude that: the quantity theory of money states that the central bank, which controls the money supply, has the ultimate control over the rate of inflation. If the central bank keeps the money supply stable (after allowing for a constant increase in the money supply to facilitate the increased transactions accompanying economic growth), the price level will be stable. If the central bank increases the money supply rapidly, the price level will rise rapidly. According to Milton Friedman the distinguished (Nobel Prize in economics, 1976) and articulate spokesperson for Monetarism, "Inflation is always and everywhere a monetary phenomena". Working with fellow economist Anna Schwartz he wrote two treatises on monetary history. He plotted the average rate of money growth and the average rate of inflation in the United States for each decade from the 1870's to the 1980's. The data confirms the link between the growth of the money supply (M2) and inflation (GDP deflator). High money growth led to high inflation - see Figure 7-1. Plotting comparable data for 34 countries in the 1980's again reveals the link between money growth and inflation. Low growth in the money supply, low inflation - see Figure 7-2. However, if we look at monthly figures on money supply growth and inflation rather than decennial data we do not find as close a connection between the two variables. Indeed, if we plot the growth of M2 (which is one of the ten components of the Index of Leading Economic Indicators) and the CPI or GDP deflator in the period since 1995 we find no discernable connection between the money supply and the inflation rate. The Monetarists theory of inflation works best in the long run. In the short run most prices tend to be sticky and do not correlate with modest increases in the money supply. 2 INFLATION AND NOMINAL AND REAL INTEREST RATES: THE FISHER EFFECT The interest income, which individuals receive on their financial assets, is calculated in terms of current dollars. It is based on an interest rate not adjusted for inflation. It is called the nominal interest rate. The real interest rate takes inflation into account. It is the return to investors after adjusting for inflation. For example, if one bought U.S. Series E saving Bonds in the early 1970's, it earned a nominal interest rate of 6%. If you redeemed them at the end of that decade when the annual rate of interest in the CPI was about 12%, the purchasing power of the original investment plus the accumulated interest would have fallen by approximately 50%. To add insult to injury one would have had to pay income tax on the nominal interest you received. The relationship between real and nominal interest rates is as follows: r i where r is the real interest rate i is the nominal interest rate is the rate of inflation The equation states that the real interest rate is the nominal rate minus inflation. Rearranging the equation: i r , the nominal interest rate is the sum of the real rate and the inflation rate. This form of the equation is called the Fisher equation named after the U.S. neoclassical economist Irving Fisher. This enables us to develop a theory of the nominal interest rate. The Quantity Theory tells us that a one percent increase in the money supply causes a one percent increase in inflation. This is called the Fisher Effect. A one percent increase in inflation causes a one percent increase in the nominal interest rate. Data over almost a 50 year period from 1950 to the late 1990's shows that the Fisher Effect fairly accurately predicted the relationship between inflation and nominal interest rates. When inflation was high, nominal interest rates also tended to be high - see Figure 7-3. Examining comparable data at a single point in time for 30 countries in 1996 shows once again that inflation and nominal rates are closely related. Countries with high inflation tend to have high nominal interest rates - see Figure 7-4. Note that U.S. nineteenth century experience did not conform to the Fisher Effect. When a borrower and a lender agree on a nominal interest rate they do not know what the inflation rate will be over the term of the loan. The real interest rate they expect is called the ex ante rate and the one that actually occurs - ex post. The ex ante real rate is i e and the ex post is i . Since the nominal rate cannot adjust to actual (future) inflation it must be based on expected inflation. Thus the Fisher Effect is more precisely written as: 3 i r e The nominal interest rate moves one-for-one with changes in expected inflation. EXCHANGE RATES One of the major determinants of the volume and composition of transactions between a country and the rest of the world is its exchange rates. As in the case of the domestic economy we want to distinguish between nominal and real measures. In addition to explaining nominal and real exchange rates we will examine trade weighted and purchasing power parity exchange rates. Nominal exchange rates usually referred to as the exchange rate or the foreign exchange rate is the number of units of foreign currency that can be purchased with one unit of a domestic currency. It is the relative price of the currencies of two countries. It is conventional to express the exchange rate of the dollar as units of foreign currency per dollar - for example, 104.75 Japanese yen per dollar or 9.36 Mexican pesos per dollar. However, there are two major exceptions. The exchange rate of the dollar with the British pound and the euro are always quoted as the number of dollars per one unit of the foreign currencies - for example, $1.58 for one British pound and $0.9597 for one euro. In the period from 1870 to 1930 when the international gold standard was in place, the United Kingdom was the center of the world's monetary system and London was its capital. London still accounts for more foreign exchange transactions than any other world financial center. In the case of the euro, its initial exchange rate with the dollar when it was launched on January 1, 1999 was $1.18 for one euro. Subsequently, it has fallen to less than par with the dollar. Assuming floating exchange rates, as is the case with the dollar and most of its major trading partners, the exchange rate of the dollar with foreign currencies will vary on a daily basis. Fundamentally, the exchange rate is determined by the forces of demand and supply. For example, let us consider the principal