BA 521 - Northern Arizona University

advertisement

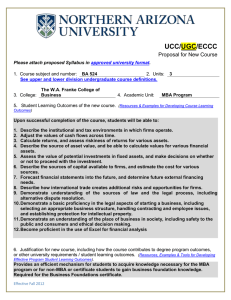

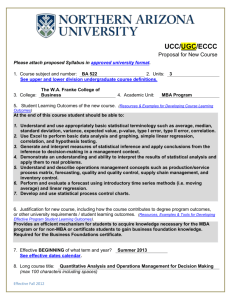

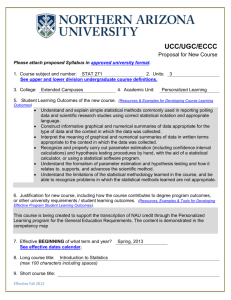

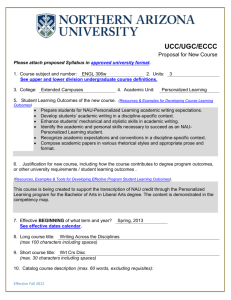

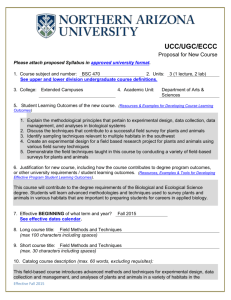

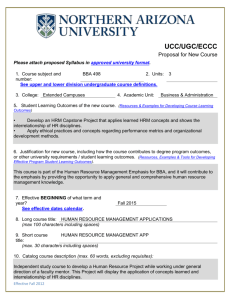

UCC/UGC/ECCC Proposal for New Course Please attach proposed Syllabus in approved university format. 1. Course subject and number: BA 521 2. Units: See upper and lower division undergraduate course definitions. 3. College: The W.A. Franke College of Business 4. Academic Unit: 3 MBA Program 5. Student Learning Outcomes of the new course. (Resources & Examples for Developing Course Learning Outcomes) Upon successful completion of the course, students will be able to: 1. 2. 3. 4. 5. 6. 7. Learn and apply the basic principles and procedures of accountancy in the preparation, analysis, and interpretation of general purpose financial statements Learn fundamental concepts of accounting practices and analyze and understand their impact on financial statements Develop analytic and problem solving skills Understand the planning and control function of management accounting information; produce, analyze, and interpret financial information to inform business decisions. Calculate basic accounting measures used in performance evaluation of managers and business sub-units; discuss the advantages and disadvantages of the measures; and identify conditions for their appropriate use Use appropriate spreadsheet technology to produce reports and analyses Competently present financial analyses orally and through written reports. 6. Justification for new course, including how the course contributes to degree program outcomes, or other university requirements / student learning outcomes. (Resources, Examples & Tools for Developing Effective Program Student Learning Outcomes). Provides an efficient mechanism for students to acquire knowledge necessary for the MBA program or for non-MBA or certificate students to gain business foundation knowledge. Required for the Business Foundations certificate. 7. Effective BEGINNING of what term and year? See effective dates calendar. 8. Long course title: Accounting for Managers (max 100 characters including spaces) 9. Short course title: Accounting for Managers (max. 30 characters including spaces) Effective Fall 2012 Summer 2013 10. Catalog course description (max. 60 words, excluding requisites): Students will develop an understanding of financial and managerial accounting from a user’s perspective and will be able to prepare financial reports, analyze and appropriately use financial information to inform business decisions. 11. Will this course be part of any plan (major, minor or certificate) or sub plan (emphasis)? Yes No If yes, include the appropriate plan proposal. Business Foundations Graduate Certificate 12. Does this course duplicate content of existing courses? Yes No If yes, list the courses with duplicate material. If the duplication is greater than 20%, explain why NAU should establish this course. Some duplication of undergraduate course content is present, but MBA students and students seeking increased knowledge of business at the graduate level do not need all the content offered in the undergraduate courses. The focus in the graduate courses will be more managerial and less procedural. The pace of material coverage will be accelerated. 13. Will this course impact any other academic unit’s enrollment or plan(s)? If yes, include a letter of response from each impacted academic unit. 14. Grading option: Letter grade Yes Pass/Fail No Both 15. Co-convened with: 14a. UGC approval date*: (For example: ESE 450 and ESE 550) See co-convening policy. *Must be approved by UGC before UCC submission, and both course syllabi must be presented. 16. Cross-listed with: (For example: ES 450 and DIS 450) See cross listing policy. Please submit a single cross-listed syllabus that will be used for all cross-listed courses. 17. May course be repeated for additional units? 16a. If yes, maximum units allowed? 16b. If yes, may course be repeated for additional units in the same term? Yes No Yes No 18. Prerequisites: Post-Baccalaureate or Graduate Status If prerequisites, include the rationale for the prerequisites. This course is designed for academically advanced students. Both content and pace will be suited to students who have completed undergraduate degrees. 19. Co requisites: If co requisites, include the rationale for the co requisites. Effective Fall 2012 20. Does this course include combined lecture and lab components? Yes No If yes, include the units specific to each component in the course description above. Kathy Savage, Kathe Shinham, 21. Names of the current faculty qualified to teach this course: Nancy Wilburn, Bob Kilpatrick Answer 22-23 for UCC/ECCC only: 22. Is this course being proposed for Liberal Studies designation? If yes, include a Liberal Studies proposal and syllabus with this proposal. Yes 23. Is this course being proposed for Diversity designation? If yes, include a Diversity proposal and syllabus with this proposal. Yes Scott Galland Reviewed by Curriculum Process Associate 10/9/2012 Date Approvals: Department Chair/ Unit Head (if appropriate) Date Chair of college curriculum committee Date Dean of college Date For Committee use only: UCC/UGC/ECCC Approval Date Approved as submitted: Yes No Approved as modified: Yes No Effective Fall 2012 No No COURSE SYLLABUS –BA 521 ACCOUNTING FOR MANAGERS General Information The W.A. Franke College of Business BA 521, Accounting for Managers 3 credit hours Units Summer Only, time to be determined (TBD) Instructor’s name: TBD Office address: TBD Office hours: TBD Course prerequisites: Post baccalaureate or graduate status Course description: Students will develop an understanding of financial and