GOODS TRANSPORT AGENCY AND SERVICE TAX By CA. Srikantha Rao T The

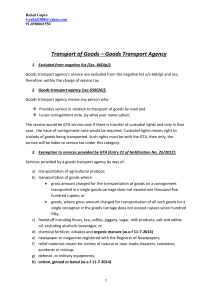

advertisement

GOODS TRANSPORT AGENCY AND SERVICE TAX By CA. Srikantha Rao T The levy of service tax on the services of transport of goods by road in its present form has been in force with effect 01.01.2005. The scheme calls for payment of service tax on freight charges by the service receiver in certain specified cases rather than the service provider who is generally required to collect service tax on the value charged towards taxable services provided under Chapter V of Finance Act 1994 as amended from time to time. This was after a committee was formed in 2004 to look into issues of taxing services in relation to transport of goods as a result of opposition from the transport operators. The scheme for taxing such services was notified through various notifications (32 to 35) issued on 3.12.2004 and it was Notification 35/2004 dated 03.12.2004 which cast the liability to pay service tax on the person paying the freight or liable to pay the freight where the consignor or consignee happened to be any of the persons specified in the said notification. The notification specifically clarified that the liability was not on the goods transport operator. For this purpose, Rule 2(1)(d) of Service Tax Rules 1994 dealing with “person liable to pay tax” was also amended to clarify the liability. This brings us to the important question and that is whether the levy of service tax on services in relation to transport of goods by road as it stands today was first of all intended by the law makers at all in 2004. Before we discuss this further, it would be worthwhile to note that the legislature has been eyeing this category of service for quite sometime and the first efforts to tax the same was made when service tax was levied on “goods transport operators” for services rendered in relation to transport of goods, with effect from 16.11.1997. For this purpose, “goods transport operator” had been defined to mean any commercial concern engaged in the transportation of goods not including a courier agency. When this was introduced, the goods transport operators went on an all India strike which compelled the government to make payment of service tax the responsibility of their customers by amending Rule 2(1)(d) of Service Tax Rules 1994. This was challenged by the customers and the Supreme Court in Laghu Udyog Bharati Vs UOI (1999 (112) ELT 365 (SC)) held such collection from customers as envisaged by Rule 2(1)(d) of Service Tax Rules 1994 to be ultravires the Act itself. The government responded by inserting changes in the Finance Act itself in 2000 which were intended to have retrospective effect to grant power to collect service tax from customers of GTO which was once again challenged only for the Supreme Court in Gujarat Ambuja Cements Ltd Vs UOI (2005 (182) ELT 33 (SC)) to uphold validity of such changes for the period concerned. This levy existed only till 02.06.1998 on account of pending litigations at that point of time, before being brought back with some changes in 2004. The determination is important because today service tax is being paid by the service receiver where the service provider happens to be a transport operator. If one were to go through paragraph 149 of the Budget Speech of the Honorable Finance Minister on July 8th 2004, while presenting the budget, what was stated was the intention to levy service tax on services provided by transport booking agents. The then Finance Minister had also clarified that there was no intention to levy service tax on truck owners or truck operators. Pursuant to this, a new sub clause was inserted in Section 65(105) for the purpose of defining the concept of taxable service in relation to transport booking agents. It is however very interesting to note that while the intention as disclosed by the Budget Speech was to tax services provided by transport booking agents, the changes in Section 65(105) sought taxing goods transport agency. Now, the term “goods transport agency” is something which is quite different from the term “transport booking agents”. If what is happening in practice [ departments view] is any indication, there is no difference between “goods transport operator”, “goods transport agency” and “transport booking agents” though we would like to differ in opinion. This would be so even though the original intention of the law makers might have been to levy service tax on goods transport operators themselves which might have been rolled back only due to the powerful transport lobby. The power to collect service tax from a person other than the service provider in case of notified taxable services is now available to the Government u/s 68(2) of Chapter V of Finance Act 1994 as amended from time to time. Rule 2(1)(d)(v) of Service Tax Rules 1994 specifies the circumstances in which the payer of freight would be regarded as the person liable for paying service tax. The payer of freight charges would be required to pay service tax where the consignor or consignee of goods happens to be any of the following – i. A factory registered under or governed by Factories Act 1948 ii. A Company