Updated 2 & 16 marks for EEFA

advertisement

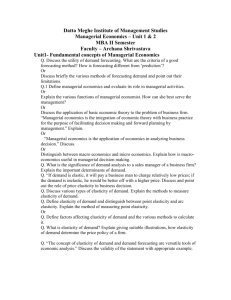

ANAND INSTITUTE OF HIGHER TECHNOLOGY DEPARTMENT OF COMPUTER SCIENCE MG2452 ENGINEERING ECONOMICS AND FINANCIAL ACCOUNTING Year / SEM: IV / VII PART A UNIT I INTRODUCTION 1. Managerial economics. Managerial economics (also referred as business economics), is a branch of economics that applies microeconomic analysis to decision methods of businesses or other management units. It is the integration of economic theory with business practice for the purpose of facilitating decision making and forward planning by management. 2. Types of analysis: Risk analysis - various models are used to quantify risk and asymmetric information and to employ them in decision rules to manage risk. Production analysis - microeconomic techniques are used to analyze production efficiency, optimum factor allocation, costs, economies of scale and to estimate the firm's cost function. Pricing analysis - microeconomic techniques are used to analyze various pricing decisions including transfer pricing, joint product pricing, price discrimination, price elasticity estimations, and choosing the optimum pricing method. Capital budgeting - Investment theory is used to examine a firm's capital purchasing decisions. 3. Types of Firms Sole proprietorships Partnerships Joint Stock Government Corporations Joint Hindu family 4. Goals of the firms: I. Profit Maximization II. Maximization of the Shareholders Wealth III. Sales Maximisation 5. State the law of equi-marginal principle. The law of equi-marginal utility states that a consumer will reach the stage of equilibrium whent the marginal utilities of various commodities he consumes is equal. 6. Objectives of managerial economics Achieving leadership For avoiding potential competition For preventing government intervention For maintaining customer goodwill For restraining wage demand 7. Define Partnership. It is a relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all. 8. What is Decision Making? Decision making is a process which includes identifying and defining the nature of the situation, identifying acceptable alternative courses of action, choosing the “best” one and placing it into operation. 9. What is a firm? A firm is a unit engaged in production of goods and services. The term firm includes all those enterprises which are related with the production not only of goods but also of services. 10. Show the significance of economic analysis in business decision. Economic Analysis is used to diagnose the situation and internal perspective, which makes clear that the direction of the company may be making the decisions to correct the weak spots that may threaten their future, while that capitalizes on the strengths for the company to achieve its objectives.The Economic Analysis can be diagnosed with the company, which is the result of analysis of all relevant data and report the same weaknesses and strengths. 11. What is the scope of managerial economics? It is actually solving managerial issues using micro-economics. Wherever there are scarce resources, managerial economics ensures that managers make effective and efficient decisions concerning customers, suppliers, competitors as well as within an organization. The fact of scarcity of resources gives rise to three fundamental questions What to produce? How to produce? For whom to produce? 12. Name the concepts involved in decision making. Incremental concept The concept of time perspective The discounting principle The concept of opportunity cost The equi-marginal principle 13. Define Opportunity cost. Opportunity cost is the cost of any activity measured in terms of the value of the next best alternative forgone (that is not chosen). The opportunity cost is also the "cost" (as a lost benefit) of the forgone products after making a choice. Opportunity cost is a key concept in economics, and has been described as expressing "the basic relationship between scarcity and choice". 14. Objectives of a firm. Profit Maximisation Sales Maximisation. Growth Maximisation. Long Run Profit Maximisation. Social/ Environmental concerns. Co-operatives 15. Difference between firm and industry: S.No 1. 2. 3. 4. Firm Industry A firm is a business establishment inside an An industry consists of all organized activities industry. for production and processing of products A firm can be a sole proprietorship or a Industry is also described as retail and partnership, but the basic premise is that it is wholesale depending upon the nature of run for making profits. transactions with the customers. Rules and regulations are made for an The rules and regulations typically apply to industry. all firms inside the industry. E.g. A firm of solicitors. E.g. Electronics industry. 