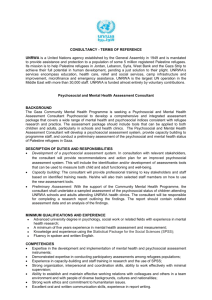

Etpu - UNRWA

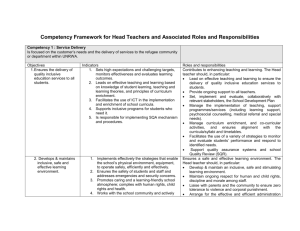

advertisement