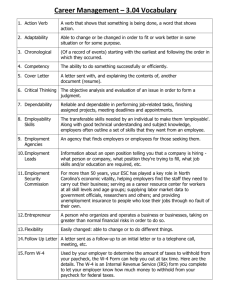

Demand for More Definite Statement

advertisement

Demand for More Definite Statement Letters For Victims of the “zero-none” letters Name, Address, etc. Date __________ Certified Mail, RR # ________________ To: Sender of “zero-none” letter Sir or Madam; Re: Your 2801(CG) Letter dated xxyyzz (copy attached) This is my formal demand for a more definite statement. I believe your letter is at best out of order, if not an act of misfeasance or malfeasance. As I understand the regulations, examinations is required to run compliance checks on all W-4 Forms submitted. 4.23.14.3 (04-21-1999) Form W-4 Compliance Checks 1. Examiners should review Forms W-4 during each compliance check or examination. The examiner's primary responsibility in the W-4 program is to ensure that employers are complying with regulation section 31.3402(f)(2)-1(g) when conducting an examination. When this check is not performed, the examiner will indicate the reasons why it was not performed on Form 4318A or Form 5773. 2. A sample inspection of retained copies of Forms W-4 for the most recent four quarters will be made to ascertain whether the taxpayer is complying with the regulations. If the sampling reveals non-compliance, the examination of W-4s will be expanded to all periods. The examiner should: A. Review Forms W-2 and W-4 to identify employees who have little or no income tax withholding. B. Identify all W-4s claiming in excess of 10 allowances and exempt status. C. Ensure that employees who claim exempt status are resubmitting new W4s to their employers by February 15th of each year. Please furnish me evidence that the above compliance check was run, or provide me the appropriate form, 4318-A or 5773 that explains why it was not run. The fact that your letter “allows” me to now file a statement in support of my claim is a clear indication that your outfit failed to request it on time, as shown by the regulation below. Paragraph (1) above explains that the regulation at 31.3402(f)(2)-1(b) requires the W-4 compliance check: 31.3402(f)(2)-1 (g) SUBMISSION OF CERTAIN WITHHOLDING CERTIFICATES-- 1 (1) GENERAL RULE. With respect to withholding exemption certificates received after November 30, 1986, an employer shall submit, in accordance with paragraph (g)(3) of this section, a copy of any withholding exemption certificate, together with a copy of any written statement received from the employee in support of the claims made on the certificate, which is received from the employee during the reporting period (even if the certificate is not in effect at the end of the quarter) if the employee is employed by that employer on the last day of the reporting period and if-(i) The total number of withholding exemptions (within the meaning of section 3402(f)(1) and the regulations thereunder) claimed on the certificate exceeds 10, or (ii) The certificate indicates that the employee claims a status exempting the employee from withholding, and the exception provided by paragraph (g)(2) of this section does not apply. (2) EXCEPTION. A copy of the certificate shall not be submitted under paragraph (g)(1)(ii) of this section if the employer reasonably expects, at the time the certificate is received, that the employee's wages (under chapter 24 of the Code) from that employer shall not then usually exceed $200 per week. For whatever reason, your outfit failed to notify my employer of his requirement to obtain a statement from me as to why I claimed exempt. Your failure to follow procedure puts you in personal jeopardy by making unlawful demands for sums greater than the law allows. Herein is my statement in support of my claim. My wages are not subject to the tax. They are excludible from tax reports or returns. Only government employees are subject to the tax and only government employers are subject to withholding requirements. If you intend to establish that my W-4 contains false information, you’d best be prepared to show precisely what information is false, because providing false information with respect to withholding is a crime. Crimes of that nature must be prosecuted by the Justice Department. See United States Attorney’s Manual, Criminal Tax section. 11.02 GENERALLY Section 7205(a) is directed at employees who attempt to thwart the income tax wage withholding system by submitting false Forms W-4 or W-4E 1(hereinafter referred to as Forms W-4) to their employers. (3) Until the above-noted (n.1, supra) statutory amendment in 1984, section 7205 had been one of the government's only prosecutorial weapons in combatting employees' attempts to pay no taxes and to remove themselves from the federal income tax system. In the first instance, the employee, often a tax protestor, submits a false employee withholding certificate (Form W-4) to an employer, claiming either an excessive number of withholding allowances or, more typically, an exemption from withholding, based on a claim of having incurred no tax liability in the previous year and anticipating no tax liability in the present year. 1 What ever happened to the W-4E- Exemption Certificate? (See attached example.) 