16. How does managerial economics help in Business decision making? The managerial economics helps in reaching a variety of business decisions in a complicated environment such as: (i) What goods and services should be produced? (ii) What inputs and production technique should be used? (iii) How much output should be produced and at what prices it should be sold? (iv) What are the best sizes and location of new plants? (v) When should equipment be replaced? (vi) How should the available capital be allocated? (vii) How should the cost is minimized and profit be maximized, etc. 17. What are the steps involved in decision making? Identifying the problem Analysing the problem Developing alternative solution for the problem Evaluating the alternatives Deciding the best course of action Conversion of decision into action Control UNIT –II DEMAND & SUPPLY ANALYSIS 1. What is Demand? In economics, demand is the desire to own anything and the ability to pay for it and willingness to pay. The term demand signifies the ability or the willingness to buy a particular commodity at a given point of time. 2. Mention the types of demand. 1. Demand for consumer goods and producer goods 2. Demand for perishable & durable goods 3. Derived and autonomous demands 4. Firm and industry demands 5. Demand by total market and by market segments 3. Mention the factors that determine the demand of a product or service? Consumers income, price of the commodity or service, prices of related goods or service, consumer taste and preference, population and its distribution, consumer expectation. 4. Explain Derived demand? When the demand for the product is tied to the purchase of some parent product, its demand is called derived demand. 5. What is Demand Function? A demand function states the dependence relationship between the demand for a commodity or service and the factors or variables affecting it. 6. What is Demand Elasticity or Elasticity of Demand and write their types? The elasticity of demand in a market is great or small according as the amount demanded increases much or little for a given fall in the price and diminishes much or little for a given rise in price. Types 1. Elastic demand 2. In elastic demand 7. Explain “unit elasticity of demand”. When the change in demand is exactly equal to the change in price is called unit elasticity of demand. 8. Write the factors determining the elasticity of demand? Nature of the commodity Availability of substitutes Variety of uses Postponement of demand. Amount of money spent Time Range of prices 9. Explain “Postponement of demand”. If the consumption of a commodity cannot be postponed the demand is inelastic. On the contrary if the demand for a commodity can be postponed it is elastic demand. 10. Write any six methods of demand forecasting? 1. 2. 3. 4. 5. 6. Opinion survey Delphi method Complete enumeration method Time series Barometric method Moving averages 11. Write the features of a good forecasting method? Plausibility, simplicity, economy & availability 12. Define the term Market Demand. The total quantity that all the consumers of a commodity are willing to buy per unit of time at a given price, all other things remaining the same is called market demand for a product. 13. What are the commonly used economic and statistical indicators? Personal income, employment, agricultural income, grosses national income, industrial production & bank deposits. 14. Write the determinants of supply. Number of firms or sellers, state of technology, cost of production (Input prices), prices of related goods, price expectation, natural factors. 15. Define price elasticity of demand. Price elasticity of demand (PED or Ed) is a measure to show the responsiveness, or elasticity, of the quantity demanded of a good or service to a change in its price. More precisely, it gives the percentage change in quantity demanded in response to a one percent change in price (holding constant all the other determinants of demand, such as income). 16. What is Supply? Supply is the amount of some product producers is willing and able to sell at a given price all other factors being held constant. The relationship of price and quantity supplied can be exhibited graphically as the supply curve. The curve is generally positively sloped. Supply curve shows the relationship of price to the amount of product businesses are willing to sell. 17. What are the limitations of elasticity of demand? They do not show the actual cause and effect. For example, an increase in demand may be accompanied by an increase in income. It could be that the higher advertising has caused the increase in demand. Each of the equations for the elasticity of demand measures the relationship between one specific factor and demand. It may therefore be difficult to know what specifically has caused any change in the quantity demanded. The value of elasticity is not actually known at any moment, it is merely estimated. This means that managers should be careful about basing decisions on their estimates of elasticity as the values will be changing all the time as the demand conditions change. 18. Define law of supply with diagram. The price of a good or service increases, the quantity of goods or services offered by supplier’s increases and vice versa, all other factors being equal. 