Sen. Judiciary

advertisement

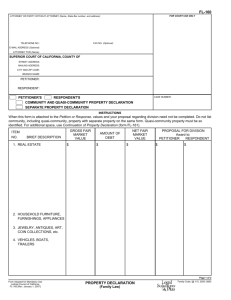

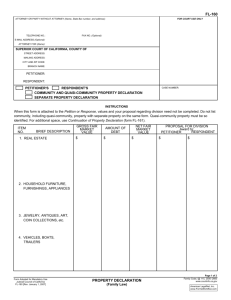

SENATE JUDICIARY COMMITTEE Senator Hannah-Beth Jackson, Chair 2015 - 2016 Regular Session SB 340 (Anderson) Version: February 23, 2015 Hearing Date: May 5, 2015 Fiscal: No Urgency: No NR SUBJECT Dissolution: disclosure DESCRIPTION Existing law requires each party in an action for dissolution of marriage or legal separation to serve a preliminary declaration of disclosure of assets, and a final declaration of disclosure on the other party. In the case of a default judgment, a petitioner may waive the final disclosure requirements. This bill would state that a petitioner is not required to provide a preliminary declaration of disclosure if the petitioner served the summons and petition by publication or posting pursuant to court order, and the respondent has not responded. The bill would require, when a petitioner has served the summons and petition by publication or posting and the respondent files a response prior to default judgment being entered, the petitioner must serve the respondent with a preliminary declaration of disclosure within 30 days. BACKGROUND The Elkins Family Law Task Force, appointed in 2008 for the purpose of conducting a comprehensive review of family law proceedings, produced a final report which contains 21 main recommendations. (Elkins Family Law Task Force: Final Report and Recommendations, (April 2010) Judicial Council <http://www.courts.ca.gov/ documents/elkins-finalreport.pdf> [as of March 24, 2015].) While many of the Task Force ’s recommendations have been implemented by the courts, whether through Rule of Court or informal policy change, others require statutory changes. In 2010, AB 939 (Committee on Judiciary, Ch. 352, Stats. 2010) was enacted to implement most of the Elkins Task Force’s key legislative recommendations. Again in 2012, AB 1406 implemented another specific recommendation of the Task Force by setting a deadline for service of preliminary financial disclosures and requiring the parties to include tax returns from the two previous years. (AB 1406, Committee on Judiciary, Ch. 107, Stats. SB 340 (Anderson) Page 2 of 5 2012.) However, key recommendations from the report have yet to be adopted. For example, one recommendation was to create more comprehensive, statewide rules. The need for this change was argued for by local family court staff who noted, “for local rules it is kind of crazy, because you have the same law being administered in different ways in 58 counties. I think more uniformity would be good.” (Id. at 30.) The lack of uniformity is evident in many places where the code is silent and counties are left to fill in any necessary gaps. The subject of this bill, financial disclosures between spouses in an action for divorce where one spouse cannot be located and defaults after being served notice by publication, lacks the consistency the Task Force called for in its recommendations. Specifically, when a person files for divorce, the law requires the petitioning spouse to serve notice of the summons and the petition for divorce on the other spouse. Both parties are also required to provide preliminary financial disclosures to the other party. In cases where the whereabouts of both spouses are known, service is relatively straight forward and can be accomplished in a number of ways, including in person or by mail. (See Code Civ. Proc. Secs. 415.10; 1012.) However, if the location of the responding spouse is unknown, notice and service become more problematic. In these cases, the court may allow the petitioning spouse to give “notice by publication” and publish the relevant information in a newspaper “most likely to give notice to the party served.” (Code Civ. Proc. Sec. 415.50.) The requirement of financial disclosure, however, is not so easily solved when the other spouse’s address is unknown. Because the Family Code does not specify how financial disclosures must be completed, there are inconsistencies in practice. Some counties have developed systems through local rule of court, some rely on general service provisions under the Code of Civil Procedure, and the Judicial Council has created a form which requires that disclosures are sent to a respondent’s last known address. Accordingly, this bill seeks to better implement the Task Force recommendation for more statewide uniformity in family law procedures. By creating a very narrow exception to the mandatory financial disclosure rules in cases where the petitioner served the petition by publication or posting and the respondent has defaulted. CHANGES TO EXISTING LAW Existing law provides that parties to a dissolution or legal separation must serve on the other party a preliminary declaration of disclosure of all assets and liabilities in which one or both parties may have an interest. (Fam. Code Sec. 2103.) Existing law provides that the preliminary declaration of disclosure of assets must be served concurrently or within 60 days service of the petition for dissolution of marriage or legal separation of the parties, and must be signed under penalty of perjury. (Fam. Code Sec. 2104.) SB 340 (Anderson) Page 3 of 5 Existing law prohibits the court from entering a judgment regarding the parties’ property rights in a dissolution proceeding unless each party has submitted a final disclosure declaration and a current income and expense declaration. (Fam. Code Sec. 2106.) Existing law allows the petitioner, in the case of a default judgment, to waive the final declaration of disclosure requirements. (Fam. Code Sec. 2110.) This bill would provide that a preliminary declaration of disclosure is not required by a petitioner if the petitioner served the summons and petition by publication or posting pursuant to a court order, and the respondent has defaulted. This bill would provide that when a petitioner serves the summons and petition by publication or posting and the respondent files a response prior to a default judgment being entered, the petitioner must serve the respondent the preliminary declaration of disclosure within 30 days of the response being filed. COMMENT 1. Stated need for the bill According to the author: The court can approve service by publication