2 Since the 1984 statutory change, the government now typically charges the filing of a false Form W-4 as an affirmative act in a Spies-evasion felony prosecution rather than bringing the misdemeanor 7205 charge. See United States v. Connor, 898 F.2d 942 (3rd Cir.), cert. denied, 110 S. Ct. 3284 (1990); United States v. Foster, 789 F.2d 457, 460-61 n.4 (7th Cir.), cert. denied, 479 U.S. 883 (1986) (explaining why, following statutory changes, the government was no longer limited to charging the filing of a false Form W-4 as a violation of section 7205, as some courts had suggested). See Section 8.04[01], supra, dealing, among other things, with Spies-evasion and false Forms W-4, and Section 40.04[01], infra, Tax Protestors. However, in appropriate cases, section 7205 charges are still available. See Foster, 789 F.2d at 460-61 (charging section 7201 and 7205 violations); United States v.Copeland, 786 F.2d 768, 770-71 (7th Cir. 1986) (same). It seems to me that if you intend to claim that I am committing a crime by putting false information on my W-4, then what you need to do is write to the Justice Department, rather than my employer. Otherwise, you must instruct my employer to follow the authorization I give him. You may, however, request that he obtain my statement in support of my claim, but you must instruct him to accept my new W-4, even if I claim exempt again. Otherwise, you are instructing him to abrogate our employment contract. Your letter says: “based on our information, we determined that your Form W-4, Employee’s Withholding Allowance Certificate, does not meet the requirements of the Internal Revenue Code and related Employment Tax Regulations. We have, therefore, directed your employer to disregard your Form W-4 and withhold as if you were claiming the following: Marital Status Allowances Single None What “information”? What “requirements”? And who are you to tell my employer to “disregard” my signed authorization? Who made my employer a tax collector? What legal effect does your (unsigned) letter have, in light of the examination requirements above? Do you, by tacit procuration, have the government’s or my power of attorney to so instruct him? Does he, by tacit procuration, have the government’s power of attorney to act on its behalf in this matter? Unless the government controls my employer’s business directly, it cannot control how, how much, or to whom he pays wages or anything else, in the normal course of his private business affairs. Please explain to me, and to my employer, why you believe that my employer is subject to employment tax laws and regulations. According to the clear instructions on page 6 of Publication 15, Circular E, Employer’s Tax Guide, there are only two categories of employers subject to those regulationsfederal government employers, and state and local government employers having Section 218 Agreements with the Social Security Administration. 3 There are no comparable instructions or Forms for use by the private sector; private sector employers are ineligible for Section 218 Agreements, hence cannot be “employers” for purposes of Subtitle C. This means that the employment tax laws and regulations do not apply to private sector employers or their employees. The Code clearly defines “employee” at Section 3401(c) as a GOVERNMENT employee. There is no constitutional foundation for the federal government to impose burdens on those of us not engaged in activities subject to exclusive federal control, such as interstate or international commerce. We are of the opinion that the attempt through the provisions of the code to fix the hours and wages of employees of defendants in their intrastate business was not a valid exercise of federal power. A.L.A. SCHECHTER POULTRY CORPORATION v. UNITED STATES, 295 U.S. 495 (1935) What separates employment tax requirements from involuntary servitude is the law. The law itself clearly relates to government employment. The government cannot compel private sector employers to collect taxes for it for free. That would clearly be involuntary servitude. Since it is obvious that private sector employers are not compensated for collecting taxes for the government, it should be equally obvious that they are not authorized to do so, and cannot be compelled to do so except by involuntary servitude. Ask yourself whether the millions of American employers who collect taxes for free really can be compelled to do so. According to the Treasury Financial Manual, Vol. I, Part 3, Chapter 4000, levies on wages can only be made against employees of the federal government or the government of the District of Columbia. That means that only federal employees and D. C. employees are “employees” for purposes of an IRS levy. Section 4075—Levy for Unpaid Tax Liability IRC provisions permit district directors to collect delinquent Federal taxes by levy on the accrued salary or wages of any officer, employee or elected official of the United States or the District of Columbia. According to the TFM, “wage levies” apply only to government workers, which is in keeping with the clear language of the Code provision of the IRC, Section 6331(a): Levy may be made upon the accrued salary or wages of any officer, employee, or elected official, of the United States, the District of Columbia, or any agency or instrumentality of the United States or the District of Columbia, by serving a notice of levy on the employer (as defined in section 3401(d)) of such officer, employee, or elected official. Please forward any information you may have that would prove to my employer that he is one of the government employers named above, and whether he could be compelled to comply with an IRS levy on my wages. 