19. Write the factors determining elasticity of demand. Nature of the product Extent of usage Availability of substitutes Income level of people Durability of a product Urgency of demand 20. List out the various demand determinants. Price of the Product Price of substitutes and complementary goods Consumer’s Income Advertisement Expenditure State of Trade Tastes and Fashions of buyers Arrival of new goods Size of population Availability of credit 21. What is sales forecasting? Sales forecasting is the process of estimating what your business’s sales are going to be in the future. The sales forecast is a prediction of a business unit and rupee sales for some future period of time, up to several years or more. These forecasts are generally based primarily on recent sales trends, competitive developments and economic trends in the industry, region and/or nation in which the organisation conducts business. 22. State any two managerial uses of production function. It can be used to compute the least-cost input combination for a given output or the maximum output-input combination for a given cost. Knowledge of production function is useful to decide the value of the variable input employed. It aids in long run decision-making. It is highly useful for decision-makers to find out the most appropriate combination of input factors. It shows the maximum output obtainable from any and all input conditions. 23. Differentiate between desire and demand for a commodity. A desire is just a wish for commodity and a person may desire for any number of commodities without having the capacity to buy it from the market. A desire becomes demand when it is backed by ability and willingness to pay the price for a commodity. 24. What is derived demand? Derived demand is the demand which has been derived form the demand of some other commodity that it helps to produce, e.g. demand for bricks is derived from the demand for construction of a house. 25. What is composite demand? The demand for a commodity which can be put to several uses and can satisfy two or more than two wants is called composite demand, e.g. electricity or milk. 26. What sort of relationship exists between the demand for goods and the price of complementary goods? The relationship between the demand for goods and the price of complementary goods is inverse. When the price of complementary goods falls its demand would increase. It would increase the demand for goods as they are going to be used along with the complementary goods. 27. What are the assumptions of law of demand? Price of related goods remain constant Income of the consumer does not change Tastes and preferences of the people remain unchanged 28. The demand by a consumer for a commodity declines by 10% when its price increases from Rs.5 to Rs. 6 per unit. What is the price elasticity of demand for a commodity? We know that the price elasticity i.e. the demand for commodity is inelastic. 29. What are the factors which affect the price elasticity of demand for a commodity? a) Nature of the commodity b) Availability of substitutes c) Share in the total expenditure d) Different uses of a commodity 30. State the assumptions of the law of supply. i. Price of related goods remains unchanged ii. Technology of production should not change iii. Cost of factors of production should remain the same iv. Goals of the firm should not change 31. Give any three factors affecting elasticity of supply. a) Nature of commodity: Perishable commodities have inelastic supply because their supply cannot be raised or curtailed according to the changes in their price. b) Cost of production: If an additional unit of a produced at a higher cost, the producer will not raise the supply even at a higher price. c) Time element: The longer the period, the more elastic the supply of a commodity would be. 32. Explain briefly any three factors on which supply of a commodity depends. i. Price of factors of production: An increase in the price of factor inputs will raise the cost of production. This may lead to fall in the production of a commodity and supply will decrease and vice-versa. ii. State of technology: A cost reducing technological change will result in a fall in the cost of production. This will encourage the producer to offer larger quantity for sale. iii. Goals or objectives of the producers: If the producers are motivated not only by profit considerations but by other considerations like keeping their status and prestige or increasing their share in the market, they may increase the supply eve at a lower price. 33. What are the types of elasticity of demand? Price elasticity of demand Income elasticity of demand Cross elasticity of demand 34. What is derived demand? Derived demand is the demand which has been derived from the demand of some other commodity that it helps to produce, e.g., demand for bricks is derived from the demand for construction of a house. 