the prediction was

TAKING CARE OF YOU

ISSUE#: One Hundred-Eighteen May, 2006

INSIDE THIS ISSUE:

1. Active Investment Management = Participate In Up/Control Participation In Down Markets

2. Markets = Recent Market Declines

3. Current Best Funds = Issue# 118 Fund Changes/Why?

4. Comprehensive Financial Planning =Estate Planning

ACTIVE

INVESTMENT

MANAGEMENT

OBJECTIVE

•Participate In Up Markets

•Control In Down Markets

ALLOCATIONS

•Asset Allocations

(Secular/Cyclical Markets)

•Opposite Categories

•Different Classes

•Independent Classes

FILL ALLOCATIONS

•Use Best Funds

•Monitor Choices

CONTROL SWINGS

•Diversify Manager Styles •

•Control Sector

Concentration

•Allow Fund Managers

To Make S/T Decisions

•Rebalance

•Fine Tuning Strategies

ADVISOR/CLIENT

•Motivate Advisor

•No Conflicts

•% Of Assets Basis

•Help Build Business

1. ACTIVE INVESTMENT MANAGEMENT

PARTICIPATING IN UP MARKETS & CONTROLLING

PARTICIPATION IN DOWN MARKETS

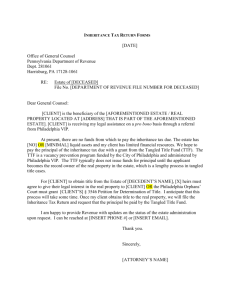

Why so important? The simple graph and comments below, from clients’ actual IRR%, clearly illustrate the tremendous value of

PARTICIPATING IN UP MARKETS &

CONTROLLING PARTICIPATION IN DOWN MARKETS:

V A N G U A R D S & P 5 0 0 V S .

.

R .

.

O .

.

I

I .

.

S T R A T E G

I

I

E

S

$1.40

$1.20

$1.00

$0.80

$0.60

$0.40

$0.20

Vanguard S&P 500

12/31/1999

R.O.I. Strategies*

8/18/2003

10/10/2002

$0.00

* R.O.I. Strategies = ROI’s most common allocation, plus each bullet in the “ACTIVE INVESTMENT MANAGEMENT” column on the left side of this page.

COMMENTS ABOUT THE VANGUARD S&P 500 GRAPH LINE

From 1/1/1999 to 12/31/1999 the Vanguard S&P 500 rose about 21%. Starting with $1.00 on 1/1/1999, one would have about $1.21 by 12/31/1999. By 10/10/2002 the S&P 500 had declined about –51%, and the $1.21 would be worth about $0.59. Getting the $0.59 back to the 12/31/1999 value of $1.21 would require growth of +105

%!!!!

As of 8/18/03, the Vanguard S&P 500 was only about $0.74.

“TAKING CARE OF YOU”, Page 2

COMMENTS ABOUT THE R.O.I. STRATEGIES GRAPH LINE

From 1/1/1999 to 12/31/1999 the R.O.I. Strategies rose about 32%, i.e., we Participated in the Up Market

(note, when the S&P 500 has large increases like 21% in 1999, we do not expect to beat the S&P 500 – we would be happy if we did 15%-18% in such a year – but we did very well in 1999). Starting with $1.00 on

1/1/1999, one would have about $1.32 by 12/31/1999. By 10/10/2002 we had declined about –21% (not -51%), and the $1.32 would be worth about $1.04, i.e., we Controlled Participation in the Down Market . Getting the $1.04 back to the 12/31/1999 Vanguard S&P 500 value of $1.21 would require growth of only +16% (not

105%) !!! Getting the $1.04 back to the 12/31/1999 R.O.I. Strategies value of $1.32 would require growth of only +27%!!! This was accomplished about 8/18/03 (less than one year from 10/10/02)!!!

The above chart and comments clearly illustrate the tremendous value of participating in up markets & controlling participation in down markets, and, clearly illustrates the tremendous importance of professional, active management to accomplish these two critical objectives. We cannot guarantee this kind of success in the future, but we can promise we will try to use our best efforts at all times.

2. MARKETS

RECENT MARKET DECLINES

Higher oil prices in April and into mid-May (reaching $79/barrel) are probably the primary influence causing the Consumer Price Index to go up significantly, which has sparked increased fears about inflation, which has led to increased concerns that the Feds will continue to make interest rate increases, which has resulted in recent significant declines in the stock markets (hopefully an over-reaction), i.e., higher oil prices

CPI increases

inflation fears

interest rate increases fears

over-reaction decline in stock markets.