4 Also, forward any information you might have that could prove that I am a government employee, subject to either levies or withholding requirements. Please explain specifically what you mean by “does not meet the requirements of the internal revenue code and related employment tax regulations.” It seems to me that if my employer is required to withhold, there should have been a compliance check. If he is not required to withhold taxes from me, you should be informing him that he is not a government employer, and is not subject to Subtitle C withholding. According to the Privacy Act/Paperwork Reduction Act Notice on the back of the W-4. it says: “We ask for the information to carry out the Internal Revenue laws of the United States. The Internal Revenue Code requires this information under sections 3402(f)(2)(A) and 6109 and their regulations.” My employer is not “we”. Your outfit is “we”. The government is “we”. That means that I am not the “you” referred to in the instructions, hence is not a form required of me. The only reason I gave it to my employer is that he demanded it as a condition of my employment, although it is not mentioned in our contract. That is because folks like you have convinced him to perform uncompensated duties for the government that he is not required to perform. IRC 6109, referred to in the notice, requires U. S. persons and foreign persons to provide taxpayer ID numbers. 26 CFR 301.6109-1 shows who those “persons” are: (b) Requirement to furnish one's own number-(1). U.S. persons. Every U.S. person who makes under this title a return, statement, or other document must furnish its own taxpayer identifying number as required by the forms and the accompanying instructions. A U.S. person whose number must be included on a document filed by another person must give the taxpayer identifying number so required to the other person on request. (c) REQUIREMENT TO FURNISH ANOTHER'S NUMBER. Every person required under this title to make a return, statement, or other document must furnish such taxpayer identifying numbers of other U.S. persons and foreign persons that are described in paragraph (b)(2)(i), (ii), (iii), or (vi) of this section as required by the forms and the accompanying instructions. Unless you have evidence to the contrary, neither my employer nor I, are “U. S. persons”. The word “person”, as used above, means “entity”, like a corporation, not “human being” or “citizen” or “resident”. Corporations formed under Washington or Georgia law are Washington or Georgia “persons”; corporations formed under federal law are U. S. persons, not Minnesota or Oregon persons. The government of the United States itself is 5 a “U. S. person”, as well as the nations biggest “employer”. Please forward any information you may have that people who are not “U. S. persons” or “foreign persons” are required to obtain and furnish numbers. Further, even if I were required by law to file a W-4, the instructions on Form W-4 say that if one marks Line 7 “Exempt” he is required to re-file each year. Please inform my employer and me what law, regulation, directive, or policy, requires him to ignore the regulation that requires him to request that I re-file, and requires me to re-file, if I filed exempt last year. Please note also that according to the instructions on the Form, one cannot claim exempt if: 1) one has taxable income in excess of $750 per year, of which 2) more than $250 of which was “unearned income”, and 3) no one else can claim you on their return. If you are claiming that some or all the information on my W-4 is incorrect or false, your office requires you to provide me with a more definite statement by citing precisely what is wrong, and any statute or regulation that overrides IRC 3402(n) which authorizes a legitimate claim of exemption. Do you know for a fact that I have any taxable income at all? Can you name any law that says workers must pay taxes before they are due, but businesses do not have to pay in advance? Does the law not treat all of us equally? Do you know for a fact that someone else can claim me a s a dependent? Do you know for a fact that I had taxable income last year? What facts led you to believe that anything I claimed on my Form “did not comply with laws and regulations”, and which ones does it not comply with? Is the information false, hence a criminal offense, or is it erroneous? Income may be untaxed, taxable, exempt, or excludible. According to the clear instructions on Form 4563, domestic income is “excludible” from federal income tax, but federal paychecks are not. Please provide me with the statutes and regulations that permit the federal government to lay and collect taxes on the wages of all Americans, particularly those engaged strictly in intrastate activities. You are on notice that if your letter is a demand for sums other or greater than the law allows, you are personally subject to Section 7214 sanctions. Thank you for your prompt response. _________________________ 6 Bobby Bleeding Cc: Employer District Director, IRS Treasury Inspector General for Tax Administration, Hotline P.O. Box 589 Ben Franklin Station Washington, DC 20044-0589 United States Office of Personnel Management 1900 E Street, NW Washington, DC 20415-0001 TIGTA Cover Letter: To Whom It May Concern; I have received the attached 2801 letter. I’m having a serious problem with it. If my reading of the law is correct, this letter is an attempt at extortion, rather than a communication