35. What is composite demand? The demand for a commodity which can be put to several uses and can satisfy two or more than two wants is called composite demand, e.g., electricity or milk. 36. What is income effect? Income effect is a part of the price effect. When the price of commodity falls, real income or the purchasing power of the consumer increases. As a result, more of the goods will be demanded. This increase in demand due to increase in real income is called the income effect. 37. What are the assumptions of law of demand? a) Price of related goods remains constant b) Income of the consumer does not change c) Tastes and preferences of the people remain unchanged 38. What are the determinants of supply? i. Price of the product ii. Technology changes iii. Resource supplies iv. Tax/subsidy v. Expectations about future price vi. Price of other goods produced. 39. Define market demand. Market demand is the total quantity demanded by all the purchasers together. 40. What is Capital? Capital is the value of resources owned and deployed in a business in the form of cash or assets like building, plant & machinery. UNIT – III PRODUCTION AND COST ANALYSIS 1. Write any six types of cost. 1. Opportunity and out lay cost 2. Real cost and money cost 3. Past and future cost 4. Historical and replacement cost 5. Incremental and sunk cost 6. Explicit and implicit cost 2. What is opportunity cost? Opportunity costs are the cost of displaced alternatives. They represent only sacrificed alternatives and hence are not recorded in any financial accounts. These costs are also known as alternative cost. 3. What is explicit cost? Explicit cost are those is fall under actual or business cost entered in the books of accounts, such as wages, salaries, interest, rent & depreciation charges. It is also known as imputed cost. 4. What is shut down cost? Shut down cost are those cost which would be incurred in the event of suspension of the plant operation and which would be saved if the operations are continued. Such costs are incurred in the event of temporary closure of the business. 5. What are the determinants of cost? Output level Prices of factors of production Productivities of factors of production Technology 6. What is production function? Production function is a tool of analysis used to explain the input output relationship. It also describes the technological relationship between inputs and outputs in physical terms. 7. What is short run? Short run refers to a period of time in which the supply of certain inputs is fixed or is inelastic. Ex. Plant, building, machinery etc. 8. What is long run? The long run refers to a period of time in which the supply of all the inputs is elastic but not enough to permit a change in technology. 9. What is production? The term production means the process by which resources (men, material & time) are transformed into a different and more useful commodity or service. 10. Explain Iso-product curve. The Iso-product curve indicates all the possible combinations of two inputs which are capable of producing the same level of output. It is also known as equal product curve. 11. What is marginal cost? It is defined as the addition made to the total cost by the production of one additional unit of output. Marginal cost is the change in total cost that arises when the quantity produced changes by one unit. 12. What is short run cost? In the short run, because at least one factor of production is fixed, output can be increased only by adding more variable factors. 13. What is the significance of isoquants? The significance of factors of productive resources is that, any two factors are substitutable e.g. labour is substitutable for capital and vice versa. No two factors are perfect substitutes. This indicates that one factor can be used a little more and other factor a little less, without changing the level of output. It is a graphical representation of various combinations of inputs says Labour (L) and capital (K) which give an equal level of output per unit of time. 14. Write the difference between explicit and implicit costs. An implicit cost is a cost that has occurred but it is not initially shown or reported as a separate cost. On the other hand, an explicit cost is one that has occurred and is clearly reported as a separate cost. Examples of explicit costs would be items such as wage expense, rent or lease costs, utility bills and the cost of materials that go into the production of goods. Examples of Implicit cost or Imputed cost or implied cost or notional cost would be the time and effort that an owner puts into the maintenance of the company rather than working on expansion and opportunity costs of using the firm's own resources. UNIT – IV PRICING 1. What is pricing? Pricing is the process of determining what a company will receive in exchange for its products. 2. Write the basic determinants for fixing the price of a commodity? The demand for the commodity Cost of production Objective of its producers Nature of the competition in its market Government policies 3. What is meant by the term Liquidity? Liquidity refers to a company’s ability to pay its bills from cash or from assets that can be turned into cash very quickly. The quick ratio, also known as the acid-test ratio, is an indicator of a company’s liquidity. 