sources of demand and supply of U.S. dollars vis-à-vis the Japanese yen. As reflected in the balance of payments the sources of demand for dollars are Japanese importers of U.S. goods and services (U.S. exports to Japan), income earned by U.S. residents from Japanese investments, unilateral transfers from Japan to the U.S., purchase of U.S. financial and real assets by Japanese investors and official Japanese government purchases of reserve assets from the U.S. The sources of supply of dollars are U.S. imports of Japanese goods and services (Japanese exports to the U.S.) income earned by Japanese residents from U.S. investments, unilateral transfers from the U.S. to Japan, financial and real assets purchased from Japan by U.S. residents and official U.S. government purchases of reserve assets from Japan. The real exchange rate is equal to the nominal rate adjusted for the difference in the price levels of the two countries. The real exchange rate is often described as the terms of trade - that is, the quantity of foreign goods that can be obtained in exchange 4 for one unit of a domestic good. Thus the real exchange rate can be viewed as the relative price of the goods of two countries. To see the relationship between real and nominal exchange rates, let us refer to the example utilized in your text (Mankiw). Assume an American car costs $10,000 and a similar Japanese car costs 2,400,000 yen. To compare the prices of the two cars we convert the cost of the American car to yen. If the nominal exchange rate is 120 yen to the dollar, then the American car costs 1,200,000 yen. We can now calculate the real exchange rate. Since the price of the American car is one half of the price of the Japanese car (1,200,000 yen vs. 2,400,000 yen) the real exchange rate is one half or 0.5. Thus at the current price levels the U.S. can exchange (trade) one American car for two Japanese cars. Generalizing this for a single good: the real exchange rate equals the nominal exchange rate times the price of the domestic good divided by the price of the foreign good. Utilizing the above analysis we can now state the formula for the real exchange rate of a representative basket of goods between two countries as follows: = e X (P/P*) where = the real exchange rate e = nominal exchange rate P = the price level in the U.S. P*= the price level in Japan The real exchange rate between two countries is equal to the nominal exchange rate times the ratio of the price level in the two countries. The real exchange rate will be low if foreign goods are relatively expensive and domestic goods are relatively cheap. The real exchange rate will be high if foreign goods are relatively cheap and domestic goods are relatively expensive. Two reasons for focusing on the real exchange rate are: first, as noted earlier, when we are analyzing long run economic phenomenon we deal only with real measures. We will illustrate this when we examine purchasing power parity exchange rates. Second, the real exchange rate influences net exports which as we have seen impacts the economy's level of GDP. If the real exchange rate is low then domestic goods are relatively cheap and foreign goods relatively expensive, causing exports to increase and imports to decrease, thus raising NX and Y. Conversely, if the real exchange rate is high, then domestic goods are relatively expensive and foreign goods are relatively cheap, causing imports to rise and exports to fall, thus lowering NX and Y. Figure 8-8 shows graphically how the real exchange rate is determined. Saving minus investment (S-I) is the excess of domestic saving over domestic investment (net foreign investment) and thus the supply of dollars to be exchanged into foreign currencies and invested abroad. S-I is a vertical line since neither S nor I depend on the real exchange rate. NX represents the net demand for dollars from foreigners who wish to buy U.S. goods and services. It slopes downward since a low real exchange rate causes NX to rise and a high real exchange rate causes NX to fall. The equilibrium real 5 exchange rate is determined at the intersection of the two curves. At this point the supply of dollars for net foreign investment equals the demand for dollars by foreigners for the U.S. net export of goods and services. Since we have identified the factors that determine the real exchange rate we can now utilize this information to derive the formula for the nominal exchange rate. Given that: ex( P / P * ) by rearranging this equation then: e x( P * / P) The nominal exchange rate (e) is equal to the real exchange rate () times the price level in the foreign country divided by the price level in the home country. Given the value of the real exchange rate, if the U.S. price level rises relative to that of Japan the nominal dollar exchange rate will fall because a dollar is worth less. Conversely, if the Japanese price level rises then the dollar will buy more and the nominal exchange rate will rise. If we wish to study changes in nominal exchange rates over time we can utilize the following: the percentage change in e = percentage change in + ( * ) where e = the nominal exchange rate = the real exchange rate = the home country's inflation rate * = the foreign country's inflation rate * = the difference in inflation rates The equation states that the percentage change in the nominal exchange rate between two countries equals the percentage change in the real exchange rate plus the difference in inflation rates. If a country has a higher rate of inflation relative to that of the U.S., then a dollar will buy an increasing amount of the foreign country's currency over time. The foreign country's exchange rate will fall (depreciate) relative to the dollar. Conversely, if a foreign country has a lower rate of inflation relative to that of the U.S., then a dollar will buy a decreasing amount of the foreign country's currency over time. The foreign country's exchange rate will rise (appreciate) relative to the dollar. This analysis identifies the inflation differential between two countries as one of the principal factors causing a nation's nominal exchange rate to rise or fall. Figure 8-13 shows the impact of inflation differentials on U.S. (nominal) exchange rates. The scatter plot shows the difference between the average U.S. inflation rate and that of several of its major trading partners over the 1970-1996 period. It relates