Trevor Greetham joined Fidelity in January 2006. He is Director of

advertisement

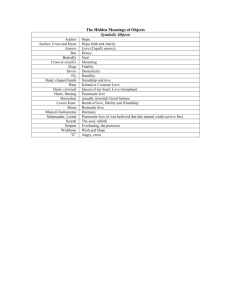

February 2013 This is for Investment Professionals only and should not be relied upon by private investors Trevor Greetham joined Fidelity in January 2006. He is Director of Asset Allocation and in addition to managing funds, Trevor is a member of Fidelity’s Asset Allocation Group. Prior to joining Fidelity, he spent ten years at Merrill Lynch, where he was Director of Asset Allocation. Trevor began his career with UK life insurer Provident Mutual. He holds an MA in Mathematics from Cambridge University and is a qualified actuary. Synchronised Global Recovery The Investment Clock model that guides our asset allocation decisions is in the equity-friendly ‘Recovery’ phase. As long as inflation pressures remain absent, central banks don’t even have to think about tightening policy. We expect rising commodity prices to push us into ‘Overheat’ phase at some point in 2013, but central banks are unlikely to tighten policy at the first sign of inflation. Investor sentiment is very positive leaving the markets vulnerable to negative shocks. However, with economic data improving and monetary policy set to remain loose, the risk/reward picture is skewed to the upside. Our multi-asset funds are overweight stocks, property and commodities and underweight bonds. Note: The red dot marks the current position of the investment clock. LEAD INDICATORS IN FOCUS Inflation The Investment Clock model is in disinflationary ‘Recovery’. Spare capacity is ample, commodity prices have lagged stocks and economists are generally downgrading their CPI forecasts. So far, our global inflation scorecard continues to point downwards. Growth Our global growth scorecard turned positive in December for the first time since June 2012. The Recovery phase of the global economic cycle sees growth pick up with monetary policy remaining loose – a bullish combination for risk markets and stocks in particular. Inflation Rises CURRENT ASSET ALLOCATION POSITIONING INDUSTRIAL METALS Growth Moves Above Trend Overheat CORPORATE BONDS HIGH YIELD BONDS SOFTS ENERGY INFLATIONLINKED BONDS GOVERNMENT BONDS Growth Moves Below Trend Recovery We are significantly overweight equities. Our strongest conviction is an overweight in the emerging markets and an underweight in Europe. We are moderately overweight commodities as they should benefit as global growth strengthens. We maintain a deep underweight position in bonds. Government yields are artificially low and could rise as inflation and growth expectations rise. Within bonds we favour high yield and investment grade corporate bonds. Stagflation Reflation PRECIOUS METALS Underweight Neutral Overweight Equities Inflation Falls Property Commodities Bonds Cash This document is for investment professionals only and should not be relied upon by private investors. It must not be reproduced or circulated without prior permission. This communication is not directed at, and must not be acted upon by persons inside the United States and is otherwise only directed at persons residing in jurisdictions where the relevant funds are authorised for distribution or where no such authorisation is required. Fidelity/ Fidelity International means FIL Limited, and its subsidiary companies. Unless otherwise stated, all views are those of the Fidelity organisation. Investors should note that the views expressed may no longer be current and may have already been acted upon by Fidelity. The research and analysis used in this material is gathered by Fidelity for its use as an Investment Manager and may have already been acted upon for its own purposes. Reference in this document to specific securities should not be construed as a recommendation to buy or sell these securities, but is included for the purposes of illustration only. Fidelity only offers information on its own products and services and does not provide investment advice based on individual circumstances. Fidelity, Fidelity Worldwide Investment and the Fidelity Worldwide Investment and F symbol are trademarks of FIL Limited. Past performance is not a reliable indicator of future results. The value of investments and the income from them can go down as well as up and investors may not get back the amount invested. Fidelity’s legal representative in Switzerland is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich. Paying agent for Switzerland is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich. Malta: Growth Investments Limited is licensed by the MFSA. Fidelity Funds is promoted in Malta by Growth Investments Ltd in terms of the EU UCITS Directive and Legal Notices 207 ad 309 of 2004. The Fund is regulated in Luxembourg by the Commission de Surveillance du Secteur Financier. Issued by FIL Investments International (registered in England and Wales), authorised and regulated in the UK by the Financial Services Authority. IC13/31