4. What are the objectives of pricing? Price stabilization Maintenance of market share Target return on capital Prevention of competition Good returns for product line Liquidity 5. What are the features of perfectly competitive market? A large number of buyers and sellers Homogenous product Free entry and exit Perfect knowledge Indifference 6. Define Load Factor. Load factor is often used to compare the actual operational performance with the maximum potential performance and is usually expressed in percentage. 7. Meaning of EPBM. Earning per Bus Mile is the ratio of total traffic revenue obtained to total bus miles operated. 8. What do you mean by “Average Pay Load. Average pay load refers to the average number of passengers carried per vehicle per trip. 9. What is price discrimination? Price discrimination or yield management occurs when a firm charges a different price to different groups of consumers for an identical good or service, for reasons not associated with costs. 10. What are all the features of a monopoly market? Single seller: there is only one seller of the commodity in the market No close substitutes: there are no close substitutes for the monopolist‘s product and the seller faces no imminent threat of competition. 11. What is the role of government in pricing control? To maintain affordability of staple foods and goods To prevent price gouging during shortages To slow inflation To insure a minimum income for providers of certain goods 12. What is penetration pricing? A strategy adopted for quickly achieving a high volume of sales and deep market penetration of a new product. Under this approach, a product is widely promoted and its introductory price is kept comparatively low that is charging a low initial price for a new product in order to attract customers and build market share. 13. How is price fixed under perfect competitive situation? The price under perfect competitive situation is fixed at a point where the supply and demand are at equilibrium. UNIT V FINANCIAL ACCOUNTING & CAPITAL BUDGETING 1. What is Financial Accounting? Reporting of the financial position and performance of a firm through financial statements issued to external users on a periodic basis. 2. What is a Balance Sheet? A financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. These three balance sheet segments give investors an idea as to what the company owns and owes, as well as the amount invested by the shareholders. The balance sheet must follow the following formula: Assets = Liabilities + Shareholders' Equity 3. What Does Profit and Loss Statement - P&L Mean? A financial statement that summarizes the revenues, costs and expenses incurred during a specific period of time - usually a fiscal quarter or year. These records provide information that shows the ability of a company to generate profit by increasing revenue and reducing costs. The P&L statement is also known as a "statement of profit and loss", an "income statement" or an "income and expense statement". 4. What Does Ratio Analysis Mean? A tool used by individuals to conduct a quantitative analysis of information in a company's financial statements. Ratios are calculated from current year numbers and are then compared to previous years, other companies, the industry, or even the economy to judge the performance of the company. Ratio analysis is predominately used by proponents of fundamental analysis. 5. What Does Acid-Test Ratio Mean? A stringent test that indicates whether a firm has enough short-term assets to cover its immediate liabilities without selling inventory. The acid-test ratio is far more strenuous than the working capital ratio, primarily because the working capital ratio allows for the inclusion of inventory assets. Calculated by: 6. What Does Working Capital Mean? A measure of both a company's efficiency and its short-term financial health. The working capital ratio is calculated as: Positive working capital means that the company is able to pay off its short-term liabilities. Negative working capital means that a company currently is unable to meet its shortterm liabilities with its current assets (cash, accounts receivable and inventory). 7. What Does Current Ratio Mean? A liquidity ratio that measures a company's ability to pay short-term obligations. The Current Ratio formula is: 8. What Does Inventory Turnover Mean? A ratio showing how many times a company's inventory is sold and replaced over a period. the The days in the period can be divided by the inventory turnover formula to calculate the days it takes to sell the inventory on hand or "inventory turnover days". 9. What Does Cash Flow Mean? 1. A revenue or expense stream that changes a cash account over a given period. Cash inflows usually arise from one of three activities - financing, operations or investing - although this also occurs as a result of donations or gifts in the case of personal finance. Cash outflows result from expenses or investments. This holds true for both business and personal finance. 