formed or registered under Companies Act 1956 iii. A corporation established by or under any law iv. A society registered under Societies Registration Act 1860 or under any law corresponding to that Act for the time being in force in any part of the country v. A cooperative society established by or under any law vi. A dealer of excisable goods who is registered under Central Excise Act 1944 or rules made there under vii. A body corporate established or a partnership firm registered under any law Where the consignor or consignee happens to be any other person not covered under the aforesaid categories, the liability for paying service tax would be on the GTA itself. The person liable for paying service tax would have to register under Service Tax for the purpose of making payment. Rule 2(p) of Cenvat Credit Rules 2004 specifically excludes such payments from the definition of output service which would mean such payments to be made in cash and not by utilising Cenvat Credits. Definition As per Section 65(105)(zzp) of Chapter V of Finance Act 1994 as amended from time to time, taxable service means any service provided or to be provided to any person by a goods transport agency, in relation to transport of goods by road in a goods carriage. The terms “goods”, “goods carriage” and “goods transport agency” have also been defined. As per Section 65(50), “goods” has the meaning assigned to it in clause (7) of Section 2 of the Sale of Goods Act 1930. As per Section 65(50a), “goods carriage” has the meaning assigned to it in clause (14) of Section 2 of Motor Vehicles Act 1988. As per Section 65(50b), “goods transport agency” means any person who provides service in relation to transport of goods by road and issues consignment note, by whatever name called. The concept of “goods transport agency” has been defined in such a way so as to make a goods transport operator issuing a consignment note liable under this category. Readers may also note that Rule 4B of Service Tax Rules 1994 require a GTA providing transport of goods by road in a goods carriage, to issue a consignment note to the recipient of service. As per Section 2(14) of Motor Vehicles Act 1988, “goods carriage” means any motor vehicle constructed or adapted for use solely for the carriage of goods, or any motor vehicle not so constructed or adapted when used for the carriage of goods. The term motor vehicle as defined u/s 2(28) of Motor Vehicles Act 1988 does not include vehicles having less than four wheels and with engine capacity not exceeding 25cc as well as vehicles running on rails or vehicles adapted for use in a factory or in an enclosed premises. Thus persons operating these vehicles cannot be brought under this category. For the purpose of trying to distinguish the concept of “transport booking agents” from “goods transport agency”, one would have to refer a standard English dictionary. The term “agent” has been defined by the Websters Dictionary as a “person or business authorized to act on another’s behalf”. The term “agency” can be understood in this context as “an organisation, company or bureau that provides a particular service.” “Booking” can be understood as the act of reserving or making a reservation. Thus if one goes through the aforesaid definitions, it would not be wrong to infer that the intention of the law makers might have been to hold a person who acts as an agent for booking of transport of goods by road by a goods carriage as being liable to service tax and not the goods transport operator or agency that operates the goods carriage. But as the scheme stands today, an operator of goods carriage issuing a consignment note to the service receiver would render the service receiver liable to service tax. Concept of consignment note Rule 4B of Service Tax Rules 1994 defines consignment note to mean a document issued by a goods transport agency against the receipt of goods for the purpose of transport of goods by road in a goods carriage, which is serially numbered, and contains the name of the consignor and consignee, registration number of the goods carriage in which the goods are transported, details of the goods transported, details of the place of origin and destination, person liable for paying service tax whether consignor, consignee or the goods transport agency. Readers may note that a consignment note generally has the following details – date, place where the note is made, name and address of sender and carrier, place of taking over the goods, date of taking over the goods, place for designated delivery, name and address of consignee, common description of goods and packaging, details of packages with gross and net weight, charges for carriage etc. Thus, unless we have a note disclosing all the required details, the same in our view cannot be regarded as a consignment note and make the customer liable to service tax. A consignment note in our view unlike a Multimodal Transport Document issued under Multimodal Transportation of Goods Act 1993 cannot be regarded as being negotiable and constituting document of title to goods unless the consignor and the transferee agree with the transport operator that the same shall constitute document of title to goods. Whether