Since mid-May oil prices have actually declined from $79/barrel to $72/barrel, i.e., a 9% decline. It may be that in the next month the same thinking above will happen in reverse, i.e., lower oil prices

CPI decrease

reduced inflation fears

reduced interest rate increase fears

over-reaction increase in stock market.

Thus, it may not be prudent to significantly react now to the recent decline in the stock markets, but to moderately react to the recent declines and watch for opportunities should their be substantial increases in the next month or so.

R.O.I. has actually already made some moderate changes during the end of April and the first of May – not in reaction to, but in anticipation of – the recent declines. Unfortunately, most clients’ portfolios have not benefited from these changes because we performed an annual rebalancing of almost all clients’ portfolios during the last of March/first of April. Rebalancing a client’s account results in: (1) Updating funds to

“Current Best Funds”, which results in selling some old and buying some new funds; and, (2) Rebalancing current positions to new “Fine Tuning” allocations, which results in small buys and/or sales in almost every fund in a client’s portfolio.

In Fidelity’s “wisdom” (and we should point out that other major networks have similar rules, so it doesn’t make much difference which network an advisor is using), they have instituted some time ago an Early

Redemption Fee (ERF) program to “protect” investors from excessive trading in mutual funds. When we rebalance a client’s portfolio we then have to be concerned for the next 60 days about Fidelity’s ERF on all non-

“TAKING CARE OF YOU”, Page 3

Fidelity funds = ¼% (a minimum $30) of the value of any sales within 60 days of any new purchases (note: a minimum $30 ERF can be a huge % of a small sale). The net effect to R.O.I. is that those rebalanced client accounts are frozen for the next 60 days, unless R.O.I. believes something so terrible or so wonderful has or will happen that R.O.I. feels it is worth the clients incurring multiple ERFs in order for us to protect their accounts or take advantage of some big opportunity.

Even though clients’ portfolios have recently been hit with substantial declines (remember this is after we had already had tremendous gains of over 8% through April 2006, so the net result is we are still doing quite well compared to most popular indexes and others’ portfolios), we didn’t feel it was worth incurring multiple ERFs in order to make effective the moderate changes we had made during the end of April and the first of May.

3. CURRENT BEST FUNDS

LAST MONTH ’06 YEAR TO DATE

1/1/97 THROUGH ‘06

ROI’S MPT INDEX* +2.0%

ROI’S “BEST FUNDS”** +3.0%

+6.2%

+8.1%

+ 74.1 %

+106.3 %

* ROI’s MPT INDEX = An index based solely upon one Modern Portfolio Theory type of Asset Allocation to each of the following

12 Asset Classes, assuming from: (1) 1/1/97, an 11% Target Return (i.e., 70% in Stocks; 15% in Bonds; 15% in Anti-Inflation); and,

(2) 3/1/03, a Moderate allocation (i.e., 50% in Stocks; 25% in Bonds; 25% in Anti-Inflation); using the average returns of all mutual funds in each Asset Class, Rebalanced on a monthly basis (data supplied by Morningstar).

** ROI’s “BEST FUNDS” = Using the accumulated yearly IRR % of an actual client’s account that uses the same Moderate Asset allocation as in ROI’s MPT INDEX, but includes all of ROI’s other strategies.

ISSUE# ONE HUNDRED-EIGHTEEN BEST FUND CHANGES & WHY?

(Funds or % in < > are new funds and allocations replacing prior choices. Current through Newsletter date.)

STOCKS

Aggressive Growth

Janus Orion (125%)

Growth

<Fidelity Cnvrtble Sec> (25%)

Pimco S-T D (200%)

JP Morgan Mtg Backed (25%)

<Dreyfus Founders Mid Cap> (150%) Junk

Pro Funds Ultra MC <112.5%>

BONDS

US/LT, ST, Mtg, Convertible

Small Cap

Van Kampen SC Grth A (112.5%)

Hancock High Yield (50%)

Global

Oppenheimer Intl Bond (50%)

Keeley Small Cap Value (131.25%)

Equity Income

Payden EM Bond (50%)

ANTI-INFLATION

Amana Income <125%> Asset Manager

Stock Index Ivy Asset Strategy A (75%)

Fidelity Spartan Market Index (133%) Ntrl Res, Utilities & Metals

Overseas: Int’l, World, SC, EM

JennDry Utilities A (50%)

