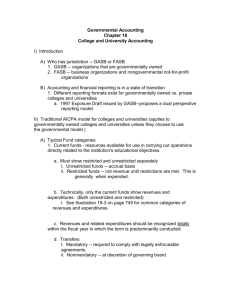

Chapter 7

advertisement

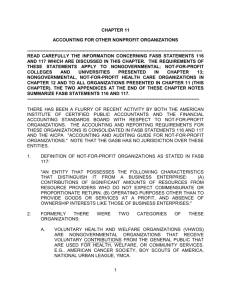

Chapter 12 Accounting for Hospitals and Other Health Care Providers This chapter examines unique features of not-for-profit private health-care organizations and briefly discusses requirements for governmental health-care entities. Not-for-profit, business-oriented health care organizations are those that raise essentially all revenues from health-care services provided, e.g., individual practitioners, clinics, hospitals, etc. FASB sets the standards for for-profit and not-for-profit entities, while GASB sets the accounting standards for governmental entities. If it is a private sector organization, is it commercial or notfor-profit? If it is a not-for-profit, then FASB’s standards for not-for-profit apply. Is health-care organization governmentally related or not? If it is, then GASB indicates that it is a proprietary activity and enterprise fund accounting applies. We are going to look at accounting and financial reporting by health care entities organized either as governmental or as not-for-profit with a business orientation. Health Care Guide Requirements: F/Ss should include a Balance Sheet, a Statement of Operations, a Statement of Changes in Net Assets, a Statement of Cash Flows, and Notes. Must provide a performance indicator, e.g., Operating Income, as well as all other changes in unrestricted net assets for the period. Show below the line: 1 Transactions with the owners, other than in exchange for services. Transfers among affiliated organizations. Receipt of temporarily or permanently restricted contributions. Items identified by FASB standards as elements of other comprehensive income (e.g., foreign currency translations adjustments). Items requiring separate display (e.g., extraordinary items or discontinued operations) Unrealized gains and losses on investments other than those classified as trading securities. Note disclosure is to indicate the methods of revenue recognition (e.g., net patient revenues) and description of the types and amounts of contractual adjustments. Management policies for providing charity care and the level of charity care provided should be disclosed in the notes. Operating revenue is often classified as net patient revenue, premium revenue, and other revenue. Unrestricted gifts and investment income for current unrestricted purposes may be reported as either operating or nonoperating revenue, depending on the policies of the entity. In this class our policy is to classify them as non-operating items that would go below the line on the income statement. Expenses may be reported by their natural or functional classifications, but must use functional classifications if not provided in Statement of Operations. 2 “Assets whose use is limited” is an unrestricted balance sheet category used to show limitations on use of assets due to bond covenant restrictions and governing board plans for future use. Illustrative transactions for a private not-for-profit hospital : Unrestricted Net Asset class: 1. Provide patient services: Cash Patient A/R Patient Service Revenue 71, 650 11,006 Contractual Adjustments Patient A/R 10,000 10,000 82,656 2. To write off bad accounts receivable as they are estimated to be uncollectible under the allowance method and to estimate bad debt expense for current receivables in #1: Allow. For Bad Debt Patient A/R 1,300 General Services (or Bad Debt Expense) Allow for Uncollectibles 1,500 1,300 1,500 3. Receive premium revenues and other revenues: Cash Premium Revenue Other Revenue 25,460 20,000 5,460 3 4. Record nonoperating income: Cash 1,856 Nonoperating income-Unrestricted gifts 822 Nonoperating income-Income from Investments of Endowment Funds 750 Nonoperating income-Investment income 284 5. Investment income for assets whose use is limited: Cash-Assets Whose Use is Limited 120 Nonoperating Income-Assets Whose Use is Limited for Capital Improvements -Investment Income 120 6. Purchase