of facts and laws in evidence. I am sending it to your office because I believe it represents a horrible misapplication of the tax laws, and a reliable demonstration of how IRS fails to follow laws, let alone regulations and policies established by the Treasury Department. As I see it, only government employers are authorized and required to request that their employees furnish tax numbers and permit tax withholding from their pay. If I am correct, the government stands to lose nearly 70% of its “income tax” revenue, which is currently being collected by private sector employers. However, if private sector employers are not required to obtain W-4’s from their employees, the government’s losses will be more than offset by the restoration of our right to earn a living without government interference. Although the Constitution vests the whole taxing power in Congress, taxes imposed by Title 26 are not collected by Congress, but by the Secretary of the Treasury. They are constitutionally inapplicable to the private citizens for that reason alone. Therefore Title 26 taxes are “special” taxes, not general taxes. If there is a tax on my wages, it is a direct tax, which Congress cannot impose on me except via the state in accord with the rule of apportionment, unless I happen to work for the government. These “employment taxes” imposed, apparently, at Subtitle C of the Code cannot apply to the public in the same way they apply to the government. 7 Publication 15 clearly applies to government employers. There are no comparable instructions for private sector employers, simply because the taxes apply only to government workers. Social Security was conceived as a grant, not as a new tax. It went to the governments of the territories, Alaska and Hawaii, and the District of Columbia. Publication 15 names as employers only federal government employers and state and local government employers having Section 218 Agreements with the Social Security Administration. My employer is not a federal employer, and is not a state or local government employer having a section 218 agreement. He should be instructed that Publication 15 clearly does not apply to him, or to me, and to cease withholding altogether. It would appear that there are horrible consequences in store for those who claim “exempt” on Line 7 of a non-required W-4, either because their wages are excludible from tax, or because they choose not to pay taxes before they are due. No “employer” can be held responsible for determining whether his employees owe federal taxes or how much. There are no Forms or instructions for private sector employers to withhold federal taxes. If my employer is an employer for Subtitle C purposes, then I must be one of the enumerated “employees” below: IRC 3401 Definitions (c) EMPLOYEE For purposes of this chapter, the term "employee" includes an officer, employee, or elected official of the United States, a State, or any political subdivision thereof, or the District of Columbia, or any agency or instrumentality of any one or more of the foregoing. The term "employee" also includes an officer of a corporation. The government has millions of employees and thousands of corporations and “independent establishments”. I am not affiliated with any of them, and neither is my employer. The regulations requiring the use of tax numbers clearly say that only “U. S. persons” and “foreign persons” are required to obtain and furnish such numbers. My employer is not a “U. S. person” or a “foreign person” as those terms are used in the Code and regulations. “Persons” are entities, not people. “U. S. persons” are corporations created by the United States, not by a State of the Union. I do not believe that my employer is one who is authorized or required to use Publication 15. I believe that for my employer to withhold federal taxes is for him to impersonate a public official- a federal government withholding agent. According to the Treasury Financial Manual, agency heads must determine whether “services constitute employment” and whether “remuneration constitutes wages.” 8 4020.10—Specific Rules IRC section 3122 gives the head of a Federal agency, or the designated delegate, the authority to determine: Whether the services performed by Federal employees constitute employment. The periods of such employment. Whether the remuneration paid for such services constitutes wages. IRC section 3402(a) requires Federal agencies to deduct and withhold Federal income taxes from wages exceeding the total amount of withholding exemptions. If the employer is the United States or an agency or instrumentality of the United States, an officer or employee with control of the payment of wages may make the tax return for the amount deducted and withheld. (See IRC section 3404.) IRC section 3101 imposes the employee portion of Social Security and Medicare taxes on wages. IRC section 3102 requires the employer to withhold these amounts from wages. IRC section 3111 imposes the employer portion of the Social Security and Medicare taxes on wages. There is nothing that puts my employer to such tasks. For him, it is fairly simple to determine whether my “services” constitute employment, and whether my pay constitutes “wages”. In point of fact, IRS Form SS-8 is a 20question form used to assist “employers” in determining the above two factors. Only bureaucrats need rules for such things. It seems reasonable to me that the Treasury Department