managerial accounting from a user’s perspective and will be able to prepare financial reports, analyze and appropriately use financial information to inform business decisions. Student Learning Expectations/Outcomes for this Course: Upon completion of this course, students should be able to: A. Learn and apply the basic principles and procedures of accountancy in the preparation, analysis, and interpretation of general purpose financial statements B. Learn fundamental concepts of accounting practices and analyze and understand their impact on financial statements C. Develop analytic and problem solving skills D. Understand the planning and control function of management accounting information; produce, analyze, and interpret financial information to inform business decisions. E. Calculate basic accounting measures used in performance evaluation of managers and business subunits; discuss the advantages and disadvantages of the measures; and identify conditions for their appropriate use F. Use appropriate spreadsheet technology to produce reports and analyses G. Competently present financial analyses orally and through written reports. Course structure/approach: The course will be a combination of lecture and problem based learning supplemented with business case analysis and project-based assignments requiring written deliverables and presentations. Textbook and required materials: Textbooks such as: Edmonds, Olds, McNair, and Tsay (2012). Survey of Accounting (3rd ed.). New York: McGraw-Hill Irwin. Or, Breitner and Anthony, (2012) Essentials of Accounting (11th ed.). New York: Prentice Hall. and, Ansari, Bell, and Klammer (2004). Management Accounting: A Strategic Focus, A modular Series. New York: Houghton-Mifflin. Recommended optional materials/references (attach reading list): Business cases from Harvard, Darden, or the Ivy schools, or from similar sources. Effective Fall 2012 Course outline: Financial Reporting Process and Financial Statements Basic Concepts of Accrual Accounting The Income Statement Revenue measurement and recording Expense measurement and recording The Balance Sheet Asset measurement and recording Liability and equity measurement and recording Statement of Cash Flows and Direct Cash Budgeting Analysis and Interpretation of Financial Statements Strategic Cost Management, Planning, and Control Cost Behavior and Profitability Analysis Cost Accumulation Systems Job costing Cost allocation and activity based costing Planning and Control Budgeting as a plan Control function of budgets Performance Assessment Relevant costs for short-run business decisions Assessment of Student Learning Outcomes: Methods of Assessment In-class individual examinations Individual problem assignments Individual projects or cases Group projects or cases Participation 60%-70% 10% 10%-15% 10%-15% 5% Timeline for Assessment Examinations will be given a minimum of twice during the term (midterm and final) Assignments, cases, and projects will be spread throughout the term. Grading System Grades will be assigned on the basis of total points earned relative to the following scale: 90% or greater A 80% to 89% B 70% to 79% C 60% to 69% D below 60% F Final grades may be based upon a curved scale representing lower point values than those above. Effective Fall 2012 Course policy: Retests/makeup tests Exams may include problems, essay questions, and case analyses relating to class discussions, lectures, assigned reading, cases, and homework. If you are unable to take an exam, you must notify your instructor before the exam is given. If you miss an exam without notifying your instructor beforehand or without a valid excuse, you will receive a zero on the exam. If you have a valid reason for missing the exam, alternative arrangements will be made. No exams will be given early, nor will retests be given. Attendance Failure to attend class will reduce a student’s participation grade. Statement on plagiarism and cheating Graduate business students are expected to meet the highest standards of professional integrity. Student behavior should set an example of integrity and serve to elicit trust from those that work with them. Graduate business students are held accountable to their peers and their faculty for their actions. (MBA Oath, adapted.) Academic dishonesty is not tolerated in any course within the graduate business program. Academic dishonesty includes, but is not strictly limited to the following: cheating by way of using any unapproved written or digital notes, study aides, or the work of someone other than yourself; the falsification, fabrication, or use of misleading data, information, or citations in any assignment; plagiarism; submitting academic work prepared for a different class without the knowledge and approval of the instructor; unsanctioned collaboration between students or groups of students; misrepresentation of personal circumstances to justify an extended deadline or makeup exam or assignment; forgery; violation of copyright; taking undue personal credit for team projects and activities; assisting or knowingly allowing another student to violate the academic dishonesty policy. If suspected, violations of the academic dishonesty policy will be investigated by the instructor and will be reported according to the policies set forth by the W. A. Franke College of Business and Northern Arizona University. Confirmed violations will result at a minimum in a point deduction of twice the grade for the specific work in question and may result in a failing grade for the course. University policies: Attach the Safe Working and Learning Environment, Students with Disabilities, Institutional Review Board, and Academic Integrity policies or reference them on the syllabus. See the following document for policy statements: http://www4.nau.edu/avpaa/UCCPolicy/plcystmt.html. Effective Fall 2012