2. An accounting statement called the "statement of cash flows", which shows the amount of cash generated and used by a company in a given period. It is calculated by adding noncash charges (such as depreciation) to net income after taxes. Cash flow can be attributed to a specific project, or to a business as a whole. Cash flow can be used as an indication of a company's financial strength. 10. What Does Fund Flow Mean? The net of all cash inflows and outflows in and out of various financial assets. Fund flow is usually measured on a monthly or quarterly basis. The performance of an asset or fund is not taken into account, only share redemptions (outflows) and share purchases (inflows). Net inflows create excess cash for managers to invest, which theoretically creates demand for securities such as stocks and bonds. 11. What Does Operating Ratio Mean? A ratio that shows the efficiency of a company's management by comparing operating expense to net sales. Calculated as: 12. What Does Comparative Statement Mean? A statement which compares financial data from different periods of time. The comparative statement lines up a section of the income statement, balance sheet or cash flow statement with its corresponding section from a previous period. It can also be used to compare financial data from different companies over time, thus revealing the trend in the financials. 13. What Does Capital Budgeting Mean? The process in which a business determines whether projects such as building a new plant or investing in a long-term venture are worth pursuing. Oftentimes, a prospective project's lifetime cash inflows and outflows are assessed in order to determine whether the returns generated meet a sufficient target benchmark. 14. Advantage of capital budgeting It is very useful to the concern for taking correct decision. To determine the required quantum and the right source of funds for investment. It informs about the right timings for the purchase of fixed assets It acts as a tool for controlling capital expenditure 15. Limitation of capital budgeting There may be controversial results among the application for various techniques There may be substantial loss in an investment of fund in the capital assets which are irreversible or reversible The application of capital budgeting techniques is normally difficult task 16. Methods of capital budgeting proposals Independent investment proposals Mutually exclusive proposals Contingent or dependant proposals Replacement and modernization schemes Cost reduction projects 17. Techniques of capital budgeting proposals A. Traditional methods Pay back period Accounting rate of return Post pay back profitability method B.Time adjusted method Net present value Internal rate of return Profitability index Discounted pay back method 18. What Does Internal Rate Of Return - IRR Mean? The discount rate often used in capital budgeting that makes the net present value of all cash flows from a particular project equal to zero. Generally speaking, the higher a project's internal rate of return, the more desirable it is to undertake the project. As such, IRR can be used to rank several prospective projects a firm is considering. Assuming all other factors are equal among the various projects, the project with the highest IRR would probably be considered the best and undertaken first. IRR is sometimes referred to as "economic rate of return (ERR)". 19. What Does Net Present Value - NPV Mean? The difference between the present value of cash inflows and the present value of cash outflows. NPV is used in capital budgeting to analyze the profitability of an investment or project. NPV analysis is sensitive to the reliability of future cash inflows that an investment or project will yield. Formula: 20.What Does Payback Period Mean? The length of time required to recover the cost of an investment. It is also called as pay-off or cash recovery period. Calculated as: 21. What Does Profitability Index Mean? An index that attempts to identify the relationship between the costs and benefits of a proposed project through the use of a ratio calculated as: 22. What Does Accounting Rate of Return - ARR Mean? ARR provides a quick estimate of a project's worth over its useful life. ARR is derived by finding profits before taxes and interest. 23. Importance of Capital Budgeting 1) Avoid forecast error 2) Helps firm to plan its financing 24. Factors influencing capital budgeting decision Amount of investment Cost of capital projects Degree of certainty Product demand Future earnings Opportunity cost Cost of production 25. List any 2 merits of payback period method for evaluating investment decision. To make quick evaluations of projects with small investment. Using the payback method one can reduce the evaluation to a simple number of years is an easily understood concept. To identify projects that provide the fastest return on investment is particularly important for companies with limited cash that need to recover their money as quickly as possible. 