can “levy” and “garnish” administratively, paychecks it issues, without court orders. However, in the private sector, our wages cannot be garnished without a court order, and the above indicates that IRS levies (and Treasury Department Automated Wage Garnishments) apply only to federal government employers and their employees. Section 4075—Levy for Unpaid Tax Liability IRC provisions permit district directors to collect delinquent Federal taxes by levy on the accrued salary or wages of any officer, employee or elected official of the United States or the District of Columbia. Since this levy is served against the take-home pay of the employee, once the levy is served, agencies should not permit an employee to increase any voluntary allotment until the tax liability is liquidated or other arrangements satisfactory to the IRS are made. If the Treasury Department cannot levy private sector wages, it cannot compel private sector employers to withhold federal ‘employment’ taxes. Therefore, I believe that the letter in question violates IRC 7214, on a grand scale, and must be investigated. If the government is collecting taxes we do not owe, what it is doing must be exposed and done away with. 9 According to the Internal Revenue Manual, examiners are required to perform compliance checks to ensure that employers are in compliance with regulation 31.3402(f)(2)-1(g) regarding “questionable W-4” forms: 4.23.14.3 (04-21-1999) Form W-4 Compliance Checks 3. Examiners should review Forms W-4 during each compliance check or examination. The examiner's primary responsibility in the W-4 program is to ensure that employers are complying with regulation section 31.3402(f)(2)-1(g) when conducting an examination. When this check is not performed, the examiner will indicate the reasons why it was not performed on Form 4318-A or Form 5773. 4. A sample inspection of retained copies of Forms W-4 for the most recent four quarters will be made to ascertain whether the taxpayer is complying with the regulations. If the sampling reveals non-compliance, the examination of W-4s will be expanded to all periods. The examiner should: A. Review Forms W-2 and W-4 to identify employees who have little or no income tax withholding. B. Identify all W-4s claiming in excess of 10 allowances and exempt status. C. Ensure that employees who claim exempt status are resubmitting new W-4s to their employers by February 15th of each year. According to the regulation, the employer must furnish the employee’s written statement in support of his claim if it is a claim for more than ten allowances or for exemption from withholding: 31.3402(f)(2)-1 (g) SUBMISSION OF CERTAIN WITHHOLDING CERTIFICATES-(1) GENERAL RULE. With respect to withholding exemption certificates received after November 30, 1986, an employer shall submit, in accordance with paragraph (g)(3) of this section, a copy of any withholding exemption certificate, together with a copy of any written statement received from the employee in support of the claims made on the certificate, which is received from the employee during the reporting period (even if the certificate is not in effect at the end of the quarter) if the employee is employed by that employer on the last day of the reporting period and if-(i) The total number of withholding exemptions (within the meaning of section 3402(f)(1) and the regulations thereunder) claimed on the certificate exceeds 10, or (ii) The certificate indicates that the employee claims a status exempting the employee from withholding, and the exception provided by paragraph (g)(2) of this section does not apply. (2) EXCEPTION. A copy of the certificate shall not be submitted under paragraph (g)(1)(ii) of this section if the employer reasonably expects, at the time the certificate is received, that the employee's wages (under chapter 24 of the Code) from that employer shall not then usually exceed $200 per week. The following provision of the IRM shows the rundown of procedures involved in mandatory compliance checks. 4.10.5.10.4 (05-14-1999) Workpaper Documentation 1. The examiner should document in the workpapers on Form 4318/4700/5773 the inspection of and/or the disposition of questionable W-4s and/or the reason why W-4s are not inspected. Exhibit 4.10.5-1 (05-14-1999) 10 Compliance Checks--Minimum Requirements Preplan Contact TP Initial Interview Records Examined All Other Returns Filed Determine return filing requirements and utilize CFOL to verify filing and audit potential. Request copies if necessary, (i.e., CFOL does not provide information.) Additional returns probed. Related Returns Determined relationship and utilize CFOL to verify filing and audit potential. Request copies if necessary, (i.e., CFOL does not provide information.) If applicable, secure/inspect/ pickup Probe with respect to return that should be filed. Document relationship and transactions. decision. Prior/Subsequent Year Returns Identify prior and subsequent years and utilized CFOL to verify filing and audit potential. Request copies if necessary (i.e., CFOL does not provide information.) Information Returns Determine potential information returns due and use available CFOL information. Determine internal control system for filing information returns. Document taxpayer's compliance. If applicable, secure/pick up returns that should be filed. Document decision. Questionable W-4s Determine if taxpayer potentially receives W-4s. Review internal