US Global Resources (125%)

<SSga International Select> (128.6%) Real Estate

Oppenheimer Intl SC (160.71%) ProFunds Ultra RE <67.43>

“TAKING CARE OF YOU”, Page 4

SSga Emerging Markets <85.72> <Morgan Stan Intl RE> <22.48%>

THE “WHYS”

1. Increased Allocations: US Equity Income; and, Reduced Allocations: US Growth/Value and

Overseas/Emerging Markets – We wanted to reduce our exposure to US non-large cap stocks and

Overseas/Emerging Markets because of recent declines in these asset classes and any possible further declines, primarily due to the Fed continually increasing interests rates (interest rate increases usually have a greater effect on US non-large cap stocks) and “hot money” leaving the Emerging Markets asset class. Additionally, we increased US Equity Income because this asset class usually consists of primarily large cap US stocks that pay significant dividends, the type of US position that generally stands up better in a weakening US market. Finally, we have a substantial cash position (7% in the Moderate allocation model) to respond if further bad things happen (maybe we will short the US markets or buy gold?), or if we have a turn around like we had last summer

(maybe we will buy more US and/or Overseas Small Caps?);

2. Dreyfus Founders Mid Cap for Turner Concentrated -- Turner dropped out of the top 25% and Dreyfus performed much better during the most recent declines;

3. SSga International Select for Driehus International Discovery -- Driehus dropped out of the top 25% and

SSga International has been performing much better during the most recent declines;

4.

Fidelity Convertible Securities for Franklin Convertible Securities -- Franklin has dropped out of the top

25% and Fidelity was ranked number one in during the last month and the last twelve months;

5 . Morgan Stanley Intl RE for 22.48% of ProFunds Ultra RE – Morgan Stanley is an international real estate fund, and international real estate has been performing better over the last few months than domestic real estate (which has generally been declining, e.g., ProFunds). We made this allocation to reduce our exposure to domestic the real estate (especially in light of expected interest rate increases in the US) and in hopes that international real estate may give us some positive performance if the US markets’ downward trends continue.

[ROI tracks each month’s consensus predictions for the Dow Jones Industrial Average (DJIA) for the upcoming six months, by the panel of “experts” in the Investment Advisor Magazine.]

THE PREDICTION WAS: THE DJIA WAS: THE PREDICTION WAS OFF BY:

MADE FOR DJIA ACTUALLY

1/05 6/05 10985 10579

2/05 7/05 11097 10626 + 471 + 4%

3/05 No Investment Advisor Magazine prediction for 8/05 – March issue prediction for 9/5.

4/05 9/05 11127 10378

5/05 10/05 11120 10281

+ 749

+ 839

+ 7%

+ 8%

6/05 11/05 10871 11081

7/05 12/05 10925 10921

8/05 1/06 10712 11031

9/05 2/06 10969 11069

- 210

+ 4

- 319

-100

- 2%

+ 0%

- 3%

- 1%

10/05 3/06 10955 11313

11/05 4/06 11048 11348

12/05 5/05 11034 11094

TWELVE MONTH ERROR RANGE =

POINTS

+ 406

-358

-300

-60

839/-358

PERCENT

+ 4%

- 3%

- 3%

- 0%

+8%/-3%

!!R.O.I. believes it is impossible to predict the short-term future. If the “experts” can’t reliably do so what chance do you or R.O.I. have? Should we make large bets on short-term predictions?

“TAKING CARE OF YOU”, Page 5

4. COMPREHENSIVE FINANCIAL PLANNING (CFP)

COMPREHENSIVE

ESTATE PLANNING

FINANCIAL

PLANNING

INCOME & EXPENSE

•Emergency Planning

•Budgeting

•Taxes

KIDS/GRANDKIDS’ GOALS

•”Teach Them To Fish”

•Missions, Education, Marriages,

and Home Down Payments

RETIREMENT

LONG TERM CARE

Estate Planning can be divided into three areas:

A.

B.

C.

Transferring Inheritance

Reducing Estate Taxes

Simply put,

According to Preferences;

Special Planning Objectives for Kids’, Family Members and Entities; and,

, Related Costs, Time Involvement and Anguish.

Below is a brief discussion of these three areas.