or posting in cases where the respondent cannot be served with reasonable diligence in another manner authorized by statute (Code of Civil Procedure Section 415.50). In these cases, if the respondent defaults, and most do, it can reasonably be assumed the respondent will not get actual notice of the disclosures, making petitioner’s efforts in completing, filing and serving the required forms an unnecessary expenditure of time and resources. These disclosures, which often contain personal financial information, like bank account and credit card account numbers and balances, must be mailed to the last known address, so there is the possibility a third party may come into possession of the Petitioner’s sensitive financial information. These disclosures are not filed with the court, so eliminating the requirement to serve a defaulting spouse with these forms, when service is by publication or posting, will not deprive the court of needed information. 2. Does not create exception for respondent to serve preliminary disclosures This bill would exempt a person who is seeking a divorce and cannot locate her spouse, from the obligation of serving preliminary financial disclosures on the missing spouse if notice by publication has been approved by the court. SB 340 (Anderson) Page 4 of 5 This bill does not exempt the missing spouse, who has been served notice by publication, from the obligation to provide preliminary financial disclosures. If the respondent does, in fact, respond to the notice by publication, the petitioner is required to serve preliminary declarations upon the respondent within 30 days of that response, and the respondent must make those same disclosures within 60 days. Accordingly, the only difference between the requirements under existing law and those set forth under this bill are that a petitioner would not be required, in the rare situation that she gave notice by publication, to send financial information to an address where the respondent no longer lives. Staff notes that it is in a respondent’s best interest to respond, and not default, to a petition for dissolution to ensure that both parties are able to present information to the court prior to the division of assets. When a respondent defaults, the court only reviews information that the petitioner has provided. Judicial Council has created a number of forms to assist a petitioner who is asking the court to divide property. For example, the “Request to Enter Default” form (FL-165) should be accompanied by a “Property Declaration” form (FL-160) and a “Proposed Judgment” form (FL-180) to help the court make the division of property. Further, under existing law (and this bill) if a petitioner lies about not knowing where the respondent is in order to get permission to serve by posting or publication, the entire judgment could subsequently be set aside due to fraud. 3. Privacy Existing law requires that preliminary financial disclosures be served on a spouse concurrently or within 60 days service of the petition for dissolution of marriage. This bill would eliminate this requirement for an individual who is unable to locate his or her spouse and has, with the court’s approval, served the petition by publication. In the event that a spouse does respond to the publication, this bill would require the petitioner to serve the respondent with the preliminary financial disclosures within 30 days. The Executive Committee of the Family Law Section of the State Bar (FLEXCOM), the sponsor of this bill, explains that, “in the vast majority of cases where service was accomplished by publication or posting, respondents default in the case, meaning they never appear or participate in the case.” Thus, preparing the financial disclosures is arguably unnecessary expenditure of time and resources because a defaulting respondent will never see the disclosures and the court does not evaluate them to determine the disposition of the case. In addition, because existing law is silent regarding how or where the disclosures must be served, counties have developed different practices to address this issue. For example, Santa Clara County employs a local rule which allows a petitioner, in the case of publication, to file his or her preliminary financial disclosures with the Superior SB 340 (Anderson) Page 5 of 5 Court. (Super. Ct. Santa Clara County, Local Family Rules, Rule. 1(J)(3).) However, the instructions on the Judicial Council form created for serving the petition by publication or posting indicate that any documents posted must be mailed to the last known address. (See Code Civ. Proc. Sec 415.50; Judicial Council Form FL-982 found at < http://www.courts.ca.gov/documents/fl982.pdf.> [as of April 29, 2015].) Because these disclosures contain personal financial information (e.g., tax returns, and bank/credit card account numbers and balances) mailing to a respondent’s last known address creates the possibility a third party may come into possession of the petitioner’s sensitive information. As noted above, this bill would address that issue by instead providing that preliminary disclosures in cases where the petitioner provided service by publication or posting need not be completed unless the respondent actually responds to the petition. Accordingly, this bill seeks to save these petitioners the time and expense of preparing preliminary disclosures and protect against the possibility that sensitive financial information will fall into the hands of third parties. Support: None Known Opposition: None Known HISTORY Source: Executive Committee of the Family Law Section of the State Bar (FLEXCOM) Related Pending Legislation: None Known Prior Legislation: AB 1406 (Committee on Judiciary, Chapter 107, Statutes of 2012) set a 60 day time limit for the preliminary declaration of disclosure, as specified, and required the preliminary declaration of disclosure of assets to include all tax returns filed by the declarant within the two years prior to the date that the party served the declaration. AB 939 (Committee on Judiciary, Chapter 352, Statutes of 2010) made various changes to family law proceedings thereby implementing a number of the legislative recommendations issued by the Elkins Family Law Task Force. **************