26. Define cross subsidization. Cross subsidization is the practice of charging higher prices to one group of consumers in order to subsidize lower prices for another group. An example of cross subsidization often occurs in the banking industry. Fees associated with maintaining a low account balance (below Rs1, 000 for example) are charged to these customers to maintain their profitability. 27. What is bank overdraft? An overdraft occurs when money is withdrawn from a bank account and the available balance goes below zero. In this situation the account is said to be "overdrawn". If there is a prior agreement with the account provider for an overdraft, and the amount overdrawn is within the authorized overdraft limit, then interest is normally charged at the agreed rate. If the negative balance exceeds the agreed terms, then additional fees may be charged and higher interest rates may apply. 28. Write down the advantages and disadvantages of IRR method. Advantages: Perfect Use of Time Value of Money Theory All Cash Flows are Equally Important Maximum profitability of Shareholder Uniform Ranking Not Need to Calculate Cost of Capital Disadvantages: To understand IRR is difficult Unrealistic Assumption E5 Not Helpful for comparing two mutually exclusive investments 29. Define Money Cost and Real cost. Cost of money is a form of indirect cost incurred by investing capital in facilities employed on government contracts. The cost of producing a good or service, including the cost of all resources used and the cost of not employing those resources in alternative uses. 30. Define Cost sheet. Cost sheet is a statement, which shows various components of total cost of a product. It classifies and analyses the components of cost of a product. The detail of total cost presented in the form of a statement is termed as Cost sheet. Cost sheet is prepared on the basis of, 1. Historical Cost 2. Estimated Cost. 31. What is the information needed for the evaluation of capital budgeting decisions? a) The amount of time it will take to recover the initial investment through subsequent inflows. b) The actual current or present value of the project adjusted to reflect the influence of the time value of money and c) How well or capable this project will meet or exceed cost of capital or the rate of return required. PART - B UNIT I 1. 2. 3. 4. 5. Explain the relationships of managerial economics with other disciplines. Discuss the nature and scope of managerial economics. Explain the goals of the firm. Managerial economics is applied in decision making – discuss. Explain the different forms of ownership and its significance in the success of an organization. 6. “Managerial Economics is Economics applied in Decision Making” –Discuss. 7. “Decision- making is truly economic in nature”- Discuss. 8. How far is profit maximisation the basic objective of a firm? What are the reasons for limiting profits? 9. Explain the objectives of the firm. 10. ‘Decision making is central in the process of management’ – Discuss. 11. What do you understand by the process of decision making? What are the main stages in the process of rational decision making? 12. Suppose you want to estimate the future demand for an air-conditioner, how do you do that? Explain your estimation method in detail. UNIT II 1. Define law of demand and explain the types of demand. 2. Why does the demand curve slopes downwards? 3. What is the concept of elasticity of demand? Discuss the various types of elasticity of demand along with the role of elasticity of demand. 4. Discuss various methods of demand forecasting along with its merits and demerits. Depending upon the marks explain 1 or 2 or 3 techniques. 5. What is law of supply and Describe the elasticity of supply? 6. In 1999, the demand for electronic gadgets was 10 million per annum and the price was Rs.200 each. In 2000, the price rose to Rs.400 (because of latest technology), the demand fell to 8 million. Calculate Arc Edp. How do you interpret it? (Edp-rice Elasticity of Demand) 7. i) Explain and enumerate the factors determining Elasticity of Demand. (8) ii) Explain how supply and demand determine the equilibrium price. (8) 8. i) What are the determinants of demand? Explain. (10) ii) Distinguish between income elasticity of demand and cross elasticity of demand. (6) 9. What is demand function? Explain the important determinants of demand. 10. Suppose you want to estimate the future demand for two-wheeler, how do you do that? Explain your estimation method in detail. 11. How can you measure future demand in respect of services? 12. How can you forecast the demand in case of new products? 13. Explain survey based demand forecasting methods with examples. 14. How is equilibrium output determined under perfect competition by a firm in the short run? UNIT III 1. Write a short note on Isoquants and its types, properties. 2. Explain the returns to scale. 