Stanwick, JOCM, 1996, Mental Imagery

advertisement

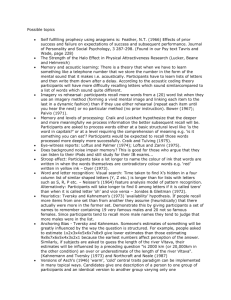

Stanwick, JOCM, 1996, Mental Imagery Use of heuristics in the cognitive process A number of researchers (Hogarth, 1980; Schwenk, 1984; 1985; Tversky and Kahneman, 1974) have identified judgemental heuristics and biases that can affect the strategic decision-making process. Hogarth (1980) describes heuristics as simple procedures or rules of thumb that are used to reduce the mental effort of the decision makers. Previous research has highlighted the benefits of heuristics. Weick and Roberts (1993) describe the aggregation of the mental processes of decision makers as critical for the survival of the organization. These mental processes, which are based on the heuristics of the managers, increase reliability in the decision-making process. Greenwood and Hinings (1993) also identify the consolidation of heuristics of managers into organizational archetypes which ensured the effective operation of the organization. However, Barr et al. (1992) warn that “(j)ust as mental maps selectively limit information attended to and similarly slant how this information is interpreted, existing mental maps will also limit the range of alternative solutions to the issues that have been identified” (p. 17). Heuristics can be classified into three major categories which correspond to the problems stated by Barr et al. (1992). Those three categories are: availability, representativeness, and adjustment and anchoring. Availability addresses biases which could occur in the selection process of the appropriate data by the decision maker. Representativeness corresponds with biases that involve the interpretation of the data, and adjustment and anchoring identifies biases which occur during the selection of alternative courses of action (see Appendix). Availability. The availability heuristic addresses issues relating to the selection of the data to be used in the decision-making process. The selection of the data could be biased, based on the ease with which past events can be retrieved by the decision maker (bias due to retrievability – Tversky and Kahneman, 1974). The selection process could also be restricted based on obtaining information that only supports the decision maker’s current beliefs (prior hypotheses bias – Levine, 1971). Representativeness. Another type of heuristic which can bias the decisionmaking process of top level managers is the use of a representativeness heuristic. A representativeness heuristic can affect the way the decision makers interpret the data. By using a representativeness heuristic, decision makers could make unsupported assumptions about the significance of the information. The data considered by the decision maker may be misrepresentative owing to: the unique characteristics of the organization (unrecognized organizational uniqueness – Tversky and Kahneman, 1974), the method in which the information is presented (insensitivity to predictability – Tversky and Kahneman, 1974 and vivid/anecdotal information – Schwenk, 1986), the illusion that the manager has more control over the situation than is warranted (illusion of control – Langer, 1975), the illusion that the information is more accurate than warranted (illusion of validity – Tversky and Kahneman, 1974), and the assumption that the current situation is similar to past events (reasoning by analogy – Steinbruner, 1974). Adjustment and anchoring. Adjustment and anchoring occurs when managers make an improper adjustment from the firm’s initial course of action which includes: resistance to change (Coch and French, 1948; Nystrom and Starbuck, 1984), escalation of commitment (Staw, 1981), and single outcome calculations (Steinbruner, 1974). Nystrom and Starbuck (1984) have identified a problem that could arise if these heuristics are entrenched in the cognitive process of decision makers of declining organizations. They state that organizations can become ineffective in a decline situation, since the managers will continue to use these heuristics in an inappropriate manner which has made the organization successful in the past but may now help to contribute to the decline of the organization. An organizational factor that can have an impact on the heuristics of the decision makers is the role of power within the organization. The relationship between power and heuristics of decision makers The role of power within an organization can significantly affect the decisionmaking heuristics of top level managers. In his review of different frameworks of power, Clegg (1989) states that power can be used for: thought control through dominant control; surveillance and embodiment through disciplinary practices; and rational articulation of meaning. Perrow (1986) refers to the control of the ideas considered (premiss control) as a form of unobtrusive control decision makers have within an organization. By limiting the issues being considered, top level managers can control the type of solutions considered by the organization. Pfeffer (1981) refers to this action as controlling the agenda. Therefore, power within the organization can be used to encourage inappropriate heuristics by: restricting alternative courses of action (single outcome calculation); controlling information flow so that only information that supports a course of action will be discussed (prior hypothesis bias); and re-enforcing resistance to change by presenting an agenda that supports the status quo (resistance to change). Appendix. Types of heuristic Availability Definition. Calculating the frequency or probability of an event based on the ease in which the decision maker can remember incidences of the event occurring (Tversky and Kahneman, 1974). Examples: • Biases due to retrievability. Decision makers believe there are more incidences of the event occurring than actually took place due to the ease in which the events are retrieved in the decision maker’s mind (Tversky and Kahneman, 1974). • Prior hypotheses bias: decision makers focusing on information that will support their beliefs and ignore information that is contrary to their beliefs (Levine, 1971; Schwenk, 1984). Representativeness Definition. The degree to which A resembles B (Tversky and Kahneman, 1974). Examples: • Unrecognized organizational uniqueness. Improperly assuming that since certain actions are effective for one part of an organization they can be applied equally to other parts of the organization (Tversky and Kahneman, 1974). • Insensitivity to predictabil ity. Improperly predicting favourable outcome of the organization’s actions based on a favourable description of the course of action (Tversky and Kahneman, 1974). • Illusion of validity. unwarranted confidence by the decision maker of the predicted organizational outcome based on the input of information received by the decision maker (Tversky and Kahneman, 1974). • Illusion of control. decision makers overestimate the amount of control they can have over the outcomes of their strategy (Langer, 1975). • Reasoning by analogy. decision makers comparing current issues and problems based on previous courses of action (Steinbruner, 1974). • Vivid and anecdotal information. Decision makers assign more importance to information that is vivid and anecdotal instead of formal reports (Schwenk, 1986). Adjustment and anchoring Definition. Improper adjustment from an initial value or course of action (Tversky and Kahneman, 1974). Examples: • Resistance to change. Decision makers refusing to acknowledge a deviation from the initial course of action and the subsequent resistance to change the course of action (Coch and French, 1948; Nystrom and Starbuck, 1984). • Escalation of commitment. Decision makers continuing to invest resources into a project that should be abandoned (Staw, 1981). • Single outcome calculations. Decision makers focusing on only one goal and one alternative course of action (Steinbruner, 1974).