the levy of service tax on GTA service needs a review? In our view the entire exercise of levying service tax on services in relation to transport of goods by road can be reviewed considering the fact that transportation is an essential service for any economy to move forward as well as the main intention and object of levying service tax going by the Budget Speech of the then Finance Minister made on the floor of the Parliament in 2004. However, whether this would be entertained by Courts at all is something which would have to be seen as the Supreme Court in ITC Ltd Vs CCE New Delhi (2004 (171) ELT 433 (SC)) has held that ordinary and natural meaning of words has to be given effect as legislature is deemed to intend and mean what it says. However, in case of ambiguity in language, reference may be made to legislative intent and object to resolve it. Prima facie, it appears that the law makers have used this principle to perfection in levying service tax with regard to services of transportation of goods by road while presenting the idea as one which involved taxing the services of transport booking agents. Readers may note that the view regarding the intention to levy service tax on transport booking agents and not on goods transport operators or truck owners has received some support if one were to go by the recent decision in Kanaka Durga Agro Oil Products (P) Ltd Vs CCE Guntur (2009 (15) STR 399 (Tri-Bang)) where transport of goods by road by individuals owning and operating trucks was held not to be liable to service tax where one of the grounds taken up for argument was that transport booking agents alone were liable to service tax. Where service tax is collected by the GTA, would the payer of the freight be again liable to pay service tax? In the opinion of the authors, the payer would not again be liable. Where the person liable to pay service tax pays the freight with the service tax thereon, service tax again cannot be levied in order to avoid double taxation of the same transaction. It is immaterial whether the service tax is paid by the payer of the freight directly to the government or pays it to the GTA who then pays it to the government. This view has also been confirmed by the Tribunal in Mandev Tubes Vs CCE Vapi (2009-TIOL-1231-CESTAT-AHM). The department may however continue to oppose this view. As a prudent practice the specified tax payers may avoid paying the transporters and pay after getting registered in their own accord to avoid dispute. Exemptions/Abatement if any Notification 13/2008 ST dated 01.03.2008 provides an exemption of 75% of the gross amount charged for the transportation of goods and consequently, service tax would be payable only on 25% of the amount charged, at the applicable rate which is 10.3% at present. Notification 34/2004 ST dated 03.12.2004 as amended also provides an exemption from service tax where the amount of freight charged for individual consignments does not exceed Rs. 750 and for other consignments where it does not exceed Rs. 1500. Service tax has also been exempted on transport of goods by road service for transportation of fruits, vegetables, egg or milk, under Notification 33/2004 ST dated 03.12.2004. Exemption on certain specified services provided to a GTA – Notification 1/2009 ST dated 05.01.2009 Certain specified taxable services provided to GTA for its use in relation to transport of goods by road service provided by it to its customer, have been exempted from service tax. These are – clearing and forwarding agent’s services, cargo handling agency service, manpower recruitment service, storage and warehousing service, business auxiliary service, packaging service, support service of business or commerce, supply of tangible goods service. This has been retrospectively made applicable from 2005 in Finance Act 2009. Whether the exemption of 75% is available in respect of ancillary services provided by GTA and whose value is included in the amount charged by GTA to its customer? Yes. The benefit of exemption of 75% would be available in respect of such charges where the service is a composite service and such composite services need not be broken up to tax separately the various elements involved, as per Circular 104/7/2008 ST dated 06.08.2008. The test to be applied here is one of form and substance of the transaction and where the essence is one of transport of goods by road service, the exemption of 75% would be available on the gross amount charged even if such amount includes charges towards ancillary services provided along with transportation service. Whether the benefit of small service provider’s exemption of Rs. 10 lakhs can be claimed by the person liable to pay service tax on this service? No. The benefit of small service provider’s exemption cannot be claimed with regard to payment of service tax under this heading as the person liable to pay service tax in this case, is not the service provider and the service cannot be construed as an output service in his hands. Cenvat Credit of Service tax paid on services in relation to transport of goods by road Readers may note that the service tax paid under this category can be claimed back as credit subject to the said