Transferring Inheritance According To Preferences generally accomplished using the following tools:

means getting the desired amount of inheritance into the hands of the desired heirs. This is

1. Wills;

2. Asset Ownership;

DEATH & DISABILITY

3. Beneficiary Designations; and/or,

IDENTITY THEFT

4. Trusts.

PROTECTION

If you don’t have special concerns about “B” and “C”, above, then Transferring

ESTATE PLANNING

Inheritance According to Preferences can usually be accomplished using tools 1-3

BUSINESS & ASSET above.

PROTECTION PLANNING

Wills generally accomplish the following: Name Guardian(s) (substitute parents) for minor children; Name Executor(s)/Personal Representatives (temporary positions to finalize the decedent’s estate in probate court); and Transfer inheritance according to preferences (who gets what and when). Any inheritance passing via a will is subject to Probate Court approval, but unless an estate is complicated, there are concerns about challenges by heirs, or there are multiple pieces of real estate in more than one state, Probate is now much quicker and less expensive than the horror stories of past years. Every married person, and singles who have significant assets, probably should have wills.

Asset Ownership passes inheritance according to the type of ownership designation, e.g., Joint Tenancy passes ownership of a jointly owned asset to the surviving joint tenant without going through probate. The simplicity of passing inheritance by Asset Ownership has attractions, but transfers by Asset Ownership are usually not the best planning method because of a host of reasons that are too many to discuss at this time.

Beneficiary Designations is the method for passing interests in life insurance, annuities and retirement plans

(e.g., 401ks, IRAs, ROTHS, et. al.). They provide for a Primary Beneficiary, and if a Primary Beneficiary predeceases the insured/annuitant/retirement plan owner, Contingent Beneficiaries are named.

Trusts pass inheritance in much the same manner as wills do, but avoid probate because the trust actually owns the assets in its own name and doesn’t die when the Grantor/Trustor (the person who created the trust and transferred assets to the trust) does. If title to assets are never actually transferred to the trust, much of the trust’s benefits are missed. Trusts name Trustees and Successor Trustees to administer the trust and distribute its assets according to the terms of the trust. Trusts can be revocable (the Grantor/Trustor can amend or even terminate the trust) or irrevocable (cannot be changed). In addition to transferring assets, trusts can do so in a

“TAKING CARE OF YOU”, Page 6

manner that maximizes various Estate Tax (i.e., taxes due at death) deductions and credits, and, are excellent tools for handling Special Planning Objectives (e.g., provisions for child(ren) who have special gifts or limitations, dealing with complicated situations resulting from multiple marriages and “yours/mine/and ours” kids, etc.). This is why trusts are so important if you have special concerns about “B” and/or “C”, above.

Other tools that are much simpler than trusts or wills that can be very helpful in planning for Special Planning

Objectives are Living Wills (“turn off the machine and let me die”, e.g., the Terry Shiavo case) and Powers of

Attorney (they give someone else authority to make medical and financial decisions on your behalf when you are incapacitated).

Under current law, if your net estate (including life insurance and retirement plans) is less than $2 million, and you don’t have Special Planning Objectives, a basic estate plan package of: Simple (everything goes to my surviving spouse) Wills (if you have minor children, possibly including Testamentary Trusts, i.e., trusts that come to life after both parents die); Living Wills; and Powers of Attorney, may suffice. Otherwise: Pour-Over

(everything goes to my trust) Wills; Revocable Trust(s) (possibly Irrevocable Trusts); Living Wills; and Powers of Attorney, may be a more appropriate estate plan. If you have business interests, and/or a net estates over $4.0 million under current law, LLCs/LPs, corporations, gifting, and maybe life insurance for estate liquidity purposes, may need to be weaved into your estate plan. In any case, ROI, with our client’s cooperation, will try to help full service clients obtain the proper estate plan for their situation.

Unfortunately, a part of life includes experiencing the death of a loved one. In this regard see, as an attachment to this newsletter, “WHAT TO DO WHEN A LOVED ONE DIES.” Please retain this in a place (maybe with your wills, trusts, living will, and powers of attorney) where you can find it when it is needed. Thanks, R.O.I.

“ TAKING CARE OF YOU” is a publication of Ronald Olson, Inc.

(dba, R.O.I.), a Registered Investment

Advisor (R.I.A.), and is produced for the sole benefit of R.O.I.’s clients. Editors: Ronald H. Olson, President,

Grant and Ben Olson, Assistants. 351 East 140 North, Lindon, Utah 84042-2004, 801-785-3254, 801-785-3244

(Fax), 801-580-7672 (Mobile), ronolson@itsnet.com

(e-mail), www.roionweb.com

(Web Site).