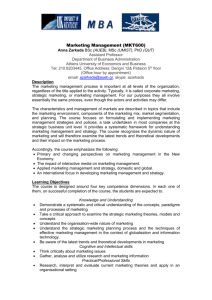

Course Syllabus - Shidler College of Business

advertisement

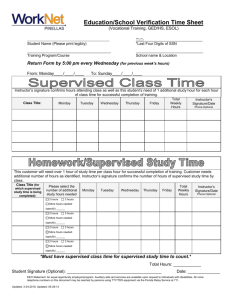

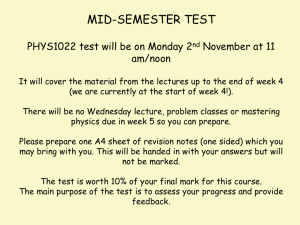

UNIVERSITY OF HAWAII AT MANOA CAMPUS Course Syllabus ACC 413 – Law for the Accountant --- Summer 2015 Course description Intensive study of areas of law of importance to accountants, which particular attention is given to principles of law relating to contracts, sales, negotiable instruments, secured transactions, property, legal entities, agency, securities, and accountant’s legal liability. Module 23 – to – Module 34 are the core subjects of this course. Prerequisite requirement: BLAW 200 or consent Instructor: Maziar Charles Rahimi JD, MS, Email: mcr7@hawaii.edu Phone: (310)622-2530 Class Times: Monday and Wednesday 6:00 pm - to - 9:30 pm Office Hours: After class and other times upon request Class Room: Business Administration Bldg – E204 In the event of disturbances before or during class time, e.g., bomb threats, meet the instructor on the grassy area on the south side of George Hall. You will be given further instructions at that point. On days of scheduled exams, you will be directed to an alternate classroom to take the exam. Students with Disabilities: Students with disabilities are encouraged to contract the KOKUA Program for information and services. Services are confidential and students are not charged for them. Contact KOKUA at 956-7511, kokua@hawaii.edu, or Student Services Center Rm. #13. Text Book: Wiley CPA excel Exam Review 2015 – Regulation, by O. Ray Whittington. Course Schedule Class Date Assignment Monday, July 6 ====== Introduction and Course overview Wednesday, July 8 ====== Contracts (Module 26) & Sales (Module 27) Monday, July 13 ====== Wednesday, July 15 ====== Negotiable Instruments (Module 28) & Secured Transactions (Module 29) Bankruptcy (Module 30) & Debtor-Creditor relationships (Module 31) Monday, July 20 ====== Agency (Module 32) & Regulation of Business Employment, Environment, and Antitrust (Module 33) Wednesday, July 22 ====== Midterm Examination Monday, July 27 ====== Federal Securities Acts (Module 24) & Professional and Legal Responsibilities (Module 33) Wednesday, July 29 ====== Property (Module 34) & Transactions in Property (Module 36) Monday, August 3 ====== Business Structure (Module 25) & Individual Taxation (Module 35) Wednesday August 5 ====== Monday, August 10 ====== Wednesday, August 12 ======= Partnership Taxation (Module 37) & Corporate Taxation (Module 38) Other Taxation Topics (Module 39) & Term Paper Due Final Examination Professor reserves the right to make any changes to this syllabus during the course. The students will be notified of any changes in advance, within a reasonable time. Grading Grading for this course is on a letter grade, which is based on the following percentages: (97-100=A+), (93-96.9=A), (90-92.9=A-), (87-89.9=B+), (83-86.9=B), (80-82.9=B-), (77-79.9=C+), (73-76.9=C), (70-72.9=C-), (67-69.9=D+), (63-66.9=D), (60-62.9=D-), (60>=F) Midterm Examination =25% of the total grade & Final Examination =25% of the total grade The examinations include: true/false, multiple choice, and essay questions. Both exams are “Closed Book” and may involve moderate calculations. A calculator may be used for the purposes of calculations only. Homework & Class Participation = 30% of the total grade Participation must be an active participation, which includes but not limited to being prepared to discuss the reading materials during the class, present the cases, answer questions in regards of the reading, and participate in the discussion in regards of the subject matter topic. Regular attendance and punctuality is expected. In an event of instructor being absent the students are expected to be prepared for the class according to the class schedule and be prepared to discuss the reading materials as noted in the class schedule. Occasionally, specific assignments will be assigned to the students. Also, there will be few guest speakers and active participation is required. Two Presentations @ 5% each = 10% of the total grade Each presentation must not be more than 5 minutes, which will follow with short discussion. Presentation must be in relation of the subject matter of the course (Law for Accountant). A problem must be addressed and a course of action that would resolve the problem must be introduced. Originality of the resolution will be highly marked. Term Paper =10% of the total grade Term paper must present an issue that is relevant to the subject matter of the course (Law for Accountant). The instructor must approve the topic, format, and other relative concerns in regards of the term paper. Please see the instructor in regards of this matter. Quality v. Quantity The number of pages will not be taken into consideration for grading. However, in this course a well-developed paper must address an existing problem in today’s accounting world. The paper must include but it’s not limited to the 5W’s and distinguishing the major issues from minor issues that are causing the problem or are the problem. Application of the relative laws and regulation in a reasonable and logical manner is required in order to resolve the problem. A clear, concise, and coherent writing is required. Students that are obtaining credits in the Master Program instead of credits for 413 ACC would have to either provide an extra assignment or the term paper must be expanded to cover a wider area of the topic with detailed resolution. Please see the instructor in regards of this matter. Academic Honesty: Students are expected to behave with integrity in all academic endeavors. Cheating, plagiarism, as well as any other form of academic dishonesty, will not be tolerated. All incidents will be handled in accordance with the UH Student Code of Conduct. The UH Student Code of Conduct, is available at: http://www.studentaffairs.manoa.hawaii.edu/policies/conduct_code/. Please become very familiar with the University Student Conduct Code so you can make conscience and informed choices about your behavior. Some relevant portions of the code are included below for your convenience. “Acts of dishonesty, types of behavior that conflict with the community standards that the UH values and expects of students, include but are not limited to the following: a. cheating, plagiarism, and other forms of academic dishonesty, b. furnishing false information to any UH official, faculty member, or office, c. forgery, alteration, or misuse of any UH document, record, or form of identification. The term "cheating" includes, but is not limited to: (1) use of any unauthorized assistance in taking quizzes, tests, or examinations; (2) use of sources beyond those authorized by the instructor in writing papers, preparing reports, solving problems, or carrying out other assignments; (3) the acquisition, without permission, of tests or other academic material belonging to a member of the UH faculty, staff or student (4) engaging in any behavior specifically prohibited by a faculty member in the course syllabus or class discussion. The term "plagiarism" includes, but is not limited to, the use, by paraphrase or direct quotation, of the published or unpublished work of another person without full and clear acknowledgement. It also includes the unacknowledged use of materials prepared by another person or agency engaged in the selling of term papers or other academic materials.” In addition to the above, the instructor specifically prohibits the following behaviors, and includes them within the definition of academic dishonesty: (1) providing another student with any form of direct or indirect, unauthorized assistance on any assignment, quiz, test or exam; and (2) copying, or recording in any manner, test or exam questions or answers. Please NOTE: UH disciplinary proceedings may be instituted against a student charged with conduct that potentially violates both the criminal law and this Student Conduct Code (that is, if both possible violations result from the same factual situation) without regard to the pendency of civil or criminal litigation in court or criminal arrest and prosecution. If a student is caught committing an act of Academic Dishonesty, as defined in the University Student Conduct Code, they will receive a grade of “F” for the course and be referred for disciplinary action as provided for by the University Student Conduct Code.