transportation services received satisfying the definition of “input service” as laid down under the Cenvat Credit Rules 2004. The Tribunal has, recently in M/s ABB Ltd & India Cements Ltd Vs Commissioner of Central Excise & Service Tax Bangalore and CCE Tirupati (2009-TIOL-830-CESTAT-Bang-LB) sought to put to rest the doubts regarding inclusion of such services under the definition of “input service” by analysing the concept of “activities relating to business” and held it to include both essential and auxiliary activities of business including outward transportation. It also held that definition of “input service” was required to be interpreted in the light of requirements of business and was not to be read restrictively so as to confine only up to the factory or up to depot of manufacturers. If services like advertising or market research were undertaken to attract a customer to buy goods, and these services are eligible to credit, services which ensured physical availability of goods to the customer i.e. services for transportation should also be eligible to credit. The issue as to credit availability was also held to be independent of the issue as to valuation of goods manufactured, under the Central Excise Act 1944. Another aspect which was highlighted was that service tax was a destination based consumption tax (as decided in All India Federation of Tax Practitioners Vs UOI (2007 (07) STR 625 SC)) and if credit on outward transportation was to be denied then levy of service tax on transportation service would amount to a tax on business rather than being a consumption tax. The definition of “input service” had however been amended by Notification 10/2008 CE (NT) dated 01.03.2008 with effect from 01.04.2008 and the definition taken up by the Tribunal in this case was the earlier definition and not the amended one. Therefore there is every chance of the department questioning the credit availment once more by considering the first limb of the definition without analyzing further as to the activities which are relating to business, especially if the amendment was with the intention to restrict the credit availability. The earlier decision of the Tribunal in Gujarat Ambuja Cements Ltd was also on the basis of the definition before it was amended with effect from 01.04.2008. Thus the manufacturers would have to demarcate between the service tax pertaining to the period prior to 01.04.2008 and the amount pertaining to period after 01.04.2008 to be on the safer side of the law as there is every possibility of the department opening up a new round of litigation. This, if it happens, is something which in our view, would have to be clarified by the Courts considering the spirit of the Cenvat Credit Rules 2004 though the present view taken by the Larger Bench is clearly logical. NOTIFICATION Sub: Service Tax – Communication of Notification No: 32/2004-ST to 35/2004-ST– Reg. ******** Copy of Notification No: 32/2004-ST, to Notification No: 35/2004-ST dated 03.12.2004, of the Government of India, Ministry of Finance, Department of Revenue, Central Board of Excise and Customs are communicated herewith for information and necessary action. The content of this trade notice may be brought to the knowledge of all concerned. (U.NIRANJAN) JOINT COMMISSIONER CHENNAI III (Issued from File C.No.IV/16/302/2004 S.Tax) To As per mailing list (Both Trade and Dept.) TO BE PUBLISHED IN PART II SECTION 3 SUB-SECTION (i) OF THE GAZETTE OF INDIA, EXTRAORDINARY DATED THE 03RD DECEEMBER, 2004 NOTIFICATION NO:32/2004-Service Tax, Dated : December 3, 2004 In exercise of the powers conferred by sub-section (1) of section 93 of the Finance Act, 1994 (32 of 1994), the Central Government, being satisfied that it is necessary in the public interest so to do, hereby exempts the taxable service provided by a goods transport agency to a customer, in relation to transport of goods by road in a goods carriage, from so much of the service tax leviable thereon under section 66 of the said Act, as is in excess of the service tax calculated on a value which is equivalent to twentyfive per cent. of the gross amount charged from the customer by such goods transport agency for providing the said taxable service: Provided that this exemption shall not apply in such cases where – (i) the credit of duty paid on inputs or capital goods used for providing such taxable service has been taken under the provisions of the Cenvat Credit Rules, 2004; or (ii) the goods transport agency has availed the benefit under the notification of the Government of India in the Ministry of Finance (Department of Revenue) No. 12/2003-Service Tax, dated the 20th June, 2003 [G.S.R. 503 (E), dated the 20th June, 2003]. 