these inflation differentials 6 to the average percentage change in a foreign country's exchange rate with the U.S. dollar. The figure shows that those countries with relatively high inflation rates tend to have depreciating (lower) exchange rates to the dollar while those with relatively low inflation rates tend to experience appreciating (higher) exchange rates to the dollar. Thus, countries such as Japan, Germany, the Netherlands, Belgium and Switzerland have experienced appreciation in their exchange rate vis-à-vis the dollar. In contrast, countries such as Canada, the UK, Italy and Sweden have seen their exchange rates depreciate against the dollar. Table B108 from the statistical appendix of the 2000 Economic Report of the President provides detailed data on changes in the exchange rate of the dollar vis-à-vis the currencies of several countries from March 1973 to the fourth quarter of 1999. This analysis shows that in any given time period a nation's exchange rate typically appreciates relative to some foreign currencies and depreciates relative to others. Thus, if one focuses solely on a particular exchange rate e.g. the dollar/yen rate, a distorted picture may result. Accordingly, it is appropriate to utilize an exchange rate measure which more accurately reflects the net change in a country's exchange rate vis-àvis its major trading partners. Trade weighted exchange rate is an average of the exchange rates between the dollar and several foreign currencies with the currencies of those nations with whom the U.S. trades most given the greatest weight. For example, from March 1973, the beginning of the OPEC boycott, to 1995, the low point of the dollar/yen exchange rate, the dollar depreciated from 261.90 yen to 93.96 yen, a decline of 64.1%. In contrast the trade weighted index of ten countries currencies exchange rates, shown in Table B108, for the same period (March 1973=100) fell from 100 to 84.2, a decline of only 15.8%. This explains in part why the dramatic decline in the dollar/yen exchange rate in this period had only a minor impact on the U.S. trade deficit. You will recall that in comparing the per capita incomes of OCED countries the use of purchasing power parity exchange rates yielded different rankings than those which used nominal exchange rates. Purchasing Power Parity (PPP) is a theory of exchange rates which holds that the price of identical goods should be the same in all countries. It implies that the differences in nominal exchange rates reflect only different price levels. PPP is based on the law of one price. It postulates that assuming international arbitrage, a dollar or any other currency will have the same purchasing power in every country. A small increase in the price of goods in the U.S. for example, soybeans or crude oil, relative to their prices abroad will cause arbitragers to buy these goods in foreign countries and ship them to the U.S. This will cause their foreign prices to rise and their U.S. prices to fall. Conversely a small decrease in U.S. prices will trigger arbitragers to buy these commodities in the U.S. and ship them abroad, again resulting in equalizing prices in the U.S. and foreign countries. Therefore the movement of goods across national boundaries is highly sensitive to small changes in prices. Accordingly as shown in Figure 8-14 the net export schedule is very flat (highly elastic) at the real exchange rate that equalizes purchasing power among countries. A small change in the real exchange rate leads to a large change in net exports. 7 Purchasing power parity theory has two implications: first, since the NX schedule is flat, changes in saving and investment do not influence the real exchange rate; and second, since the real exchange is fixed all changes in the nominal exchange rates result from changes in the price level. The concept of PPP is a long run theory which requires virtually all of the conditions that exist in a long run competitive market to prevail in order to work. These include homogenous products, especially tradable commodities, complete international market information and no artificial barriers to trade. However, the reality is as follows: 1. 2. 3. 4. Goods in the world economy are increasingly differentiated by style and trademarks. Services, which are playing an increasing role in international transactions cannot be readily transferred from one country to another. Taxes, particularly sales and value added taxes differ significantly from country to country therefore causing price differentials. PPP does not take into account significant capital flows. For example, if a country has a sizable trade and current account deficit large sums of its currency will flow into the foreign exchange market to be converted to other national currencies thereby depressing its exchange rate. The opposite will occur if a country has a large current account surplus. However these factors do not totally invalidate the purchasing power parity concept. A number of PPP models have been constructed utilizing a representative basket of homogenous internationally traded goods. Some of these have been reasonably accurate predictors of the long run movements of nominal exchange rates. In 1986 the British magazine The Economist developed the Big Mac Index as a lighthearted guide to purchasing power parity. Their goals were threefold: first, to test the practical validity of the theory of one price; second, to make economic theory "more digestible"; and three, to see if Big Mac Index could predict the future movements of nominal exchange rates. The Economist chose McDonald's Big Mac hamburger as a proxy for a representative basket of homogenous goods. The Big Mac is sold in over 80 countries worldwide. By the end of the 1990's there were over 5,000 McDonald restaurants throughout the world. The Index has been published annually since 1986 and has proved to be a fairly accurate predictor of nominal exchange rates. The Index collects and publishes data for over 40 countries. Utilizing the U.S. as its base it lists the Big Mac's price in local currency and U.S. dollars, the implied PPP of the dollar, the actual exchange rate and the extent to which a country's exchange rate is undervalued or overvalued against the dollar. Thus the Index predicts the exchange rate for each country which would make the price of a Big Mac in that country equal to its price in the U.S. see Table 2.1. 8