control system for forwarding W-4s. Secure/refer questionable W-4s to service center if not previously forwarded. Document decision. Forms 8300 and CTRs Determine if taxpayer is a financial recordkeeper or a cash business. If a financial recordkeeper or If necessary, check for compliance with cash business, review 8300/CTR requirements. Document internal control system for decision. filing 8300s/CTRs. Secure/pickup (if applicable or refer to specialists, returns that should be filled. Document decision. If applicable, secure/inspect/evaluate audit potential Pick up returns (s) not filed. Document decision. The above activities should be documented on Form 4318/4700. According to the above, there must be a documented examination of the employer’s records prior to mailing out “disregard the employee’s W-4” letters. 4.23.14.2 (04-21-1999) Definition of Incorrect Certificate 1. IRC 3402(f)(2)(A) provides, in part, that the number of withholding allowances that an employee claims on Form W-4 "shall in no event exceed the number to which he is entitled." IRC 3402(n) provides, in part, that an employee may be exempted from all income tax withholding if he or she incurred no income tax liability in the preceding tax year and no income tax liability is anticipated in the current tax year. The Form W-4 of an employee is incorrect if: A. The employee has claimed excessive withholding allowances, or B. The employee has filed an exempt Form W-4 and either the employee's income, filing status or exemptions indicate that a current year tax liability will be incurred, or the employee was liable for tax in the previous year. 2. IRC 3402 and the Employment Tax Regulations thereunder give the Service the authority to instruct an employer to disregard an incorrect certificate. According to the IRM, at 4.23.14.1 (04-21-1999), the appropriate letter is not the attached, but letter 1659 or 1660. (Letter 1659, Letter to Employer telling him/her to disregard employees Form W-4 or Letter 1660, Letter to Employer to disregard an exempt Form W-4 until further notice.) However, a clear determination of government employment status must be made before federal privilege taxes can be laid on my wages. 11 ____________________ Bobby Bleeding Attachment: Response Letter to “Questionable W-4”. Letter to Congressman; I resent receiving the attached letter from the IRS, because I have become convinced that the IRS has no legal standing relative to my employment. I understand that there are “employment taxes” on government employees, but I find no law that expands the scope of those laws to the private sector. I find no excuse for private sector employers to collect taxes without just compensation, which means that every American employer who is not an “employer” for purposes of IRC Subtitle C Employment taxes has been subjected to involuntary servitude. The Boeing Company announced in late 2001 that it costs them $3 in accounting and other expenses for every $1 it paid to the government in “employment taxes”. This is a clear case of involuntary servitude, brought about by our collective ignorance of the laws. Title 26 is obviously “special law”, in that the whole taxing power is constitutionally vested in the legislative branch, but the Secretary of the Treasury collects all the internal revenue taxes. Whatever controversies might rage over Subtitle A, Subtitle C taxes are clearly taxes on government employees, collected by other government employees, and there is absolutely no evidence to the contrary. Any person who is required to withhold taxes is a withholding agent (Publication 515). Employers are required to withhold taxes pursuant to Publication 15, which means that they must first be federal government withholding agents. The government would find it impossible to prove that my employer is subject to its employment taxes. I insist that you look into this matter as the report of a crime rather than a complaint. He who steals from another must be punished, whether he is a citizen, or a government official, or a whole government. I believe Congress is responsible for permitting IRS to extort Subtitle C Employment taxes from the private sector due to its greed, rather than admit that Congress cannot tax the private sector, and if it had, the Secretary could not collect it. An admission of this magnitude might cause this government to re-think its paper money policies, and start taxing imports instead of the American people. I am attaching the letter I received from “Questionable W-4”, my reply thereto, and my complaint to TIGTA. I believe that these documents speak for themselves, and require responsible people to respond responsibly. Thank you for you kind attention to this tragic situation. 12 Your Constitutent, _____________________ OPM letter: To Whom It May Concern; I believe the employee who sent the above letter exceeds his/her authority in the matter of a W-4 claiming “exempt”. Apparently, despite the fact that the law provides for one to claim exempt, at 3402(n), the IRS likes to punish people who do so. According to the Internal Revenue Manual, there is a procedure IRS must follow before “disallowing” a W-4, which has not been followed. See attached letter to TIGTA for a detailed description of the process. I have been, or am about to be, denied due process, and I believe the people responsible should be investigated. _________________________ Attachment: Letter of Complaint to TIGTA 13