2. This notification shall come into force on the first day of January, 2005. [F. No. 341/18/2004-TRU (Pt.)] (V. Deputy Secretary to the Government of India Sivasubramanian) NOTIFICATION NO: 33/2004-Service Tax, Dated : December 3, 2004 In exercise of the powers conferred by sub-section (1) of section 93 of the Finance Act, 1994 (32 of 1994), the Central Government, being satisfied that it is necessary in the public interest so to do, hereby exempts the taxable service provided by a goods transport agency to a customer, in relation to transport of fruits, vegetables, eggs or milk by road in a goods carriage, from the whole of service tax leviable thereon under section 66 of the said Act. 2. This notification shall come into force on the first day of January, 2005. [F. No. 341/18/2004-TRU (Pt.)] (V. Sivasubramanian) Deputy Secretary to the Government of India ----------------------------------------------------------------------------------------------- NOTIFICATION NO:34/2004-Service Tax, Dated : December 3, 2004 In exercise of the powers conferred by sub-section (1) of section 93 of the Finance Act, 1994 (32 of 1994), the Central Government, being satisfied that it is necessary in the public interest so to do, hereby exempts the taxable service provided by a goods transport agency to a customer, in relation to transport of goods by road in a goods carriage, from the whole of service tax leviable thereon under section 66 of the said Act, where,(i) the gross amount charged on consignments transported in a goods carriage does not exceed rupees one thousand five hundred; or (ii) the gross amount charged on an individual consignment transported in a goods carriage Explanation.- does For not the exceed purposes of rupees this seven hundred notification, “an fifty. individual consignment” means all goods transported by a goods transport agency by road in a goods carriage for a consignee. 2. This notification shall come into force on the first day of January, 2005. [F. No. 341/18/2004-TRU (Pt.)] (V. Sivasubramanian) Deputy Secretary to the Government of India NOTIFICATION NO:35/2004-Service Tax, Dated : December 3, 2004 In exercise of the powers conferred by sub-section (1), read with sub- section (2) of section 94 of the Finance Act, 1994 (32 of 1994), the Central Government hereby makes the following rules further to amend the Service Tax 1. Rules, 1994, namely: - (1) These rules may be called the Service Tax (Fifth Amendment) Rules, 2004. (2) They shall come into force on the first day of January, 2005. 2. In the Service Tax Rules, 1994,- (I) in rule 2, in sub-rule (1), in clause (d), after sub-clause (iv), the following sub-clause shall be inserted, namely:- “(v) in relation to taxable service provided by a goods transport agency, where the consignor or consignee of goods is,- (a) any factory registered under or governed by the Factories Act, 1948 (63 of 1948); (b) any company established by or under the Companies Act, 1956 (1 of 1956); (c) any corporation established by or under any law; (d) any society registered under the Societies Registration Act, 1860 (21 of 1860) or under any law corresponding to that Act in force in any part of India; (e) any co-operative society established by or under any law; (f) any dealer of excisable goods, who is registered under the Central Excise Act, 1944 (1 of 1944) or the rules made thereunder; or (g) any body corporate established, or a partnership firm registered, by or under any law, any person who pays or is liable to pay freight either himself or through his agent for the transportation of such goods by road in a goods carriage;” ; (II) in rule 4A, in sub-rule (1), after the first proviso, the following proviso shall be inserted, namely:- “Provided further that in case the provider of taxable service is a goods transport agency, providing service to a customer, in relation to transport of goods by road in a goods carriage, an invoice, a bill or, as the case may be, a challan shall include any document, by whatever name called, which shall contain the details of the consignment note number and date, gross weight of the consignment and also contain other information as required under this sub-rule.”; (III) after rule 4A, the following rule shall be inserted, namely:- ‘4B. Issue of consignment note.- Any goods transport agency which provides service in relation to transport of goods by road in a goods carriage shall issue a consignment note to the customer: Provided that where any taxable service in relation to transport of goods by road in a goods carriage is wholly exempted under section 93 of the Act, the goods transport agency shall not be required to issue the consignment note. Explanation.- For the purposes of this rule and the second proviso to rule 4A, “consignment note” means a document, issued by a goods transport agency against the receipt of goods for the purpose of transport of goods by road in a goods carriage, which is serially numbered, and contains the name of the consignor and consignee, registration number of the goods carriage in which the goods are transported, details of the goods transported, details of the place of origin and destination, person liable for paying service tax whether consignor, consignee or the goods transport agency.’. [F. No. 341/18/2004-TRU(Pt.)] (V. Sivasubramanian) Deputy Secretary to the Government of India Note.- The principal rules were notified vide notification no. 2/94-Service Tax dated the 28th June 1994 and published in the Gazette of India, Extraordinary vide number G.S.R.546 (E), dated the 28th June 1994 and were last amended vide notification No. 30/2004-Service Tax, dated the 22nd September, 2004 [G.S.R. 633 (E), dated the 22nd September, 2004].