Tax 706 - Office of the Provost

advertisement

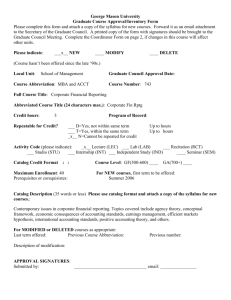

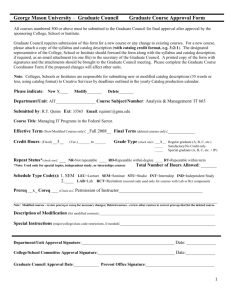

George Mason University – Graduate Council Graduate Course Approval Form All courses numbered 500 or above must be submitted to the Graduate Council for final approval after approval by the sponsoring College, School or Institute. Graduate Council requires submission of this form for a new course or any change to existing courses. For a new course, please attach a copy of the syllabus and catalog description (with catalog credit format, e.g. 3:2:1). The designated representative of the College, School or Institute should forward the form along with the syllabus and catalog description, if required, as an email attachment (in one file) to the secretary of the Graduate Council. A printed copy of the form with signatures and the attachments should be brought to the Graduate Council meeting. Please complete the Graduate Course Coordinator Form if the proposed changes will affect other units. Note: Colleges, Schools or Institutes are responsible for submitting new or modified catalog descriptions (35 words or less, using catalog format) to Creative Services by deadlines outlined in the yearly Catalog production calendar. Please indicate: New_______ Modify____X___ Delete_______ Department/Unit: School of Management - Accounting Course Subject/Number: TAX 706 Submitted by: Angel Burgos Email: aburgos2@gmu.edu Ext: 8949 Course Title: Partnership Taxation Effective Term (New/Modified Courses only): Summer 2009 Credit Hours: (Fixed) __3.0_ (Var.) _____ to ______ Final Term (deleted courses only):____________ Grade Type (check one): ___X__ Regular graduate (A, B, C, etc.) _____ Satisfactory/No Credit only _____ Special graduate (A, B, C, etc. + IP) Repeat Status*(check one): _X__ NR-Not repeatable ____ RD-Repeatable within degree ____ RT-Repeatable within term *Note: Used only for special topics, independent study, or internships courses Total Number of Hours Allowed: _3.0___ Schedule Type Code(s): 1. LEC LEC=Lecture SEM=Seminar STU=Studio INT=Internship IND=Independent Study 2.____ LAB=Lab RCT=Recitation (second code used only for courses with Lab or Rct component) Prereq ___ Coreq __X_ (Check one): Admission to the MS Tax program or permission of the director. Coreq: TAX 700. __________________________________________________________________________________________ Note: Modified courses - review prereq or coreq for necessary changes; Deleted courses - review other courses to correct prereqs that list the deleted course. Description of Modification (for modified courses): Re-activated course. Originally deleted in April 2008. Special Instructions (major/college/class code restrictions, if needed):__________________________________________ Department/Unit Approval Signature:_________________________________________ Date: _____________ College/School Committee Approval Signature:__________________________________ Date:_____________ Graduate Council Approval Date:____________ Provost Office Signature:_________________________________ George Mason University Graduate Course Coordination Form Approval from other units: NONE Please list those units outside of your own who may be affected by this new, modified, or deleted course. Each of these units must approve this change prior to its being submitted to the Graduate Council for approval. Unit: Head of Unit’s Signature: Date: Unit: Head of Unit’s Signature: Date: Unit: Head of Unit’s Signature: Date: Unit: Head of Unit’s Signature: Date: Unit: Head of Units Signature: Date: Graduate Council approval: ______________________________________________ Date: ____________ Graduate Council representative: __________________________________________ Date: ____________ Provost Office representative: ____________________________________________ Date: ____________ Catalog Description: Major aspects of taxation affecting partners and partnerships. Emphasis on tax planning and detailed study of the Internal Revenue Code, Treasury Regulations, and case law governing these areas. Master Syllabus Tax 706: Partnership Taxation Course Description: This course addresses concepts and principles of federal income taxation as they relate to partnerships and their partners. Emphasis is on researching specific fact situations to identify and apply appropriate law. Topics covered include the formation, basis, distributions, and terminations of partnerships, Limited Liability Corporations (LLCs), and Limited Liability Partnerships (LLPs). Learning Objectives: Students will learn the fundamental concepts of the federal income taxation of partnerships, LLCs, LLPs, and their partners. Students will understand the role that taxes play in the business environment faced by partnerships, LLCs, and LLPs. Students will read, interpret and apply primary tax authority (e.g., Internal Revenue Code, Treasury Regulations, court cases, etc.) to partnership, LLC, and LLP transactions. Students will assess risks of potential positions and transaction structures and argue persuasively for a position. Students will communicate analysis of complex regulatory provisions appropriately to both technical and non-technical users. Approach to Learning: The course will be conducted in seminar format. Class will consist of discussion and analysis of the tax law and application to specific partnership, LLC, and LLP tax scenarios. Course Website: (See individual instructor syllabi for specific section addresses) Representative Text and Materials: Fundamentals of Partnership Taxation (Eighth Edition) by S. Lind, S. Schwartz, D. Lathrope, and J. Rosenberg: The Foundation Press, Inc., 2008. Internal Revenue Code Income Tax Regulations Student Responsibilities: Students will be expected to have read relevant primary and secondary sources (e.g. textbook) prior to class. Students are expected to contribute to the class discussion of points and analysis of issues during every meeting. Methods of Student Evaluation: Students’ performance will be assessed on four factors: short cases, class participation, a comprehensive project, and examinations. Course Topics Formation of Partnerships, Limited Liability Companies, and Limited Liability Partnerships Determination of tax and book basis in flow-through entities, including liability allocations Flow-through taxation of operations and separately stated items. Distributions from partnerships/LLCs/LLPs (current and liquidating) Termination of Partnerships, LLCs, and LLPs Preparation of Form 1065- Federal Partnership Tax Return Honor Code: Students are expected to follow the Honor Code as presented in the University’s publications. DRC Statement: If you are a student with a disability and you need academic accommodations, please see the instructor and contact the Disability Resource Center (DRC) at 993-2474. All academic accommodations must be arranged through DRC.