3. Describe the cost of production in the long run and short run average cost curve. 4. Discuss cost output relationship in both short and long run. 5. Describe production function in long run and short run. Long Run: explain production function with two variable inputs which includes isoquants returns to scale. Short run: explain production function with one variable input which is law of diminishing margin returns. 6. i) Explain the concept of Returns on investments with appropriate examples. (8) ii) Discuss the economies of scale that can accurate to a firm. (8) 7. Explain the nature and managerial uses of production function. 8. Discuss briefly about different cost concepts relevant to managerial decisions of planning and control. 9. Bring out clearly the relationship between TR, MR and AR. 10. How does a least-cost combination arrived at with the help of isoproduct and isocost curves. Explain the significance of tangential point. 11. What is the difference between returns to scale and returns to proportion? 12. Distinguish between (a) Fixed cost and Variable cost (b) Opportunity cost and actual cost. 13. Explain the features of Short-run Average Cost curve and Long-run Average Cost curve. 14. Discuss briefly the different cost concepts relevant to managerial decisions of control. UNIT IV 1. Write a note on cost oriented pricing. Explain all the pricing which are based on cost. Ex: Marginal cost pricing, cost plus pricing. 2. Explain common pricing practices. 3. What are the factors determining the price of the products? 4. Describe price discrimination. 5. Explain the pricing under different market structure and competition. 6. How the selling price of a product is fixed? What pricing policy will you suggest for sale of mobile phone wile introducing for the first time in the market. 7. Discuss various techniques of price formulation in actual business situation. 8. Distinguish between cost approach to pricing and market approach to pricing. 9. Distinguish between perfect competition and monopoly. 10. Explain different types of competition situations that may possible be found in a market. 11. What are the necessary conditions for perfect competition to prevail? UNIT V THEORY 1. Write the limitations of financial statements and Ratio Analysis. 2. Give the meaning of ratio analysis and its significance. 3. What are the steps involved in ARR method? Have a glance on all the 4 methods. 4. Difference between Cash flow and funds flow and balance sheet and P& L a/c. 5. What are the nature and limitations of financial accounting? 6. What are the purposes of activity ratios? Summarise the different activity ratios. 7. How do you prepare a cash flow statement for a new venture? 8. What is the purpose of analyzing the financial statement? 9. What ratios will you study to understand the sound health of an organisation? 10. Explain the meaning, importance and objectives of fund flow statement. 11. By giving a suitable illustration, explain how the fund-flow statement helps the management in making the finances of an enterprise? 12. Explain the technique of preparing the fund-flow statement along with its objectives. 13. Explain the significance of ratio analysis in financial management. 14. Explain briefly the different ratios that are commonly used and show how they are useful in financial analysis. 15. What do you understand by financial statement? 16. What is capital-budgeting? Describe the main steps involved in investment decisionmaking. 17. Describe briefly the four methods of investment evaluation. 18. Discuss in detail the Pay Back Period method of capital budgeting. 19. Discuss with a example the NPV method of investment decision. 20. What are the advantages and disadvantages of four methods of capital budgeting? Discuss in detail. 21. Contrast the net present value and internal rate of return approaches in the evaluation of capital projects. PROBLEMS: 1. Final accounts (Trading A/c, P& L A/c, Balance sheet) 2. Ratio Analysis Current ratio Proprietary ratio Debt-equity ratio Quick ratio Stock turnover ratio Debtors turnover ratio Creditors turnover ratio Assets turnover ratio Net and gross profit ratio 3. Capital Budgeting (NPV, ARR, IRR, PAY-BACK) 4. Comparative Balance sheet. Note: Answer all the questions to the marks given. Neatly present the paper this will give a good opinion to the person who corrects your paper. Study the 2 marks from the previous year question paper and try to write the 2 marks well because first impression is the best impression. For the V unit concentrate on both theory and problems. Study the side headings well if side headings are not there try to make the important point as the heading and highlight the heading in black. See the previous 2 question paper to get an idea how the questions may be asked. Study the diagrams, graphs well, do not make mistake in that. Avoid spelling mistakes. Single question may not be asked in 16 marks. There might be split of questions either 6 & 10 or 8 & 8. So try to cover maximum portions.