Job profile

advertisement

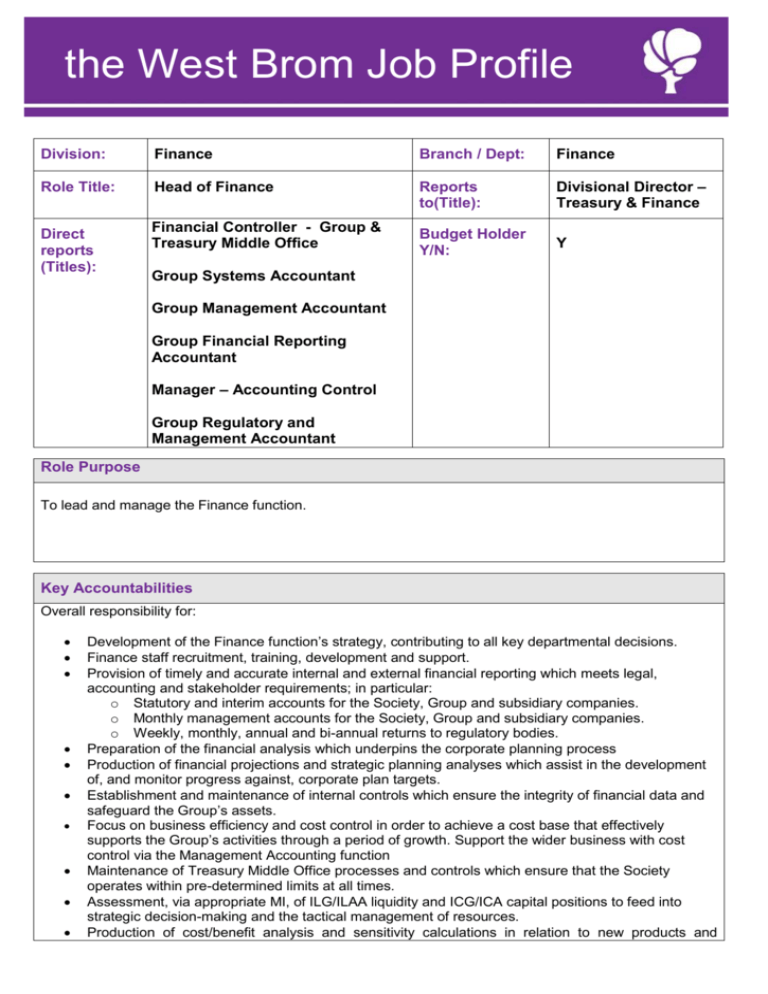

the West Brom Job Profile Division: Finance Branch / Dept: Finance Role Title: Head of Finance Reports to(Title): Divisional Director – Treasury & Finance Direct reports (Titles): Financial Controller - Group & Treasury Middle Office Budget Holder Y/N: Y Group Systems Accountant Group Management Accountant Group Financial Reporting Accountant Manager – Accounting Control Group Regulatory and Management Accountant Role Purpose To lead and manage the Finance function. Key Accountabilities Overall responsibility for: Development of the Finance function’s strategy, contributing to all key departmental decisions. Finance staff recruitment, training, development and support. Provision of timely and accurate internal and external financial reporting which meets legal, accounting and stakeholder requirements; in particular: o Statutory and interim accounts for the Society, Group and subsidiary companies. o Monthly management accounts for the Society, Group and subsidiary companies. o Weekly, monthly, annual and bi-annual returns to regulatory bodies. Preparation of the financial analysis which underpins the corporate planning process Production of financial projections and strategic planning analyses which assist in the development of, and monitor progress against, corporate plan targets. Establishment and maintenance of internal controls which ensure the integrity of financial data and safeguard the Group’s assets. Focus on business efficiency and cost control in order to achieve a cost base that effectively supports the Group’s activities through a period of growth. Support the wider business with cost control via the Management Accounting function Maintenance of Treasury Middle Office processes and controls which ensure that the Society operates within pre-determined limits at all times. Assessment, via appropriate MI, of ILG/ILAA liquidity and ICG/ICA capital positions to feed into strategic decision-making and the tactical management of resources. Production of cost/benefit analysis and sensitivity calculations in relation to new products and initiatives. Communication of new and revised International Financial Reporting Standards (IFRS) and changes to the regulatory reporting environment, highlighting the implications for the Society. Development of accounting systems and processes which enhance controls and efficiency within Finance. Maintenance of an effective control framework with respect to accounting, payment and reconciliation processes The departmental operational risk register and measurement framework. Finance projects and contribution to Society-wide projects, as appropriate. Documentation and implementation of policies which ensure compliance with HMRC rules for all relevant taxes (i.e. corporation tax, income tax, PAYE/NI and VAT). Liaison with external auditors and tax advisors. Deputising for Divisional Director – Treasury & Finance, as and when required. Communication The role requires effective verbal and written communication at all levels to include: Executive and Non-Executive Directors, Divisional Directors, Heads of Department and Senior Managers Regulators, primarily the Prudential Regulation Authority Internal and external auditors External tax consultants The jobholder must be able to convey technical information to non-technical colleagues and influence others to assure that Finance objectives are consistently met. Complexity Integral to the role is the ability to: Operate in an environment of change with potential restrictions on capacity/resource; Independently understand, analyse and interpret accounting standards, regulatory guidance and complex datasets; Utilise advanced Excel/other functionality to create financial models and provide MI to various audiences; and Optimise financial systems and processes using an in-depth knowledge of departmental activities, individuals’ skill sets, technological capabilities and the interaction of these factors. Knowledge, Skills and Experience The jobholder should possess the following: Accountancy qualification (ACA, ACCA or CIMA) with relevant post-qualification experience in the Financial Services sector. Ability to communicate across all levels of the business; both internally (from the Board to the detailed operational level) and externally with regulators, customers, suppliers and advisers. Detailed knowledge of accounting and tax systems, processes and reconciliations/controls. Ability to work to tight deadlines in a flexible and evolving work environment. Advanced IT skills: Experience of using Microsoft Office packages, especially Excel. (Experience of SPSS, Agresso and TM1 is preferable). Excellent teamwork and administration skills, displayed through an ability to manage a team, develop team members and run a significant department. Ability to engage and influence people at all levels. Experience of implementing core projects, including IT projects. Planning and Control In the areas of planning and control, the jobholder should: Contribute to setting divisional goals and lead and develop the Finance team to achieve them. Demonstrate the ability to manage own and team’s workload, prioritising as appropriate to ensure deadlines and key project milestones are met. Consider the wider business impact and focus of all Finance activities. Identify and act upon opportunities to improve business efficiency and controls. Ensure the team delivers the requirements of the Society’s Risk Framework. Responsibility Responsible for managing the Finance function and departmental budget to achieve the ‘Key Accountabilities’ detailed above. Core Values Friendly and welcoming Be approachable Help and support each other Share ideas and knowledge Build strong relationships Keep it simple and straightforward Be clear and concise Avoid jargon and check understanding Find the most effective way Suggest improvements Embrace Change Be receptive and adaptable to change Show willingness to try new things Challenge the way things are done Be a champion for change Understand and respond to customer needs Put myself in the customer’s shoes Always do what I’ve said I’ll do Listen to customer feedback and learn Strive for excellence Take individual responsibility Find the solutions rather than leave it to someone else Be accountable for my actions Take responsibility for my personal development Ask if I’m not sure Leadership Essentials Think Strategic Insightful Innovative Develop Empower Coach Reflect Lead Guide Communicate Influence Deliver Accountable Driven Flexible