of supplies and pay off accrued payables and expenses: Supplies Accts. Payable Accrued Expenses Cash 500 800 900 2,200 7. Additional expenses were incurred: Professional Care of Patients General Services Admin. Services Accumulated Depr Supplies Accts. Payable Accrued Expenses Cash 75, 656 14,105 15,245 4,800 400 900 1,000 97,906 Reclass. from Temp. Restricted-Program 3,500 Reclass. to Unrestricted Net Assets-Program 3,500 4 8. To reclassify cash from temporary restricted to unrestricted (time): Cash Contributions Receivable 4,200 4,200 Reclass. from Temp. Restricted-Time 4,200 Reclass. to Unrestricted Net Assets-Time 4,200 9. Reclassify temporary restricted cash to pay for equipment in accordance with restrictions: PP&E Cash 5,200 5,200 Reclass from Temp. Restricted-Plant 1,200 Reclass. to Unrestricted Net Assets-Plant 1,200 10. To record receipt of temporarily and permanently restricted contributions. Cash 5,600 Contributions Receivable 7,700 Revenues-Temp. Restricted-Contributions Revenues-Perm. Restricted-Contributions 12,500 800 11. To record receipt of endowment pledges and to write some off. Cash Allow. for Uncollectible Contributions Contributions Receivable 800 300 1,100 12. The current portion of long-term debt was paid and an addition amount reclassified as current. Long-term Debt-Current Installment Cash 1,000 1,000 5 Long-term Debt-Noncurrent 1,000 Long-term Debt-Current Installment 1,000 13. To record investment income restricted as to purpose. Cash 200 Investment Income-Temp. Restricted 200 14. Some investments were sold at a gain. Cash 4,100 Investments-Other Net Realized/Unrealized Gains on Investments-Temp. Restricted 4,000 100 15. To purchase investments during the year, including $120 set aside for capital improvement from earlier transaction. Investments-Assets Whose Use is Limited Investments-Other Cash-Assets Whose Use is Limited Cash 120 6,480 120 6,480 16. To adjust investments to fair value at year end. Investment-Other 100 Net Realized/Unrealized Losses on Investments --Perm. Restricted 550 Net Realized/Unrealized Gains on Investments --Temp. Restricted 650 6 17. Make closing entries: Patient Service Revenue Premium Revenue Other Revenue Nonoperating income-Unrestricted gifts Nonoperating income-Income from Investment Of Endowment Funds Nonoperating income-Investment income Reclass-Time Reclass-Program Reclass-Plant Contractual adjustments Professional Care of Patients General Services Admin. Services Net Assets-Undesignated Nonoperating Income-Assets whose use is Limited for capital improvementsBoard designated Net Assets-Board designated 82,656 20,000 5,460 822 750 284 4,200 3,500 1,200 10,000 75,656 15,605 15,245 2,366 120 120 18. Closing entry made for temporarily restricted net assets: Contributions - Temp Restr Net Realized/Unrealized Gain/Loss On Investments-Temp Rest Investment Income-Temp. Restricted Reclass-Time Reclass-Program Reclass-Plant Net Assets - Temp Restr 12,500 750 200 4,200 3,500 1,200 4,550 7 19. Closing entry made for permanently restricted assets: Contributions-Perm. Restricted Net Realized/Unrealized Gain/Loss On Investments-Perm Restr Net Assets- Perm Restr 800 550 250 Financial Statements for Private Sector NFP Health Care Entities Statement of Operations—Ill. 12-3 Statement of Changes in Net Assets—Ill. 12-4 Statement of Financial Position—Ill. 12-5 Statement of Cash Flow—Ill. 12-6 Financial Reporting for Governmental Health Care Entities Follow accounting standards established by GASB and AICPA Health Care Guide (Category B GAAP). If engaged in business-type activities will prepare three financial statements. Statement of Net Position, Ill. 6-3 Statement of Revenues, Expenses, and Changes in Net Position, Ill. 6-4 Statement of Cash Flows, Ill. 6-5 Financial Reporting for Commercial (For-Profit) Health Care Entities Follow accounting standards established by FASB (Category A GAAP) and the AICPA Health Care Guide (Category B GAAP). However, FASB’s pronouncements related to NFPs do not apply to them. 8